Archive

Magic pill thought experiment

First of all I want to thank you guys. I’m feeling incredibly lucky that, when I asked for comments and ideas, both for my book and for the “Public Facing Math” panel, you guys delivered immediately and impressively.

You guys are the best!

Next, here’s the ridiculous thought experiment I’m cooking up this morning, inspired by this recent Room For Debate focusing on fessing up about cosmetic surgery and this recent New Yorker column by Matthew Hutson about nonconformity as a signal of status.

So, imagine there’s an very inexpensive and very accessible “magic pill” that makes you appear incredibly average. It doesn’t do anything to your health, just your appearance, which is key – we don’t want to conflate the issues of appearance and health. And let’s assume it works for 5 years and then stops. It doesn’t have side effects.

And as we know, average is in a certain sense quite beautiful, if this graph of the “average face of women” in a bunch of countries can be believed (more info here and here). But of course, it’s also not very interesting, being totally average.

So here’s the thought experiment: three questions.

First, would you take the pill?

Second, would you hang out with other people who took the pill?

Third, considering your answer to the second question, would you take the pill?

I’ll give you guys a moment to think about this…

——

OK, here’s what I think. At first I thought I might take the pill. I mean, it wouldn’t be so bad to live behind a mask of averageness. I’d be bland but attractive, it might be nice. Never worry about a bad hair day, which truth be told I don’t really worry about much now.

But then again, I immediately realized I’d rather hang out with people who refused the pill. I mean, they’d be more interesting for sure, right? They’d be strangely not insecure. They might even be proud of pimples and asymmetries, in a world of everyone looking super perfect. I’d definitely want to hang with them.

But then would they want to hang with me? On second thought, I wouldn’t take the pill because it would matter more to me to signal interestingness than to be considered attractive, especially if attractiveness was cheaply gotten.

What about you guys? This might be the dumbest post I’ve ever written but for some reason I like this thought experiment, and when I’ve asked different people they never give me the same answer, and so far nobody agrees with me.

One last thing. I think the entire game changes if the pill only lasted for 12 hours.

I’m writing a book called Weapons of Math Destruction

I’m incredibly excited to announce that I am writing a book called Weapons of Math Destruction for Random House books, with my editor Amanda Cook. There will also be a subtitle which we haven’t decided on yet.

Here’s how this whole thing went down. First I met my amazing book agent Jay Mandel from William Morris though my buddy Jordan Ellenberg. As many of you know, Jordan is also writing a book but it’s much farther along in the process and has already passed the editing phase. Jordan’s book is called How Not To Be Wrong and it’s already available for pre-order on Amazon.

Anyhoo, Jay spent a few months with me telling me how to write a book proposal, and it was a pretty substantial undertaking actually and required more than just an outline. It was like a short treatment of all the chapters but then two chapters pretty filled in, including the first, and as you know the first is kind of like an advertisement for the whole rest of the book.

Then, once that proposal was ready, Jay started what he hoped would be a bidding war for the proposal among publishers. He had a whole list of people he talked to from all over the place in the publishing world.

What actually happened though was Amanda Cook from Crown Publishing, which is part of Random House, was the first person who was interested enough to talk to me about it, and then we hit it off really well, and she made a pre-emptive offer for the book so the full on bidding war didn’t end up needing to happen. And then just last week she announced the deal in what’s called the Publisher’s Marketplace, which is for people inside publishing to keep abreast of the deals and news. The actual link is here, but it’s behind a pay wall, so Amanda got me a screen shot:

If that font is too small, it says something like this:

Harvard math Ph.D., former Wall Street quant, and advisor to the Occupy movement Cathy O’Neil’s WEAPONS OF MATH DESTRUCTION, arguing that mathematical modeling has become a pervasive and destructive force in society—in finance, education, medicine, politics, and the workplace—and showing how current models exacerbate inequality and endanger democracy and how we might rein them in, to Amanda Cook at Crown in a pre-empt by Jay Mandel at William Morris Endeavor (NA).

So as you can tell I’m incredibly excited about the book, and I have tons of ideas about it, but of course I’d love my readers to weigh in on crucial examples of models and industries that you think might get overlooked.

Please, post a comment or send me an email (located on my About page) with your favorite example of a family of models (Value Added Model for teachers is already in!) or a specific model (Value-at-Risk model in finance in already!) that is illustrative of feedback loops, or perverted incentives, or creepy modeling, or some such concept that you imagine I’ll be writing about (or should be!). Thanks so much for your input!

One last thing. I’m aiming to finish the writing part by next Spring, and then the book is actually released about 9 months later. It takes a while. I’m super glad I have had the experience of writing a technical book with O’Reilly as well as the homemade brew Occupy Finance with my Occupy group so I know at least some of the ropes, but even so this is a bit more involved.

Aunt Pythia’s advice

Aunt Pythia woke up this morning wondering what to wear now that the bipolar vortex is showing its warm side. Something flannel, obv, but what exactly? Believe it or not, this kind of quotidian conundrum is how Aunt Pythia gets warmed up (har!) to answer your lovely questions. Please, enjoy Aunt Pythia’s advice, and don’t forget to:

think of something to ask Aunt Pythia at the bottom of the page!

By the way, if you don’t know what the hell Aunt Pythia is talking about, go here for past advice columns and here for an explanation of the name Pythia.

——

Dear Aunt Pythia,

My husband and I both have Ph.D.s in the same STEM subject from the same university, so educationally we are on the same footing. His career has progressed to tenure, and mine has not. Every time I even hint that I might have been mistreated because of my gender, in terms of invitations to talk or grant applications, we end up having an argument.

He claims to be feminist, and I suppose his rational self is, but the implicit bias is there and he finds it very difficult to act to counter that or even talk about the issues with me without getting angry at me. How would aunt Pythia conduct these discussions at home without a fight? Or should I just not even bother bringing gender issues up with him?

Implicit Bias at Home

Dear IBaH,

Super hard problem, and I have a ton of things to say about it, having worked in the same math department with my husband in two jobs. But first I need to mention that I met my husband when he was being offered professorships and I was still a grad student, so we didn’t have the same exact problem. Still, we had enough.

For example, I experienced an enormous amount of bullshit, especially in my Assistant Professor job, at the hands of my husband’s colleagues. Outrageous shit, which at some point I will blog about. And it was extremely difficult to talk to my wonderful feminist and supportive husband about that treatment, because these people were also his colleagues and he wanted so much to like and be liked by his colleagues.

After much retrospection and many years and jobs later, I’m here to explain what happened there, at least from my perspective. The key phrase to keep in mind is cognitive dissonance. It means you have two opposing sets of beliefs and, since they don’t make any sense when put together, you get really upset when someone tries to bring up both things. And I mean REALLY upset, as in irrational and angry.

When you challenge the fact that he’s being offered good jobs and you’re not, he can’t actually think clearly about it, because the key fact for him is that he’s being offered good jobs and that’s something he’s been working towards for half his life or more. He knows it’s a good thing and therefore cannot be a bad thing. The fact that you’re not getting these nice offers can be a bad thing, considered separately, but he will have a huge problem connecting that bad thing to the thing he knows is good.

And I’m not trying to trivialize the guy, I really think what I’m saying is true at a deeply emotional level.

It’s not an exaggeration to say that my marriage improved 100% on the “supportiveness” front, when I took a job in a place my husband didn’t work. At last, when someone said something sexist, dismissive, and humiliating to me, my husband could take my side unfettered. I had my supportive husband back, and it didn’t take me long to see why. He had no stake in those assholes liking him, so he could hate them with me and for me. In fact we even developed a fun ritual, where I’d complain about a colleague or a situation at work, and he’d immediately say, “Go tell those guys to SHOVE IT!!” in a gleefully violent way. It was so much better than wondering if I was crazy.

My advice: if I were you I’d try to give him some understanding on this point, because his ego is on the line. That’s not to say you shouldn’t talk about it, you should. Just understand that he is protecting another thing which is very very important to him.

Also, he’s very likely to be perfectly reasonable about how other people get treated poorly. Get him to read this article, for example, about hidden biases. Make sure he treats his female colleagues and students really well. Make sure he sticks up for women in general. Appreciate and encourage his feminism in other manifestations.

One last thing. I don’t avoid fights at home. I mean, I don’t go looking for them, but I certainly don’t avoid them. If you think there’s a specific thing you could ask your husband to do or not do that would help alleviate this problem, by all means talk it through with him. I’m not sure what that would be though, because it wouldn’t make sense for him to refuse to give a talk or to suggest you instead – both of those would be weird. The problem here is that it’s a systemic bias thing, and your husband is not directly in control of it, and neither are you. It’s really frustrating but that’s one reason it continues to exist.

Having said that, in the future when you or your husband is in charge of a seminar or hiring, you should by all means talk through who you’re inviting to speak and why, or who you’re making offers to and why, and make sure you’re not propagating the same biases that were used against you. That’s about the best approach I know of.

Good luck,

Aunt Pythia

——

Dear Aunt Pythia,

What are your thoughts on offering blow jobs or another form of sex in exchange for doing extra work around the house? Note – I am assuming everyday work is already split more or less evenly (which I know is not reality), so we are only talking about an extraordinary chore or two, such as cleaning out the basement. I’m also assuming this is more motivating for men, which obviously won’t fit every case, but probably is a reasonable supposition.

We asked some friends, and the pattern of responses was amusing. Most of the women we’ve asked said they would never offer this (or would feel guilty about doing so) because it was demeaning to the man. Every single man was totally onboard, thinking it was an excellent idea.

So is this an acceptable method of encouraging chore doing?

OK, I’ll Bite

Dear OKIB,

In terms of “acceptable”, I’m very open minded, as you might have guessed. What could possibly be the negative externality of such a deal? If everyone involved is happy and nobody else gets hurt, then do what you want, it’s a free country. For me it’s all about whether the plan will work.

One caveat to that. I’m wondering if the blowjob (or the other form of sex) is something that is normally withheld? In which case I’d feel weird saying to go for it, because I’d feel weird about the withholding part. But maybe that’s just me. Or maybe it’s an in between, special occasion kind of sex act, which I can totally dig.

For now let’s assume that blowjobs (or the other form of sex) are not normally withheld. Then my guess is the guys just get a kick out of having made such a deal. They might figure that, if they don’t agree to this deal, they’ll end up cleaning the basement anyway with nothing to look forward to. Yes, I totally get that.

It might even make the entire cleaning process somewhat titillating. Who knew Hefty garbage bags and work gloves could be sexy?! Probably someone, actually, there are all kinds of people out there.

It seems to me that the only reason not to go for it would be if the woman’s discomfort at demeaning her husband – a discomfort which is not shared by the husband – overwhelms her desire to get her basement cleaned quickly and happily by an eager spouse. I highly doubt this possibility! I know from personal experience that women love a clean basement way more than is rationally explicable.

Conclusion: I see this plan working. Please report back.

Auntie P

——

Dear Aunt Pythia,

What can I say to people who assume that I need to have a baby, and have one now? I am a woman in my early thirties, and have been married for a few years.

While my husband and I would welcome a child, we have decided to take life as it comes to us, and are happily engaging in many activities for personal and professional fulfillment that we know we would have to cut back on once a child enters the picture. When asked if I have kids, or plan to, people take ‘no’ and ‘maybe’ to launch into all sorts of unwanted details about their own lives, implying that all I need to do is try harder, pray harder, or turn my husband into my baby-sex slave. (Not that I would mind the last one if he did so on his own, but it seems demeaning to make such demands.). And gasp, I better hurry, because, you know, that ticking clock!

Do you have any short witty comebacks to end such discussions? The best I have so far are “it’s none of your freaking business” and “Gee, I really like to plan ahead for major events and to have all of my key positions covered. I still have some openings for 3am feedings and diaper laundry, which would you prefer?”

Maybe Baby

Dear Maybe,

First of all, don’t discount the baby-sex-slave role for your husband too soon. It’s really much better than it sounds. And don’t assume something is demeaning to your husband without checking (see above)!!

There are two things about human nature that will not end just because you wish them to: people interpret ambivalence as an opportunity for advice, and people want kids. Maybe there’s a third, which is that people want you to want what they want.

In any case, your ambivalence, which is showing up loud and clear in your letter, is getting you into trouble. If you really don’t want advice from nosy outsiders, then I suggest you train yourself not to display an iota of ambivalence. Examples of what you can say:

- Oh, my husband and I don’t want kids.

- My husband and I do not wish to be “breeders.” Then send them here.

- We have pets, and that’s already too much work.

As soon as you say “we don’t want kids yet” then the whole ticking clock door will be opened, so hold yourself back. As soon as you say “we’d welcome a child” then it opens the door to the problems with passivity and possible IVF treatment starting tomorrow.

But if you say “we don’t want kids” and leave it there, then only the pushiest people will have something to say back, and then you can just repeat it or you can say, “actually, I’ve never wanted kids and neither has my husband. It’s something we completely agree on, and that’s nice.” Case closed.

Good luck,

Aunt Pythia

——

Please submit your well-specified, fun-loving, cleverly-abbreviated question to Aunt Pythia!

AMS Panel on The Public Face of Mathematics

A week from today I’ll be at the Joint Math Meetings in Baltimore to join a panel discussion on the Public Face of Mathematics. I’ll steal the blurb for my panel from this page:

The Public Face of Mathematics, Friday, 2:30 p.m.–4:00 p.m. Moderated by Arthur Benjamin, Harvey Mudd College. Panelists Keith Devlin, Stanford University; Jerry McNerney, U. S. Congress; Cathy O’Neil, Johnson Research Labs; Tom Siegfried, Freelance Journalist; and Steve Strogatz, Cornell University, will share ideas and lead discussion about how the mathematics community can mobilize more members to become proactive in representing mathematics to the general public and to key audiences of leaders in discussions of public policy. Sponsored by the Committee on Science Policy and the Committee on Education.

One thing I’ve already noticed that might make me different from some of the other panelists is that I don’t spend too much time explaining math to the general public, although my notes on teaching at HCSSiM might arguably be the exception. And sometimes I explain how to do modeling, but that’s not stuff I learned as a mathematician.

Mostly what I do, at least from my perspective, is comment on the culture of mathematics (for women, for example) or talk about how unfortunate it is that the public’s trust in mathematics and mathematician is being perverted into a political campaign about the (supposed) objectivity of mathematical modeling by people like Bill Gates. I specialize in calling out the misapplication of mathematical imprimatur.

Anyhoo, two questions for my readers:

- Are you going to JMM too and wanna hang with me? Please know I’m only there during the day Friday, it’s a short visit. But please contact me!

- The moderator, Art Benjamin, is asking us panelists for questions that he should ask the panel next week. Please comment below with your suggestions, and thanks!

Short Facebook

I don’t normally give investing advice, and I don’t even actually trade myself – although some of my retirement money is invested in the market – but in spite of that I plan to explain my dim view of Facebook today.

Here’s the thing. Facebook is boring. Super boring, and super commercial and getting worse. It’s used anyway, by almost everyone, because everyone else they care about is already on it.

But think about how that happened. First a generation of people started using it, then their parents started using it. And Facebook did a pretty good job of making those parents welcome. Things are inoffensive and super easy to use. Inoffensive to the point of being utterly bland.

Here’s what’s not going to happen. The kids today are just not going to be interested in adopting Facebook. Why should they, when their parents and teachers and coaches are on there already, and it’s just another place where they can get into trouble with authority, not to mention be bombarded with ridiculous ads?

My theory is that some other sexier and edgier social media platform is going to come along and sweep up the next generation of users who want to get the hell away from their parents and grandparents and teachers and coaches. And it’s not Twitter, or Instagram. It doesn’t exist yet, but it will. And when it exists, Facebook will never gain another user and will lose a bunch and the entire younger generation will be embarrassed to admit they ever used it.

One more ridiculous opinion on technology for the morning. Email, I claim, is also dying. Nowadays if you really want someone’s attention you need to text them, not email them. Too many people know each others’ email addresses, so knowing someone’s phone number is really the only sign of authentic connection. And even that is falling by the wayside in our age of over-sharing and constrained attention.

My theory is that pretty soon we’re going to have yet a new way of communicating with each other, which isn’t really new but which has a privileged status. Perhaps it will require that, not only do you know my phone number, but you also have a password to indicate that your message is important enough for me to read it.

Four Horsemen showing this Sunday in Alt Banking #OWS

This coming Sunday we’re having a special Alt Banking meeting where, instead of having our usual format, we’re all watching Four Horsemen, a recent documentary film put out by Renegade Economists (on twitter as @RenegadeEcon). We’ll first watch the film and then have a discussion about it.

The entire film is available on youtube here, although I paid 5 bucks to download it from this website in preparation for this coming Sunday’s viewing and discussion. Here’s the trailer, it looks amazing:

Feel free to come to Sunday’s meeting, it starts at 2pm and is uptown at Columbia University. Send an email to alt.banking.ows@gmail.com and ask to be added to the email list for details, or go to the alt banking webpage for details.

Judge Rakoff explains why no banker is in jail #OWS

United States District Judge Jed S. Rakoff is already kind of a hero to me, given that he’s the guy who rejected a “do not admit wrongdoing” settlement between Citigroup and the SEC over mortgage-backed securities fraud because, according to Rakoff, the proposed settlement was “neither fair, nor reasonable, nor adequate, nor in the public interest.”

More recently Rakoff has written a fine essay in the New York Review of Books entitled The Financial Crisis: Why Have No High-Level Executives Been Prosecuted? which I will summarize below but is well worth your time to read.

Rakoff’s essay

First Rakoff made the point that if there was no intentional fraud we should not scapegoat people and put them to jail. But on the other hand, if there was intentional fraud, then it’s a reflection on a dysfunctional justice system that nobody has gone to jail.

Then he examined that first possibility and found it unlikely, given that “… the Financial Crisis Inquiry Commission, in its final report, uses variants of the word “fraud” no fewer than 157 times in describing what led to the crisis…” In fact, fraud permeated at every level.

The Department of Justice (DOJ) has focused on explaining why nobody has gone to jail in spite of the existence of fraud. They have three reasons.

First, the DOJ claims it’s hard to prove intent for high-level management. But Rakoff demurs on this point, explaining that in cases of accounting fraud, “willful blindness” or “conscious disregard” is a well-established basis on which federal prosecutors have asked juries to infer intent.

Second, since many counterparties were “sophisticated,” it’s difficult to prove “reliance“. Again Rakoff demurs, pointing out that “In actuality, in a criminal fraud case the government is never required to prove—ever—that one party to a transaction relied on the word of another.”

Third, because of the “Too Big To Jail” problem, namely that prosecuting fraud would kill the economy. To this, Rakoff points out what that means in terms of class: that poor people can be prosecuted but the rich are protected.

Next, Rakoff says what he thinks is actually happening. First he discounts the revolving door: he thinks lawyers are thoroughly incentivized to make a name for themselves. Then what? He’s got three reasons.

Well, first, people were distracted. The FBI was distracted by terrorists, and the SEC was focused on Ponzi schemes and insider trading. The DOJ was inexperienced and the Southern District US Attorney’s Office was also focused on insider trading. And given the complexity and incentives, it’s hard for a given lawyer to decide to go with an MBS case instead of insider trading.

Second, the government had direct conflict in the fraud, given that the Fed and the regulators had deregulated everything in sight and then kept interest rates low to keep the mortgage machine going. They also meddled a lot during the crisis, deciding which failing bank should be taken over by whom. It made it hard for them to admit shit went wrong.

Finally, it’s because it’s now in vogue to prosecute corporations instead of people, but that really doesn’t work. Here’s Rakoff on this prosecutorial method:

Although it is supposedly justified because it prevents future crimes, I suggest that the future deterrent value of successfully prosecuting individuals far outweighs the prophylactic benefits of imposing internal compliance measures that are often little more than window-dressing. Just going after the company is also both technically and morally suspect. It is technically suspect because, under the law, you should not indict or threaten to indict a company unless you can prove beyond a reasonable doubt that some managerial agent of the company committed the alleged crime; and if you can prove that, why not indict the manager? And from a moral standpoint, punishing a company and its many innocent employees and shareholders for the crimes committed by some unprosecuted individuals seems contrary to elementary notions of moral responsibility.

And then his final conclusion:

So you don’t go after the companies, at least not criminally, because they are too big to jail; and you don’t go after the individuals, because that would involve the kind of years-long investigations that you no longer have the experience or the resources to pursue.

Comments

First, I am super grateful for Judge Rakoff’s essay, because as an experienced lawyer he has way more ammunition than I do to explain this stuff from the perspective of what is actually done in law. The “willful blindness” issue is particularly ridiculous. I’m glad to hear that courts have a way to deal with that problem, even if they aren’t using their tools against Jamie Dimon.

I am also grateful to hear him make the point that widespread fraud, unprosecuted, is not simply a theoretical issue. It exposes the dysfunctionality of our justice system and it exposes basic unfairness in society, where depending on how rich you are and how complicated your crime is, you can avoid going to jail. Personally, in the past few months I’ve gone from being angry at the bankers to being angry at the prosecutors.

Finally, I disagree with Rakoff on one point. Namely, his argument against the negative effect of the revolving door. His argument, I stipulate, only works for lawyers in a US Attorney’s office. I don’t think the average SEC lawyer or economist, or for that matter an employee at any captured regulator, has that much incentive to take on a big MBS case and be hard-assed. I think we would have seen more cases if that were true.

Parents fighting back against sharing children’s data with InBloom

There is a movement afoot in New York (and other places) to allow private companies to house and mine tons of information about children and how they learn. It’s being touted as a great way to tailor online learning tools to kids, but it also raises all sorts of potential creepy modeling problems, and one very bad sign is how secretive everything is in terms of privacy issues. Specifically, it’s all being done through school systems and without consulting parents.

In New York it’s being done through InBloom, which I already mentioned here when I talked about big data and surveillance. In that post I related an EducationNewYork report which quoted an official from InBloom as saying that the company “cannot guarantee the security of the information stored … or that the information will not be intercepted when it is being transmitted.”

The issue is super important and timely, and parents have been left out of the loop, with no opt-out option, and are actively fighting back, for example with this petition from MoveOn (h/t George Peacock). And although the InBloomers claim that no data about their kids will ever be sold, that doesn’t mean it won’t be used by third parties for various mining purposes and possibly marketing – say for test prep tools. In fact that’s a major feature of InBloom’s computer and data infrastructure, the ability for third parties to plug into the data. Not cool that this is being done on the downlow.

Who’s behind this? InBloom is funded by the Bill & Melinda Gates foundation and the operating system for inBloom is being developed by the Amplify division (formerly Wireless Generation) of Rupert Murdoch’s News Corp. More about the Murdoch connection here.

Wait, who’s paying for this? Besides the Gates and Murdoch, New York has spent $50 million in federal grants to set up the partnership with InBloom. And it’s not only New York that is pushing back, according to this Salon article:

InBloom essentially offers off-site digital storage for student data—names, addresses, phone numbers, attendance, test scores, health records—formatted in a way that enables third-party education applications to use it. When inBloom was launched in February, the company announced partnerships with school districts in nine states, and parents were outraged. Fears of a “national database” of student information spread. Critics said that school districts, through inBloom, were giving their children’s confidential data away to companies who sought to profit by proposing a solution to a problem that does not exist. Since then, all but three of those nine states have backed out.

Finally, according to this nydailynews article, Bill de Blasio is coming out on the side of protecting children’s privacy as well. That’s a good sign, let’s hope he sticks with it.

I’m not against using technology to learn, and in fact I think it’s inevitable and possibly very useful. But first we need to have a really good, public discussion about how this data is being shared, controlled, and protected, and that simply hasn’t happened. I’m glad to see parents are aware of this as a problem.

Aunt Pythia’s advice

Aunt Pythia is on her yearly retreat to her favorite yarn store in the world, otherwise known as Webs in North Hampton, MA. It’s a nice town but very cold. In that spirit, and as you are enjoying today’s column,

please, think of something warm to ask Aunt Pythia at the bottom of the page!

By the way, if you don’t know what the hell Aunt Pythia is talking about, go here for past advice columns and here for an explanation of the name Pythia.

——

Dear Aunt Pythia,

Being a divorced father of three lovely grown daughters, two of whom who live in AK, I have decided to be with them over the holidays. Now according to them and most other women there, “it is where the odds are good, but the goods are odd.” That of course reflects the fact that there are many more men than there are women in Alaska, but the men are a bit kooky.

Anyway, I have three questions for you. First, will I be viewed as being “odd” because of my two year involvement with Occupy? I mean, there are not a lot of enlightened people in the red state of Alaska, women or men. You do remember Sarah Palin, right?!

Now considering myself an ‘enlightened man’, my second question is this: if I do have the chance to have a tryst with an un-enlightened woman, should I go for it, and talk politics afterward?

And the third question is if, I do go for it, how do I get out of my daughter’s home without raising suspicion? I mean… I cannot tell them that I am going out to the ‘deli’ because having been raised in the East, they know there are no such things in Alaska, so this would automatically make them become suspicious.

Soon To Be Bewildered In AK

Dear Soon,

First, do you mind if I change your name to “Recently”?

Second, I know there was an Occupy Anchorage arm of the movement, so please go find those guys.

Next, always talk politics afterwards. If then.

Finally, you’re a grown man, I’d expect you can just tell your daughters you’re sneaking out to get lucky and ask them to keep their fingers crossed.

Good luck!

Auntie P

——

Dear Aunt Pythia,

For the last 2.5 years I have been the care taker for my seriously ill elderly parents of whom one died over a year ago. I only now feel free to apply for full time faculty positions, but I am worried how to explain this situation on my job applications. I know I can’t just ignore it as my last paper was published in 2011. I have though continued to do some research and have backlog of seven papers that are at least half finished. Other than getting those papers out, what other advice do you have?

Thank you

JAA is Another Acronym

Dear JAA,

I honestly think you just tell them straight up that you were taking care of your seriously ill elderly parents. Mathematicians are people too and they have sympathy.

And yes, get the papers out, and talk about how much you love teaching and doing research. When you think about it, 2.5 years isn’t really that long, if you can still demonstrate that you’re active in research. I’d probably try to go to a conference in your field as well to be on top of things.

Good luck,

Aunt Pythia

——

Hello Aunt Pythia,

I am really fascinated by your acceptance of your body. However, I don’t have that. Is that something that one can develop?

One thing that is an obstacle is that being overweight increases my chances of developing type II diabetes like my parent and grandparent. My doctor would like me to lose weight, I want to lose weight, which makes it hard to accept my current weight.

The second issue is that my mental image of attractiveness involves not having rolls of fat. I don’t care about size so much as about the body not being lumpy. I find it very difficult to accept that I am sexually attractive.

Unhappily Overweight

Dear Unhappily,

I’m not sure how easy it is to develop acceptance of your own body, but it’s definitely worth a try and even small improvements will be worthwhile. Here are some tips.

- Think long and hard about what actually looks and feels attractive to you in terms of clothing, and do what you can to wear clothing that emphasizes parts of your body that you like. I go through phases of this, sometimes it’s “fit and flare” dresses that avoid the tent problem, sometimes it’s jeans and flannel shirts with funky shoes that just make me feel badass.

- Make a list of activities that leave your body feeling good and that you enjoy doing, and make a daily high-priority appointment with yourself to do one of those things – block out some time and don’t make appointments then. Taking a brisk walk works for me, and so does swimming and biking. Try to do something like that once or twice a day, but forgive yourself immediately if you don’t, so you’ll try again the next day.

- Keep in mind that nobody really knows how to lose weight, including doctors, so a doctor telling you to deal with it is kind of useless and promotes guilt in you without solving the problem. Fuck that.

- Which is not to say you should ignore your risk of diabetes. If you are taking unavoidable naps a couple of hours after meals, and if coffee doesn’t help but sugar does, that’s a bad sign, which I experienced when I was 39. What helps for me is to religiously avoid “fast carbs,” and I encourage you to experiment.

- But in any case keep in mind that other people are at risk for diseases too, and that doesn’t make them question their attractiveness. Try to separate the two issues.

- Next, stop watching TV or whatever media is convincing you that you cannot be attractive. Just turn it off. I’m in a hotel this week, so I’m exposed to TV in ways that I’m normally not (we don’t have TV at home) and I really can’t believe how many ads there are for weight loss – probably timed for New Year’s resolutions. I’m getting carpal tunnel syndrome from all the turning off I’m doing here. What does that mean? It means there’s an industry out there trying to make you feel bad so you will pay for their products. Fuck that.

- Finally, I suggest denial of small imperfections (or large ones, what the hell). Some people have body dysmorphia, but I’ve invented another condition which I’ve termed “body eumorphia” and which consists of believing I’m pretty much irresistibly attractive, at least to people who are wise enough to acknowledge it. It is achieved through following the above advice and just willing it to be true.

Good luck!

Aunt Pythia

——

Dear Aunt Pythia,

I was recently reading about 23andMe’s plan to collect all of our genomes, merge them with Google’s don’t-worry-your-privacy-is-totally-protected data stash (a founder of 23andMe is married to Sergei Brin), and create some orgasmic data analysis of Hitachi Magic Wand proportions. I’d like to ask your advice on how to design my own virus genome to irretrievably corrupt their system.

If that isn’t possible, what’s the best way to knock delivery drones out of the sky?

I’m glad Reagan is dead

Dear IgRid,

Wow, no offense, but you’re kind of evil. And I like you. I don’t think you really need my advice though, since you have much better ideas than I do. Instead I’ll ask you some questions.

First, when drones deliver our goods in the future, what’s gonna stop us from stealing those drones and repurposing them to our own benefit? I mean besides the video cameras and other surveillance mechanisms that will tip off Amazon and its private army about what we’re up to?

Second, have you seen this article about how shitty the current generation of genetics testing is? That’s not to say that it will be shitty in the future, especially when they sequence our entire genomes instead of looking for tiny little markers.

In fact, the whole industry has an incredible potential for creepiness, and I’m glad you’re thinking about ways to push back. Please keep me updated with your progress.

Love,

Auntie P

——

Please submit your well-specified, fun-loving, cleverly-abbreviated question to Aunt Pythia!

10 Worst things about Wall Street in 2013 (and 5 Silver Linings) #OWS

Written by the Alternative Banking group of Occupy Wall Street.

Compiling a list of the 10 Worst Wall Street Actions of 2013 should be easy–there are so many to choose from! The problem is, it often takes years to see which financial activities and innovations have been the most destructive and destabilizing. Therefore, the following should be considered merely a sample of the ways Wall Street has maneuvered, manipulated, defrauded and deceived us during the past year.

Bottom 10 things we found out about Wall Street in 2013

-

In Washington, It’s a Wash

One of the most obvious examples of Wall Street influence on Congress was HR 992 to roll back some of the derivatives restrictions on banks. The NY Times discovered that Citigroup had drafted most of the language, some of which was accepted almost word-for-word. The House passed it with bipartisan support. Meanwhile, bank lobbyists had excessive influence on the agencies writing and enforcing the Volcker rule. -

Still Too Big to Jail

The financial system in general, and the mammoth banks in particular, are still just too damn big. In 2013, JP Morgan Chase was the poster child for this problem, with its numerous legal problems, for which they set aside on the order of $28 billion dollars just to pay legal fees. The London Whale debacle, which involved Dimon lying to shareholders and Congress, showcased both how banks make their biggest money from pure speculation, and how they are enabled by lawmakers and regulators through their “Too Big To Fail” status. -

Banks Manipulate Commodities, Fed OKs It

Banks like JP Morgan Chase and Goldman Sachs have manipulated access to commodities such as aluminum and electricity in order to increase their profits. The Federal Reserve has permitted the biggest banks to postpone complying with such regulations as still exist to limit banks’ involvement in commodities, or to ignore them altogether. Minimal fines the banks have paid are simply the cost of doing business and are far outweighed by the money they’ve made. -

Zombie Foreclosures

The banks continued to exploit underwater homeowners. One of the worst abuses is called “zombie foreclosures” where the bank pretended to foreclose — evicting the owner — but then didn’t file legal papers. This allowed the banks to continue to rack up interest, fees and penalties because the homeowners, reasonably, stopped making payments because they thought the homes were no longer theirs. To add insult to injury, when the banks sent out checks to homeowners in restitution for past misdeeds, they bounced. -

Pillaging of Detroit

Detroit’s largest creditors, UBS and Bank of America, made it clear just how far they’re willing to go to collect on debts from highly-risky interest rate swap deals they made with Detroit’s leaders before the 2008 financial collapse: they’re coming for the art! Creditors, led by Detroit’s imposed “Emergency Manager” Kevyn Orr, sent Christie’s auction house to the Detroit Institute of Arts to valuate the works, which are all held tightly in public trust by the city. It still remains to be seen whether the approximately $900 million works – we think they’re priceless! – will be sold off to pay off debts or in some hostage deal to pay threatened but constitutionally-protected city worker pensions. -

Killing Credit Unions

According to MSN.com, credit unions offer low rates on loans, higher rates on savings, better credit cards deals, and lower fees. Perhaps because of these competitive benefits, the American Banking Association ran an ad campaign to revoke the tax exempt status for America’s credit unions. -

Court Evasion

There’s a familiar yet still outrageous lack of criminal prosecution for (pick your favorite settlement). But let’s concentrate on an exception that proved the rule, specifically what has been termed the “Bank of America/ Countrywide hustle”. Here Countrywide deliberately and desperately gamed underwriting standards to dump loans on Fannie and Freddie, and got caught. Worst of all, jury found defendants guilty in about 3 hours. If only more cases had been brought to trial: juries are chomping at the bit to find banks guilty. Which is probably why more weren’t. -

Never on Hold

U.S. Attorney General Eric Holder was an egregious case study in how Washington kowtows to Wall Street. When JPMorgan Chase wanted to settle their many legal difficulties, CEO Jamie Dimon had a private meeting with Holder to negotiate; the final settlement involved admission of illegal activity by JPMorgan but no criminal charges — just fines mainly paid by shareholders. Holder also admitted to Congress in March that the megabanks were too big to prosecute. While he later retracted the statement, his actions — never bringing criminal charges despite admitted criminal activities — speak louder than his words. -

Writing the Rules

The banks, among other corporations, pushed for the Trans Pacific Partnership (TPP) treaty that will greatly constrain efforts by the U.S. and other countries to regulate. For instance, it would prevent the imposition of a “Robin Hood Tax” on stock trading, it would roll back some of Dodd-Frank and prevent a return to Glass-Steagall. TPP would also forbid public banks such as the Bank of North Dakota or a return of the Post Office Bank. No wonder we aren’t hearing more details. -

Ongoing cultural confusion

AIG’s President and CEO Robert Benmosche compared criticism of AIG bonuses to lynchings in the Jim Crow South. Mistaking a papercut for a crucifixion is the inevitable delusion of a pampered and under-prosecuted criminal upper class.

5 Silver Linings

-

Occupy the SEC Gains Ground

Occupy the SEC‘s impact on the Volcker Rule (which originally aspired to banning proprietary trading and ownership of hedge funds by banks) could not be more evident. When the Volcker Rule was finalized in December, the hard work Occupy the SEC did writing a 325-page comment letter on paid off. The letter was cited 284 times by the regulators. In some cases, the final rule adopted their recommendations while in others the rule was modified in the direction of Occupy’s suggestions. -

Radical Eminent Domain

Richmond, California Mayor Gayle McLaughlin ignited a fury on Wall St and in Washington by employing an eminent domain threat to force intransigent banks to renegotiate – and reduce principal – for underwater homeowners. The move has sparked everything from lawsuits and threats of mortgage lenders leaving town to copycat actions in other underwater cities as far away as Irvington and Newark, New Jersey. Supporters of the promising tactic are calling it the Reverse Eminent Domain Movement and even Occupy 2.0. -

No Highchair for Larry

Larry Summers did not become the new Fed Chair in 2013. It was a close call but Larry Summers may finally have made too many obvious and ridiculous mistakes – deregulating financial derivatives to pave the way for the financial crisis, for one, and aiding criminal fraud in Russia for another – to be made, once again, one of the most powerful people in the world. -

Journalists Expose the Banks

Several journalists deserve extra praise this year for their coverage of Wall Street’s illegal and undemocratic behavior:: Matt Taibbi, Bill Moyers, Yves Smith, Gretchen Morgenson, the International Consortium of Investigative Journalism, ProPublica and Wikileaks. Taibbi alerted us to the HSBC settlement proving the drug war is a joke, Moyers highlighted how people can provoke change and, with Smith, exposed the dangers of the Trans-Pacific Partnership. Morgenson skewered payday lending and many other unsavory financial practices. The International Consortium of Investigative Journalism and WIkileaks exposed documents that the banks want to keep secret — for good reason — about enormous amounts held off-shore and TPP drafts.. -

Occupy Finance and Strike Debt

-

The OWS Alternative Banking Working group released Occupy Finance, a 100-page book explaining the financial crisis in layman’s terms on the second anniversary of Occupy, and supplies of the book were quickly exhausted (a new printing has been ordered for January 2014).

-

In the past two months alone, Strike Debt’s Rolling Jubilee has collected and abolished $14.7 million in debt, as a means of raising awareness about the personal debt crisis, and a step towards building a debt resistance movement.

Dallas Fed’s Richard Fisher talks TBTF on EconTalk (#OWS)

Yesterday Russ Roberts had Dallas Federal Reserve President Richard Fisher as his guest on his podcast EconTalk to talk about Too-Big-To-Fail (TBTF) banks and the Fed’s monetary policy. It was a fantastic discussion and I’m grateful to Roberts for continuing to discuss this important and nonpartisan issue.

We in Alt Banking have been impressed by Fisher’s stance on TBTF and have thought about trying to get him to come visit us to talk, so this was a great opportunity to get a preview of what he’d likely say if he ever made it over. Given that he’s an active central banker, he’s refreshingly open and honest about stuff, even if every now and then he deliberately makes it seem like everything that happened was a mistake rather than a criminal act.

Fisher and Roberts on TBTF

You should listen to the entire podcast, it’s about an hour long but well worth the time. I will submit a short summary of their conversation here:

- First they discuss the problem of TBTF banks, that instead of failing, large banks were merged into even larger banks during the crisis, and now we have institutions that are too big to manage and are being backed by an implicit government guarantee that the Dodd-Frank regulation isn’t removing.

- Next, the discuss a takeaway in terms of community banks. Is it a problem that it’s not a level playing field for community banks? Or is it primarily a problem that any bank that should fail is being propped up?

- Roberts makes the point that he doesn’t care so much that the system isn’t fair, he cares only that this banking system isn’t effective. If the threat is that France might overtake us in an ineffective field such as finance, then so be it.

- Then Fisher started talking solutions. He has a two-part plan. The first part is to make very explicit which parts of a bank have deposit insurance and access to the Fed window, namely only the commercial bank part that accepts deposits, not any special investment vehicles or insurance subsidiaries etc.

- The second part is to hold a ritual signing of a contract among every bank customer, creditor, investor, and counter-party (but not depositor!) which states that they know their investment is not protected by a government guaranteed. Roberts suggested this might be done in a public ceremony and include a statement that people will refuse government support, so that there will be an added element of public shaming if people go back on this promise. Here’s an example of such a covenant available at the Dallas Fed webpage:

- Next Roberts pushes back: the institutions that got bailed out in 2008 didn’t have insurance, so why will this work?

- To this Fisher acknowledges that it’s all about beliefs and expectations of market participants, but he thinks that the simplicity of this, as well as the signing of the covenant, might be convincing enough. By contrast he mentions that the current system, where we have a Financial Stability Oversight Council that decides which institutions need closing, has a very low probability of working. In particular, Fisher points out that it will take 24 million man hours to simply interpret current law to break down a bank.

- Roberts then asks, what about larger capitalization requirements of banks, or capping the size of the banks? Turns out that Fisher wants to minimize government intervention and maximize “market driven approaches.” He’s a real free market lover. He also says that, in the case of a liquidity run, capital cushions, even big ones, will be insufficient if you’re dependent on short-term funding.

- One last thing. They both mention that TBTF will only be solved when a president wants it to be solved. But they also both agree that no politician wants to lose the money they get from Wall Street lobbyists.

- Next, on to monetary policy. Fisher points out that the dual mandate of the Fed is supposed to focus on long term issues, and that QE’s policy of cornering the market on treasuries and mortgage-backed solutions (MBS) is both unsustainable and doesn’t work well in a long term way.

- Fisher mentions that the Fed has made money on its enormous, $4.2 trillion portfolio, to the tune of $300 billion in the past few years, but on the other hand that’s partly because interest rates are so low. What will happen when that changes?

- He’s worried long-term about inflation, since the Fed is basically printing money, which is being stored by the banks (and hedge funds and private equity) and not lent out, at least for now.

- Finally, and this is where I care the most, this is a policy that benefits rich people and doesn’t do much at all for the rest of Americans. The balance sheets of big US companies look great now because of QE, but they largely don’t hire people because they’ve realized they don’t really need to – they’ve harnessed IT. So actually there’s less need for credit in the system altogether. Conclusion: we should reduce QE sooner rather than later.

A couple of comments

I’m not as much of a fan of “free market solutions” as Fisher and Roberts. In particular I don’t think the influence of the Fed is going to be immediately forgotten, even if we scale it down, and the bailouts will take a while to forget as well. In other words I don’t think it will be realistic to think of our system as a free market any time soon. Plus I believe in good strong rules for the market to work well.

Having said that, I love the idea of implementing these two steps to end TBTF and then seeing how well they work. By all means protect only deposits and let everyone else risk their money. See if we can at least make a dent in the implicit government subsidy.

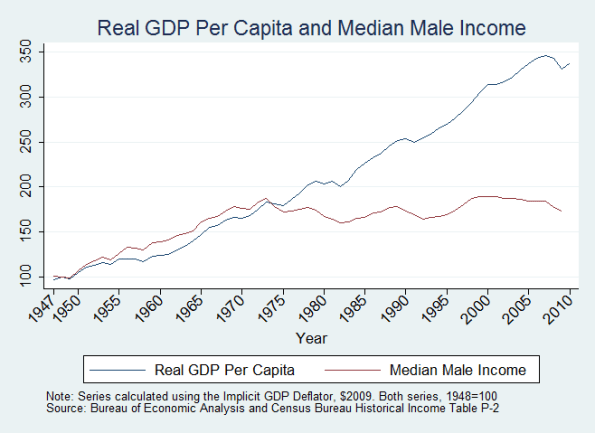

In terms of QE, there’s something to be said for everyone suffering together, and this policy is the opposite of that. Right now we see the GDP decoupled from the fate of the working man, and QE is a primary cause of that decoupling. Even so, we still use GDP as proxy for growth and success for our economy, even though the benefits are almost exclusively going to rich people. Here’s a chart showing what I mean, which I got here:

Lean in to what?

Women are underrepresented in businesses like Goldman Sachs and JP Morgan Chase, especially in the upper management. Why is that?

Many women never go into finance in the first place, and of course some of them do go in but leave. Why are they leaving, though? Is it because they don’t like success? Or they don’t like money? Are they forgetting to lean in sufficiently?

Here’s another possibility, which I dig. They’re less willing to sacrifice their ethics than their male colleagues for the sake of money and business success.

Last Friday I read this paper entitled Who Is Willing to Sacrifice Ethical Values for Money and Social Status? Gender Differences in Reactions to Ethical Compromises and written by Jessica A. Kennedy and Laura J. Kray. It offers ethical distaste problems as at least one contributing reason we don’t see as many women as we might otherwise.

The paper

Please read the paper for details, I’m only giving a very brief overview without figures of statistical significance. They have three experiments.

First they saw who were interested in jobs that had major ethical compromises. Turns out that women were way less interested than men.

Second, to check whether that was because of the ethical compromises or because of the “job” part, they had different kinds of job descriptions and found that, in the presence of a culture of good ethics, women were just as interested in a job as men.

Third, they checked on the existing assumptions about the connection between ethics and various kinds of jobs, like the law, medicine, and “business”. Turns out woman associate compromised ethics with business but less so with law and medicine.

Conclusion: we can attribute some of the lack of women in business to a combination of assumed and real ethical compromises.

Some thoughts

First, I love that this paper was written by two women. Maybe that’s what it took for such an common sense idea to be tested.

Secondly, I think this paper should be kept in mind when we read things about how companies that are diverse are more successful. It’s probably because they are nice places to be that women and others are there, which in turn makes them more successful. It also explains why, when companies set out to be diverse, they often have so much trouble. They want to achieve diversity without changing their underlying culture.

Thirdly, I’m going to have to admit that men are under enormous pressure to succeed at all costs, which could explain why they’re more willing to become ethically compromised to be successful. That says something about our crazy expectations of men in this culture which I think we need to address. I say that as a mother of three sons.

Finally, whenever I hear someone talking about “leaning in” from now on, I will ask them, “lean in to what?”.

Aunt Pythia’s advice

Aunt Pythia is almost embarrassed today by how much fun it is to be her. Almost. But honestly she doesn’t embarrass easily.

So in case you don’t get a kick out of today’s column, especially by the end, then please take comfort in the fact that Aunt Pythia got a huge kick out of writing this stuff. It was really a pleasure, thanks. Oh, and please

think of something to ask Aunt Pythia at the bottom of the page!

By the way, if you don’t know what the hell Aunt Pythia is talking about, go here for past advice columns and here for an explanation of the name Pythia.

——

Aunt Pythia,

I’m a math undergrad at a large state school working on the side as a tutor at my university’s campus learning center. There are 2 flavors of tutoring that I do: “drop-in” tutoring (which is essentially an emergency room for lower division math students doing homework) and “group” tutoring (which is a course-specific, supplemental problem solving session). I don’t care much for the “drop-in” part, but I really, really love the group tutoring, mostly because I have control over how to run the class.

Every week I TeX up a nice little sheet of practice problems for my kids and they get to come up to the board one-by-one to work on them while I sit on their shoulder being a snarky, spiritual math-guide. I’m very passionate about involving the kids directly and consider it my moral duty as a math tutor to create an environment where that can happen. However about half of the students dropped after hearing that they would be required to directly participate. The ones who stayed though have stuck it out like champs and they’ve all reported an improvement in their course grade as a result of doing the extra problems.

But here’s the problem: my supervisor keeps criticizing the low attendance (which is about 50% of the average group size) and either wants me to change my style of teaching or give me fewer group hours next quarter (which means more icky drop-in hours) if I keep things the same.

What should I do? I asked my students if I should change things up and (surprisingly) they all emphatically said “no,” adding that despite being initially intimidated they were able to overcome their confusion more quickly by being put on the spot and having the instant feedback from myself and the rest of the class (it was a touching moment).

On the other hand, I can understand where my supervisor is coming from because the learning center gets funded based on how many students are using its services, and tutors who solve more example problems at the board for free get more students. Am I too low on the food-chain to be this principled about how to run a supplementary problem solving session for a single lower division math class? Working out problems at the board has always been the most effective way for me to learn math. But maybe it’s not for everyone?

Won’t Oppose Modifying my Perspective

Dear WOMmP,

It’s definitely not for everyone. But on the other hand, it is very effective for the students that have chosen to stay with your class, and I think you should be proud of the work you’re doing with them.

In terms of advice, I think it depends on your situation. If you’re not desperate for this job, you can just tell your supervisor that this is how you work, and the results for your students will be excellent, and you will refuse more drop-in hours, and that you will quit if you are not appreciated for your efforts.

If you are desperate for this job, then you probably want to find a compromise. Maybe it can be something like, for the first half (or more) of the hour you will not do the work for them but in the last part you will answer questions. That way people will be coaxed into thinking for themselves but they will know they have the option to be lazy.

Good luck, and thank you for being such a devoted math teacher!

Aunt Pythia

——

Dear Aunt Pythia

In online discussions – and in real life – what is the best response to someone who calls me or infers something inappropriate about me?

On blogs it can be easy to spot the offenses, though in general I find it aggravating how humor cloaks a lot of sexist and generally demeaning comments in life.

I tend to be the kind of person to let bygones be bygones, and chalk it up as a sign of victory in the preceding debate; however, I am uncertain. Does my continuing to talk (obviously not right after the blow up) to that person somehow justify or encourage their methods?

I hate to leave these conversation spaces altogether (sometimes they are good dorky fun) but I noticed that though I keep my cool with the aggressors, residual bits of negativity stick in my mind and sometimes ooze into my other interactions. I appreciated your niece’s advice that “it’s not about me” but sometimes I wonder if by being present and vocal I am making it about me.

One more bit of color, the last straw attack was a sexually offensive name. And though several comments, some coming to my defense, were deleted from the thread the comment attacking me stayed up. When I complained to a friend about the incident, he suggested (jokingly, of course) that I enjoyed being called nasty names.

In public? On a blog some of my colleagues read? Exactly what is it with men? Sorry that’s a larger, near rhetorical question. Thanks.

No Offense To All’s Cool Until Negates Truth

Dear NOTACUNT,

First of all, it’s not about you, and any guy who calls you a cunt because you don’t agree with them has problems.

Second, what are you doing on discussion forums that allow such comments? Surely there are better things for you to do with your time. Like even just taking a nap would be a better use of your time.

And if you tell me I’m being sexist because men still have the option to be on such forums without being called a cunt, I’d argue that anyone there is wasting their time.

It’s a sad fact about anonymity of the web that there are weird, sad people who spend their time being hateful, as hateful as they can be, to as many people as they can be, via comments. I’ve had to go from allowing comments to moderating all mathbabe comments because of this problem, and it’s a total pain in the ass, but the only other option is frankly to forbid all comments. And since I cherish good thoughtful comments, I don’t want to do that. But keep in mind it’s a real investment of time to moderate comments!

My advice is to find a place to talk to people that’s either in the real world, or in an online forum where the comments are well curated and hateful speech is removed.

And one last thing. If someone has identified themselves as an asshole, by saying something hateful and sexist to you after you try to make an intellectual point, please ignore them forever after. That way your quality of life has improved and, as a bonus, assholes are not being encouraged to continue with their asshole tactics.

Aunt Pythia

——

Aunt Pythia,

What do you think is the sexiest knitwear? (Assuming, of course, that the set of sexy knitwear is nonempty.)

Asking for a friend

Dear Asking,

Great question! Lots of knitting is sexy. In fact anything is sexy that either a) shows off people’s bodies or b) is so incredibly scrumptiously comfortable that you just want to get inside it with the person wearing it.

In terms of the first category, let’s start with a corset-ish (but not actually one of those crazy freaking shapewear things) that shows off women’s curves, kinda like this (which happens to have been designed by a friend of mine):

Next, we have the skin-baring type of sexiness that everyone can get behind:

Next we’ve got some examples from the latter category, of scrumptiously sexy:

This is my favorite design, I’ve made it 3 times, and it’s super simple. Top down. I usually make it with REALLY BIG BUTTONS.

and for the man-loving crowd:

Did I mention there are sexy things you can knit?

Finally, I want to mention that it’s of course also possible to be sexy while knitting, which is kind of different but also makes the final product titillating, at least for those in the know:

Did I answer your question? What was your question, anyway? I’m completely distracted.

Love,

Aunt Pythia

——

Hi Aunt P,

Porn. I’m tired of the options for women. I don’t want the traditional hetero porn and I’m not into lesbian porn. Where can I find sexy, thoughtful, and maybe even *nerdy* porn (on or off) the internet? Even well-written erotica would be a nice diversion.

Upstate Upstart

Dear UU,

Look I’m as nerdy and as horny as the next girl, or maybe I’m off the spectrum for each, but even I’m not looking for thoughtful porn. If anything I’m looking for totally thoughtless porn, as long as it’s not nasty (in a bad way). And I agree that there’s not enough of it for us.

Here’s an idea, which I totally haven’t tried but I want to, and I learned about through this amazing article (thank you Business Insider!) which talks about Amazon banning smut like “Cum for Bigfoot” by Virginia Wade (not her real name!) and which contains the following unbelievable line:

“‘It’s f—ing Bigfoot,’ hissed Shelly. ‘He’s real, for f—‘s sake.’ Horror filled her eyes. ‘With a huge c—.’”

Yes! What!? Go here for more. I’m thinking New Year’s resolution.

Auntie P

——

Please submit your well-specified, fun-loving, cleverly-abbreviated question to Aunt Pythia!

How do opinions and convictions propagate?

Yesterday I read an interesting paper entitled Social influence and the collective dynamics of opinion formation, written by Mehdi Moussaïd, Juliane E. Kämmer, Pantelis P. Analytis, and Hansjörg Neth, about how opinions and strength of conviction spread in a crowd with many interactions, and how consensus is reached. I found the paper on Twitter through Steven Strogatz’s feed.

The paper

First they worked on individuals, and how they might update their opinion on some topic upon hearing of someone else’s opinion. They chose super unpolitical questions like, “what is the melting point of aluminum?”.

The interesting thing they did was to track both the opinion and the conviction – how sure someone was.

As expected, people did update their opinion if they heard someone else had a somewhat similar opinion, especially if that other person had a stronger conviction. They tended to ignore opinions that were super different, especially if the convictions were weaker. Sometimes they even adopted the other person’s opinion, if it wasn’t too different and if their original conviction was very low. But most of the time they ignored stuff:

What was also interesting, and what we will get back to, is that when they heard other people had similar opinions to their own, their conviction went up without their opinion changing.

Next they used a computer simulation to see how opinions would propagate if no new information was introduced but many interactions occurred, if everyone acted the same in terms of updating opinions, and if they did so time after time.

So what were the results? I’ll explain a couple, please read the paper for more details, it’s short.

The most interesting to me was that, at the end of the day, after many interactions, the convictions of the group always ended up high even if the answer was wrong. This is because, when people heard similar opinions, their convictions rose, but if they heard differing opinions their convictions didn’t lower. But the end result is that, although high conviction correlated with being correct at the start, it had no correlation with being correct by the end.

In fact, conviction correlated to consensus rather than correctness after a few interactions. The takeaway is that, in the presence of not much information, strong convictions might just imply lots of local agreement.

The next result they found was that the dynamical system that was the opinion making soup had two kinds of attractors. Namely, small groups of “experts,” defined as people with very strong convictions but who were not necessarily correct (think Larry Summers), and large groups of people with low convictions but who all happen to agree with each other.

The fact that these two populations are attractors was named by the authors as “the expert effect” and “the majority effect” respectively. And if fewer than 15% of the population were experts, in the presence of a majority, the majority effect dominated.

Finally, the presence of random noise, which correspond to people with random opinions and random conviction levels, weakened both of the above effects. If 70% or more of the population was noise, then the two effects described above vanished.

Thoughts on the paper

- One thing I’ve thought about a lot from working with my Occupy group is how opinions form on a given issue. Since we’re going for informed opinions, we very deliberately start out with a learning phase, which could last a long time depending on the complexity of the subject. We also have a thing against experts, although we do have to trust our sources when we read up on a topic. So it’s kind of balancing act at all times.

- Also, of course, most opinions are not 1-dimensional. I can’t say my opinion on the Fed on a scale between 1 and 100, for example.

- Also, it’s not clear that I update my opinion on issues in exactly the same way each time I hear someone else’s. On the other hand I do continually revise my opinion on stuff.

- The study didn’t look at super political issues. I wonder if it’s different. I guess one of the big differences is in how often someone is truly neutral on a political topic. Maybe you could even define a topic as political in this context somehow, or at least build a test for the politicalness of a topic.

- Let’s assume it also works for political topics. Then the “I heard this so many times it must be true” effect seems to be directly in line with the agenda of Fox News. Also there’s the expert effect going on there as well.

- In any case it’s interesting to note that, if you’re trying to effect opinions, you might either go with “informing and educating the general public” on something or “building up a sufficient squad of experts” on that same thing, where experts are people with super strong opinions and have the ability to interact with lots of people.

How do we encourage empathy?

Usually I spend a lot of time reading stuff, and then I get outraged or otherwise respond internally to something I read. I take notes on the article, in an email to myself, and that later becomes a blog post.

But since all I’ve been doing lately is hanging out with the family, cooking, and watching Psych and Star Wars: Enterprise marathons, I have less to react to and therefore less to write about.

[Aside: if you haven’t seen Psych yet, please take a look, especially if you like hilarious and snarky references to the 1980’s, but even if you don’t. Season 4 episode 1 is a great starting point. Netflixxable.]

Even so, here we are, friend, and I wanted to write this morning, and you’re here already.

So I will share some thoughts I had when I took a brisk walk last night, to try to get rid of the big Christmas dinner feeling. Big dinner, not big feeling, although the feeling was pretty big too.

I was thinking about gratitude, for even having the opportunity to have such a nice meal to share with my family, and then I started thinking about what I consider the flip side of gratitude, namely empathy. I was wondering, how do we encourage empathy and gratitude in ourselves and in others? In, say, our children?

First, who cares?

Lots of people have been writing about empathy lately, how rich people have less empathy, and the failure of technical fields to encourage empathy. We also seem to have connected gratitude with happiness.

Personally I’m pretty convinced these are both critical feelings both for relating to others on an individual basis and on thinking about public policy and income inequality, which I think about quite a bit. So I’m game.

Second, why those two things?

It occurred to me as I was walking that maybe other people don’t think of gratitude and empathy together. But for me there’s a pretty straight line from empathy to gratitude, and it’s not all that easy to get to gratitude some other way.

Some people write about how to raise your kids to be grateful, for example, and they often suggest that we ask our kids to think of things for which they are grateful, say before bed every night.

This strikes me as hollow. I don’t think people can just conjure up gratitude. Instead they will learn to list things which they are lucky to have, but being fortunate is not the same as feeling grateful. And listing a bunch of things you are fortunate to have can backfire, I’d imagine. I’m not into this plan.

But maybe I’m wrong, or maybe I misunderstood the plan. Readers, is there a connection for you too between empathy and gratitude, and is there a way to engender gratitude directly?

So, what about empathy?

Do you remember how much you hated your father growing up? I do. And I also remember the time, or times, that I realized I had the same tendencies inside myself. I could be just like that guy, I realized. FUCK.

And that’s when I realized I had a choice. I could either hate myself as much as I hated him, or I could forgive both of us. Or actually there are more options, including things like continuing to hate him and ignoring those same qualities in myself, but I try not to be too hypocritical.

Anyhoo, the point is that I forgave both of us. I empathized with his weaknesses, which were mine as well. And that is how I empathize with people in general, because I realize I am one mistake away from fucking up, or having too much debt, or being homeless or jobless.

And by the way, I even have made those mistakes, or many of them anyway, but I’ve been bailed out because of friends, or because I’m educated, or because I’m white. I am largely insulated from my bigger mistakes, but when I see someone in pain, it’s my pain, because it could be me.

And of course we have empathy for people because they are unlucky, like if someone they love gets sick, or if they themselves get sick and this ridiculous health system lands them in deep debt, or if they are at the wrong place at the wrong time, like if someone gets into an accident or if they are born into poverty.

But we also have empathy in recognition of making super shitty decisions and even of being cruel. Because cruelty is a weakness of ours too.

For me at least, gratitude comes right after that. It’s actually just a continuation of the feeling of empathy. I am grateful to my friends, and I am grateful for my freedom, and I am grateful I have not been in a situation recently where I’ve been overly tempted to wield my personal arsenal of evil weapons.

So, how do we encourage empathy and/or gratitude?

That’s the thing, I don’t know. The truth is, I’m not sure how it can be done without going through this whole process of hating something, then recognizing it inside yourself, and then coming to terms with it kindly. That’s pretty much all I got.

And so instead of asking my kids to be grateful, I just try to do my best to role model empathy and gratitude myself, in my words and actions and especially in my inactions.

What does a really efficient market look like?

The raison d’être of hedge funds is to make the markets efficient. Or at least that’s one of the raisons d’être, the others being 1) to get rich and 2) to leave early on Fridays in the summer (resp. winter) to get a jump on traffic to the Hamptons (resp. ski area, possibly in Kashmir).

And although having efficient markets sounds like a great thing, it makes sense to ask what that would look like from the perspective of a non-insider.

This recent Wall Street Journal article on high-tech snooping does a pretty good job setting the tone here. First, the kind of thing they’re doing:

Genscape is at the vanguard of a growing industry that employs sophisticated surveillance and data-crunching technology to supply traders with nonpublic information about topics including oil supplies, electric-power production, retail traffic and crop yields.

Next, who they’re doing it for:

The techniques, which are perfectly legal, represent the latest advance in the longtime Wall Street practice of searching for every possible trading advantage. But the high cost of much of the new information—Genscape’s oil-supply report costs $90,000 a year—means that some forms of trading are becoming even more the province of firms with substantial resources.

Let’s put these two things together from the perspective of the public. The market is getting information from hidden cameras and sensors, and all that information is being fed to “the market” via proprietary hedge funds via channels we will never tap into. The end result is that the prices of commodities are being adjusted to real-world events more and more quickly, but these are events that are not truly known to the real world.

[Aside: I’m going to try to avoid talking about the “true price” of things like gas, because I think that’s pretty much a fool’s errand. In any case, let me just say that, in addition to the potentially realtime sensor information that goes into a commodity’s price, we also have people trading on it because they are adjusting their exposure to some other historically correlated or anti-correlated instrument, or because they’ve decided to liquidate their books, or because they’ve decided the Fed has changed its macroeconomic policy, or because Spain needs to deal with its bank problems, or because someone wants to take money out of the market to rent their summer house in the Hamptons. In other words, I’m not ready to argue that we’re getting close to the “true price” of gas here. It’s just tradable information like any other.]

I am now prepared, as you hopefully are as well, to question what good this all does for people like us, who are not privy to the kind of expensive information required to make these trades. From our perspective, nothing happens, the price fluctuates, and the market is deemed efficient. Is this actually an improvement over the alternative version where something happens, and then the price adjusts? It’s an expensive arms race, taking up vast resources, where things have only become more opaque.