P-values and power in statistical tests

Today I’m going to do my best to explain Andrew Gelman’s recent intriguing post on his blog for the sake of non-statisticians including myself (hat tip Catalina Bertani). If you are a statistician, and especially if you are Andrew Gelman, please do correct me if I get anything wrong.

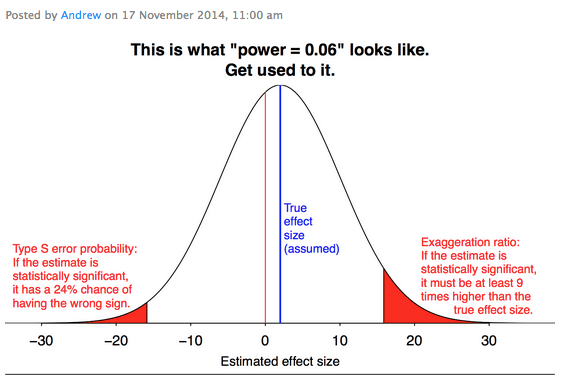

Here’s his post, which more or less consists of one picture:

I decided to explain this to my friend Catalina, because she asked me to, in terms she could understand as a student of midwifery. So I invented a totally fake set-up involving breast-fed versus bottle-fed babies.

Full disclosure: I have three kids who were both breast fed and bottle fed for various lengths of time and, although I was once pretty opinionated about the whole thing, I could care less at this point and I don’t think the data is in either (check this out as an example). So I’m not actually trying to make any political point.

Anyhoo, just to make things super concrete, I want to imagine there’s a small difference in weight, say at 5 years of age, between bottle fed and breast fed children. The actual effect is like 1.7 pounds at 5 years. Let’s assume that, which is why we see a blue line in the graph above at 1.7 with the word “assumed” next to it. You can decide who weighs more and if that’s a good thing or not depending on your politics.

OK, so that’s the underlying “truth” in the situation, but the point is, we don’t actually know it. We can only devise tests to estimate it, and this is where the graph comes in. The graph is showing us the distribution of our estimates of this effect if we have a crappy test.

So, imagine we have a crappy test – something like, we ask all our neighbors who have had kids recently how they fed their kids and how much those kids weighed at 5 years, and then we averaged the two groups. That test would be crappy because we probably don’t have very many kids overall, and the 5-year check-ups aren’t always exactly at 5 years, and the scales might have been wrong, or clothes might have been confusing the scale, and people might not have reported it correctly, or whatever. A crappy test.

Even so, we’d get some answer, and the graph above tells us that, if our tests are at a certain level of crappiness, which we will go into in a second, then very likely our estimate of the difference will come in between something like -22 pounds and +24 pounds. And the “most likely” answer would be the correct one, sure, but that doesn’t mean it’s all that likely to even come close – say within 2 pounds – of the “true effect”. In fact, if you make a band of width 4 centered around the “true effect” level, you’d definitely capture a smallish percentage of the total area under the curve. In fact, it looks like a good 45% of the area under the curve is in negative territory, so the chances are really very good that the test estimate, at this level of crappiness, would give you the wrong sign. That’s a terrible test!

Let’s be a bit more precise now about what we mean by “crappy.” The crappiness of our test is measured by its power, which is defined as “the probability that it correctly rejects the null hypothesis – i.e. the hypothesis that the “true effect” is zero – when it is false.” In other words, power quantifies how well the test can distinguish between the blue line above and the line at zero. So if the bell curve were really really concentrated at the blue line, then more of the total area under the curve would be on the positive side of zero, and we’d have a much better test. Alternatively, if the true effect were much stronger, say at 25 instead of 1.7, then even with a test this imprecise, the power would be much much higher because the bulk of the bell curve would be to the right of zero.

On the one hand, power estimates are done by researchers, and they are attempting to achieve a power of at least 0.80, or 80%, so the above power of 0.06 is indeed extremely low and our test is indeed very crappy by researching standards. But on the other hand, since researchers are expected to estimate their power to be at least 0.80, there’s probably fudging going on and we might be trusting tests to be less crappy than they actually are. Also, I am no expert on how to accurately estimate the power of a test, but there’s an example here, and in general it depends on your sample size (how many kids) and the actual effect size, as we have already discussed. In general it requires way more data to produce evidence of a small effect.

OK so now we have some general sense of what “crappiness” means. But what about the red parts?

Those are the “statistically significant” parts of the distribution. If we did our neighborhood kids test and we found an effect of 20 or -20, we’d be totally convinced, even though our test was crap. There are two take-aways from this. First, that “statistically significant” in the presence of a small actual effect and a crappy test means that we are wildly overestimating the effect. Second, that the red part on the left is about a third of the size of the red part on the right, which is to say that when we get a result that seems “statistically significant,” in the presence of a crappy test, it still has a one in four chance of being totally wrong.

In other words, when we have crappy tests, we just shouldn’t be talking about statistical significance at all. But of course, nobody can publish their results without statistical significance, so there’s that.

Aunt Pythia’s advice

Greetings, friends! I’ve missed you all!

Since returning from her travels, Aunt Pythia has been continuously marveling in the wonders of flannel and wool, and has decided to knit up something along these Celtic lines:

Is that not gorgeous? I love the tangled-upedness of the center. And, of course, the doubly rainbow-ic aspects.

Here’s the thing, though: the pattern comes from the excellent book Celtic Charted Designs that Aunt Pythia is absolutely sure she has somewhere in her house, but can’t find. in fact she’s spent the good part of the morning searching her house. So if the column is a wee bit short and/or frustrated today, you’ll know why.

On to business! Aunt Pythia has lots of questions to answer, given that she was away last week, and she’s eager to get through some. But before she forgets,

please think of something Celtic

to ask Aunt Pythia at the bottom of the page!

By the way, if you don’t know what the hell Aunt Pythia is talking about, go here for past advice columns and here for an explanation of the name Pythia.

——

Dear Aunt Pythia,

What are your thoughts on this 401k article?

Another Potential Pass At Legalizing Longterm Investments Not Going (well)

Dear APPALLING,

Wow, your sign off is longer than the body of you letter. Well done. OK so let me quote the heart of the problem fingered in the article:

Millions of people are clearly not using 401(k) plans as retirement accounts at all, and it’s a threat to their financial health.

I’d phrase it differently, namely:

In this day and age, working people need all their money, and 401(k) plans have proven to be saving strategies which are only realistic for well-off people, which entirely misses the point of how to deal with the older middle class in our country. Instead of relying on such wishful thinking, we should scrap the whole system, which by the way only serves to expand Wall Street’s power and give tax breaks to the rich, and we should instead expand Social Security.

Love,

Aunt Pythia

——

My Dearest Aunt Pythia,

In mid-90’s I completed class work on an MA in Applied Economics/Econometrics at a state school in California. Stupidly did not complete thesis (things got busy on political campaigns and such, and never got back to it). Like many I fell in love with economics, public policy, and their interrelations.

Now, many years later, my econometric/data/statistical modeling skills have aged with me and have become lost from my mind.

My first question is: What would you recommend as a refresher of data skills? I’m certain I don’t need to redo all I’ve done before- the skills are there but need to be refreshed and awakened (I assume/hope).

My second question is: Assuming the skills can be reawakened, what is my fastest and least costly method to enter data work? For programming many people create apps or small programs to be able to show code samples to prospective employers. Is there something analogous in data work? Should I build a model of aggregate demand changes from quantitative easing/M2 changes and shrinking consumer credit (from institutional rule changes) and post it online to show skills? I’ve also been looking at the data science certificate from Coursera/Johns Hopkins, but don’t know that it would matter on a resume. My old university requires restart for the old M.S. (which I understand), so should I pursue a new M.S. in current state school (UMUC has a Masters Data Analytics, which I think I would enjoy anyway, but is pretty pricy).

Anyway, hoping you, my dear Aunt, will have some advice for a data enthusiast with dusty data skills to freshen skills and move into analysis. Oh, I should mention that I am taking a lot of computer programming classes lately to get skills in that area as well.

Dusty Skills

Dear Dusty Skills,

Please don’t take this the wrong way, but the very first thing you need to do when applying for any data job is to use a spell-checker. I must have corrected 5 words in your letter.

Next, although I agree that a Coursera certificate might not be considered all that important, the skills you hopefully acquire with such a certificate would be. And yes, I do suggest you build something with your skills, although tackling QE seems both onerous and unlikely. I’d do something less abstract if I were you, and set up a website portfolio so everyone can see your mad skillz. Oh, and you might want to take a look at my book, Doing Data Science, although you might be past that stuff already.

Good luck!

Aunt Pythia

——

Aunt Pythia,

I’m a father whose daughter is applying to colleges. I also work at a college, as does my wife. And like many employees in academia, I’ve been following with horror the reports of college rape: the under-reporting, the Judicial review boards, the administrators eager to downplay the problem, etc.

As a father the horror easily spills over into terror. I want my daughter to grow into the challenges of living away from home; I want her to learn in a enlightening, and encouraging environment; and I want her to have fun. I also want her to be safe.

I am outraged at the clueless administration officials and public safety officers who say “girls should not go to parties, or drink,” all the while wanting to scream at my daughter “don’t go to parties or drink.”

How can I have a meaningful conversation about going off to college, learning, having fun, but be safe, without sounding like *those* administrators?

Worried In Academia

——

Dear Worried,

I went to college in the early 1990’s at UC Berkeley. My first year there was the scene of multiple Gulf War protests, and about 3 or 4 street riots, streaming by my dorm near Telegraph Ave, during which me and my two roommates didn’t dare leave our room. In my sophomore year we heard the Rodney King verdict and it was chaos in the streets for a few days.

I guess what I’m saying is that, due to the obviously volatile and threatening mood of the campus and neighboring towns back then, I was always on alert, and defensive. All of my friends took self-defense classes, and I carried around pepper spray, in my right hand, and my keys in my left, whenever I walked home at night. I biked places so I could get away more quickly. It was my assumption that I would need to protect myself and that there were people who would hurt me if I didn’t. I’m not saying there weren’t people who drank too much and got themselves vulnerable – in fact while I was there, there were multiple burning deaths in fraternities that did crazy things with couches – but that I personally would never have been involved with such stuff. For that matter there was a lot of campus rapes, which we knew about, and the police knew about, and kept us going to our self-defense classes.

Nowadays, we have a very different notion, and also a different reality, which is mostly a good thing, but has weird consequences. One of them is a sense that colleges are safe places, which they most certainly are not. College administrations have come a long way on marketing their campuses as attractive and safe, but it’s just a marketing thing, and it sends confusing and deeply mixed messages to parents and kids, which pisses me off. At the end of the day, when you go to college, you are an adult, and you need to be responsible for your safety, which means not getting out of hand, and keeping trustworthy friends close to you to make sure you don’t, and to make sure they don’t.

So, and I know this is a tough issue, but my advice is to tell your daughter to learn to size up the energy of a party, and see if dangerous things are happening, and to have a group of friends at all times that are looking out for you, and who you are looking out for, and to take self-defense classes, and to carry mace or at least a siren for when you travel alone at night.

Also, and this is actually the most important piece of advice: get your daughter to drink with you a few times, before she goes to college, so she’ll know what it feels like to have too much. The most educational night of my life was a night in the summer before college, when my dad got me and my friend Becky puking drunk. I never let that happen again, because I knew when I’d had too much. I think far too many kids get to college never having been allowed to go overboard with drinking, so they do it for the first time with strangers. Bad idea!

One last thing. I think that in the next couple of decades, the police will learn how to adequately and sensitively deal with rapes, and when that happens we won’t need to worry as much about campus police forces, which are totally inadequate and rife with conflicts of interest. But obviously you don’t have two decades to wait for that to happen, since your daughters are going to college now. Plus, I may be just being unrealistic about the progress we could make.

I hope that helps!

Aunt Pythia

——

Dear Aunt Pythia,

I keep hearing about how rampant sexism is in STEM fields, particularly in tech workplaces, where I can see myself heading toward after college. It’s really discouraging, especially since I think I experience some sort of sexism in my classes here in college (in computer science way more than in math), and even worse, I can’t seem to speak up because this kind of sexism is really subtle (i.e. a guy got angry with me for his incompetence with a certain technology. I would’ve spoke up but the assignment was worth so little.)

These hurtful incidences just build up over time, and whenever I vent to my friends, some “brush it off” as it not being serious. My parents told me that what I experience here in college won’t be any different in the workplace.

So as I search for summer internships, I carry this cloud of insecurity and doubt. Should I go forward? What’s the point? Breaking gender barriers sounds great, but my God, there are so many women out there who choose to leave because the barrier is so high and strong. I can easily see myself leaving the tech industry because its stubborn lack of support toward women and its more harmful PR farces showing that they do “support women.” Is it ever worth it? How do I reconcile with this?

Unsure of the future

Dear Unsure,

My motto is, celebrate the victories and ignore the defeats. Where by “victories” we mean “getting a computer program to work” and by “defeats” we mean “some insecure guy took out his frustration on me because I’ve got boobs.”

In other words, don’t think about yourself or your actions as A Woman In STEM. Instead, think about what your personal goals are, and what interests you, and what you’d like to learn about or accomplish. Make it an internal conversation about your wants and needs and passions, rather than an external conversation about how you look to other people. And if your internal voice is telling you to leave STEM, then by all means do it, but if not, don’t let those fuckers get you down. Do it because it’s cool and you love it, not because some assholes do or do not have an agenda for you or an ego riding on what and how you do things. Separate the two issues and it will help, because math and computer science are really cool.

And because it’s not always possible to totally ignore the defeats, I’d also encourage you to find better friends who will let you vent and will vent along with you. What’s up with them?!

Good luck, for reals! Keep me posted!

Aunt Pythia

——

Please submit your well-specified, fun-loving, cleverly-abbreviated question to Aunt Pythia!

Click here for a form.

Guest Post: What does it mean to “create jobs”?

This is a guest post by FogOfWar.

The phrase is used constantly by politicians and economists, but what does it actually mean to “create jobs”?

Here’s an example: I open a coffee shop and hire two people. So I’ve created three jobs (counting myself), right? Really? Let’s assume for the moment that I’m no more or less efficient at making and distributing coffee than my competitors and also that the total amount of coffee required in the world is constant. Then my coffee shop must be taking customers away from another coffee shop, and at a frictionless level, there are three coffee jobs lost for the three coffee jobs I just created.

Yet no politician, and indeed no economist quoted on TV or newspaper, will go into the distinction between gross job creation (3) and net job creation (0). For politicians this makes sense because they want the appearance of good results to be reelected (and often nothing more than that). For economists, or at least economists dealing with journalists, it may well be that it just gets too fuzzy to make a simple point, and a story without a simple and strong hook is killed by your editor.

Another point: I can think of a specific example of something that really did “destroy jobs”–it’s the invention of the EZ Pass. When I was growing up (yes, I’m ancient), there were dozens of people working at each of the toll collection booths on the highways, each counting out miserable hours collecting change from surly passengers and inhaling vast amounts of carbon monoxide. Now there are a handful at each on ramp and a row of EZ-Pass computers.

There’s no question in my mind that EZ-Pass destroyed jobs, but this seems like a good thing rather than a bad thing. Should we strive to keep really crappy jobs that are obsolete by technology just so that people have something awful to do with themselves all day, instead of doing something equally unproductive like watching TV all day, or maybe even spending time with their families and community? I think this is a variation of the “broken window fallacy” if I remember my intro economics correctly.

Lastly, I’ve assumed a closed system, but let’s relax that assumption. Here are two things that definitively will create jobs: (1) start manufacturing cell phones in the US; and (2) have 20% of the US consumers buy American when they have a choice. Both of these actions will move actual jobs from overseas to the US and thus will “create [US] jobs” in a very real sense of the word.

One other thing that must be true: I’m not the first person to think of this and suspect there are people who have dedicated more serious time and attention to the question than my casual observations. Thoughts?

I am old in Haiti

I am old in Haiti. This fact dawns on me slowly over the six days I am there, because there is so much to take in. Mostly I figure it out because I am constantly amazed by how beautiful and healthy everyone looks. But then again, I keep finding myself thinking, people who are 24 often look healthy and beautiful. It’s when you’re 54 that you begin to show signs of wear and tear. I will reserve judgment until I see older folks.

But then, after a while, I realize how few people I’ve seen that are 54, or even 44, or even 39. Almost nobody, in fact. Every now and then a very old person will cross the street slowly, hobbling with a stick for support. On my 6th day there I tried to figure out exactly how old such people were. Maybe not much older than me, in fact.

The statistics, which I don’t look at until afterwards, back up my observation. A third of the population is below the age of 15, half of the population is below the age of 20, and 70 percent of the population is below the age of 30. Probably the places I went, the cities, skew even younger. It looks like about 25% of the women of childbearing age are pregnant, and all of the women are of childrearing age. The population has tripled in Haiti since 1950 and it isn’t slowing down. If anything it’s bumping up because of the devastating 2010 earthquake – women tend to replace their lost babies by even more babies after such events.

This matters because the Haitian land is overpopulated. In fact it’s worse than that: the land suffers from a severe erosion of its topsoil, due to deforestation over the years. In part – get this – Haiti was deforested to repay the debt to France for letting them be free back in the early 1800’s after the (world’s only successful) slave revolt. But it’s continued since then, and when you chop down all your trees, the rains take away your topsoil, which means your land slowly becomes desert. For the most part that’s what it looks like when you drive through. The result is not very much agriculture, and when you combine that with a fast-growing population, you get an horribly unsustainable situation.

In spite of all these problems, and in part because of them, the Haitians I came across seem incredibly nice to me and to each other. Trucks, people, motorcycles, cars, and 4-by-4’s compete for space in the one-lane roads in Port Au Prince but everyone stops dead when a young child needs to cross the street. It is a society that cherishes safety and looking out for one another.

When the water and soda sellers come to our public bus window to offer us drinks, and someone wants a cake instead, or to buy minutes for their cell phone, there’s a scramble by the nearby vendors to find the cake seller or the roaming Digicelwoman. The sellers at each stop form a collective that look out for each other, because if they didn’t look out for each other they’d all be screwed.

The same is true for with any resource. A UN worker we met explained that microfinance researchers are frustrated by Haitians when they try to estimate the impact of their loans, because they keep finding that a family has borrowed money and given it to another family. But if they didn’t share resources locally, all the families in a given neighborhood would be risking too much. It is better to be known as a generous person so that in a time of scarcity people will be generous to you. Your reputation is your most valuable asset.

When I think about how we live here in New York – where I don’t know most of my neighbors’ names, and nobody can see what happens behind closed doors, and we hoard resources except in our most immediate family – I feel like we’re missing out on something valuable. At the same time, privacy is nice, and I don’t think most Haitians have much of that. Not to mention a healthy middle age.

What the fucking shit, Barbie?

I’m back from Haiti! It was amazing and awesome, and please stand by for more about that, with cultural observations and possibly a slide show if you’re all well behaved.

Today, thanks to my math camp buddy Lenore Cowen, I am going to share with you an amazing blog post by Pamela Ribon. Her post is called Barbie Fucks It Up Again and it describes a Barbie book entitled Barbie: I Can Be a Computer Engineer

Just to give you an idea of the plot, Barbie’s sister finds Barbie engaged on a project on her computer, and after asking her about it, Barbie responds:

“I’m only creating the design ideas,” Barbie says, laughing. “I’ll need Steven and Brian’s help to turn it into a real game!”

What the fucking shit, Barbie?

Wanted: Dead or Alive

I came across an interesting poster that’s been put up on a few lampposts on my street. It rather pathetically offers a $2,000 reward for information leading to the arrest of George Welch for operating a bucket shop in New York.

This got me thinking about the notion of vigilante justice and the failure of the Department of Justice, or pretty much anyone else, to prosecute people on Wall Street for the financial crisis. What if more people, frustrated by the lack of prosecutorial interest in Wall Street, decided to take matters into their own hands? What if there was an outbreak of bounties being put on the heads of wrong-doing bankers so that some street justice could be applied, as the person posting this poster appeared to be seeking?

Wikipedia has a surprisingly elegant definition of vigilante justice as:

the idea that adequate legal mechanisms for criminal punishment are either nonexistent or insufficient. Vigilantes typically see the government as ineffective in enforcing the law; such individuals often claim to justify their actions as a fulfillment of the wishes of the community.

The mood of the community I follow on Twitter and around the web certainly resonates with this definition. A lot of ink has been spilled on how the government has failed to enforce the law with respect to the Financial Crisis and that a collection of the wrong-doers, big and small, have gotten away with it, at the expense of the rest of us. Occupy, obviously, was an expression of frustration about the lack of law enforcement, though it did not have a vigilante component. Growing dissatisfaction with our government is manifesting itself in many places – including the most recent anti-incumbent mid-term elections. And despite whistleblowers, such as Alayne Fleischmann or Edward Snowden naming names and institutions, nothing seems to change.

There’s a long, (not so) proud tradition of vigilante justice in our country (and, of course dating back to societies much older than our country). Vigilante justice stories in the American frontier were tales of how people bound together to fight back against lawlessness. In my youth, movies like Billy Jack, Death Wish or Rambo portrayed the desperate, yet justified (?), actions of people who had had enough with lawlessness and weren’t going to take it anymore. The real life story of Bernhard Goetz was often portrayed in a similar fashion in the tabloids. Today, vigilante themed movies and shows, like Batman or Dexter, are everywhere. In the hands of the right storyteller, vigilante justice has a visceral appeal.

Vigilantism also has an awful, dark history in the US and elsewhere, including the legacy of lynchings in our not too distant past. As angry as many of us have been about the aftermath of the financial crisis and the sense that the government has been bought by Wall Street money, the notion of vigilantism is still scary. Who will really be making decisions about right and wrong if people take law into their own hands – the downtrodden and righteous, or the powerful and corrupt?

Upon doing a little internet research into the Wanted! poster on my street, I discovered that it wasn’t exactly a call for justice from a poor aggrieved investor in some bucket shop scheme. Perhaps the name of the firm – Hooke, Lyon and Cinquer – should have given it away. Instead, this poster seems to be a reference to a piece of strange art by a early 20th Century artist named Marcel Duchamp. Duchamp was a mysterious man and many people had a hard time understanding what he was getting at with his art. He made this poster, with a picture of himself as the wanted man, but critics are unclear about what he was saying with it.

Frankly, I have no idea why someone is posting them on my street now, almost 50 years after the original artist’s death. It seems noteworthy, somehow, that Duchamp’s poster originated in the lawless, Boardwalk Empire days of the 1920s, but I’m not sure why exactly.

I realized that I had been pranked by the poster, because I was sympathetic to a story about a small investor being burned by a Wall Street con artist, and a bounty on the scammer’s head seemed like an innovative, though unlikely, solution to the failure of law enforcement. So what was the point of this prank by Duchamp and by his new imitator on my street?

I’m not an art expert in any way (particularly not an expert on Dadaism that Duchamp helped originate), but my interpretation of today’s poster is that vigilantism is, itself, a prank. Despite fantasies of lawless bankers being tarred and feathered, what I (and I assume others) really want is a justice system that works, not one where people have to take the law into their own hands. In an excellent article written in response to the Ferguson troubles, Kareem Abdul Jabbar argues that we should use our rage at injustice to work to fix the system, and he has a point. Vigilantism is an illusion of justice… but the sense that the system isn’t working is still real. Maybe there’s an alternative interpretation of Duchamp’s prank: Unless more people within the system actually start to enforce the law against the powerful (as folks like Judge Rakoff or Ben Lawsky have shown is possible), then justice and government will lose their authority and become an illusion.

It’s art, so I don’t know that there is a definitive interpretation, but Duchamp’s piece tricked me and challenged me and pushed me, so I like whichever of these interpretations I apply.

What Happens as a Bubble Deflates?

Having written a couple of guest posts about bubbles possibly inflating (college tuition, high end Manhattan condos), I thought it might be interesting to consider what a deflating bubble looks like.

A number of observers point to the oil markets, where the price of crude has fallen by about 30% since June of this year, to a multi-year low today of about $75.50 per barrel. Just last spring, Bloomberg was reporting on how the drilling and exploration business in the US was heavily dependent on the issuance of junk rated debt – over $160 billion worth by some measures – to fund the shale drilling that has been so popular lately. The junk debt had been popular because it was a source of relatively cheap funds, thanks in part to the Federal Reserve’s efforts with Quantitative Easing to drive down bond yields. Oil and shale exploration are expensive and there are quite a few people that believe that certain types of exploration only make economic sense when the price of oil is above a certain level – say $80 a barrel (or perhaps even higher). Now that the price of oil has plummeted, there is a possibility that a whole collection of oil drillings and mines are underwater, so to speak, and no longer profitable.

Funding a bunch of expensive exploration with junk bonds makes things complicated and speculative. For instance, a substantial portion of these junk offerings were purchased by issuers of collateralized loan obligations (CLO) and then rated (up to the AAA level), securitized and distributed to an audience of investors who may or may not have been investing in energy related debt otherwise. CLOs are being issued at a record pace, by the way, and 2014 is on track to be the highest issuance year ever, exceeding the pre-crisis peak in 2007 of $93 billion. If the energy exploration companies that issued junk debt are no longer profitable and getting squeezed by the falling price of oil, will that lead to a bunch of companies defaulting and then sending shockwaves through the securitized market, via CLOs? (Note – the CLO market is much smaller than the subprime mortgage backed collateralized debt obligation market got to be before the 2007 implosion and energy companies are only a portion of the total issuance).

One thing that happens when investable asset prices fall, is that a bunch of people think that maybe it means there’s a new buying opportunity – a chance to get a hot asset at a cheap price on the expectation that prices will spring back up again soon. That’s what a bunch of hedge funds did a couple of weeks ago, betting that the sharp fall in oil would turn around. And then it fell another 6 or 7% to today’s levels. If oil prices continue to fall, as some speculate may happen, that would be called “catching a falling knife” and the investors may end up feeling rather burned by their optimism. Once cut by the falling knife, some investors become reluctant to come back a re-test their theory on rising prices, and this can contribute to a negative spiral for the falling asset.

I learned from my father-in-law, who worked at an oil company his whole life until he retired, that the oil business is always complicated. Up and down, supply and demand; they don’t work the way you’d think they would. When oil prices go down, gasoline gets cheaper, so people drive more, which drives prices back up (unless people are driving less and buying fewer cars, as appears to be happening now, perhaps because of those darn millennials and their urbanization and bike riding). Plus, there’s international politics, with Russian, OPEC, the Middle East, China the drive for energy independence, solar power, etc. On the other hand, gasoline and home heating oil and such are getting cheaper, which is a nice bonus for consumers, particularly in more car dependent regions. The economy benefits from the effect of extra money in the hands of consumers as that money gets spent elsewhere (other than on oil executives third or fourth homes, presumably). Oil is complicated.

But oil can and does crash. When it does, it can have a wider adverse impact on local oil-dependent economies, like Texas in the 80’s or perhaps, North Dakota, today. While there are a number of mysterious factors at play in the current fall in oil prices, the knock-on effects are starting to pile up. Oil producers are cutting production, idling rigs and cutting prices to stay competitive. The somewhat worried sounding consensus is that there is “too much oil supply” currently. The speculative portion of the oil market will be hit hardest, i.e. the junk-debt fueled shale companies. At some point, investors in the CLOs (and regular debt) backed by this highly leveraged debt from companies that aren’t profitable anymore, are going to get nervous (yields on such debt are already quite a bit higher) and start selling. In all likelihood, some exploration companies will fail. I wouldn’t describe it as a fear environment yet – in many cases the junk debt from exploration companies doesn’t come due for a few years – but the seeds of worry have been planted on fertile ground. One observer described the current environment as a “negative bubble”, with a herd mentality driving investors away from any optimistic assumptions for the market.

Why should we care? For most consumers, the most likely impact of a continuing deflation in oil prices will, as I mentioned, be cheaper gas and heating costs. When the housing market crashed, the negative impact was mostly felt by average Americans, as wealth was destroyed up and down the block, whereas the oil market seems very different and more removed. Still, it’s fascinating and instructive to watch the dynamics of a (potential) collapse of a bubble – on exploration, shale, oil prices, international politics – and the odds are high for unexpected consequences and global volatility. What will happen to the recent growth in solar and other renewable energies, if the price of the competing product gets much cheaper? What about the local politics of fracking? What kind of exposure do banks have to the oil markets and will it trigger any regulatory issues? What will happen to the international politicians, who like moving chess pieces around the Middle East map if oil-producing countries lose their political clout? Also, it’s odd that the Fed’s efforts to fight deflation have contributed, in part, to a price collapse of a crucial commodity, via QE-fueled easy money helping to push oil producers to dig up too much oil? How will the Fed react to this challenge?

I don’t know the answer, nor do I expect anyone else does either. But oil and energy are hugely important issues to most Americans (and the people of other countries, too, obviously) and to the national and global economies – not as big as housing, but pretty close. What happens in the next few months may affect many of us and it bears watching how our regulators, politicians, mega-companies and generals respond to the emerging (potential) collapse.

Will Demographics Solve the College Tuition Problem? (A: I Don’t Know)

I’ve got two girls in middle school. They are lovely and (in my opinion as a proud dad) smart. I wonder, on occasion, what college will they go to and what their higher education experience will be like? No matter how lovely or smart my daughters are, though, it will be hard to fork over all of that tuition money. It sure would be nice if college somehow got cheaper by the time my daughters are ready in 6 or 8 years!

How likely is this? There has been plenty of coverage about how the cost of college has risen so dramatically over the past decades. A number of smart people have argued that the reason tuition has increased so much is because of all of the amenities that schools have built in recent years. Others are unconvinced that’s the reason, pointing out that increased spending by universities grew at a lower than the rate of tuition increases. Perhaps schools have been buoyed by a rising demographic trend – but it’s clear tuition increases have had a great run.

One way colleges have been able to keep increasing tuitions is by competing aggressively for wealthy students who can pay the full price of tuition (which also enables the schools to offer more aid to less than wealthy students). The children of the wealthy overseas are particularly desirable targets, apparently. I heard a great quote yesterday about this by Brad Delong – that his school, Berkeley, and other top universities presumably had become “finishing school[s] for the superrich of Asia.” It’s an odd sort of competition, though, where schools are competing for a particular customer (wealthy students) by raising prices. Presumably, this suggests that colleges have had pricing power to raise tuition due to increased demand (perhaps aided by increase in student loans, but that’s an argument for another day).

Will colleges continue to have this pricing power? For the optimistic future tuition payer, there are some signs that university pricing power may be eroding. Tuition increased at a slower rate this year (a bit more than 3%) but still at a rate that well exceeds inflation. And law schools are already resorting to price cutting after precipitous declines in applications – down 37% in 2014 compared to 2010!

College enrollment trends are a mixed bag and frequently obscured by studies from in-industry sources. Clearly, the 1990s and 2000s were a time a great growth for colleges – college enrollment grew by 48% from 1990 (12 million students) to 2012 (17.7 million). But 2010 appears to be the recent peak and enrollment fell by 2% from 2010 to 2012. In addition, overall college enrollment declined by 2.3% in 2014, although this decline is attributed to the 9.6% decline in two-year colleges while 4-year college enrollment actually increased by 1.2%.

It makes sense that the recent college enrollment trend would be down – the number of high school graduates appears to have peaked in 2010 at 3.3 million or so and is projected to decline to about 3.1 million in 2016 and stay lowish for the next few years. The US Census reports that there was a bulge of kids that are college age now (i.e. there were 22.04 million 14-19 year olds at the 2010 Census), but there are about 1.7 million fewer kids that are my daughters’ age (i.e., 5-9 year olds in the 2010 Census). That’s a pretty steep drop off (about 8%) in this pool of potential college students. These demographic trends have got some people worried. Moody’s, which rates the debt of a lot of colleges, has been downgrading a lot of smaller schools and says that this type of school has already been hit by declining enrollment and revenue. One analyst went so far as to warn of a “death spiral” at some schools due to declining enrollment. Moody’s analysis of declining revenue is an interesting factor, in light of reports of ever-increasing tuition. Last year Moody’s reported that 40% of colleges or universities (that were rated) faced stagnant or declining net tuition revenue.

Speaking strictly, again, as a future payer of my daughters’ college tuition, falling college age population and falling enrollment would seem to point to the possibility that tuition will be lower for my kids when the time comes. Plus there are a lot of other factors that seem to be lining up against the prospects for college tuition – like continued flat or declining wages, the enormous student loan bubble (it can’t keep growing, right?), the rise of online education…

And yet, I’m not feeling that confident. Elite universities (and it certainly would be nice if my girls could get into such a school) seem to have found a way to collect a lot of tuition from foreign students (it’s hard to find a good data source for that though) which protects them from the adverse demographic and economic trends. I’ve wondered if US students could get turned off by the perception that top US schools have too many foreign students and are too much, as Delong says, elite finishing schools. But that’s hard to predict and may take many years to reach a tipping point. Plus if tuition and enrollment drop a lot, that may cripple the schools that have taken out a lot of debt to build all of those nice amenities. A Harvard Business School professor rather bearishly projects that as many as half of the 4,000 US colleges and universities may fail in the next 15 years. Would a sharp decrease in the number of colleges due to falling enrollment have the effect of reducing competition at the remaining schools? If so, what impact would that have on tuition?

Both college tuition and student loans have been described as bubbles thanks to their recent rate of growth. At some point, bubbles burst (in theory). As someone who watched, first hand and with great discomfort, the growth of the subprime and housing bubbles before the crisis, I’ve painfully learned that bubbles can last much longer than you would rationally expect. And despite all sorts of analysis and calculation about what should happen, the thing that triggers the bursting of the bubble is really hard to predict. As is when it will happen. To the extent I’ve learned a lesson from mortgage land, it’s that you shouldn’t do anything stupid in anticipation of the bubble either bursting or continuing. So, as much as I hope and even expect that the trend for increased college tuition will reverse in the coming years, I guess I’ll have to keep on trying to save for when my daughters will be heading off to college.

Time to Short 57th Street?

As a New Yorker, it’s hard to travel through the city these days without coming across construction sheds, scaffolding and giant cranes. New building construction is everywhere and much of it is for residential apartments. Midtown Manhattan and 57th Street in particular, sometimes referred to as “Billionaire’s Row”, seems to be overrun with giant new condo buildings going up (though the construction is hardly limited to that neighborhood). It’s not just my imagination. An astonishing number of super high end apartments are being built – one recent report estimated that 7,000 new apartments will be coming on line in the next two years. Sometimes, this can cause an average New Yorker like myself to get annoyed by the inconvenience of the construction sites, the altering of the city skyline, the rapid and radical changes to neighborhoods or the loss of an old, favorite haunt. It can some cause a person to shake their fists at the sky and ask how much longer can this madness go on? Just how many rich people in the are there in the world who don’t already have giant apartments in the city?

There are some people who are worried that the construction and development of some many high-end homes in New York might be entering a danger zone. There are signs that the pace of expensive condos may be slowing. London, a city similarly blessed with an influx of expensive apartments and the bankers and oligarchs who love them, has recently seen a sharp decline in high end home sales. The fall in the prices of the Ruble and oil may start to make some overseas buyers more reticent. The supply of high end homes may, perhaps, be exceeding demand, for now at least.

One New York City developer recently shared his concern and negative outlook for what he describes as a bubble in high end Manhattan real estate – he said he wished he could short 57th street! In other words, this developer doesn’t see a bright future for high end New York City condos and he thinks there would be more money to make by betting on the prices of these condos falling. Readers may recall that in 2007 a number of hedge fund managers, such as John Paulson and Magnetar, and investment banks, such as Deutsche Bank and Goldman Sachs, made boatloads of money by using Credit Default Swaps to bet that subprime mortgage backed securities would fall in value.

Is this possible? Is there a market for betting on individual apartment buildings or neighborhoods falling in value? Sort of? Yale Professor Robert Shiller helped create something known as the Case Shiller Home Price Futures Exchange, which trades on the CME. This exchange does let a person who might be inclined to make bets on the future price movements of Case Shiller’s national home price index, including either shorting (betting on a decline in price of homes underlying the index) or going long (betting on an increase in the prices of homes underlying the index). However, it is still a relatively new concept and is relatively thinly traded. In any event, the index is based on the home prices of the whole country (or at least the top ten regions of the country), so it really isn’t narrowly focused enough to get at the issue of over-priced billionaire condos in New York.

Alternatively, if you were a billionaire thinking about buying a $20 million pied-à-terre overlooking Central Park but worried that prices might go down, you could just decide not to buy right now. Unfortunately, this might not be very satisfying until condo prices did eventually fall and you got to tell everyone “I told you so.”

Why would someone want to be able to short this segment of the market? Is it just because they’re jealous of the rich and hope that they lose some (paper) wealth? In the stock market, short sellers sometimes get attacked for being bad for the market or harming otherwise nice companies. Defenders of short sellers (and there have been many similar defenses in recent years), however, argue that shorting stocks is good for market liquidity and price discovery. Short sellers expose fraud and correct mis-pricing in the market. Likewise, the hedge fund guys and bankers who shorted the subprime market argued in books like Michael Lewis’s The Big Short that they did provide a service (as well as make themselves wealthy) by helping to expose the shoddy mortgage underwriting practices and national housing bubble that dominated the early 2000s.

If there really is a bubble in multi-million dollar apartments in New York City, would New Yorkers benefit from having the bubble deflated or fraudulent apartment buyers or sellers exposed? Potentially. If this market is a bubble, it may have the effect of driving up land values throughout the neighborhood, or cause landlords to warehouse empty buildings in anticipation of future paydays. Pricking the bubble might prevent the speculative construction of buildings that don’t, subsequently, find enough apartment buyers and then end up in bankruptcy, sitting vacant and neglected for many years. If there really is a bubble, shouldn’t the speculative excesses of the billionaire condo market be exposed to price discovery and negative bets the way the subprime market was back in 2007?

Unfortunately, no such market really exists at this time. Until Professor Shiller decides to narrow his index and futures exchange down to just Manhattan’s 57th Street, or some clever trader comes up with a new way to trade property values, we may be stuck having to wave our fists angrily at the skyscrapers blotting out the sun. But it is interesting to think about.

My annoying neighbor (and the banality of political corruption)

Greetings! Thanks so much to Cathy for having me in to guest blog for her while she visits Haiti! While neither a math pro nor a babe, I do, on occasion confer with Cathy about her posts and contribute a few thoughts of my own about the world on Twitter at @advisoryA. And I also play bluegrass with her most Tuesday nights – so I guess that qualifies me as a substitute.

To start, I thought I’d share some observations about my new neighbor. West 22nd Street, where my family and I live, is a lovely, tree-lined area with a mix of modest townhouses, apartments and an occasional upscale single-family home mixed in.

In early October my street was lined with pink “No Parking Tuesday” signs. Through neighborhood scuttlebutt I learned the reason: President Obama was attending a fundraiser at a home across the street from me. The location of the fundraiser was at what had been, until recently, a modest townhouse owned by an old Chelsea family for decades. In 2012 the building was bought for $4.6 million. It received a lavish renovation and was put on the market a couple of weeks ago for …. $16.5 million (yes, nearly four times the price paid less than 18 months earlier). It’s being marketed by some real estate broker guy who is a regular on a TV show called Million Dollar Listing – i.e. a home flipping show. http://ny.curbed.com/tags/460-west-22nd-street For fun, check out the comments on Curbed.com (which note that a more “reasonable” flip might be $7 or $8 million, the layout of the narrow home is awkward because the dining room is on a different floor from the kitchen and the master bath that is down the hall from the master bedroom. Plus, there’s a playground pretty much in the backyard and it’s in flood zone A – this area was hit during Hurricane Sandy).

As far as I can tell, the new owners have never lived there – I watched the renovation over the past several months and, since it was put on the market, the only people I’ve noticed inside have come from a stream of of black cars delivering their passengers to apartment viewings.

It didn’t take much effort to discover who was the mastermind behind this audacious exercise in house-flipping: the owners of this lovely home are Bill White and Bryan Eure. White manages to get his name in the paper with some regularity. He’s basically a professional fundraiser. His wiki is…interesting. http://en.wikipedia.org/wiki/Bill_White_(administrator) His big claim to fame is raising funds for, and subsequently managing, the Intrepid Museum. In 2010 he also formed a consulting company called Constellation Group for advice on charitable contributions, etc., and, within no time, he somehow got tangled up in the pay-to-play scandals. He was subpoenaed by then-Attorney General Andrew Cuomo (hmmm?) and ended up paying $1 million to resolve the mess. http://www.bloomberg.com/news/2010-09-16/ex-intrepid-president-said-to-settle-cuomo-pension-probe-for-1-million.html A million dollars sounds like a pretty big check and it came with some loss of status, including a “Disgraced” headline from the Daily News (“disgraced ex-head of the Intrepid” http://www.nydailynews.com/new-york/bill-white-disgraced-ex-head-intrepid-agrees-pay-1-million-settlement-pay-to-play-deal-article-1.443855 ). The New York pay-to-play scandal was pretty ugly and a few notables, including former New York City Comptroller Alan Hevisi, were convicted and sent to prison. White, however, was undeterred and instead, went about ramping up his political mover-and-shaker career. Within a year, his “disgrace” was fully rehabilitated.

Not one to let a romantic occasion go to waste, in 2011 White threw an elaborate, 700 guest wedding extravaganza at the Plaza to commemorate his wedding Bryan Eure. It wasn’t just any wedding – David Boies officiated! http://www.nytimes.com/2011/10/24/nyregion/wedding-of-bill-white-and-bryan-eure-is-extravagant.html http://nypost.com/2011/07/19/my-big-fab-gay-wedding/ And it was filled with luminaries and politicians, including Bill Clinton, both George Bushes, David Patterson, Scott Stringer, Christine Quinn, and, remarkably, White’s former Javert, Andrew Cuomo. Nothing like a wedding to help bury old grudges.

For some reason, White appears to be a bit fickle when it comes to his political affiliation. Despite supposedly being considered for senior military positions in the Obama Administration during Obama’s first term, White presented himself as a Romney supporter in 2012. He was back in the news for withdrawing support, and requesting his contributions back, from Romney in 2012 over Romney’s gay marriage stance http://politicalticker.blogs.cnn.com/2012/05/14/romney-donor-pulls-support-backs-obama-over-same-sex-marriage/.

White also calls on his political friends to help out the neighborhood sometimes, too. Even though he doesn’t spend much time at his 22nd Street home, White still has strong opinions on the neighborhood. He angrily petitioned Mayor Bloomberg over the CitiBikes station that would be a few feet from his front door. http://www.dnainfo.com/new-york/20140106/chelsea/mayor-bloombergs-friends-emailed-for-help-with-their-citi-bike-woes In an email to his old buddy, he argued that it was just plain unfair that the ugly bike rack would mess up the character of “his” block.

I’d estimate roughly 200 police officers and at least 50 Secret Service officers arrived on Tuesday, October 7th to prepare for the President’s arrival. Security gates were all over the place, the street was closed off to traffic and eventually the police and Secret Service required ID for anyone entering the block (the NY Times had a little commentary about the visit http://www.nytimes.com/2014/10/08/nyregion/before-a-visit-from-obama-a-chelsea-block-goes-on-lockdown.html?_r=0. At one point, the Secret Service came to my door to ask about the open window in the upstairs apartment – apparently it made the snipers (!!) uncomfortable (since my upstairs neighbor was out at the time, I’m not sure how this was resolved). Many thousands of dollars were spent securing this visit. The President showed up, hung out for about an hour and headed out to Greenwich, Connecticut for fundraiser part II. But the good news is Bill White can now say that the President (who he may or may not support, depending on the current tides) broke bread in his house, which should certainly help boost resale value – I bet they don’t have that happen every day on Million Dollar Listing!

The President’s visit was, for me, a rather sad window into the fundraising machine of rich guys and the politicians who need them. As a coda, investigative reporter Roddy Boyd provided an additional glimpse into my millionaire-next-door. As part of his many efforts to help Veterans, White worked as a fundraiser for New York City’s Veteran’s Day parade. Sadly, due to rising costs of throwing a parade, it almost didn’t happen this year. But thanks to the fundraiser with Obama at White’s house, he managed to scrape enough money together to save the parade. As Roddy notes, there’s a little more to this story. http://observer.com/2014/11/stumbling-up-fifth-avenue/ Just ten years ago, the NY Veteran’s Day parade cost about $35,000 to run. Now, a much more elaborate, televised parade costs more than a million dollars to run each year, in part due to the $570,000 fund-raising contract for our old friend Bill White. Roddy has much more on the ugly sausage-making of charitable fund raising and I highly recommend you check out his article. I eagerly await the arrival of the Russian oligarch or Chinese official who’ll buy White’s house and help make the neighborhood a little more respectable.

Alt Banking in Huffington Post #OWS

Great news! The Alt Banking group had a piece published today in the Huffington Post entitled With Economic Justice For All, about our hopes for the next Attorney General.

For the sake of the essay, we coined the term “marble columns” to mean the opposite of “broken windows.” Instead of getting arrested for nothing, you never get arrested, as long as you work at a company with marble columns. For more, take a look at the whole piece!

Also, my good friend and bandmate Tom Adams (our band, the Tomtown Ramblers, is named after him) will be covering for me on mathbabe for the next few days while I’m away in Haiti. Please make him feel welcome!

Bitcoin provocations

Yesterday at the Alt Banking meeting we had a special speaker and member, Josh Snodgrass (not his real name), come talk to us about Bitcoin, the alternative “cryptocurrency”. I’ll just throw together some fun and provocative observations that came from the meeting.

- First, Josh demonstrated how quickly you can price alternative currencies, by giving out a few of our Alt Banking “52 Shades of Greed” cards and stipulating that the jacks (I had a jack) were worth 1 “occudollar” but the 2’s (I also had a 2) were worthy 1,000,000,000 occudollars. Then he paid me $1 for my jack, which made me a billionaire. After thinking for a minute, I paid him $5 to get my jack back, which made me a multibillionaire. Come to think of it I don’t think I got that $5 back after the meeting.

- There’s a place you can have lunch in the city that accepts Bitcoin. I think it’s called Pita City.

- The idea behind Bitcoin is that you don’t have to have a trustworthy middleman in order to buy stuff with it. But in fact, the “bitcoin wallet” companies are increasingly playing the role of the trusted middlemen, especially considering it takes on average 10 minutes, but sometimes up to 40 minutes, of computing time to finish a transaction. If you want to leave the lunch place after lunch, you’d better have a middleman that the shop owner trusts or you could be sitting there for a while.

- People compare bitcoin to other alternative currencies like the Ithaca Hours, but there are two very important differences.

- First, Ithaca Hours, and other local currencies, are explicitly intended to promote local businesses: you pay for your bread with them, and the bread company you give money to buys ingredients with them, and they need to buy from someone who accepts them, which is by construction a local business.

- Second, local currencies like the Madison East Side Babysitting Coop’s “popsicle currency” are very low tech, used my middle class people to represent labor, whereas Bitcoin is highly technical and used primarily by technologists and other fancy people.

- There is class divide and a sophistication divide here, in other words.

- Speaking of sophistication, we had an interesting discussion about whether it would ever make sense to have bitcoin banks and – yes – fractional reserve bitcoin banking. On the one hand, since there’s a limit to the number of overall bitcoins, you can’t have everyone pretending they can pay a positive interest rate on all the bitcoin every year, but on the other hand a given individual can always write a contract saying they’d accept 100 bitcoins now and pay back 103 in a year, because it might just be a bet on the dollar value of bitcoins in a year. And in the meantime that person can lend out bitcoins to people, knowing full well they won’t all be spent at once. Altogether that looks a lot like fractional reserve bitcoin banking, which would effectively increase the number of bitcoins in circulation.

- Also, what about derivatives based on bitcoins? Do they already exist?

- Remaining question: will bitcoins ever actually be usable and trustworthy for people to send money to their families across the world below the current cost? And below the cost of whatever disruptions are being formulated in the money business by Paypal and Google and whoever else?

Update: there will be a Bitcoin Hackathon at NYU next weekend (hat tip Chris Wiggins). More info here.

Aunt Pythia’s advice

Holy crap! Aunt Pythia is in love with a new knitting pattern and has just completed her first reversible “flaming hat”:

The green is leftover from a sweater Aunt Pythia knitted for her husband years ago, a wool/silk blend. Also scrumptious.

And that’s all I got today, folks.

Just kidding! I’m here for you guys, of course! Let’s dig in. But before I forget,

please think of something

titillating, reversible, and scrumptious

to ask Aunt Pythia

at the bottom of the page!

By the way, if you don’t know what the hell Aunt Pythia is talking about, go here for past advice columns and here for an explanation of the name Pythia.

——

Dear Aunt Pythia,

This may be too broad a generalization, but I feel that current practices of teaching math were developed in an era when computers were not available. In an age where powerful, open-source tools are readily available and it’s even possible to do symbolic math using a computer, is it still useful to teach traditional pen-and-paper math to students who have no interest in becoming professional mathematicians? Does one really need to know that a trigonometric substitution would convert a tricky integral to a familiar one? As teachers, should we just focus on “big picture” concepts and use computers to explore problems on a larger scale than are feasible by hand (e.g. 1000 X 1000 matrices instead of 3 X 3)? Or, will lack of rigor in teaching have long term consequences (dubious application of math in real world)? Are there examples of the use of computers in mathematical education that you would recommend?

Obsessive Correlator

Dear OC,

I kind of agree. I never saw the point of cosines and sines until Taylor Series, even though they theoretically help ships navigate in the ocean. I mean, maybe, but that connection was never made clear to us.

If I had my way, we’d spend a lot more time doing simple data analysis, trying to understand what “statistical evidence” means, so we train people to read the newspaper and scientific research papers and not be cowed by the math, which is usually pretty simple.

Also, there are new tools like this one (hat tip Josh Vekhter) which are taking care of the rote arithmetic already:

The good news is, there are efforts underway to modernize the mathematics curriculum. The bad news is they’ve gotten caught in a web of politics. But I do expect this stuff to get sorted out over time.

Aunt Pythia

——

Dear Aunt Pythia,

I’m an undergrad freshman studying physics and math. I absolutely adore physics and it’s what I want to be doing for the rest of my life. I’d really, really love to become a physicist but I fear I’m just not smart enough. Reading your sample question has worried me. I had always thought if I work hard enough I could do it, but it’s always in the back of my mind that I’m not creative/intelligent enough. When (if ever) will I know if I have what it takes?

Unsure and Insecure

Dear U&I,

Short answer: never.

The long answer has four parts.

First, I have actually never met anyone who thinks they are smart enough to be a physicist or a mathematician at the level they want to be. Just get used to it and enjoy the love for the subject anyway. Also, knowing that nobody ever feels smart enough might be comforting.

Second, in general the more time you spend with something, the better you get at it, and the more you love something the more time you want to spend with it. Sometimes insecurity can be debilitating, but if you remember you love it aside from your ability, you can try to keep things cool.

Third, when your teachers and others encourage you, believe them. If you don’t get into a grad school for math or physics, take it as a sign – probably – that it might not be for you, but if you do get into a grad school, just trust that other people see something in you that you can’t see yourself, yet.

Finally, I am not sure what you mean by my “sample question”, did I ask something that made a bunch of people feel not smart enough for physics and math? If so, I apologize. I never mean to do that. I really don’t think any one question could possibly be sufficient to size someone up in this kind of deep way.

Good luck!

Aunt Pythia

——

Dear Aunt Pythia,

Lately I’ve been a bit of a hermit. I do go out sometimes, but I often don’t really talk to anyone because of the well-documented awkwardness involved in starting conversations with strangers (which somehow seems to not bother some people).

I have a work friend in a similar predicament, and we came up with the idea for a “woman scavenger hunt” (we’re both single straight men) designed to help us get over our discomfort with talking to strangers (specifically, women). The scavenger hunt would be a race to meet women with particular characteristics such as:

- wearing a bandanna

- reading a book in a bar at night

- has a driver’s license from Hawaii or Alaska

- knows sign language

We would have to talk to the person in question and secure some sort of evidence, such as a photograph (consensually, of course!)

My questions are:

- Does this sound creepy? For some reason it feels like we’re plotting to invade other people’s privacy, and it’s hard to decide if this is real or if I’m just antisocial.

- If you endorse the idea, can you add to our list? It has to be something for which one can collect evidence; we ruled out “met Elizabeth Warren”, for example.

Tired Introvert Mulling Interpersonal Development

Dear TIMID,

First of all, I think it’s a goodish idea. I would like to suggest that you enlarge the goal to “meeting a person with the following characteristic” rather than a woman specifically, because the truth is you’re probably awkward meeting men and women, and this will give you practice, and although you are theoretically more interested in the women, meeting men is a good idea too. Plus, men have friends who are girls. If you give a good impression to the men you meet, the women will be like, “who’s this guy?”.

By the way, one of my good friends had a habit when she was single of hanging out with her girlfriends (wingwomen actually) and coming up with slightly artificial arguments at their table, which they would turn into “polls” for the entire bar. In other words, they’d argue aimlessly until they came up with something jicy enough to bring to every other group of men, women, and mixed groups at the bar and poll them. They might do this all night, gradually getting to know people at the bar, and they might have actually been interested romantically or sexually in only a few of the people they interacted with, but their friendliness and interactivity was a hit with everyone, assuming their polls questions were funny and smart, which they were.

In other words, it’s a good idea, and it’s quirky, and if you can play with it and have fun with it, and get other people to be into it and have fun with it, then it’s all good. You might not get laid, but in the worst case scenario you make friends.

Just to be clear, you gotta make sure the “characteristics” you’re looking for don’t get creepy or sexual. Don’t, for example, go up to women and say you’re looking for a woman with such-and-such sexual experience or physical attributes. Gross.

And never, ever, ever do anything this guy suggests.

Good luck!

Aunt Pythia

——

Dear Aunt Pythia,

I’m applying for (academic) math jobs at the moment. I’m also female (obvious from my name) and a lesbian (unsurprising once you meet me).

Occasionally, as part of the job application, I’m asked to comment on how I might contribute to diversity in mathematics. This is obviously a broad question, but part of my answer inevitably involves a discussion of women in mathematics. The way I talk about this issue is naturally colored by the fact that I’m a woman.

One of the prompts explicitly mentions the GLBT axis of diversity. It is not as clear to me how or whether to address this in my statement. My personal experience is that anti-gay biases in mathematics aren’t as pernicious as racial or gender biases, so I tend not to raise this issue on my own.

If I come out while saying that I’m supportive of GLBT students, then it sounds like I’m looking for extra credit for being a minority. I don’t need brownie points for being queer. But on the other hand, I’m out in my personal life and so it seems weird to be closeted in a discussion touching on GLBT diversity. But then again it seems weird to be discussing sexuality at all in the context of a job application.

In summary: would you come out in a “statement of diversity”?

Closeted Around Diversity

Dear CAD,

Things have changed since I applied for jobs! We didn’t have diversity statements back then. And it’s weird to think they’d be prompting you to disclose stuff like your sexuality – in fact it sounds downright illegal.

After some thought and a minimal amount of googling, I think maybe you should interpret this as prompting your experience in promoting diversity in mathematics. This idea is backed up by the advice on this webpage, although I don’t know if that makes it a universal truth.

In other words, have you mentored women? Have minorities of one type or another felt comfortable enough around you to come ask you questions? Did you organize or give a talk at a Sonia Kovalesky Day somewhere? Were you the faculty advisor for some other group that was diverse? That kind of thing.

I guess I think there’s no reason to talk directly about your sexuality when you talk about your experience promoting diversity, even though it might be inferred, rightly or wrongly.

To sum up, I would not come out in a “statement of diversity.”

Auntie P

——

Please submit your well-specified, fun-loving, cleverly-abbreviated question to Aunt Pythia!

Click here for a form.

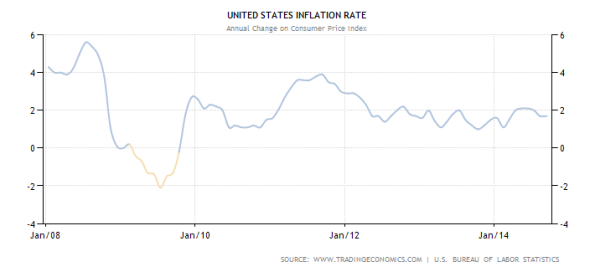

Inflation for the rich

I’m preparing for my weekly Slate Money podcast – this week, unequal public school funding, Taylor Swift versus Spotify, and the economics of weed, which will be fun – and I keep coming back to something I mentioned last week on Slate Money when we were talking about the end of the Fed program of quantitative easing (QE).

First, consider what QE comprised:

- QE1 (2008 – 2010): $1.65 trillion dollars invested in bonds and agency mortgage-back securities,

- QE2 (2010 – 2011): another $600 billion, cumulative $2.25 trillion, and

- QE3 (2012 – present): $85 billion per month, for a total of about $3.7 trillion overall.

Just to understand that total, compare it to the GDP of the U.S. in 2013, at 16.8 trillion. Or the federal tax spending in 2012, which was $3.6 trillion (versus $2.5 trillion in revenue!).

Anyhoo, the point is, we really don’t know exactly what happened because of all this money, because we can’t go back in time and do without the QE’s. We can only guess, and of course mention a few things that didn’t happen. For example, the people against it were convinced it would drive inflation up to crazy levels, which it hasn’t, although of course individual items and goods have gone up of course:

Well but remember, the inflation rate is calculated in some weird way that economists have decided on, and we don’t really understand or trust it, right? Actually, there are a bunch of ways to measure inflation, including this one from M.I.T., and most of them kinda agree that stuff isn’t crazy right now.

So did QE1, 2, and 3 have no inflationary effect at all? Were the haters wrong?

My argument is that it indeed caused inflation, but only for the rich, where by rich I mean investor class. The stock market is at an all time high, and rich people are way richer, and that doesn’t matter for any inflation calculation because the median income is flat, but it certainly matters for individuals who suddenly have a lot more money in their portfolios. They can compete for New York apartments and stuff.

As it turns out, there’s someone who agrees with me! You might recognize his name: billionaire and Argentinian public enemy #1 Paul Singer. According to Matt O’Brien of the Washington Post, Paul Singer is whining in his investor letter (excerpt here) about how expensive the Hamptons have gotten, as well as high-end art.

It’s “hyperinflation for the rich” and we are not feeling very bad for them. In fact it has made matters worse, when the very rich have even less in common with the average person. And just in case you’re thinking, oh well, all those Steve Jobs types deserve their hyper-inflated success, keep in mind that more and more of the people we’re talking about come from inherited wealth.

Nerd catcalling

This is a guest post by Becky Jaffe.

It has come to my attention that I am a nerd. I take this on good authority from my students, my friends, and, as of this morning, strangers in a coffee shop. I was called a nerd three times today before 10:30 am, while I was standing in line for coffee – which is to say, before I was caffeinated, and therefore utterly defenseless. I asked my accusers for suggestions on how to be less nerdy. Here was their helpful advice:

Guy in coffee shop: “Wear makeup and high heels.”

Another helpful interlocutor: “Use smaller words.”

My student, later in the day: “Care less about ideas.”

A friend: “Think less like NPR and more like C-SPAN.”

What I wish someone had said: “Is that a dictionary in your pocket or are you happy to see me?”

What I learned today is that if I want to avoid being called a nerd, I should be more like Barbie. And I don’t mean the Professor Barbie version, which – get this – does not exist. When I googled “Professor Barbie,” I got “Fashion Professor Barbie.”

So many lessons in gender conformity for one day! This nerd is taking notes.

Going to Haiti next week

I’m off to Haiti next week, for a week, with my buddie and bandmate Jamie Kingston. I was trying to figure out what to do with the blog while I was gone, and so I asked sometimes-guest blogger Becky Jaffe to cover for me (some of you may remember her Hip Hop’s Cambrian Explosion series which to this day gets traffic) but by the time I’d explained my trip, she’d decided to come along too! Which is awesome. We’re staying at the Hotel Oloffson in Port au Prince:

So two things. First, if you know of fun stuff to do in the Port au Prince area, please tell me. I tend to like talking to people, and music and crafts, and Becky and Jamie are more into nature and insects.

Second, if you have a lovely or inspiring suggestion for what should happen to mathbabe next week while we’re away, please tell me!

“Hand To Mouth” and the rationality of the poor

Here’s one thing that you do as a mathematician a lot: change the assumptions and see how wildly the conclusions change. You usually start with lots of assumptions, and then see how things change when they are taken away one by one: what if the ring isn’t commutative? What if it doesn’t have a “1”?

Of course, it’s easy enough to believe that we can no longer prove the same theorems when we don’t start with the same kinds of mathematical set-ups. But this kind of thing can also apply to non-mathematical scenarios as well.

So, for example, I’ve long thought that the “marshmallow” experiment is nearly universally misunderstood: kids wait for the marshmallow for exactly as long as it makes sense to them to wait. If they’ve been brought up in an environment where delayed gratification pays off, and where the rules don’t change in the meantime, and where they trust a complete stranger to tell them the truth, they wait, and otherwise they don’t – why would they? But since the researchers grew up in places where it made sense to go to grad school, and where they respect authority and authority is watching out for them, and where the rules once explained didn’t change, they never think about those assumptions. They just conclude that these kids have no will power.

Similarly, this GoodBooksRadio interview with Linda Tirado is excellent in explaining the rational behavior of poor people:

Tirado just came out with a book called Hand To Mouth: Living in Bootstrap America and was discussing it with Dr. John Cook, who was a fantastic interviewer. You might have come across Tirado’s writing – her essay on poverty that went viral, or the backlash against that essay. She’s clearly a tough cookie, a great writer, and an articulate speaker.

Among the things she explains is why poor people eat McDonalds food (it’s fast, cheap, and filling), why they don’t get much stuff done (their lives are filled with logistics), why they make bad decisions (stress), and, what’s possibly the most important, how much harder work it is to be poor than it is to be rich. She defines someone as “rich” if they don’t lease their furniture.

I’m looking forward to reading her book. As the Financial Times review says, “Hand to Mouth – written with scorching flair – should be read by every person lucky enough to have a disposable income.”

Aunt Pythia’s advice

Well, hello and good morning! Glad you all could make it onto Aunt Pythia’s magic bus today! I’ve redecorated to celebrate Daylight Savings Time (or rather, the end of it):

Daylight savings time has made Aunt Pythia very happy today, because it means an extra hour for me to focus on you, you and your problems, which is what Aunt Pythia loves to do, at least on Saturday mornings, and at least when they involve sex or math (or ideally, both).

By the way, to investigate and demolish the myths around Daylight Savings Time, check out this fantastic and scientific video (best line, “waking up is like sneezing”).