Archive

O’Reilly book deal signed for “Doing Data Science”

I’m very happy to say I just signed a book contract with my co-author, Rachel Schutt, to publish a book with O’Reilly called Doing Data Science.

The book will be based on the class Rachel is giving this semester at Columbia which I’ve been blogging about here.

For those of you who’ve been reading along for free as I’ve been blogging it, there might not be a huge incentive to buy it, but I can promise you more and better math, more explicit usable formulas, some sample code, and an overall better and more thought-out narrative.

It’s supposed to be published in May with a possible early release coming up at the end of February, in time for the O’Reilly Strata Santa Clara conference, where Rachel will be speaking about it and about other stuff curriculum related. Hopefully people will pick it up in time to teach their data science courses in Fall 2013.

Speaking of Rachel, she’s also been selected to give a TedXWomen talk at Barnard on December 1st, which is super exciting. She’s talking about advocating for the social good using data. Unfortunately the event is invitation-only, otherwise I’d encourage you all to go and hear her words of wisdom. Update: word on the street is that it will be video-taped.

Columbia Data Science course, week 11: Estimating causal effects

The week in Rachel Schutt’s Data Science course at Columbia we had Ori Stitelman, a data scientist at Media6Degrees.

We also learned last night of a new Columbia course: STAT 4249 Applied Data Science, taught by Rachel Schutt and Ian Langmore. More information can be found here.

Ori’s background

Ori got his Ph.D. in Biostatistics from UC Berkeley after working at a litigation consulting firm. He credits that job with allowing him to understand data through exposure to tons of different data sets; since his job involved creating stories out of data to let experts testify at trials, e.g. for asbestos. In this way Ori developed his data intuition.

Ori worries that people ignore this necessary data intuition when they shove data into various algorithms. He thinks that when their method converges, they are convinced the results are therefore meaningful, but he’s here today to explain that we should be more thoughtful than that.

It’s very important when estimating causal parameters, Ori says, to understand the data-generating distributions and that involves gaining subject matter knowledge that allows you to understand if you necessary assumptions are plausible.

Ori says the first step in a data analysis should always be to take a step back and figure out what you want to know, write that down, and then find and use the tools you’ve learned to answer those directly. Later of course you have to decide how close you came to answering your original questions.

Thought Experiment

Ori asks, how do you know if your data may be used to answer your question of interest? Sometimes people think that because they have data on a subject matter then you can answer any question.

Students had some ideas:

- You need coverage of your parameter space. For example, if you’re studying the relationship between household income and holidays but your data is from poor households, then you can’t extrapolate to rich people. (Ori: but you could ask a different question)

- Causal inference with no timestamps won’t work.

- You have to keep in mind what happened when the data was collected and how that process affected the data itself

- Make sure you have the base case: compared to what? If you want to know how politicians are affected by lobbyists money you need to see how they behave in the presence of money and in the presence of no money. People often forget the latter.

- Sometimes you’re trying to measure weekly effects but you only have monthly data. You end up using proxies. Ori: but it’s still good practice to ask the precise question that you want, then come back and see if you’ve answered it at the end. Sometimes you can even do a separate evaluation to see if something is a good proxy.

- Signal to noise ratio is something to worry about too: as you have more data, you can more precisely estimate a parameter. You’d think 10 observations about purchase behavior is not enough, but as you get more and more examples you can answer more difficult questions.

Ori explains confounders with a dating example

Frank has an important decision to make. He’s perusing a dating website and comes upon a very desirable woman – he wants her number. What should he write in his email to her? Should he tell her she is beautiful? How do you answer that with data?

You could have him select a bunch of beautiful women and half the time chosen at random, tell them they’re beautiful. Being random allows us to assume that the two groups have similar distributions of various features (not that’s an assumption).

Our real goal is to understand the future under two alternative realities, the treated and the untreated. When we randomize we are making the assumption that the treated and untreated populations are alike.

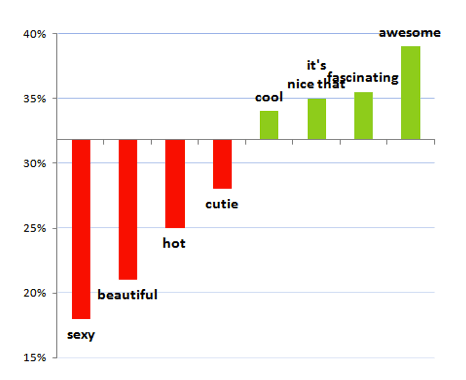

OK Cupid looked at this and concluded:

But note:

- It could say more about the person who says “beautiful” than the word itself. Maybe they are otherwise ridiculous and overly sappy?

- The recipients of emails containing the word “beautiful” might be special: for example, they might get tons of email, which would make it less likely for Frank to get any response at all.

- For that matter, people may be describing themselves as beautiful.

Ori points out that this fact, that she’s beautiful, affects two separate things:

- whether Frank uses the word “beautiful” or not in his email, and

- the outcome (i.e. whether Frank gets the phone number).

For this reason, the fact that she’s beautiful qualifies as a confounder. The treatment is Frank writing “beautiful” in his email.

Causal graphs

Denote by the list of all potential confounders. Note it’s an assumption that we’ve got all of them (and recall how unreasonable this seems to be in epidemiology research).

Denote by the treatment (so, Frank using the word “beautiful” in the email). We usually assume this to have a binary (0/1) outcome.

Denote by the binary (0/1) outcome (Frank getting the number).

We are forming the following causal graph:

In a causal graph, each arrow means that the ancestor is a cause of the descendent, where ancestor is the node the arrow is coming out of and the descendent is the node the arrow is going into (see this book for more).

In our example with Frank, the arrow from beauty means that the woman being beautiful is a cause of Frank writing “beautiful” in the message. Both the man writing “beautiful” and and the woman being beautiful are direct causes of her probability to respond to the message.

Setting the problem up formally

The building blocks in understanding the above causal graph are:

- Ask question of interest.

- Make causal assumptions (denote these by

).

- Translate question into a formal quantity (denote this by

).

- Estimate quantity (denote this by

).

We need domain knowledge in general to do this. We also have to take a look at the data before setting this up, for example to make sure we may make the

Positivity Assumption. We need treatment (i.e. data) in all strata of things we adjust for. So if think gender is a confounder, we need to make sure we have data on women and on men. If we also adjust for age, we need data in all of the resulting bins.

Asking causal questions

What is the effect of ___ on ___?

This is the natural form of a causal question. Here are some examples:

- What is the effect of advertising on customer behavior?

- What is the effect of beauty on getting a phone number?

- What is the effect of censoring on outcome? (censoring is when people drop out of a study)

- What is the effect of drug on time until viral failure?, and the general case

- What is the effect of treatment on outcome?

Look, estimating causal parameters is hard. In fact the effectiveness of advertising is almost always ignored because it’s so hard to measure. Typically people choose metrics of success that are easy to estimate but don’t measure what they want! Everyone makes decision based on them anyway because it’s easier. This results in people being rewarded for finding people online who would have converted anyway.

Accounting for the effect of interventions

Thinking about that, we should be concerned with the effect of interventions. What’s a model that can help us understand that effect?

A common approach is the (randomized) A/B test, which involves the assumption that two populations are equivalent. As long as that assumption is pretty good, which it usually is with enough data, then this is kind of the gold standard.

But A/B tests are not always possible (or they are too expensive to be plausible). Often we need to instead estimate the effects in the natural environment, but then the problem is the guys in different groups are actually quite different from each other.

So, for example, you might find you showed ads to more people who are hot for the product anyway; it wouldn’t make sense to test the ad that way without adjustment.

The game is then defined: how do we adjust for this?

The ideal case

Similar to how we did this last week, we pretend for now that we have a “full” data set, which is to say we have god-like powers and we know what happened under treatment as well as what would have happened if we had not treated, as well as vice-versa, for every agent in the test.

Denote this full data set by

where

denotes the baseline variables (attributes of the agent) as above,

denotes the binary treatment as above,

denotes the binary outcome if treated, and

denotes the binary outcome if untreated.

As a baseline check: if we observed this full data structure how would we measure the effect of A on Y? In that case we’d be all-powerful and we would just calculate:

Note that, since and

are binary, the expected value

is just the probability of a positive outcome if untreated. So in the case of advertising, the above is the conversion rate change when you show someone an ad. You could also take the ratio of the two quantities:

This would be calculating how much more likely someone is to convert if they see an ad.

Note these are outcomes you can really do stuff with. If you know people convert at 30% versus 10% in the presence of an ad, that’s real information. Similarly if they convert 3 times more often.

In reality people use silly stuff like log odds ratios, which nobody understands or can interpret meaningfully.

The ideal case with functions

In reality we don’t have god-like powers, and we have to make do. We will make a bunch of assumptions. First off, denote by exogenous variables, i.e. stuff we’re ignoring. Assume there are functions

and

so that:

i.e. the attributes

are just functions of some exogenous variables,

i.e. the treatment depends in a nice way on some exogenous variables as well the attributes we know about living in

, and

i.e. the outcome is just a function of the treatment, the attributes, and some exogenous variables.

Note the various ‘s could contain confounders in the above notation. That’s gonna change.

But we want to intervene on this causal graph as though it’s the intervention we actually want to make. i.e. what’s the effect of treatment on outcome

?

Let’s look at this from the point of view of the joint distribution These terms correspond to the following in our example:

- the probability of a woman being beautiful,

- the probability that Frank writes and email to a her saying that she’s beautiful, and

- the probability that Frank gets her phone number.

What we really care about though is the distribution under intervention:

i.e. the probability knowing someone either got treated or not. To answer our question, we manipulate the value of first setting it to 1 and doing the calculation, then setting it to 0 and redoing the calculation.

Assumptions

We are making a “Consistency Assumption / SUTVA” which can be expressed like this:

We have also assumed that we have no unmeasured confounders, which can be expressed thus:

We are also assuming positivity, which we discussed above.

Down to brass tacks

We only have half the information we need. We need to somehow map the stuff we have to the full data set as defined above. We make use of the following identity:

Recall we want to estimate which by the above can be rewritten

We’re going to discuss three methods to estimate this quantity, namely:

- MLE-based substitution estimator (MLE),

- Inverse probability estimators (IPTW),

- Double robust estimating equations (A-IPTW)

For the above models, it’s useful to think of there being two machines, called and

, which generate estimates of the probability of the treatment knowing the attributes (that’s machine

) and the probability of the outcome knowing the treatment and the attributes (machine

).

IPTW

In this method, which is also called importance sampling, we weight individuals that are unlikely to be shown an ad more than those likely. In other words, we up-sample in order to generate the distribution, to get the estimation of the actual effect.

To make sense of this, imagine that you’re doing a survey of people to see how they’ll vote, but you happen to do it at a soccer game where you know there are more young people than elderly people. You might want to up-sample the elderly population to make your estimate.

This method can be unstable if there are really small sub-populations that you’re up-sampling, since you’re essentially multiplying by a reciprocal.

The formula in IPTW looks like this:

Note the formula depends on the machine, i.e. the machine that estimates the treatment probability based on attributes. The problem is that people get the

machine wrong all the time, which makes this method fail.

In words, when we are taking the sum of terms whose numerators are zero unless we have a treated, positive outcome, and we’re weighting them in the denominator by the probability of getting treated so each “population” has the same representation. We do the same for

and take the difference.

MLE

This method is based on the machine, which as you recall estimates the probability of a positive outcome given the attributes and the treatment, so the $latex P(Y|A,W)$ values.

This method is straight-forward: shove everyone in the machine and predict how the outcome would look under both treatment and non-treatment conditions, and take difference.

Note we don’t know anything about the underlying machine $latex Q$. It could be a logistic regression.

Get ready to get worried: A-IPTW

What if our machines are broken? That’s when we bring in the big guns: double robust estimators.

They adjust for confounding through the two machines we have on hand, and

and one machine augments the other depending on how well it works. Here’s the functional form written in two ways to illustrate the hedge:

and

Note: you are still screwed if both machines are broken. In some sense with a double robust estimator you’re hedging your bet.

“I’m glad you’re worried because I’m worried too.” – Ori

Simulate and test

I’ve shown you 3 distinct methods that estimate effects in observational studies. But they often come up with different answers. We set up huge simulation studies with known functions, i.e. where we know the functional relationships between everything, and then tried to infer those using the above three methods as well as a fourth method called TMLE (targeted maximal likelihood estimation).

As a side note, Ori encourages everyone to simulate data.

We wanted to know, which methods fail with respect to the assumptions? How well do the estimates work?

We started to see that IPTW performs very badly when you’re adjusting by very small thing. For example we found that the probability of someone getting sick is 132. That’s not between 0 and 1, which is not good. But people use these methods all the time.

Moreover, as things get more complicated with lots of nodes in our causal graph, calculating stuff over long periods of time, populations get sparser and sparser and it has an increasingly bad effect when you’re using IPTW. In certain situations your data is just not going to give you a sufficiently good answer.

Causal analysis in online display advertising

An overview of the process:

- We observe people taking actions (clicks, visits to websites, purchases, etc.).

- We use this observed data to build list of “prospects” (people with a liking for the brand).

- We subsequently observe same user during over the next few days.

- The user visits a site where a display ad spot exists and bid requests are made.

- An auction is held for display spot.

- If the auction is won, we display the ad.

- We observe the user’s actions after displaying the ad.

But here’s the problem: we’ve instituted confounders – if you find people who convert highly they think you’ve done a good job. In other words, we are looking at the treated without looking at the untreated.

We’d like to ask the question, what’s the effect of display advertising on customer conversion?

As a practical concern, people don’t like to spend money on blank ads. So A/B tests are a hard sell.

We performed some what-if analysis stipulated on the assumption that the group of users that sees ad is different. Our process was as follows:

- Select prospects that we got a bid request for on day 0

- Observe if they were treated on day 1. For those treated set

and those not treated set

collect attributes

- Create outcome window to be the next five days following treatment; observe if outcome event occurs (visit to the website whose ad was shown).

- Estimate model parameters using the methods previously described (our three methods plus TMLE).

Here are some results:

Note results vary depending on the method. And there’s no way to know which method is working the best. Moreover, this is when we’ve capped the size of the correction in the IPTW methods. If we don’t then we see ridiculous results:

The ABC Conjecture has not been proved

As I’ve blogged about before, proof is a social construct: it does not constitute a proof if I’ve convinced only myself that something is true. It only constitutes a proof if I can readily convince my audience, i.e. other mathematicians, that something is true. Moreover, if I claim to have proved something, it is my responsibility to convince others I’ve done so; it’s not their responsibility to try to understand it (although it would be very nice of them to try).

A few months ago, in August 2012, Shinichi Mochizuki claimed he had a proof of the ABC Conjecture:

For every there are only finitely many triples of coprime positive integers

such that

and

where

denotes the product of the distinct prime factors of the product

The manuscript he wrote with the supposed proof of the ABC Conjecture is sprawling. Specifically, he wrote three papers to “set up” the proof and then the ultimate proof goes in a fourth. But even those four papers rely on various other papers he wrote, many of which haven’t been peer-reviewed.

The last four papers (see the end of the list here) are about 500 pages altogether, and the other papers put together are thousands of pages.

The issue here is that nobody understands what he’s talking about, even people who really care and are trying, and his write-ups don’t help.

For your benefit, here’s an excerpt from the very beginning of the fourth and final paper:

The present paper forms the fourth and final paper in a series of papers concerning “inter-universal Teichmuller theory”. In the first three papers of the series, we introduced and studied the theory surrounding the log-theta-lattice, a highly non-commutative two-dimensional diagram of “miniature models of conventional scheme theory”, called Θ±ell NF-Hodge theaters, that were associated, in the first paper of the series, to certain data, called initial Θ-data. This data includes an elliptic curve EF over a number field F , together with a prime number l ≥ 5. Consideration of various properties of the log-theta-lattice led naturally to the establishment, in the third paper of the series, of multiradial algorithms for constructing “splitting monoids of LGP-monoids”.

If you look at the terminology in the above paragraph, you will find many examples of mathematical objects that nobody has ever heard of: he introduces them in his tiny Mochizuki universe with one inhabitant.

When Wiles proved Fermat’s Last Theorem, he announced it to the mathematical community, and held a series of lectures at Cambridge. When he discovered a hole, he enlisted his former student, Richard Taylor, in helping him fill it, which they did. Then they explained the newer version to the world. They understood that it was new and hard and required explanation.

When Perelman proved the Poincare Conjecture, it was a bit tougher. He is a very weird guy, and he’d worked alone and really only written an outline. But he had used a well-known method, following Richard Hamilton, and he was available to answer questions from generous, hard-working experts. Ultimately, after a few months, this ended up working out as a proof.

I’m not saying Mochizuki will never prove the ABC Conjecture.

But he hasn’t yet, even if the stuff in his manuscript is correct. In order for it to be a proof, someone, preferably the entire community of experts who try, should understand it, and he should be the one explaining it. So far he hasn’t even been able to explain what the new idea is (although he did somehow fix a mistake at the prime 2, which is a good sign, maybe).

Let me say it this way. If Mochizuki died today, or stopped doing math for whatever reason, perhaps Grothendieck-style, hiding in the woods somewhere in Southern France and living off berries, and if someone (M) came along and read through all 6,000 pages of his manuscripts to understand what he was thinking, and then rewrote them in a way that uses normal language and is understandable to the expert number theorist, then I would claim that new person, M, should be given just as much credit for the proof as Mochizuki. It would be, by all rights, called the “Mochizuki and M Theorem”.

Come to think of it, whoever ends up interpreting this to the world will be responsible for the actual proof and should be given credit along with Mochizuki. It’s only fair, and it’s also the only thing that I can imagine would incentivize someone to do such a colossal task.

Update 5/13/13: I’ve closed comments on this post. I was getting annoyed with hostile comments. If you don’t agree with me feel free to start your own blog.

Data science in the natural sciences

This is a guest post written by Chris Wiggins, crossposted from strata.oreilly.com.

I find myself having conversations recently with people from increasingly diverse fields, both at Columbia and in local startups, about how their work is becoming “data-informed” or “data-driven,” and about the challenges posed by applied computational statistics or big data.

A view from health and biology in the 1990s

In discussions with, as examples, New York City journalists, physicists, or even former students now working in advertising or social media analytics, I’ve been struck by how many of the technical challenges and lessons learned are reminiscent of those faced in the health and biology communities over the last 15 years, when these fields experienced their own data-driven revolutions and wrestled with many of the problems now faced by people in other fields of research or industry.

It was around then, as I was working on my PhD thesis, that sequencing technologies became sufficient to reveal the entire genomes of simple organisms and, not long thereafter, the first draft of the human genome. This advance in sequencing technologies made possible the “high throughput” quantification of, for example,

- the dynamic activity of all the genes in an organism; or

- the set of all protein-protein interactions in an organism; or even

- statistical comparative genomics revealing how small differences in genotype correlate with disease or other phenotypes.

These advances required formation of multidisciplinary collaborations, multi-departmental initiatives, advances in technologies for dealing with massive datasets, and advances in statistical and mathematical methods for making sense of copious natural data.

The fourth paradigm

This shift wasn’t just a series of technological advances in biological research; the more important change was a realization that research in which data vastly outstrip our ability to posit models is qualitatively different. Much of science for the last three centuries advanced by deriving simple models from first principles — models whose predictions could then be compared with novel experiments. In modeling complex systems for which the underlying model is not yet known but for which data are abundant, however, as in systems biology or social network analysis, one may turn this process on its head by using the data to learn not only parameters of a single model but to select which among many or an infinite number of competing models is favored by the data. Just over a half-decade ago, the computer scientist Jim Gray described this as a “fourth paradigm” of science, after experimental, theoretical, and computational paradigms. Gray predicted that every sector of human endeavor will soon emulate biology’s example of identifying data-driven research and modeling as a distinct field.

In the years since then we’ve seen just that. Examples include data-driven social sciences (often leveraging the massive data now available through social networks) and even data-driven astronomy (cf., Astronomy.net). I’ve personally enjoyed seeing many students from Columbia’s School of Engineering and Applied Science (SEAS), trained in applications of big data to biology, go on to develop and apply data-driven models in these fields. As one example, a recent SEAS PhD student spent a summer as a “hackNY Fellow” applying machine learning methods at the data-driven dating NYC startup OKCupid. [Disclosure: I’m co-founder and co-president of hackNY.] He’s now applying similar methods to population genetics as a postdoctoral researcher at the University of Chicago. These students, often with job titles like “data scientist,” are able to translate to other fields, or even to the “real world” of industry and technology-driven startups, methods needed in biology and health for making sense of abundant natural data.

Data science: Combining engineering and natural sciences

In my research group, our work balances “engineering” goals, e.g., developing models that can make accurate quantitative predictions, with “natural science” goals, meaning building models that are interpretable to our biology and clinical collaborators, and which suggest to them what novel experiments are most likely to reveal the workings of natural systems. For example:

- We’ve developed machine-learning methods for modeling the expression of genes — the “on-off” state of the tens of thousands of individual processes your cells execute — by combining sequence data with microarray expression data. These models reveal which genes control which other genes, via what important sequence elements.

- We’ve analyzed large biological protein networks and shown how statistical signatures reveal what evolutionary laws can give rise to such graphs.

- In collaboration with faculty at Columbia’s chemistry department and NYU’s medical school, we’ve developed hierarchical Bayesian inference methods that can automate the analysis of thousands of time series data from single molecules. These techniques can identify the best model from models of varying complexity, along with the kinetic and biophysical parameters of interest to the chemist and clinician.

- Our current projects include, in collaboration with experts at Columbia’s medical school in pathogenic viral genomics, using machine learning methods to reveal whether a novel viral sequence may be carcinogenic or may lead to a pandemic. This research requires an abundant corpus of training data as well as close collaboration with the domain experts to ensure that the models exploit — and are interpretable in light of — the decades of bench work that has revealed what we now know of viral pathogenic mechanisms.

Throughout, our goals balance building models that are not only predictive but interpretable, e.g., revealing which sequence elements convey carcinogenicity or permit pandemic transmissibility.

Data science in health

More generally, we can apply big data approaches not only to biological examples as above but also to health data and health records. These approaches offer the possibility of, for example, revealing unknown lethal drug-drug interactions or forecasting future patient health problems; such models could have consequences for both public health policies and individual patent care. As one example, the Heritage Health Prize is a $3 million challenge ending in April 2013 “to identify patients who will be admitted to a hospital within the next year, using historical claims data.” Researchers at Columbia, both in SEAS and at Columbia’s medical school, are building the technologies needed for answering such big questions from big data.

The need for skilled data scientists

In 2011, the McKinsey Global Institute estimated that between 140,000 and 190,000 additional data scientistswill need to be trained by 2018 in order to meet the increased demand in academia and industry in the United States alone. The multidisciplinary skills required for data science applied to such fields as health and biology will include:

- the computational skills needed to work with large datasets usually shared online;

- the ability to format these data in a way amenable to mathematical modeling;

- the curiosity to explore these data to identify what features our models may be built on;

- the technical skills which apply, extend, and validate statistical and machine learning methods; and most importantly,

- the ability to visualize, interpret, and communicate the resulting insights in a way which advances science. (As the mathematician Richard Hamming said, “The purpose of computing is insight, not numbers.”)

More than a decade ago the statistician William Cleveland, then at Bell Labs, coined the term “data science” for this multidisciplinary set of skills and envisioned a future in which these skills would be needed for more fields of technology. The term has had a recent explosion in usage as more and more fields — both in academia and in industry — are realizing precisely this future.

Anti-black Friday ideas? (#OWS)

I’m trying to put together a post with good suggestions for what to do on Black Friday that would not include standing in line waiting for stores to open.

Speaking as a mother of 3 smallish kids, I don’t get the present-buying frenzy thing, and it honestly seems as bad as any other addiction this country has gotten itself into. In my opinion, we’d all be better off if pot were legalized country-wide but certain categories of plastic purchases were legal only through doctor’s orders.

One idea I had: instead of buying things your family and loved ones don’t need, help people get out of debt by donating to the Rolling Jubilee. I discussed this yesterday in the #OWS Alternative Banking meeting, it’s an awesome project.

Unfortunately you can’t choose whose debt you’re buying (yet) or even what kind of debt (medical or credit card etc.) but it still is an act of kindness and generosity (towards a stranger).

It begs the question, though, why can’t we buy the debt of people we know and love and who are in deep debt problems? Why is it that debt collectors can buy this stuff but consumers can’t?

In a certain sense we can buy our own debt, actually, by negotiating directly with debt-collectors when they call us. But if a debt-collector offers to let you pay 70 cents on the dollar, it probably means he or she bought it at 20 cents on the dollar; they pay themselves and their expenses (the daily harassing phone calls) with the margin, plus they buy a bunch of peoples’ debts and only actually successfully scare some of them into paying anything.

Question for readers:

- Is there a way to get a reasonable price on someone’s debt, i.e. closer to the 20 cents figure? This may require understanding the consumer debt market really well, which I don’t.

- Are there other good alternatives to participating in Black Friday?

Free people from their debt: Rolling Jubilee (#OWS)

Do you remember the group Strike Debt? It’s an offshoot of Occupy Wall Street which came out with the Debt Resistors Operation Manual on the one-year anniversary of Occupy; I blogged about this here, very cool and inspiring.

Well, Strike Debt has come up with another awesome idea; they are fundraising $50,000 (to start with) by holding a concert called the People’s Bailout this coming Thursday, featuring Jeff Mangum of Neutral Milk Hotel, possibly my favorite band besides Bright Eyes.

Actually that’s just the beginning, a kick-off to the larger fundraising campaign called the Rolling Jubilee.

The main idea is this: once they have money, they buy people’s debts with it, much like debt collectors buy debt. It’s mostly pennies-on-the-dollar debt, because it’s late and there is only a smallish chance that, through harassment legal and illegal, they will coax the debtor or their family members to pay.

But instead of harassing people over the phone, the Strike Debt group is simply going to throw away the debt. They might even call people up to tell them they are officially absolved from their debt, but my guess is nobody will answer the phone, from previous negative conditioning.

Get tickets to the concert here, and if you can’t make it, send donations to free someone from their debt here.

In the meantime enjoy some NMH:

Aunt Pythia’s advice

I’d like to preface Aunt Pythia’s inaugural advice column by thanking everyone who has sent me their questions. I can’t get to everything but I’ll do my best to tackle a few a week. If you have a question you’d like to submit, please do so below.

—

Dear Aunt Pythia,

My friend just started an advice column just now. She says she only wants “real” questions. But the membrane between truth and falsity is, as we all know, much more porous and permeable than this reductive boolean schema. What should I do?

Mergatroid

Dear Mergatroid,

Thanks for the question. Aunt Pythia’s answers are her attempts to be universal and useful whilst staying lighthearted and encouraging, as well as to answer the question, as she sees it, in a judgmental and over-reaching way, so yours is a fair concern.

If you don’t think she’s understood the ambiguity of a given question, please do write back and comment. If, however, you think advice columns are a waste of time altogether in terms of information gain, then my advice is to try to enjoy them for their entertainment value.

Aunt Pythia

—

Aunt Pythia,

I have a friend who always shows up to dinner parties empty-handed. What should I do?

Mergatroid

Mergatroid,

I’m glad you asked a real question too. The answer lies with you. Why are you having dinner parties and consistently inviting someone you aren’t comfortable calling up fifteen minutes beforehand screaming about not having enough parmesan cheese and to grab some on the way?

The only reason I can think of is that you’re trying to impress them. If so, then either they’ve been impressed by now or not. Stop inviting people over who you can’t demand parmesan from, it’s a simple but satisfying litmus test.

I hope that helps,

Aunt Pythia

—

Aunt Pythia,

Is a protracted discussion of “Reaganomics” the new pick-up path for meeting babes?

Tactile in Texas

T.i.T,

No idea, try me.

A.P.

—

Aunt Pythia,

A big fan of your insightful blog, I am interested in data analysis. Seemingly, marketers I have recently met with tend to misunderstand that they can find or identify causation just by utilizing quantitative methods, even if statistical software will never tell us the estimation results are causal. I’m using causation here is in the sense of potential outcomes framework.

Without knowing the idea of counterfactual, marketers could make a mistake when they calculate marketing ROI, for instance. I am wondering why people teaching Business Statistics 101 do not emphasize that we need to justify causality, for example, by employing randomization. Do you have similar impressions or experiences, auntie?

Somewhat Lonely in Asia

Dear SLiA,

I hear you. I talked about this just a couple days ago in my blog post about Rachel’s Data Science class when David Madigan guest lectured, and it’s of course a huge methodological and ethical problem when we are talking about drugs.

In industry, people make this mistake all the time, say when they start a new campaign, ROI goes up, and they assume it’s because of the new campaign but actually it’s just a seasonal effect.

The first thing to realize is that these are probably not life-or-death mistakes, except if you count the death of startups as an actual death (if you do, stop doing it). The second is that eventually someone smart figures out how to account for seasonality, and that smart person gets to keep their job because of that insight and others like it, which is a happy story for nerds everywhere.

The third and final point is that there’s no fucking way to prove causality in these cases most of the time, so it’s moot. Even if you set up an A/B test it’s often impossible to keep the experiment clean and to make definitive inferences, what with people clearing their cookies and such.

I hope that helps,

Cathy

—

Aunt Pythia,

What are the chances (mathematically speaking) that our electorial process picks the “best” person for the job? How could it be improved?

Olympian Heights

Dear OH,

Great question! And moreover it’s a great example of how, to answer a question, you have to pick a distribution first. In other words, if you think the elections are going to be not at all close, then the electoral process does a fine job. It’s only when the votes are pretty close that it makes a difference.

But having said that, the votes are almost always close on a national scale! That’s because the data collectors and pollsters do their damndest to figure out where people are in terms of voting, and the parties are constantly changing their platforms and tones to accommodate more people. So by dint of that machine, the political feedback loop, we can almost always expect a close election, and therefore we can almost always expect to worry about the electoral college versus popular vote.

Note one perverse consequence of our two-party system is that, if both sides are weak on an issue (to pull one out of a hat I’ll say financial reform), then the people who care will probably not vote at all, and so as long as they are equally weak on that issue, they can ignore it altogether.

AP

—

Dear Aunt Pythia,

Would you believe your dad is doing dishes when I teach now?

Mom

Dear Mom,

If by “your dad” you mean my dad, then no.

AP

—

Hey AP,

I have a close friend who has regularly touted his support for Obama, including on Facebook, but I found out that he has donated almost $2000 to the Romney campaign. His political donations are a matter of public record, but I had to actually look that up online. If I don’t say anything I feel our relationship won’t be the same. Do I call him on this? What would you do?

Rom-conned in NY

Dear Rom-conned,

Since the elections are safely over, right now I’d just call this guy a serious loser.

But before the election, I’d have asked you why you suspected your friend in the first place. There must have been something about him that seemed fishy or otherwise two-faced; either that or you check on all your friends’ political donation situations, which is creepy.

My advice is to bring it up with him in a direct but non-confrontational way. Something like, you ask him if he’s ever donated to a politician. If he looks you in the eye and says no, or even worse lies and says he donated to the Obama campaign, then you have your answer.

On the other hand, he may fess up and explain why he donated to Romney – maybe pressure from his parents? or work? I’m not saying it will be a good excuse but you might at least understand it more.

I hope that helps,

Aunt Pythia

—

Yo Auntie,

Caddyshack or Animal House?

UpTheArsenal

Dear UTA,

Duh, Animal House. Why do you think I had the picture I did on my zit post?

Auntie

—

Again, I didn’t get to all the questions, but I need to save some for next week just in case nobody ever asks me another question. In the meantime, please submit yours! I seriously love doing this!

Medical research needs an independent modeling panel

I am outraged this morning.

I spent yesterday morning writing up David Madigan’s lecture to us in the Columbia Data Science class, and I can hardly handle what he explained to us: the entire field of epidemiological research is ad hoc.

This means that people are taking medication or undergoing treatments that may do they harm and probably cost too much because the researchers’ methods are careless and random.

Of course, sometimes this is intentional manipulation (see my previous post on Vioxx, also from an eye-opening lecture by Madigan). But for the most part it’s not. More likely it’s mostly caused by the human weakness for believing in something because it’s standard practice.

In some sense we knew this already. How many times have we read something about what to do for our health, and then a few years later read the opposite? That’s a bad sign.

And although the ethics are the main thing here, the money is a huge issue. It required $25 million dollars for Madigan and his colleagues to implement the study on how good our current methods are at detecting things we already know. Turns out they are not good at this – even the best methods, which we have no reason to believe are being used, are only okay.

Okay, $25 million dollars is a lot, but then again there are literally billions of dollars being put into the medical trials and research as a whole, so you might think that the “due diligence” of such a large industry would naturally get funded regularly with such sums.

But you’d be wrong. Because there’s no due diligence for this industry, not in a real sense. There’s the FDA, but they are simply not up to the task.

One article I linked to yesterday from the Stanford Alumni Magazine, which talked about the work of John Ioannidis (I blogged about his work here called “Why Most Published Research Findings Are False“), summed the situation up perfectly (emphasis mine):

When it comes to the public’s exposure to biomedical research findings, another frustration for Ioannidis is that “there is nobody whose job it is to frame this correctly.” Journalists pursue stories about cures and progress—or scandals—but they aren’t likely to diligently explain the fine points of clinical trial bias and why a first splashy result may not hold up. Ioannidis believes that mistakes and tough going are at the essence of science. “In science we always start with the possibility that we can be wrong. If we don’t start there, we are just dogmatizing.”

It’s all about conflict of interest, people. The researchers don’t want their methods examined, the pharmaceutical companies are happy to have various ways to prove a new drug “effective”, and the FDA is clueless.

Another reason for an AMS panel to investigate public math models. If this isn’t in the public’s interest I don’t know what is.

Columbia Data Science course, week 10: Observational studies, confounders, epidemiology

This week our guest lecturer in the Columbia Data Science class was David Madigan, Professor and Chair of Statistics at Columbia. He received a bachelors degree in Mathematical Sciences and a Ph.D. in Statistics, both from Trinity College Dublin. He has previously worked for AT&T Inc., Soliloquy Inc., the University of Washington, Rutgers University, and SkillSoft, Inc. He has over 100 publications in such areas as Bayesian statistics, text mining, Monte Carlo methods, pharmacovigilance and probabilistic graphical models.

So Madigan is an esteemed guest, but I like to call him an “apocalyptic leprechaun”, for reasons which you will know by the end of this post. He’s okay with that nickname, I asked his permission.

Madigan came to talk to us about observation studies, of central importance in data science. He started us out with this:

Thought Experiment

We now have detailed, longitudinal medical data on tens of millions of patients. What can we do with it?

To be more precise, we have tons of phenomenological data: this is individual, patient-level medical record data. The largest of the databases has records on 80 million people: every prescription drug, every condition ever diagnosed, every hospital or doctor’s visit, every lab result, procedures, all timestamped.

But we still do things like we did in the Middle Ages; the vast majority of diagnosis and treatment is done in a doctor’s brain. Can we do better? Can you harness these data to do a better job delivering medical care?

Students responded:

1) There was a prize offered on Kaggle, called “Improve Healthcare, Win $3,000,000.” predicting who is going to go to the hospital next year. Doesn’t that give us some idea of what we can do?

Madigan: keep in mind that they’ve coarsened the data for proprietary reasons. Hugely important clinical problem, especially as a healthcare insurer. Can you intervene to avoid hospitalizations?

2) We’ve talked a lot about the ethical uses of data science in this class. It seems to me that there are a lot of sticky ethical issues surrounding this 80 million person medical record dataset.

Madigan: Agreed! What nefarious things could we do with this data? We could gouge sick people with huge premiums, or we could drop sick people from insurance altogether. It’s a question of what, as a society, we want to do.

What is modern academic statistics?

Madigan showed us Drew Conway’s Venn Diagram that we’d seen in week 1:

Madigan positioned the modern world of the statistician in the green and purple areas.

Madigan positioned the modern world of the statistician in the green and purple areas.

It used to be the case, say 20 years ago, according to Madigan, that academic statistician would either sit in their offices proving theorems with no data in sight (they wouldn’t even know how to run a t-test) or sit around in their offices and dream up a new test, or a new way of dealing with missing data, or something like that, and then they’d look around for a dataset to whack with their new method. In either case, the work of an academic statistician required no domain expertise.

Nowadays things are different. The top stats journals are more deep in terms of application areas, the papers involve deep collaborations with people in social sciences or other applied sciences. Madigan is setting an example tonight by engaging with the medical community.

Madigan went on to make a point about the modern machine learning community, which he is or was part of: it’s a newish academic field, with conferences and journals, etc., but is characterized by what stats was 20 years ago: invent a method, try it on datasets. In terms of domain expertise engagement, it’s a step backwards instead of forwards.

Comments like the above make me love Madigan.

Very few academic statisticians have serious hacking skills, with Mark Hansen being an unusual counterexample. But if all three is what’s required to be called data science, then I’m all for data science, says Madigan.

Madigan’s timeline

Madigan went to college in 1980, specialized on day 1 on math for five years. In final year, he took a bunch of stats courses, and learned a bunch about computers: pascal, OS, compilers, AI, database theory, and rudimentary computing skills. Then came 6 years in industry, working at an insurance company and a software company where he specialized in expert systems.

It was a mainframe environment, and he wrote code to price insurance policies using what would now be described as scripting languages. He also learned about graphics by creating a graphic representation of a water treatment system. He learned about controlling graphics cards on PC’s, but he still didn’t know about data.

Then he got a Ph.D. and went into academia. That’s when machine learning and data mining started, which he fell in love with: he was Program Chair of the KDD conference, among other things, before he got disenchanted. He learned C and java, R and S+. But he still wasn’t really working with data yet.

He claims he was still a typical academic statistician: he had computing skills but no idea how to work with a large scale medical database, 50 different tables of data scattered across different databases with different formats.

In 2000 he worked for AT&T labs. It was an “extreme academic environment”, and he learned perl and did lots of stuff like web scraping. He also learned awk and basic unix skills.

It was life altering and it changed everything: having tools to deal with real data rocks! It could just as well have been python. The point is that if you don’t have the tools you’re handicapped. Armed with these tools he is afraid of nothing in terms of tackling a data problem.

In Madigan’s opinion, statisticians should not be allowed out of school unless they know these tools.

He then went to a internet startup where he and his team built a system to deliver real-time graphics on consumer activity.

Since then he’s been working in big medical data stuff. He’s testified in trials related to medical trials, which was eye-opening for him in terms of explaining what you’ve done: “If you’re gonna explain logistical regression to a jury, it’s a different kind of a challenge than me standing here tonight.” He claims that super simple graphics help.

Carrotsearch

As an aside he suggests we go to this website, called carrotsearch, because there’s a cool demo on it.

What is an observational study?

Madigan defines it for us:

An observational study is an empirical study in which the objective is to elucidate cause-and-effect relationships in which it is not feasible to use controlled experimentation.

In tonight’s context, it will involve patients as they undergo routine medical care. We contrast this with designed experiment, which is pretty rare. In fact, Madigan contends that most data science activity revolves around observational data. Exceptions are A/B tests. Most of the time, the data you have is what you get. You don’t get to replay a day on the market where Romney won the presidency, for example.

Observational studies are done in contexts in which you can’t do experiments, and they are mostly intended to elucidate cause-and-effect. Sometimes you don’t care about cause-and-effect, you just want to build predictive models. Madigan claims there are many core issues in common with the two.

Here are some examples of tests you can’t run as designed studies, for ethical reasons:

- smoking and heart disease (you can’t randomly assign someone to smoke)

- vitamin C and cancer survival

- DES and vaginal cancer

- aspirin and mortality

- cocaine and birthweight

- diet and mortality

Pitfall #1: confounders

There are all kinds of pitfalls with observational studies.

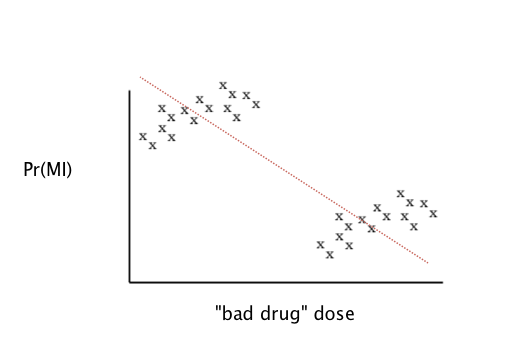

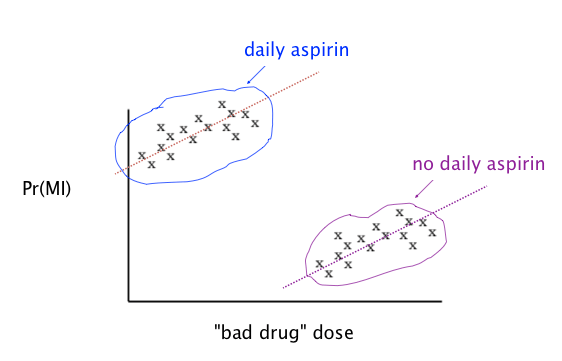

For example, look at this graph, where you’re finding a best fit line to describe whether taking higher doses of the “bad drug” is correlated to higher probability of a heart attack:

It looks like, from this vantage point, the more drug you take the fewer heart attacks you have. But there are two clusters, and if you know more about those two clusters, you find the opposite conclusion:

Note this picture was rigged it so the issue is obvious. This is an example of a “confounder.” In other words, the aspirin-taking or non-aspirin-taking of the people in the study wasn’t randomly distributed among the people, and it made a huge difference.

It’s a general problem with regression models on observational data. You have no idea what’s going on.

Madigan: “It’s the wild west out there.”

Wait, and it gets worse. It could be the case that within each group there males and females and if you partition by those you see that the more drugs they take the better again. Since a given person either is male or female, and either takes aspirin or doesn’t, this kind of thing really matters.

This illustrates the fundamental problem in observational studies, which is sometimes called Simpson’s Paradox.

[Remark from someone in the class: if you think of the original line as a predictive model, it’s actually still the best model you can obtain knowing nothing more about the aspirin-taking habits or genders of the patients involved. The issue here is really that you’re trying to assign causality.]

The medical literature and observational studies

As we may not be surprised to hear, medical journals are full of observational studies. The results of these studies have a profound effect on medical practice, on what doctors prescribe, and on what regulators do.

For example, in this paper, entitled “Oral bisphosphonates and risk of cancer of oesophagus, stomach, and colorectum: case-control analysis within a UK primary care cohort,” Madigan report that we see the very same kind of confounding problem as in the above example with aspirin. The conclusion of the paper is that the risk of cancer increased with 10 or more prescriptions of oral bisphosphonates.

It was published on the front page of new york times, the study was done by a group with no apparent conflict of interest and the drugs are taken by millions of people. But the results were wrong.

There are thousands of examples of this, it’s a major problem and people don’t even get that it’s a problem.

Randomized clinical trials

One possible way to avoid this problem is randomized studies. The good news is that randomization works really well: because you’re flipping coins, all other factors that might be confounders (current or former smoker, say) are more or less removed, because I can guarantee that smokers will be fairly evenly distributed between the two groups if there are enough people in the study.

The truly brilliant thing about randomization is that randomization matches well on the possible confounders you thought of, but will also give you balance on the 50 million things you didn’t think of.

So, although you can algorithmically find a better split for the ones you thought of, that quite possible wouldn’t do as well on the other things. That’s why we really do it randomly, because it does quite well on things you think of and things you don’t.

But there’s bad news for randomized clinical trials as well. First off, it’s only ethically feasible if there’s something called clinical equipoise, which means the medical community really doesn’t know which treatment is better. If you know have reason to think treating someone with a drug will be better for them than giving them nothing, you can’t randomly not give people the drug.

The other problem is that they are expensive and cumbersome. It takes a long time and lots of people to make a randomized clinical trial work.

In spite of the problems, randomized clinical trials are the gold standard for elucidating cause-and-effect relationships.

Rubin causal model

The Rubin causal model is a mathematical framework for understanding what information we know and don’t know in observational studies.

It’s meant to investigate the confusion when someone says something like “I got lung cancer because I smoked”. Is that true? If so, you’d have to be able to support the statement, “If I hadn’t smoked I wouldn’t have gotten lung cancer,” but nobody knows that for sure.

Define:

to be the treatment applied to unit

(0 = control, 1= treatment),

to be the response for unit

if

,

to be the response for unit

if

.

Then the unit level causal effect is , but we only see one of

and

Example: is 1 if I smoked, 0 if I didn’t (I am the unit).

is 1 or 0 if I got cancer and I smoked, and

is 1 or 0 depending on whether I got cancer while not smoking. The overall causal effect on me is the difference

This is equal to 1 if I got really got cancer because I smoked, it’s 0 if I got cancer (or didn’t) independent of smoking, and it’s -1 if I avoided cancer by smoking. But I’ll never know my actual value since I only know one term out of the two.

Of course, on a population level we do know how to infer that there are quite a few “1”‘s among the population, but we will never be able to assign a given individual that number.

This is sometimes called the fundamental problem of causal inference.

Confounding and Causality

Let’s say we have a population of 100 people that takes some drug, and we screen them for cancer. Say 30 out of them get cancer, which gives them a cancer rate of 0.30. We want to ask the question, did the drug cause the cancer?

To answer that, we’d have to know what would’ve happened if they hadn’t taken the drug. Let’s play God and stipulate that, had they not taken the drug, we would have seen 20 get cancer, so a rate of 0.20. We typically say the causal effect is the ration of these two numbers (i.e. the increased risk of cancer), so 1.5.

But we don’t have God’s knowledge, so instead we choose another population to compare this one to, and we see whether they get cancer or not, whilst not taking the drug. Say they have a natural cancer rate of 0.10. Then we would conclude, using them as a proxy, that the increased cancer rate is the ratio 0.30 to 0.10, so 3. This is of course wrong, but the problem is that the two populations have some underlying differences that we don’t account for.

If these were the “same people”, down to the chemical makeup of each other molecules, this “by proxy” calculation would work of course.

The field of epidemiology attempts to adjust for potential confounders. The bad news is that it doesn’t work very well. One reason is that they heavily rely on stratification, which means partitioning the cases into subcases and looking at those. But there’s a problem here too.

Stratification can introduce confounding.

The following picture illustrates how stratification could make the underlying estimates of the causal effects go from good to bad:

In the top box, the values of b and c are equal, so our causal effect estimate is correct. However, when you break it down by male and female, you get worse estimates of causal effects.

The point is, stratification doesn’t just solve problems. There are no guarantees your estimates will be better if you stratify and all bets are off.

What do people do about confounding things in practice?

In spite of the above, experts in this field essentially use stratification as a major method to working through studies. They deal with confounding variables by essentially stratifying with respect to them. So if taking aspirin is believed to be a potential confounding factor, they stratify with respect to it.

For example, with this study, which studied the risk of venous thromboembolism from the use of certain kinds of oral contraceptives, the researchers chose certain confounders to worry about and concluded the following:

After adjustment for length of use, users of oral contraceptives were at least twice the risk of clotting compared with user of other kinds of oral contraceptives.

This report was featured on ABC, and it was a big hoo-ha.

Madigan asks: wouldn’t you worry about confounding issues like aspirin or something? How do you choose which confounders to worry about? Wouldn’t you worry that the physicians who are prescribing them are different in how they prescribe? For example, might they give the newer one to people at higher risk of clotting?

Another study came out about this same question and came to a different conclusion, using different confounders. They adjusted for a history of clots, which makes sense when you think about it.

This is an illustration of how you sometimes forget to adjust for things, and the outputs can then be misleading.

What’s really going on here though is that it’s totally ad hoc, hit or miss methodology.

Another example is a study on oral bisphosphonates, where they adjusted for smoking, alcohol, and BMI. But why did they choose those variables?

There are hundreds of examples where two teams made radically different choices on parallel studies. We tested this by giving a bunch of epidemiologists the job to design 5 studies at a high level. There was zero consistency. And an addition problem is that luminaries of the field hear this and say: yeah yeah yeah but I would know the right way to do it.

Is there a better way?

Madigan and his co-authors examined 50 studies, each of which corresponds to a drug and outcome pair, e.g. antibiotics with GI bleeding.

They ran about 5,000 analyses for every pair. Namely, they ran every epistudy imaginable on, and they did this all on 9 different databases.

For example, they looked at ACE inhibitors (the drug) and swelling of the heart (outcome). They ran the same analysis on the 9 different standard databases, the smallest of which has records of 4,000,000 patients, and the largest of which has records of 80,000,000 patients.

In this one case, for one database the drug triples the risk of heart swelling, but for another database it seems to have a 6-fold increase of risk. That’s one of the best examples, though, because at least it’s always bad news – it’s consistent.

On the other hand, for 20 of the 50 pairs, you can go from statistically significant in one direction (bad or good) to the other direction depending on the database you pick. In other words, you can get whatever you want. Here’s a picture, where the heart swelling example is at the top:

Note: the choice of database is never discussed in any of these published epidemiology papers.

Next they did an even more extensive test, where they essentially tried everything. In other words, every time there was a decision to be made, they did it both ways. The kinds of decisions they tweaker were of the following types: which database you tested on, the confounders you accounted for, the window of time you care about examining (spoze they have a heart attack a week after taking the drug, is it counted? 6 months?)

What they saw was that almost all the studies can get either side depending on the choices.

Final example, back to oral bisphosphonates. A certain study concluded that it causes esophageal cancer, but two weeks later JAMA published a paper on same issue which concluded it is not associated to elevated risk of esophageal cancer. And they were even using the same database. This is not so surprising now for us.

OMOP Research Experiment

Here’s the thing. Billions upon billions of dollars are spent doing these studies. We should really know if they work. People’s lives depend on it.

Madigan told us about his “OMOP 2010.2011 Research Experiment”

They took 10 large medical databases, consisting of a mixture of claims from insurance companies and EHR (electronic health records), covering records of 200 million people in all. This is big data unless you talk to an astronomer.

They mapped the data to a common data model and then they implemented every method used in observational studies in healthcare. Altogether they covered 14 commonly used epidemiology designs adapted for longitudinal data. They automated everything in sight. Moreover, there were about 5000 different “settings” on the 14 methods.

The idea was to see how well the current methods do on predicting things we actually already know.

To locate things they know, they took 10 old drug classes: ACE inhibitors, beta blockers, warfarin, etc., and 10 outcomes of interest: renal failure, hospitalization, bleeding, etc.

For some of these the results are known. So for example, warfarin is a blood thinner and definitely causes bleeding. There were 9 such known bad effects.

There were also 44 known “negative” cases, where we are super confident there’s just no harm in taking these drugs, at least for these outcomes.

The basic experiment was this: run 5000 commonly used epidemiological analyses using all 10 databases. How well do they do at discriminating between reds and blues?

This is kind of like a spam filter test. We have training emails that are known spam, and you want to know how well the model does at detecting spam when it comes through.

Each of the models output the same thing: a relative risk (causal effect estimate) and an error.

This was an attempt to empirically evaluate how well does epidemiology work, kind of the quantitative version of John Ioannidis’s work. we did the quantitative thing to show he’s right.

Why hasn’t this been done before? There’s conflict of interest for epidemiology – why would they want to prove their methods don’t work? Also, it’s expensive, it cost $25 million dollars (of course that pales in comparison to the money being put into these studies). They bought all the data, made the methods work automatically, and did a bunch of calculations in the Amazon cloud. The code is open source.

In the second version, we zeroed in on 4 particular outcomes. Here’s the $25,000,000 ROC curve:

To understand this graph, we need to define a threshold, which we can start with at 2. This means that if the relative risk is estimated to be above 2, we call it a “bad effect”, otherwise call it a “good effect.” The choice of threshold will of course matter.

If it’s high, say 10, then you’ll never see a 10, so everything will be considered a good effect. Moreover these are old drugs and it wouldn’t be on the market. This means your sensitivity will be low, and you won’t find any real problem. That’s bad! You should find, for example, that warfarin causes bleeding.

There’s of course good news too, with low sensitivity, namely a zero false-positive rate.

What if you set the threshold really low, at -10? Then everything’s bad, and you have a 100% sensitivity but very high false positive rate.

As you vary the threshold from very low to very high, you sweep out a curve in terms of sensitivity and false-positive rate, and that’s the curve we see above. There is a threshold (say 1.8) for which your false positive rate is 30% and your sensitivity is 50%.

This graph is seriously problematic if you’re the FDA. A 30% false-positive rate is out of control. This curve isn’t good.

The overall “goodness” of such a curve is usually measured as the area under the curve: you want it to be one, and if your curve lies on diagonal the area is 0.5. This is tantamount to guessing randomly. So if your area under the curve is less than 0.5, it means your model is perverse.

The area above is 0.64. Moreover, of the 5000 analysis we ran, this is the single best analysis.

But note: this is the best if I can only use the same method for everything. In that case this is as good as it gets, and it’s not that much better than guessing.

But no epidemiology would do that!

So what they did next was to specialize the analysis to the database and the outcome. And they got better results: for the medicare database, and for acute kidney injury, their optimal model gives them an AUC of 0.92. They can achieve 80% sensitivity with a 10% false positive rate.

They did this using a cross-validation method. Different databases have different methods attached to them. One winning method is called “OS”, which compares within a given patient’s history (so compares times when patient was on drugs versus when they weren’t). This is not widely used now.

The epidemiologists in general don’t believe the results of this study.

If you go to http://elmo/omop.org, you can see the AUM for a given database and a given method.

Note the data we used was up to mid-2010. To update this you’d have to get latest version of database, and rerun the analysis. Things might have changed.

Moreover, an outcome for which nobody has any idea on what drugs cause what outcomes you’re in trouble. This only applies to when we have things to train on where we know the outcome pretty well.

Parting remarks

Keep in mind confidence intervals only account for sampling variability. They don’t capture bias at all. If there’s bias, the confidence interval or p-value can be meaningless.

What about models that epidemiologists don’t use? We have developed new methods as well (SCCS). we continue to do that, but it’s a hard problem.

Challenge for the students: we ran 5000 different analyses. Is there a good way of combining them to do better? weighted average? voting methods across different strategies?

Note the stuff is publicly available and might make a great Ph.D. thesis.

When are taxes low enough?

What with the unrelenting election coverage (go Elizabeth Warren!) it’s hard not to think about the game theory that happens in the intersection of politics and economics.

[Disclaimer: I am aware that no idea in here is originally mine, but when has that ever stopped me? Plus, I think when economists talk about this stuff they generally use jargon to make it hard to follow, which I promise not to do, and perhaps also insert salient facts which I don’t know, which I apologize for. In any case please do comment if I get something wrong.]

Lately I’ve been thinking about the push and pull of the individual versus the society when it comes to tax rates. Individuals all want lower tax rates, in the sense that nobody likes to pay taxes. On the other hand, some people benefit more from what the taxes pay for than others, and some people benefit less. It’s fair to say that very rich people see this interaction as one-sided against them: they pay a lot, they get back less.

Well, that’s certainly how it’s portrayed. I’m not willing to say that’s true, though, because I’d argue business owners and generally rich people get a lot back actually, including things like rule of law and nobody stealing their stuff and killing them because they’re rich, which if you think about it does happen in other places. In fact they’d be huge targets in some places, so you could argue that rich people get the most protection from this system.

But putting that aside by assuming the rule of law for a moment, I have a lower-level question. Namely, might we expect equilibrium at some point, where the super rich realize they need the country’s infrastructure and educational system, to hire people and get them to work at their companies and the companies they’ve invested in, and of course so they will have customers for their products and the products of the companies they’ve invested in.

So in other words you might expect that, at a certain point, these super rich people would actually say taxes are low enough. Of course, on top of having a vested interest in a well-run and educated society, they might also have sense of fairness and might not liking seeing people die of hunger, they might want to be able to defend the country in war, and of course the underlying rule of law thingy.

But the above argument has kind of broken down lately, because:

- So many companies are off-shoring their work to places where we don’t pay for infrastructure,

- and where we don’t educate the population,

- and our customers are increasingly international as well, although this is the weakest effect since Europeans can’t be counted on that so much what with their recession.

In other words, the incentive for an individual rich person to argue for lower taxes is getting more and more to be about the rule of law and not the well-run society argument. And let’s face it, it’s a lot cheaper to teach people how to use guns than it is to give them a liberal arts education. So the optimal tax rate for them would be… possibly very low. Maybe even zero, if they can just hire their own militias.

This is an example of a system of equilibrium failing because of changing constraints. There’s another similar example in the land of finance which involves credit default swaps (CDS), described very well in this NYTimes Dealbook entry by Stephen Lubben.

Namely, it used to be true that bond holders would try to come to the table and renegotiate debt when a company or government was in trouble. After all, it’s better to get 40% of their money back than none.

But now it’s possible to “insure” their bonds with CDS contracts, and in fact you can even bet on the failure of a company that way, so you actually can set it up where you’d make money when a company fails, whether you’re a bond holder or not. This means less incentive to renegotiate debt and more of an incentive to see companies go through bankruptcy.

For the record, the suggestion Lubben has, which is a good one, is to have a disclosure requirement on how much CDS you have:

In a paper to appear in the Journal of Applied Corporate Finance, co-written with Rajesh P. Narayanan of Louisiana State University, I argue that one good starting point might be the Williams Act.

In particular, the Williams Act requires shareholders to disclose large (5 percent or more) equity positions in companies.

Perhaps holders of default swap positions should face a similar requirement. Namely, when a triggering event occurs, a holder of swap contracts with a notional value beyond 5 percent of the reference entity’s outstanding public debt would have to disclose their entire credit-default swap position.

I like this idea: it’s simple and is analogous to what’s already established for equities (of course I’d like to see CDS regulated like insurance, which goes further).

[Note, however, that the equities problem isn’t totally solved through this method: you can always short your exposure to an equity using options, although it’s less attractive in equities than in bonds because the underlying in equities is usually more liquid than the derivatives and the opposite is true for bonds. In other words, you can just sell your equity stake rather than hedge it, whereas your bond you might not be able to get rid of as easily, so it’s convenient to hedge with a liquid CDS.]

Lubben’s not a perfect solution to the problem of creating incentives to make companies work rather than fail, since it adds overhead and complexity, and the last thing our financial system needs is more complexity. But it moves the incentives in the right direction.

It makes me wonder, is there an analogous rule, however imperfect, for tax rates? How do we get super rich people to care about infrastructure and education, when they take private planes and send their kids to private schools? It’s not fair to put a tax law into place, because the whole point is that rich people have more power in controlling tax laws in the first place.

Money market regulation: a letter to Geithner and Schapiro from #OWS Occupy the SEC and Alternative Banking

#OWS working groups Occupy the SEC and Alternative Banking have released an open letter to Timothy Geithner, Secretary of the U.S. Treasury, and Mary Schapiro, Chairman of the SEC, calling on them to put into place reasonable regulation of money market funds (MMF’s).

Here’s the letter, I’m super proud of it. If you don’t have enough context, I give a more background below.

What are MMFs?

Money market funds make up the overall money market, which is a way for banks and businesses to finance themselves with short-term debt. It sounds really boring, but as it turns out it’s a vital issue for the functioning of the financial system.

Really simply put, money market funds invest in things like short-term corporate debt (like 30-day GM debt) or bank debt (Goldman or Chase short-term debt) and stuff like that. Their investments also include deposits and U.S. bonds.

People like you and me can put our money into money market funds via our normal big banks like Bank of America. In face I was told by my BofA banker to do this around 2007. He said it’s like a savings account, only better. If you do invest in a MMF, you’re told how much over a dollar your investments are worth. The implicit assumption then is that you never actually lose money.

What happened in the crisis?

MMF’s were involved in some of the early warning signs of the financial crisis. In August and September 2007, there was a run on subprime-related asset backed commercial paper.

In 2008, some of the funds which had invested in short-term Lehman Brother’s debt had huge problems when Lehman went down, and they “broke the buck”. This caused wide-spread panic and a bunch of money market funds had people pulling money from them.

In order to avoid a run on the MMF’s, the U.S. stepped in and guaranteed that nobody would actually lose money. It was a perfect example of something we had to do at the time, because we would literally not have had a functioning financial system given how central the money markets were at the time, in financing the shadow banking system, but something we should have figured out how to improve on by now.

This is a huge issue and needs to be dealt with before the next crisis.

What happened in 2010?