Archive

#Occupy Wall Street meeting and news

First, I wanted to mention that there will be an Alternative Banking meeting on Sunday from 3-5pm at 1401 IAB (14th floor of the International Affairs Building), Columbia University. This is on the corner of Amsterdam and 118th. Please come!

Next I wanted to mention that I’ve been hearing from other occupied cities, namely Occupy Oakland and Occupy LA. I’ve been meeting the most amazing people this way and I’m super grateful for that. I should be talking to Cheryl from Occupy LA later today, and it sound like her posse of occupiers have really been making things happen with something called the “Responsible Banking Measure” recently passed by the LA City Council. Awesome stuff, and I’ll post more as I learn it. My favorite part was the last line of her email, “let’s do this!”

Another inspiring figure is coming from Occupy Oakland, a photographer named Miles Boisen, whose trademark phrase, “struggle and snuggle,” is very close to my heart. He recently met a group of four protesters who were so fascinating that he asked them to tell a bit more about their story. First, here’s their picture:

Next, here’s one of their stories:

Dear Myles,

It was wonderful to meet you at the time and place we did. I am happy to give you some background information. Feel free to use it (or not) any way you like.

I was born in San Francisco in 1944, the year that millions of Jews were being slaughtered by Hitlers minions in Europe. My mother, Hodee Edwards, is Jewish. My father, Harvey Richards, is of Welsh ancestry. I witnessed the 1950s in the streets of Oakland, watching my mother crying over the Rosenbergs execution, and experiencing the racism of our world through the eyes of my African American step father (George Edwards) and my sister (Lou Edwards). I dodged the FBI coming to my house to harrass my family and witnessed doors being slammed in the FBI’s faces as they sought to intimidate dissidents in Oakland. I traveled to the USSR in the summer of 1961, the year I graduated from high school, to help my father and his wife, my stepmother Alice Richards, make two films on ordinary life in the USSR. See this for a clip from that movie.

I entered UC Berkeley in the fall of 1961 and immediately joined the civil rights movement. My first demonstrations were against compulsory ROTC at Berkeley, a struggle that resulted in the cancellation of compulsory ROTC in my sophmore year. I participated in the sit-ins at Mel’s drive-in restaurants (see this for a clip of my father’s film showing those demos and a shot of me on the picket line), at the Sheraton Palace Hotel (see this which includes a shot of me being dragged out of the lobby by the SFPD) and along auto row on Van Ness in San Francisco in 1963 and 1964 against racial discrimination in hiring, then rampant all around the bay area. I spent 2 months in the San Francisco County Jail in San Bruno in 1966 for my efforts.

I resisted the draft from my graduation in 1966 when I was classified 1A to 1969 when the draft board just gave up on me and never sent me another nasty letter. See this for a slide show of events that took place on the day I was drafted (but slipped out of their grasp), Oct 18,1967 during the Stop the Draft Week events on the very same street Occupy Oakland’s general strikers walked down last Tuesday.

As you can see the events of those years are still very alive for me through the work I have done archiving my father’s film collection (see this). I have kept the memories of those movements alive because I believe in them now as I did then. So, for me, the Occupy Oakland movement is a dream come true. It finally gives voice to the cry for justice and sanity that has been silenced for so long under the hegemony of the Republican and Democratic Parties ever since the election of the crook, Richard Nixon, and continuing until the present day with the election of the most recent fraud, Obama the bomber.

I rejoice at the outpouring of outrage from our youth. They have made it possible for me to switch from the tiny minority who over the past 40 years have dissented against the American empire, to the 99% who are dissenting today. What a relief. I don’t know where this movement is headed nor how long it will last. But I do know that it has my whole hearted support and that it opens the door to ten thousand possibilities. I am in awe that I lived to witness it. Since I am retired now, my future plans are to continue to manage Estuary Press and the Harvey Richards Media Archive and to make sure that we do not forget our history, even as we are making it right now.

I guess you can’t call this brief, but I tried my best.

Thanks for asking, and hoping you don’t regret it,

Paul Richards

Why I’m involved with #Occupy Wall Street

I get a lot of different responses when I tell people I’m heavily involved with the Alternative Banking group at #OWS. I find myself explaining, time after time, why it is I am doing this, even though I have a full-time job and three children (let’s just say that my once active knitting circle hasn’t met in a while).

I was not particularly activist before this. In fact I went to UC Berkeley for college and managed to never become politically involved, except for two anti-Gulf war protests in San Francisco which were practically required. While my best friend Becky was painting banners in protest of the U.S. involvement in El Salvador, I was studying tensor products and class field theory.

It’s true that I’ve been much more involved in food-based charities like Fair Foods since high school. One of the most attractive things about Fair Foods was that it acts as an outsider to the system, creating a network of gifts (of primarily food and lumber) which was on the one hand refreshingly generous, based on trust, and the other hand small enough to understand and affect personally.

I, like many people, figured that the political system was too big to affect. After all, it was enormous, did lots of very reasonable things and some unreasonable things; it didn’t solve every problem like hunger and crime, but the people running it were presumably doing their best with incomplete information. Even if those people didn’t know what they were doing, I didn’t know how to change the system. In short, I wasn’t an expert myself, so I deferred to the experts.

Same goes with the economic system. I assumed that the people in charge knew what they were doing when they set it up. I was so trusting, in fact, that I left my academic job and went to work at a hedge fund to “be in business”. I had essentially no moral judgement one way or the other about the financial system.

Once I got there, though, I had a front row seat to the unfolding crisis. As I wrote about, I got to see former Treasury Secretaries and Fed Chairman explain how shitty the securitized products are, that were currently being sold all around the world, and how they had no idea what to do about it except to tell everyone to get the hell out (which we can see has been harder for some than for others).

That meeting wasn’t the only clue I received that pointed to one thing: the experts had no idea what they are doing. The system was based on an overwhelming arrogance and network of vested interests. My conclusion as well as many other people’s.

On the other hand, it was a crisis. It was a fantastic opportunity to set up a better system. The optimist in me assumed that we would. I applied to work for the regulators to be part of the solution. When I didn’t get any offers I worked for a risk company instead.

After two years in risk, and no new system, I had to admit that there was no reason for optimism. The system is still being controlled by the same group of arrogant architects who argue that we can’t change it because then it would collapse. There’s always a problem with asking people on the inside to fix their problems. The politicians don’t understand enough about the financial system to know what to do, and the financial lobbyists telling them what to do are always protecting the banks.

Once I lost faith in fixing the problems, I felt pretty hopeless. I left finance, and considered working for a food-based charity in New York, but finally decided to stay a nerd since that’s what makes me happiest. I started this blog in a moment of hope that something as small as explaining how quants do modeling could be interesting to someone, that maybe the techniques used for so much destruction could also be used for construction.

Then something happened. It was the #OWS protest. I started going down to see if I could get people interested in talking about the financial system. Mostly people were only tepid, but sometimes people really wanted to know. I kept looking for a working group that would focus on this, and eventually I found one.

People talk about how the protesters are a bunch of lazy dirty hippies. There is certainly a group of people who don’t have access to baths, and there are people there who don’t work regularly (although that’s one reason they are there to protest). In fact there are some downright annoying people in the mix as well. But if you focus on those people, you are missing the point entirely. People also say they’re sympathetic, but that there’s no chance we could ever make a difference. I also politely disagree.

What this movement has done is to create a new opportunity for people to try to fix the system. I’m not saying I am 100% convinced it will work; in my practical-minded way, I think the best-case scenario is more like, we will influence the conversation.

But maybe influencing is enough, considering that very few people think things are working right now. At the policy level, we need to influence the conversation in the direction of showing what else could be done, rather than letting things stay the same for lack of a better plan. At the individual level we need to continue what has already begun: getting people interested and informed about the system and how it affects their everyday lives.

What’s the worst-case scenario? We have already seen it: it’s the past 4 years of doing nothing and letting the economy fall apart with no plan for improvement. The #OWS movement has already brought about a meaningful and hugely important conversation, and a sense of involvement by ordinary people, about what experts are doing with their lives.

This emerging conversation is perfectly illustrated in this Bloomberg article – not the article itself, which is strangely self-contradictory and even journalistically dishonest (it tells people to take their money out of Wall Street by investing with Vanguard in the stock market), but the comments on this article are some of the best comments I’ve ever seen on a business-oriented website. People are no longer letting themselves be spoon-fed bullshit.

The dirty hippies are a distraction, and the people who admit the system is broken but who obsess about them need to stop complaining about the embarrassing image and figure out how to help. People who think that we will never accomplish something without a few key experts should contact those experts and invite them to the meetings. Or tell me who they are and I’ll invite them. It’s time to try.

The Numbers are in: Round 1 to #OWS

This is a guest post by FogOfWar:

CUNA (a trade industry group for credit unions) just announced that at least 650,000 customers and USD $4.5 Billion have switched from banks to credit unions in the last five weeks. I think this is a pretty impressive showing for the lead up to “Bank Transfer Day”, and, as posted before, am a supporter of the CU transfers. A few quick points on the announcement:

Are those numbers driven by “Move Your Money” or BofA’s $5 Debit Fee?

A little of both, I suspect, and there’s no hard survey data (that I know of) splitting it out. The two points aren’t completely separate, as one of the points of “move your money” (at least in my mind) is to let people know that credit unions generally have lower fees than large commercial banks & it often makes financial sense to shift your account over regardless of your political views on “Too Big To Fail (TBTF)”.

So is 4.5 Billion a lot or a little?

It isn’t a big number in the scope of overall deposits, but it’s a really big number for transfers in just one month. For scale, the total deposits in all 11,000+ CUs nationwide are somewhere around $800Bn, and that’s roughly 10% of the total deposits in the US. So $4Bn (to make the math easy) is a 0.5% increase in deposits for CUs and somewhere around a 0.05% reduction in the deposit base of US banks in the aggregate. I suspect the transfers are concentrated in the large “final four” banks (BAC, JPM, C, WFC which, if memory serves, account for somewhere around 40% of deposits), so the reduction might be closer to 0.10% for the TBTF quartet.

Wait, those seem like really small percentages—why do you think this matters?

Well, because it’s a greater increase in deposits in one month than credit unions (in aggregate) got in the entirety of last year (and last year was a good year for CUs in which they saw their market share increase). People (rightly) don’t change their checking accounts lightly (there’s a lot of “stickiness” to having direct deposit/ATM cards/etc.—in short it’s a pain in the ass to change your financial institution), so this is a pretty impressive number of people and amount of deposits in this span of time.

Also (and this will play out over time), this could be the start of a trend. Certainly there seems to be a large uptick in discussion of “move your money”, and, as the idea percolates around there’s a lag between thought an action, so this well could be a slow build.

“A Slow Deliberative Walk Away from the TBTF Banks.”

Another important point is that, in fact, you really don’t want too many people moving their accounts in a short period of time for two reasons. First, a rush of people all removing their deposits at the same time is, in fact, a “run on the bank”. This is destructive for a host of reasons—in particular it can cause the institution on which there’s been a run to go into bankruptcy (regardless of whether that bank is otherwise solvent), and, let’s not forget, we the taxpayer are ultimately on the hook for the deposits of bankrupt commercial banks through the FDIC, which is funded by bank fees but backed by the full faith and credit of the taxpayer (and a BofA bankruptcy might put that backstop to the test). So, much as I disagree with many of the decisions of the mega banks, I don’t want the “move your money” campaign to be a catalyst for their insolvency proceedings.

Instead, what I’d really like to see is a slow steady whittling down of their deposit base, and thus their overall size, until they are no longer considered “to big to fail” and thus pose no danger to the taxpayers, as they will be free to make good or bad decisions and live or die, respectively, by them. In short, I’d like to see a “slow deliberative walk away from the TBTF banks” playing out over the course of the next 2-3 years.

The other reason is that credit union’s can only take deposits at a certain pace without running into issues with their own capital buffers and operations. This is a slightly technical issue, but with a substantive point behind it. In essence, absorbing a large growth in new deposits takes some time, not just from an operational perspective (ramping up staff, at a certain point opening new branches and ATMs), but also because more capital needs to be accumulated to provide a safety buffer for the additional deposits that have been taken on. From this perspective, the $4.5 Bn in 5 weeks is a “goldilocks” level—not to much to overheat, not too little to be a rounding error, but just right (OK, actually think it could be 2-3 times the pace without overheating, but everyone else loves to use that hackneyed “goldilocks” metaphor and I just felt peer pressure to frame it that way).

I read that it won’t have an impact on the banks—is that true?

In a word, “total fucking bullshit”. The deposit base is the skeleton of a bank—it’s what holds the whole thing together. Deposits are steady (essentially) free money. Money that can be deployed wherever the bank finds interesting at the moment: loans to customers, speculative exotic derivatives, new branches, foreign investment, whatever. Moreover, if retail deposits mean so little to banks, then why in the world do they spend so much advertising coin chasing them? Generally for profit institutions advertise for products that are profitable to them, not one’s that are irrelevant. QED.

That’s true over the long term. It is worth noting, however, that at this exact moment in time the banks are flush with cash sitting idle on deposit with the fed. http://www.cnbc.com/id/44019510/Bank_of_New_York_Puts_Charge_on_Cash_Deposits Which, by the way, makes it perfect timing for the “move your money” campaign. As I said before, I really don’t want a “run” on the banks, and the fact that banks are flush with cash currently means they’re relatively safe in the immediate moment from a loss of deposits.

But the real reason you’re still seeing Chase commercials on TV even though they’re flush with cash doing nothing at the Fed, is that Chase knows that most people rarely change their primary checking accounts. The accounts that are moving over now are (statistically) gone for good. Later, when that flush cash at the Fed is no more and the banks want the easy money of a wide retail deposit base, they’ll find it very difficult to bring those people back. Not because credit unions are really awesome, just because people really don’t like switching accounts—BofA has to spend a lot of energy to bring in a new account from another institution and doesn’t actually care if it brings it in from lower east side people’s or from Citibank (money is fungible).

Lastly, and perhaps most important, the primary checking account is the primary point of entry to our financial lives. Big banks like the free money you give them on deposits, but equally much they like the chance to have your credit card business, your mortgage and car loan business, your insurance business, your investing business and possibly your retirement and college savings business. All that ancillary business can be (and very much is) statistically quantified on a per-account average basis. All those cross-sells add up over time to big numbers.

FoW

Open Forum speeches

Last night Andrew, myself and Christian gave the Open Forum at Zucotti Park, representing the Alternative Banking working group. I wanted to share a couple of the speeches we used here. Andrew wrote the first part, and I wrote the second and third parts (the third part was adapted from FogOfWar’s breakdown of the banking system). Because we used the human microphone to speak, it had to be written almost like poetry. For now I’ll only share the ones I wrote, since I haven’t asked Andrew for permission to publish his. The event was videotaped and I’ll post a link to the YouTube when I know it. Hopefully we got a few more people to come to our meeting this afternoon.

Cathy:

I want to say something

about my background

When I was a kid

I wanted to become a mathematician

I was a nerd

I loved math because

it made everything

either true or false

it made everything

feel clean and safe

and I liked to feel that way

I worked hard

I went to college

I went to grad school

I was a post-doc

I became a professor of math

at Barnard College

but when I finally got there

I realized I wanted something else

I wanted to be in the real world

I wanted to be part of this city

I decided to work in business

the only job I knew how to get

was as a quant at a hedge fund

I didn’t know anything

about finance

I went there anyway

I learned a lot

I worked with smart people

I learned how they think

I learned how the markets work

I learned how to predict the market

I started to see the system

as an enormous junkyard

and the role we played

as the scavengers

we were the junkyard dogs

we used math and computers

we skimmed off the top

of the enormous system of money

this math is not clean

this math is not safe

there was something wrong

whose money is this?

Where does this money come from?

I couldn’t understand it

I asked other people there

whose money is this?

this is the system they said

it’s just money in the system

your question doesn’t make sense

but I thought more about it

I realized this money

it comes from somewhere

it comes from people

it is their savings

it is their mortgage payments

it is their retirements

some of them are rich

they can afford to make bets

but not all of them are rich

most of the system is made

from normal people’s money

I finally decided

I had to go

it didn’t seem right

to take that money

I went to work at a risk firm

we tried to understand risk

but after some time there

I realized something

people don’t care about risk

not the way they should

I left that place too

I left finance

but I still wanted to do something

about how the financial system works

which is why I’m here

I’m very thankful to you

that you are here too

and we know something

we know the system isn’t working

let’s figure it out

let’s talk about it

let’s understand it

and why it is failing

and let’s make it work

it needs to work for us

it needs to work for everyone

Thank you

Christian:

What is banking?

there are four parts

The first is old-school

traditional banking

the institutions in this

are Banks and Thrifts,

Credit Unions, and Payday Lenders

they take deposits

they start checking accounts

they make loans

they make mortgages

they give out credit cards

they give out debit cards.

The second category of banking

is Investment Funds

the institutions here

are pension funds

mutual funds

index funds

and hedge funds

the collect money from investors

to invest in the market

this is how your 401ks

get into the system

The third kind of banking

is investment banking

here the institutions

are the investment banks

like Goldman Sachs

they give advice to companies

like when they go IPO

or need to raise money

they also make trades

that are supposed to help

their clients

The fourth kind of banking

is Insurance

the institutions are

the insurance companies

they pool risks

they make big pools of money

from lots of people

so that when bad things happen

the pool can pay

instead of one person

we use this system

for Home insurance,

for life insurance,

for car insurance,

and for medical insurance

I am telling you this

to let you know

that this system is big

but it is not infinite

it has been set up by people

and it can be understood by people

and it can improved by people

please join us

the Alternative Banking group

we are meeting tomorrow

Thank you

#OWS meeting tomorrow

I’ve been busy writing my speech for the Open Forum today. Finally finished it just now. I’m going to do it with Andrew, who’s also involved in the Alternative Banking working group. I’m very impressed with the work he and other people are doing for this group, it’s inspiring to see how much people care. I’ve been told that the Open Forum will be videotaped and put on YouTube- stay tuned for the link to that!

One outcome of all that hard work is that we found a place to meet! We’re meeting Saturday (tomorrow) from 4 to 6pm at the Community Church of New York, located at 28 East 35th Street. Hopefully we will have skype set up for people to call in. For skype details keep an eye on the Alternative Banking webpage. That webpage also has the minutes of our last meeting as well as the invitation to this one, complete with a questionnaire that we put together to make the actual meeting more productive.

It also looks like after that we have a room at Columbia reserved for a few Sundays, which is also very awesome.

Sorry for the incredibly boring post. It’s actually really exciting but I don’t imagine that’s coming through. I actually do have plenty of things to say about other stuff, specifically how crazy I’d be if I were an unemployed Greek person right now, but I’m really lacking in time and sleep so I will have to let Floyd Norris from the New York Times say those things:

There is little reason to think that Greek citizens will be more cooperative now that it has been made clear their opinions are irrelevant to the people who run Europe.

#OWS Alternative Banking update

I’m excited about the meeting from yesterday and I’m trying to help coordinate next steps. As before, the caliber of the people and the conversation was inspiring – people from all over the place, with so many different background and perspectives. Really exciting! At the same time, we were left with a bunch of open questions and issues; we could really use your help!

The group was quite large, on the order of 55 or 60 people, and after some deliberation we split into two groups: Carne’s group went to the other side of the room to discuss a true alternative banking system, and quite a few of us stayed on the first side of the room to discuss problems with our current system and incremental (but not minor) changes to improve it.

We discussed, (not in this order) how the financial system can be divided into four parts, according to FogOfWar:

- Traditional Banking: taking deposits, checking accounts, CDs, making loans/mortgages, credit cards, debit cards, banks, Thrifts, Credit Unions, Payday Lenders

- Investment Funds: collecting money from investors and making investment in the capital markets: 401(k), 403(b), IRAs, pension funds, mutual funds, index funds, hedge funds (also money market funds with a big asterisk)

- Investment Banking: traditionally two categories: I-banking (giving advice to companies on raising money in the capital markets, M&A, etc), and broker/dealer activities (making trades on behalf of clients and market making) including derivatives

- Insurance: pooling risks amongst large statistical pools to spread large losses into smaller, manageable premiums. Home insurance, life insurance, car insurance, etc.

We also talked about the power grid, how the capital markets and the players in the capital markets control the small businesses which leads to what we see today, with people feeling disempowered from their own money and their own business. We talked about the shadow banking system, politics and the power of lobbyists, and about how we might be able to effect change on the state level by trying to influence where pensions are being invested. We also heard from a fantastic woman who helped form the Dodd-Frank bill and is an expert on the FDIC and various other regulators and understands where their vested interests lie (this line of thought makes me want to write a post on an idea my friend has of paying SEC lawyers on commission, in reaction to the Citigroup – SEC debacle).

[We will write the minutes of the meeting soon, hopefully; the above is just my recollection. Please comment if I’ve missed something.]

It was all very stimulating, and made me want to draw a bunch of visuals to help with the (very large) educational background required to really tackle these problems. Visuals like this or this would also help me prepare for my upcoming Open Forum this Friday.

At the end, Carne invited us to form a separate group from Alternative Banking, which makes sense as we are on the one hand quite large for his office and on the other hand interested in improving the current system more than a completely alternative one. That leaves us with a bunch of things to do though:

- Formally create a new working group through #OWS

- Choose a name

- Choose a representative to go to the #OWS meetings and explain our activities

- Find a place to meet

- Find a way to communicate

#OWS Alternative Banking meeting today

I’m excited to go to the second meeting today of the Alternative Banking working group, whose web page is still a work in progress. We’re meeting at 3pm at Carne Ross’s office.

Dial-in instructions:

At 3 PM Eastern Standard Time (in the US), please dial: (530) 881-1000

When you are asked to enter the conference code, enter this: 451166

Then hit the pound key (#).

Last week we set up an ambitious agenda for ourselves. After passing the “Move your Money” campaign to Alternative Economy (because they are already on it), we decided to focus on two things:

1) What are the legislative steps we think need to be made to fix the current system? To this end the discussion has been centered on commenting on the Volcker Rule, which the public can do until January 13th.

2) Reimagining our current financial system – what would it look like where our deposits, our retirements, and small businesses weren’t being held hostage by a few powerful banks and corporations? Much of this discussion will probably be centered on how things used to work in this country and how things work or worked in other countries.

In the meantime, I’ll share some great links with you:

- Credit unions are seeing a surge in new members.

- When you hear “recapitalization of banks,” what does that mean?

- How do CDS’s work, and what is going to happen in Greece if their 50% haircut counts as a default?

- My hero judge Jed Rakoff tells the SEC to do their job.

- More background on Jed Rakoff.

- A former derivatives guys explains where Wall St. went wrong and comments on #OWS.

- Trick-or-treating tips for #OWS sympathizers

Open Forum next Friday

I went back to Occupy Wall Street two nights ago after work. I hadn’t been there since last Friday, and all of the tents made the place awfully depressing. I was getting kind of skeeved out when I found myself next to the “red structure” and in the middle of the beginning of an “Open Forum” about Media Justice.

It was the first time I was an actual human microphone for a meeting, and the speeches were really good (they explained net neutrality and the cell phone industry). I was super impressed, and afterwards I introduced myself to the organizer. She explained it’s part of the Education and Empowerment working group.

Bottomline is, I’m giving an Open Forum about the financial system next Friday, November 4th. Very exciting! This format is exactly what I was hoping for when I tried to do the “teach-in” a couple of weeks ago. It’s also a chance to hand out my flyer.

I have to go write a speech consisting of 4-word phrases now. Kind of like poetry.

What’s your short list of actionable complaints?

After reading this article from the New York Times about what Volcker says still needs to be done about the financial system (the title of his speech was “Three Years Later: Unfinished Business in Financial Reform”), I’m wondering if he wants to join the #OWS Alternative Banking working group. He’s got his own “short list of actionable complaints” list, not that different from mine:

- make capital requirements for banks tough and enforceable,

- make derivatives more standardized and transparent,

- ensure auditors are truly independent by rotating them periodically,

- end too big to fail,

- create and enforce reserve requirements and capital requirements for money market funds, and

- get rid of Fannie and Freddie, or at least make a plan to.

He also pointed to the weakness of the ratings agencies as one of the big reasons for the credit crisis, so I assume that “making the ratings agencies accountable” may be on the list too, at least in the top 10.

I was interviewed last night about being on the Alternative Banking working group for #OWS (I will link to the article if and when it comes out), and I mentioned this speech as well as the general fact that many of these problems named above are really non-partisan, especially “Too Big to Fail”. This column from the New York Times, written by former IMF chief economist Simon Johnson points this out as well.

That makes me encouraged and depressed at the same time. Encouraged because there really does seem to be a consensus about what’s terribly wrong with at least some of the most obvious issues, but depressed because in spite of this we haven’t solved any of them. To make this vague sense of depression precise, just take a look at what has happened to the original “Volcker Rule”: it has expanded by a factor of 100, from 3 to 300 pages, making it impossibly difficult to understand or probably to follow (unless you have fancy lawyers who do nothing else besides find loopholes). It’s reminiscent of our tax code. Speaking of which, here’s yet another “short list of actionable complaints” to fix that.

I’m enjoying how many people are now coming up with personal short lists of actionable complaints (even if it’s in response to complete stalemate of the political process). It’s a way of claiming and maintaining our freedom and agency. It isn’t as easy at is seems, because you have to sort out the important from the annoying, and the actionable from the existential. If you haven’t already, I encourage you to write your own short list, and feel free to post it here.

Why Credit Unions? (#OWS) (part 1)

This is a guest post by FogOfWar. See also the “Credit Unions in NYC flyer“.

Moving your money from a megabank to a credit union or community development bank makes for a good sound bite, but is it really an action that can have an impact in the right direction? I think so (although the matter is not free from doubt), and thought it would be worthwhile to lay out thoughts on the subject as a follow-up to the “What is a Credit Union?” post.

I’ll focus this discussion on credit unions, rather than community development banks or smaller locally owned banks as that’s where my knowledge lies.

Credit Unions are not Too Big To Fail

A quick google search indicates the largest credit union in America is Navy FCU with $34Bn in assets. (Internationally, it may be the Dutch Rabobank, although I’ve never gotten a good handle on whether Rabo is still a cooperative or not.) Individual credit unions fail regularly, just like individual banks, but there isn’t one CU that’s in danger of crashing the entire financial system in the same manner as BAC, C, JPM or WF.

During the 2008 crisis and aftermath the only credit unions that got a federal bailout were the corporate credit unions. There’s a good article about that here. The corporate credit unions definitely got into trouble buying structured products and I don’t want to gloss this fact over. There’s a split between the retail credit unions, who are going to have to pay for these mistakes, and the corporate credit unions which made the bad investments as well as the NCUA, who was asleep at the switch when the corporate CUs were making that investment. Also worth noting that the NCUA has filed suit against the banks for selling crap product to the corporate CUs.

The corporate credit union bailout was small proportionate to the overall credit union size. $30 bn of gov’t backed bonds equates to $270 bn proportionate for banks—less than ½ of the official state of TARP and a small fraction of the overall size of the taxpayer support given to the large (non-CU) banks indirectly through TAF, TSLF, PDFC, TARP, TALF, etc.,… (see this for an explanation of term).

All in all, I’d say CUs come out somewhat ahead by this measure.

Volker Rule/Glass Steagall

Unlike commercial banks, credit unions never revoked the Glass Steagall act and remained segmented as “pure” traditional banking entities. This means that CUs don’t mingle traditional banking (deposits, checking accounts, loans to customers), with investment banking activities (IPOs, M&A advisory) or derivatives trading or sales desks, let alone prop desk frontrunning of client information.

There’s a lot of ink out there on Volker and Glass Steagall. In short, it seems like a good idea, if not sufficient as a complete solution, to keep traditional banking segmented from investment banking and proprietary trading. The core point is that trading risk should not infect the core banking business putting it (and the taxpayer standing behind the federal deposit insurance) at risk. Very good recent example of this here.

CUs come out dramatically ahead on this measure.

Lobbying—just as bad?

Credit Unions do lobby, largely through two groups, CUNA and NAFCU. In fact, NAFCU has been an opponent of the CPFB, and the CU lobby got itself removed from the debit swipe fee cap.

There was a time I can remember when CUNA and NAFCU just went up to the hill to remind Congress that they existed and defend against the ABA’s occasional attempts to change the tax status of CUs. It seems times have, rather unfortunately, changed.

Regrettably, no advantage to Credit Unions here.

Part 2 will talk about investments in local communities, democratic control (the good, the bad and the ugly) and securitization/mortgage transfers.

FoW

David Graeber on Occupy Wall Street

Could I love David Graeber any more? He wrote a fantastic book which I’ve blogged about here just in case you missed it.

Check out his account, cross posted from Naked Capitalism, on being one of the original Occupiers of Wall Street (I feel like I should have guessed this but I didn’t).

I hope he gets onto the Alternative Banking working group.

Alternative Banking System

I just got invited to join the Alternative Banking System working group from Occupy Wall Street. It’s run by Carne Ross, who has written a book called the Leaderless Revolution. I’m excited to meet the group this coming weekend. It looks like there will be many interesting and unconventional thinkers there.

I got back last night from my Cambridge, where I spoke to people about doing math in business. I will write up my notes from that talk soon and post them, and they will include my suggestions for how to prepare yourself to be a data scientist if you’re an academic mathematician. This is a first stab at a longer term project I have to define a possible “data science curriculum”.

What is a Credit Union? (#OWS)

This is a guest post by FogOfWar:

There’s been a call (associated with the “Occupy Wall Street” movement) for consumers to move their bank accounts from large TBTF banks into local credit unions. Nov. 5th is the target date. This is a similar message to one Arianna Huffington gave a few years back.

The above inspire a quick post on the subject of “What is a Credit Union and why is it different from a mega-bank?”

What can I do at a Credit Union?

Pretty much all the same stuff you can do at a bank. They have checking accounts (although they call them “share accounts”, it’s the same thing), savings accounts, CDs, credit cards, debit cards, auto loans, mortgages, lines of credit. All of the stuff a normal bank offers. Some of the smaller CUs (just like some of the smaller banks) don’t offer everything, but it’s substantially the same.

The only difference in services is that you generally can’t make investments (stocks, bonds, etc.) through your credit union. IMHO, this isn’t much of a downside, as the brokers associated with major banks generally aren’t as good as the standalone retail brokers (like Fidelity, Vanguard, TIAA-CREF, etc.)

The other difference is that you can’t just walk off the street and open a credit union account; you have to be eligible in their “field of membership” (more on that below).

How are the rates?

It varies, but in general you’ll get better rates at a credit union than at a bank (certainly than at a megabank). An easy way to check is to look at your checking account statement now (or call your bank) and see what the APY is (Annual Percentage Yield), and then check the credit union to see the APY on their basic share draft account.

There are credit unions with sucky rates out there (often the really small ones—they have a lot of operational costs), but I’ve usually found that I get better rates on savings and better rates on loans from a CU.

What’s the real difference?

The real difference is ownership. Banks are owned by outside investors—usually people who own the stock for a big bank—and they need to pay those owners a profit in the form of dividends (or share repurchases which are economically equivalent). Credit Unions are owned by their depositors (called “members”). That’s why the “checking account” is called a “share account”—you own a “share” (another name for stock) in the credit union. The board of directors is elected at an annual meeting, one person, one vote. BoD members are not paid for serving on the board.

This also explains why Credit Unions can offer better rates: they don’t have to pay a profit to their stockholders, instead that “profit” is returned back to you, the owners. Note that CUs are also exempt from corporate tax, and this makes some difference, but IMHO, it’s the absence of needing to pay dividends that really gives CUs the ability to pay better rates to their customer/owners.

Am I supporting the community when I deposit with a Credit Union?

There’s a good argument that yes, you are. Credit Union’s make loans back to the people in their membership. So the money you put on deposit is being leant back to people in the community of the credit union. Credit unions don’t trade derivatives or run speculative investment books. By and large they make loans to members and then hold on to those loans (i.e., they don’t “securitize” those loans out to other people).

For those who know the movie It’s a Wonderful Life, it’s a pretty good description of how a credit union can work within a community. Technically the movie describes a Thrift (somewhat similar), but it could just as easily been about a CU.

Who is eligible to join a Credit Union?

Each credit union has a “field of membership”. Some are employment-based, so you are eligible if you or an immediate family member works at a certain place. For example, NBC has a credit union for its NY employees. Note that NBC does not own the credit union, the CU is owned by its members (one person, one vote), it’s just that the credit union is there for NBC employees.

Some credit unions are associational. A good example of this is church credit unions (which are pretty common). There are also Community Development Credit Unions, which are set in lower-income areas and anyone in the area can join (Lower East Side People’s FCU is a good example).

There are a number of educational credit unions—these vary, but often faculty, students, employees and alumni are all eligible to join. Again, note that the university does not own the credit union—the CU is owned by the members—it’s just the prerequisite to join that particular credit union.

How do I find a credit union I can join?

There are some “credit union locators” online, but the one’s I’ve seen kinda suck. I’d say try a Google search. So if you live in Boise, I’d search for “Boise Credit Unions”. You can also try www.ncua.gov, which will give you all the credit unions in a particular area. I tend to like the larger credit unions (at least $20m in assets), as they tend to have hit a size where they’re operationally more together (making mistakes on your money is no fun).

You can also ask at the HR department at your job “hey, does working here make me eligible to join a credit union?” If they say “no”, you can say “why not? Is anyone working on having us join up with a good CU?”

Are there any downsides?

There aren’t a lot of ATMs, so every time you need cash & use a bank ATM, you’ll be paying that ridiculous fee. This can definitely suck, although one way around it is to have a debit card and take cash back all the time when you buy stuff (there’s no charge for taking cash back on a debit card—it’s just a question of whether the merchant lets you do it, and most supermarkets and drug stores do).

Also, this makes depositing paper checks a pain in the ass: you actually have to put them in an envelope and mail them to the credit union. How did society function before we had the internet?

Also, if it’s a work credit union, you can check to see if they have a branch at your office—this can make things a lot easier.

Anyway, that’s a quick rundown. Sure I missed something, but I’ll drop it in the comments if I remember later.

Here’s a flyer I made for OWS which contains information on a few credit unions in New York City:

FoW

NYCLU: Stop Question and Frisk data

As I mentioned yesterday, I’m the data wrangler for the Data Without Borders datadive this weekend. There are three N.G.O.’s participating: NYCLU (mine), MIX, and UN Global Pulse. The organizations all pitched their data and their questions last night to the crowd of nerds, and this morning we are meeting bright and early (8am) to start crunching.

I’m particularly psyched to be working with NYCLU on Stop and Frisk data. The women I met from NYCLU last night had spent time at Occupy Wall Street the previous day giving out water and information to the protesters. How cool!

The data is available here. It’s zipped in .por format, which is to say it was collected and used in SPSS, a language that’s not open source. I wanted to get it into csv format for the data miners this morning, but I have been having trouble. Sometimes R can handle .por files but at least my install of R is having trouble with the years 2006-2009. Then we tried installing PSPP, which is an open source version of SPSS, and it seemed to be able to import the .por files and then export as csv, in the sense that it didn’t throw any errors, but actually when we looked we saw major flaws. Finally we found a program called StatTransfer, which seems to work (you can download a trial version for free) but unless you pay $179 for the package, it actually doesn’t transfer all of the lines of the file for you.

If anyone knows how to help, please make a comment, I’ll be checking my comments. Of course there could easily be someone at the datadive with SPSS on their computer, which would solve everything, but on the other hand it could also be a major pain and we could waste lots of precious analyzing time with formatting issues. I may just buckle down and pay $179 but I’d prefer to find an open source solution.

UPDATE (9:00am): Someone has SPSS! We’re totally getting that data into csv format. Next step: set up Dropbox account to share it.

UPDATE (9:21am): Have met about 5 or 6 adorable nerds who are eager to work on this sexy data set. YES!

UPDATE (10:02am): People are starting to work in small groups. One guy is working on turning the x- and y-coordinates into latitude and longitude so we can use mapping tools easier. These guys are awesome.

UPDATE (11:37am): Now have a mapping team of 4. Really interesting conversations going on about statistically rigorous techniques for human rights abuses. Looking for publicly available data on crime rates, no luck so far… also looking for police officer id’s on data set but that seems to be missing. Looking also to extend some basic statistics to all of the data set and aggregated by months rather than years so we can plot trends. See it all take place on our wiki!

UPDATE (12:24pm): Oh my god, we have a map. We have officer ID’s (maybe). We have awesome discussions around what bayesian priors are reasonable. This is awesome! Lunch soon, where we will discuss our morning, plan for the afternoon, and regroup. Exciting!

UPDATE (2:18pm): Nice. We just had lunch, and I managed to get a sound byte about every current project, and it’s just amazing how many different things are being tried. Awesome. Will update soon.

UPDATE (7:10pm): Holy shit I’ve been inside crunching data all day while the world explodes around me.

Wall Street and the protests

Today I want to update you on my involvement with the Occupy Wall Street protest and also make an observation about the defensive behavior we see by the Wall Streeters themselves.

Update

Yesterday after work I went back to the protests and looked around to offer a teach-in. Unfortunately it hadn’t been sufficiently organized: the contact who had originally invited me wasn’t around, and hadn’t confirmed with me on email, and nobody else knew anything. It was also very windy, threatening rain, and the noise of the drumming was overbearing. There were drumming circles on two of the four corners of the square, and in the other two corners there were already meetings going on. It would be great if the protests could restrict the drumming area so that people could actually talk.

However, I kind of suspected this would happen, so I wasn’t disappointed. I handed out some flyers with a few friends that met me down there, and I met a few new really interesting and engaging people. I got re-invited to give a teach-in by a very nice man named Rock, who took my information. Rock suggested a daytime talk sometime around noon, and this sounds about right. Hopefully this will pan out, but even if it doesn’t now I have a flyer to distribute and it’s a conversation starter if nothing else. One of my friends also suggested having a t-shirt made with the phrase, “ask me about the financial system” printed on it. I think this is a great idea. I will go back down and be involved when I can make the time.

Also, I wanted to share Matt Taibbi’s column about the protest. His five top demands have a lot in common with the ones we came up with here.

Act Crazy

You know how some people win fights even though they’re not big or strong? They act totally crazy and angry, and it works because it confuses their opponents. This is what I think the tactic of the big bosses on Wall Street is right now. They’ve got Tim Geithner talking about it:

“They react to what is pretty modest, common sense observations about the system as if they are deep affronts to the dignity of their profession. And I don’t understand why they are so sensitive,” Geithner said at a forum hosted by The Atlantic and the Aspen Institute.

We’ve also seen Paul Krugman address this:

Last year, you may recall, a number of financial-industry barons went wild over very mild criticism from President Obama. They denounced Mr. Obama as being almost a socialist for endorsing the so-called Volcker rule, which would simply prohibit banks backed by federal guarantees from engaging in risky speculation. And as for their reaction to proposals to close a loophole that lets some of them pay remarkably low taxes — well, Stephen Schwarzman, chairman of the Blackstone Group, compared it to Hitler’s invasion of Poland.

The overall idea is to act like they are the victims somehow. Actually there’s another article in Bloomberg about the Wall St suffering, which I find fascinating as a phrase, and which contains passages like this one:

Bankers aren’t optimistic about those gains. Options Group’s Karp said he met last month over tea at the Gramercy Park Hotel in New York with a trader who made $500,000 last year at one of the six largest U.S. banks.

The trader, a 27-year-old Ivy League graduate, complained that he has worked harder this year and will be paid less. The headhunter told him to stay put and collect his bonus.

Here’s the thing. They are suffering, in exactly the same way that a child who is spoiled suffers when they are told they can’t get a toy in a store that they want even though they have one at home just like it. But that’s not real need, that’s a temper tantrum. It’s the parents’ responsibility to ignore that kind of posturing and establish reasonable expectations. But the analogy becomes kind of painful here, because who are the parents?

I guess you’d want them to be the government, or the regulators, but the problem is that those groups have shown the same lack of imagination (or fear) of a new world as the people on Wall Street.

So even though the protests are disorganized and sometimes annoying, the very fact that they are putting pressure on the system to fundamentally change is why I will continue to support them.

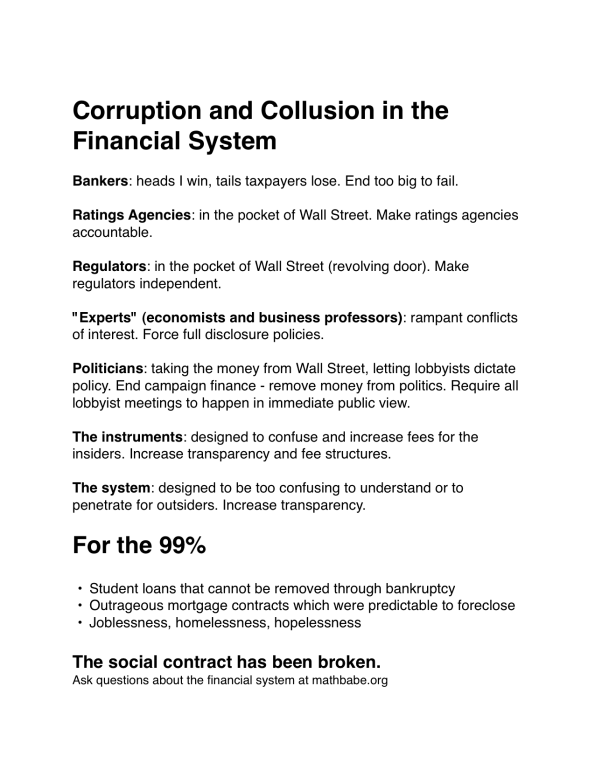

What’s wrong with Wall Street and what should be done about it?

I am trying to figure out the top five (or so) most important corrupt and actionable issues related to the financial system. I’m going to compile this list in order to conduct a “teach-in” at the Occupy Wall Street protest next week. The tentative date is Wednesday, October 12, at 5:30pm.

I’d love to hear your thoughts: please tell me if I’m missing something or got something wrong or left something out.

The list I have so far:

- Investment bankers trading their books and taking outrageous risks which lead to government-backed bailouts because they are “too big to fail”. The related action in the U.S. might be the “Volcker rule” (i.e. reinstating something like Glass-Steagall); unfortunately it’s being watered down as you read this.

- Ratings agencies in collusion with their clients. The actions here would be changing the pay structure of the ratings agencies and opening up the methods, as well as having better regulatory oversight. We also need to change the structure of ratings agencies, and either make it easier to form an agency or make the agencies that already exist and have government protection actually accountable for their “opinions”.

- SEC and other regulators in collusion with the industry. The action here would be to nurture and maintain an adversarial relationship between regulators and bankers. We’ve seen too many people skip from the SEC to the banks they were regulating and then back. There should be rules against this (how about a minimum time requirement of 5 years between jobs on the opposite sides?). There should also be much better funding for the SEC and the other regulators, so they can actually meet their expanded mandate.

- Conflict of interest issues from economists and business school professors. If you’ve seen “Inside Job” then you’ll know all about how professors at various universities use their credentials to back up questionable practices. Moreover, they are often not even required to expose their industry connections when they do expert witnessing or write “academic” papers. The action here would be, at the very least, to force full disclosure for all such appearances and all publications. I’ve heard some good news in this direction but there obviously should be a standard.

- Rampant buying of politicians and influence of lobbyists from the financial industry. This is maybe more of a political problem than a financial one so I’m willing to chuck this off the list. Please tell me if you have something else in mind. Someone has suggested the opaque and elevated pension fund management system. Although I consider that pretty corrupt, I’m not sure it’s as important as other issues to the average person. I’m on the fence.

Saturday afternoon quickie

Two things.

- If I see another fucking article about how the world is going to miss Steve Jobs I’m going to puke. He made and sold overpriced gadgets for fucks sake! It’s hero worship plain and simple, maybe even a sick cult.

- I am happy that I’ve been invited to give a “teach-in” at Occupy Wall Street next Wednesday at 5:30 (tentative date and time). I’ve promised an overview of the 5 top corrupt things in the financial system. I’d really appreciate your thoughts: what is your top 5 list? I want them to be both important and relatively actionable. So far I’ve got:

- Volcker rule (i.e. reinstating something like Glass-Steagall); it’s being watered down as you read this.

- Ratings agencies in collusion with their clients

- SEC and other regulators in collusion with the industry

- Rampant buying of politicians and influence of lobbyists from the financial industry

- Incredibly poor incentives for the individuals in the industry, both in terms of salary and whistleblowing

Financial Terms Dictionary

I’ve got a bunch of things to mention today. First, I’ll be at M.I.T. in less than two weeks to give a talk to women in math about working in business. Feel free to come if you are around and interested!

Next, last night I signed up for this free online machine learning course being offered out of Stanford. I love this idea and I really think it’s going to catch on. There are groups here in New York that are getting together to talk about the class and do homework. Very cool!

Next, I’m going back to the protests after work. The media coverage has gotten better and Matt Stoller really wrote a great piece and called on people to stop criticizing and start helping, which is always my motto. For my part, I’m planning to set up some kind of Finance Q&A booth at the demonstration with some other friends of mine in finance. It’s going to be hard since I don’t have lots of time but we’ll try it and see. One of my artistic friends came up with this:

Finally, one last idea. I wanted to find a funny way to help people understand financial and economic stuff, so I thought of starting a “Financial Terms Dictionary”, which would start with an obscure phrase that economists and bankers use and translate it into plain English. For example, under “injection of liquidity” you might see “the act of printing money and giving it to the banks”.

Finally, one last idea. I wanted to find a funny way to help people understand financial and economic stuff, so I thought of starting a “Financial Terms Dictionary”, which would start with an obscure phrase that economists and bankers use and translate it into plain English. For example, under “injection of liquidity” you might see “the act of printing money and giving it to the banks”.

I’d love comments and suggestions for the Financial Terms Dictionary! I’ll start a separate page for it if it catches on.

Occupy Wall Street: Day 13

So I went to see the Occupy Wall Street protests this morning before work and this evening after work again. Here are some of my comments and observations.

First, if you are interested in checking it out, know that there are small marches at opening and closing bell for the market.

However, the police have made it basically impossible to walk on Wall Street, due to some incredibly annoying barricades.

So for our march this morning we seemed to just circle the city block where the protest is based, although I didn’t stay til the end so it’s possible they decided to very very slowly march on Wall Street proper.

So for our march this morning we seemed to just circle the city block where the protest is based, although I didn’t stay til the end so it’s possible they decided to very very slowly march on Wall Street proper.

Second, they have “assemblies” twice a day, with guest speakers sometimes (Michael Moore, Susan Sarandon and Cornel West have visited), and this is where general announcements are made. The crowd was quite large tonight and it was difficult to hear what the speaker and the repeaters were saying, which is frustrating. But maybe it’s easier at the 1pm assembly. Also, it seems to be easier to actually discuss issues in the morning- at night it gets loud and kind of crazy and hard to focus in my opinion.

Next, I’d like to address the issue of the message of the protesters being dismissed as incoherent. For the record, I went to a conference at the end of 2009 at Columbia Business School on the financial crisis and what we should do about it, where the speakers were fancy economists from central banks and CEOs of international banks, and they were about as incoherent as these protesters. There was absolutely no getting them to say anything that was an actual plan or even an attempt at a plan for changing the system so this mess wouldn’t happen again. I should know, because there was a question and answer period and I asked.

Having said that, there have been some pretty unconvincing statements reported from some of the protesters in terms of what they would like to see. For example, some of them seem to think that short selling should be banned. As some of you know, I disagree. In fact there are lots of seriously corrupt and ridiculous things going on in the financial system which they should know about and they should protest, and I’d like to invite them to educate themselves.

In particular, if you are someone interested in knowing stuff about how the financial system works, then please ask! A major part of why I blog is to try to inform people about these things who are interested. Please comment below and ask whatever you want, and if I don’t know the answer I will find someone who does, or I will blog about the question.

Having said that, I’d like to add that it’s on the one hand perfectly reasonable that people don’t understand the financial system, because it has essentially been set up to be too complicated to understand, and on the other hand it’s also reasonable to think of the entire financial system as a black box which can be judged by its outputs.

Finally, if we are going to judge the system by looking at its outputs, then these protesters, who are in general young, with educations, huge students debts, and hopeless outlooks, have a pretty dismal view. In other words they have every right to complain that the system is fucking them, even though they don’t know how the system works. I for one am super proud that they’re out there doing something, even if it’s not obviously organized and polished, rather than passively sitting by.