Archive

Guest Post SuperReview Part III of VI: The Occupy Handbook Part I and a little Part II: Where We Are Now

Whattup.

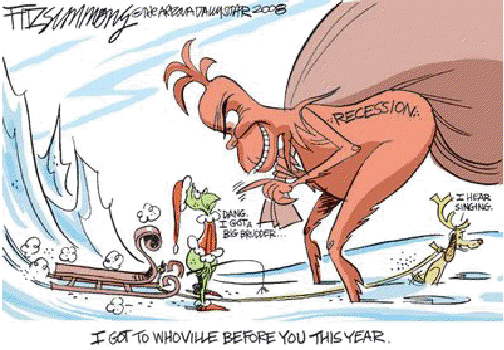

Moving on from Lewis’ cute Bloomberg column reprint, we come to the next essay in the series:

The Widening Gyre: Inequality, Polarization, and the Crisis by Paul Krugman and Robin Wells

Indefatigable pair Paul Krugman and Robin Wells (KW hereafter) contribute one of the several original essays in the book, but the content ought to be familiar if you read the New York Times, know something about economics or practice finance. Paul Krugman is prolific, and it isn’t hard to be prolific when you have to rewrite essentially the same column every week; question, are there other columnists who have been so consistently right yet have failed to propose anything that the polity would adopt? Political failure notwithstanding, Krugman leaves gems in every paragraph for the reader new to all this. The title “The Widening Gyre” comes from an apocalyptic William Yeats Butler poem. In this case, Krugman and Wells tackle the problem of why the government responded so poorly to the crisis. In their words:

By 2007, America was about as unequal as it had been on the eve of the Great Depression – and sure enough, just after hitting this milestone, we lunged into the worst slump since the Depression. This probably wasn’t a coincidence, although economists are still working on trying to understand the linkages between inequality and vulnerability to economic crisis.

Here, however, we want to focus on a different question: why has the response to crisis been so inadequate? Before financial crisis struck, we think it’s fair to say that most economists imagined that even if such a crisis were to happen, there would be a quick and effective policy response [editor’s note: see Kautsky et al 2016 for a partial explanation]. In 2003 Robert Lucas, the Nobel laureate and then president of the American Economic Association, urged the profession to turn its attention away from recessions to issues of longer-term growth. Why? Because he declared, the “central problem of depression-prevention has been solved, for all practical purposes, and has in fact been solved for many decades.”

Famous last words from Professor Lucas. Nevertheless, the curious failure to apply what was once the conventional wisdom on a useful scale intrigues me for two reasons. First, most political scientists suggest that democracy, versus authoritarian system X, leads to better outcomes for two reasons.

1. Distributional – you get a nicer distribution of wealth (possibly more productivity for complicated macro reasons); economics suggests that since people are mostly envious and poor people have rapidly increasing utility in wealth, democracy’s tendency to share the wealth better maximizes some stupid social welfare criterion (typically, Kaldor-Hicks efficiency).

2. Information – democracy is a better information aggregation system than dictatorship and an expanded polity makes better decisions beyond allocation of produced resources. The polity must be capable of learning and intelligent OR vote randomly if uninformed for this to work. While this is the original rigorous justification for democracy (first formalized in the 1800s by French rationalists), almost no one who studies these issues today believes one-person one-vote democracy better aggregates information than all other systems at a national level. “Well Leon,” some knave comments, “we don’t live in a democracy, we live in a Republic with a president…so shouldn’t a small group of representatives better be able to make social-welfare maximizing decisions?” Short answer: strong no, and US Constitutionalism has some particularly nasty features when it comes to political decision-making.

Second, KW suggest that the presence of extreme wealth inequalities act like a democracy disabling virus at the national level. According to KW extreme wealth inequalities perpetuate themselves in a way that undermines both “nice” features of a democracy when it comes to making regulatory and budget decisions.* Thus, to get better economic decision-making from our elected officials, a good intermediate step would be to make our tax system more progressive or expand Medicare or Social Security or…Well, we have a lot of good options here. Of course, for mathematically minded thinkers, this begs the following question: if we could enact so-called progressive economic policies to cure our political crisis, why haven’t we done so already? What can/must change for us to do so in the future? While I believe that the answer to this question is provided by another essay in the book, let’s take a closer look at KW’s explanation at how wealth inequality throws sand into the gears of our polity. They propose four and the following number scheme is mine:

1. The most likely explanation of the relationship between inequality and polarization is that the increased income and wealth of a small minority has, in effect bought the allegiance of a major political party…Needless to say, this is not an environment conducive to political action.

2. It seems likely that this persistence [of financial deregulation] despite repeated disasters had a lot do with rising inequality, with the causation running in both directions. On the one side the explosive growth of the financial sector was a major source of soaring incomes at the very top of the income distribution. On the other side, the fact that the very rich were the prime beneficiaries of deregulation meant that as this group gained power- simply because of its rising wealth- the push for deregulation intensified. These impacts of inequality on ideology did not in 2008…[they] left us incapacitated in the face of crisis.

3. Conservatives have always seen seen [Keynesian economics] as the thin edge of the wedge: concede that the government can play a useful role in fighting slumps, and the next thing you know we’ll be living under socialism.

4. [Krugman paraphrasing Kalecki] Every widening of state activity is looked upon by business with suspicion, but the creation of employment by government spending has a special aspect which makes the opposition particularly intense. Under a laissez-faire system the level of employment to a great extend on the so-called state of confidence….This gives capitalists a powerful indirect control over government policy: everything which may shake the state of confidence must be avoided because it would cause an economic crisis.

All of these are true to an extent. Two are related to the features of a particular policy position that conservatives don’t like (countercyclical spending) and their cost will dissipate if the economy improves. Isn’t it the case that most proponents and beneficiaries of financial liberalization are Democrats? (Wall Street mostly supported Obama in 08 and barely supported Romney in 12 despite Romney giving the house away). In any case, while KW aren’t big on solutions they certainly have a strong grasp of the problem.

Take a Stand: Sit In by Phillip Dray

As the railroad strike of 1877 had led eventually to expanded workers’ rights, so the Greensboro sit-in of February 1, 1960, helped pave the way for passage of the Civil Rights Act of 1964 and the Voting Rights Act of 1965. Both movements remind us that not all successful protests are explicit in their message and purpose; they rely instead on the participants’ intuitive sense of justice. [28]

I’m not the only author to have taken note of this passage as particularly important, but I am the only author who found the passage significant and did not start ranting about so-called “natural law.” Chronicling the (hitherto unknown-to-me) history of the Great Upheaval, Dray does a great job relating some important moments in left protest history to the OWS history. This is actually an extremely important essay and I haven’t given it the time it deserves. If you read three essays in this book, include this in your list.

Inequality and Intemperate Policy by Raghuram Rajan (no URL, you’ll have to buy the book)

Rajan’s basic ideas are the following: inequality has gotten out of control:

Deepening income inequality has been brought to the forefront of discussion in the United States. The discussion tends to center on the Croesus-like income of John Paulson, the hedge fund manager who made a killing in 2008 betting on a financial collapse and netted over $3 billion, about seventy-five-thousand times the average household income. Yet a more worrying, everyday phenomenon that confronts most Americans is the disparity in income growth rates between a manager at the local supermarket and the factory worker or office assistant. Since the 1970s, the wages of the former, typically workers at the ninetieth percentile of the wage distribution in the United States, have grown much faster than the wages of the latter, the typical median worker.

But American political ideologies typically rule out the most direct responses to inequality (i.e. redistribution). The result is a series of stop-gap measures that do long-run damage to the economy (as defined by sustainable and rising income levels and full employment), but temporarily boost the consumption level of lower classes:

It is not surprising then, that a policy response to rising inequality in the United States in the 1990s and 200s – whether carefully planned or chosen as the path of least resistance – was to encourage lending to households, especially but not exclusively low-income ones, with the government push given to housing credit just the most egregious example. The benefit – higher consumption – was immediate, whereas paying the inevitable bill could be postponed into the future. Indeed, consumption inequality did not grow nearly as much as income inequality before the crisis. The difference was bridged by debt. Cynical as it may seem, easy credit has been used as a palliative success administrations that been unable to address the deeper anxieties of the middle class directly. As I argue in my book Fault Lines, “Let them eat credit” could well summarize the mantra of the political establishment in the go-go years before the crisis.

Why should you believe Raghuram Rajan? Because he’s one of the few guys who called the first crisis and tried to warn the Fed.

A solid essay providing a more direct link between income inequality and bad policy than KW do.

The 5 Percent by Michael Hiltzik

The 5 percent’s [consisting of the seven million Americans who, in 1934, were sixty-five and older] protests coalesced as the Townsend movement, launched by a sinewy midwestern farmer’s son and farm laborer turned California physician. Francis Townsend was a World War I veteran who had served in the Army Medical Corps. He had an ambitious, and impractical plan for a federal pension program. Although during its heyday in the 1930s the movement failed to win enactment of its [editor’s note: insane] program, it did play a critical role in contemporary politics. Before Townsend, America understood the destitution of its older generations only in abstract terms; Townsend’s movement made it tangible. “It is no small achievment to have opened the eyes of even a few million Americans to these facts,” Bruce Bliven, editor of the New Republic observed. “If the Townsend Plan were to die tomorrow and be completely forgotten as miniature golf, mah-jongg, or flinch [editor’s note: everything old is new again], it would still have left some sedimented flood marks on the national consciousness.” Indeed, the Townsend movement became the catalyst for the New Deal’s signal achievement, the old-age program of Social Security. The history of its rise offers a lesson for the Occupy movement in how to convert grassroots enthusiasm into a potent political force – and a warning about the limitations of even a nationwide movement.

Does the author live up to the promises of this paragraph? Is the whole essay worth reading? Does FDR give in to the people’s demands and pass Social Security?!

Yes to all. Read it.

Hidden in Plain Sight by Gillian Tett (no URL, you’ll have to buy the book)

This is a great essay. I’m going to outsource the review and analysis to:

http://beyoubesure.com/2012/10/13/generation-lost-lazy-afraid/

because it basically sums up my thoughts. You all, go read it.

What Good is Wall Street? by John Cassidy

If you know nothing about Wall Street, then the essay is worth reading, otherwise skip it. There are two common ways to write a bad article in financial journalism. First, you can try to explain tiny index price movements via news articles from that day/week/month. “Shares in the S&P moved up on good news in Taiwan today,” that kind of nonsense. While the news and price movements might be worth knowing for their own sake, these articles are usually worthless because no journalist really knows who traded and why (theorists might point out even if the journalists did know who traded to generate the movement and why, it’s not clear these articles would add value – theorists are correct).

The other way, the Cassidy! way is to ask some subgroup of American finance what they think about other subgroups in finance. High frequency traders think iBankers are dumb and overpaid, but HFT on the other hand, provides an extremely valuable service – keeping ETFs cheap, providing liquidity and keeping shares the right level. iBankers think prop-traders add no value, but that without iBanking M&A services, American manufacturing/farmers/whatever would cease functioning. Low speed prop-traders think that HFT just extracts cash from dumb money, but prop-traders are reddest blooded American capitalists, taking the right risks and bringing knowledge into the markets. Insurance hates hedge funds, hedge funds hate the bulge bracket, the bulge bracket hates the ratings agencies, who hate insurance and on and on.

You can spit out dozens of articles about these catty and tedious rivalries (invariably claiming that financial sector X, rivals for institutional cash with Y, “adds no value”) and learn nothing about finance. Cassidy writes the article taking the iBankers side and surprises no one (this was originally published as an article in The New Yorker).

Your House as an ATM by Bethany McLean

Ms. McLean holds immense talent. It was always pretty obvious that the bottom twenty-percent, i.e. the vast majority of subprime loan recipients, who are generally poor at planning, were using mortgages to get quick cash rather than buy houses. Regulators and high finance, after resisting for a good twenty years, gave in for reasons explained in Rajan’s essay.

Against Political Capture by Daron Acemoglu and James A. Robinson (sorry I couldn’t find a URL, for this original essay you’ll have to buy the book).

A legit essay by a future Nobelist in Econ. Read it.

A Nation of Business Junkies by Arjun Appadurai

Anthro-hack Appadurai writes:

I first came to this country in 1967. I have been either a crypto-anthropologist or professional anthropologist for most of the intervening years. Still, because I came here with an interest in India and took the path of least resistance in choosing to retain India as my principal ethnographic referent, I have always been reluctant to offer opinions about life in these United States.

His instincts were correct. The essay reads like an old man complaining about how bad the weather is these days. Skip it.

Causes of Financial Crises Past and Present: The Role of This-Time-Is-Different Syndrome by Carmen M. Reinhart and Kenneth S. Rogoff

Editor Byrne has amazing powers of persuasion or, a lot of authors have had some essays in the desk-drawer they were waiting for an opportunity to publish. In any case, Rogoff and Reinhart (RR hereafter) have summed up a couple hundred studies and two of their books in a single executive summary and given it to whoever buys The Occupy Handbook. Value. RR are Republicans and the essay appears to be written in good faith (unlike some people *cough* Tyler Cowen and Veronique de Rugy *cough*). RR do a great job discovering and presenting stylized facts about financial crises past and present. What to expect next? A couple national defaults and maybe a hyperinflation or two.

Government As Tough Love by Robert Shiller as interviewed by Brandon Adams (buy the book)!

Shiller has always been ahead of the curve. In 1981, he wrote a cornerstone paper in behavioral finance at a time when the field was in its embryonic stages. In the early 1990s, he noticed insufficient attention was paid to real estate values, despite their overwhelming importance to personal wealth levels; this led him to create, along with Karl E. Case, the Case-Shiller index – now the Case-Shiller Home Prices Indices. In March 2000**, Shiller published Irrational Exuberance, arguing that U.S. stocks were substantially overvalued and due for a tumble. [Editor’s note: what Brandon Adams fails to mention, but what’s surely relevant is that Shiller also called the subprime bubble and re-released Irrational Exuberance in 2005 to sound the alarms a full three years before The Subprime Solution]. In 2008, he published The Subprime Solution, which detailed the origins of the housing crisis and suggested innovative policy responses for dealing with the fallout. These days, one of his primary interests is neuroeconomics, a field that relates economic decision-making to brain function as measured by fMRIs.

Shiller is basically a champ and you should listen to him.

Shiller was disappointed but not surprised when governments bailed out banks in extreme fashion while leaving the contracts between banks and homeowners unchanged. He said, of Hank Paulson, “As Treasury secretary, he presented himself in a very sober and collected way…he did some bailouts that benefited Goldman Sachs, among others. And I can imagine that they were well-meaning, but I don’t know that they were totally well-meaning, because the sense of self-interest is hard to clean out of your mind.”

Shiller understates everything.

Verdict: Read it.

And so, we close our discussion of part I. Moving on to part II:

In Ms. Byrne’s own words:

Part 2, “Where We Are Now,” which covers the present, both in the United States and abroad, opens with a piece by the anthropologist David Graeber. The world of Madison Avenue is far from the beliefs of Graeber, an anarchist, but it’s Graeber who arguably (he says he didn’t do it alone) came up with the phrase “We Are the 99 percent.” As Bloomberg Businessweek pointed out in October 2011, during month two of the Occupy encampments that Graeber helped initiate and three moths after the publication of his Debt: The First 5,000 Years, “David Graeber likes to say that he had three goals for the year: promote his book, learn to drive, and launch a worldwide revolution. The first is going well, the second has proven challenging and the third is looking up.” Graeber’s counterpart in Chile can loosely be said to be Camila Vallejo, the college undergraduate, pictured on page 219, who, at twenty-three, brought the country to a standstill. The novelist and playwright Ariel Dorfman writes about her and about his own self-imposed exile from Chile, and his piece is followed by an entirely different, more quantitative treatment of the subject. This part of the book also covers the indignados in Spain, who before Occupy began, “occupied” the public squares of Madrid and other cities – using, as the basis for their claim on the parks could be legally be slept in, a thirteenth-century right granted to shepherds who moved, and still move, their flocks annually.

In other words, we’re in occupy is the hero we deserve, but not the hero we need territory here.

*Addendum 1: Some have suggested that it’s not the wealth inequality that ought to be reduced, but the democratic elements of our system. California’s terrible decision–making resulting from its experiments with direct democracy notwithstanding, I would like to stay in the realm of the sane.

**Addendum 2: Yes, Shiller managed to get the book published the week before the crash. Talk about market timing.

Guest Post SuperReview Part II of VI: The Occupy Handbook Part I: How We Got Here

Whatsup.

This is a review of Part I of The Occupy Handbook. Part I consists of twelve pieces ranging in quality from excellent to awful. But enough from me, in Janet Byrne’s own words:

Part 1, “How We Got Here,” takes a look at events that may be considered precursors of OWS: the stories of a brakeman in 1877 who went up against the railroads; of the four men from an all-black college in North Carolina who staged the first lunch counter sit-in of the 1960s; of the out-of-work doctor whose nationwide, bizarrely personal Townsend Club movement led to the passage of Social Security. We go back to the 1930s and the New Deal and, in Carmen M. Reinhart and Kenneth S. Rogoff‘s “nutshell” version of their book This Time Is Different: Eight Centuries of Financial Folly, even further.

Ms. Byrne did a bang-up job getting one Nobel Prize Winner in economics (Paul Krugman), two future Economics Nobel Prize winners (Robert Shiller, Daron Acemoglu) and two maybes (sorry Raghuram Rajan and Kenneth Rogoff) to contribute excellent essays to this section alone. Powerhouse financial journalists Gillian Tett, Michael Hilztik, John Cassidy, Bethany McLean and the prolific Michael Lewis all drop important and poignant pieces into this section. Arrogant yet angry anthropologist Arjun Appadurai writes one of the worst essays I’ve ever had the misfortune of reading and the ubiquitous Brandon Adams make his first of many mediocre appearances interviewing Robert Shiller. Clocking in at 135 pages, this is the shortest section of the book yet varies the most in quality. You can skip Professor Appadurai and Cassidy’s essays, but the rest are worth reading.

Advice from the 1 Percent: Lever Up, Drop Out by Michael Lewis

Framed as a strategy memo circulated among one-percenters, Lewis’ satirical piece written after the clearing of Zucotti Park begins with a bang.

The rabble has been driven from the public parks. Our adversaries, now defined by the freaks and criminals among them, have demonstrated only that they have no idea what they are doing. They have failed to identify a single achievable goal.

Indeed, the absurd fixation on holding Zuccotti Park and refusal to issue demands because doing so “would validate the system” crippled Occupy Wall Street (OWS). So far OWS has had a single, but massive success: it shifted the conversation back to the United States’ out of control wealth inequality managed to do so in time for the election, sealing the deal on Romney. In this manner, OWS functioned as a holding action by the 99% in the interests of the 99%.

We have identified two looming threats: the first is the shifting relationship between ambitious young people and money. There’s a reason the Lower 99 currently lack leadership: anyone with the ability to organize large numbers of unsuccessful people has been diverted into Wall Street jobs, mainly in the analyst programs at Morgan Stanley and Goldman Sachs. Those jobs no longer exist, at least not in the quantities sufficient to distract an entire generation from examining the meaning of their lives. Our Wall Street friends, wounded and weakened, can no longer pick up the tab for sucking the idealism out of America’s youth.We on the committee are resigned to all elite universities becoming breeding grounds for insurrection, with the possible exception of Princeton.

Michael Lewis speaks from experience; he is a Princeton alum and a 1 percenter himself. More than that however, he is also a Wall Street alum from Salomon Brothers during the 1980s snafu and wrote about it in the original guide to Wall Street, Liar’s Poker. Perhaps because of his atypicality (and dash of solipsism), he does not have a strong handle on human(s) nature(s). By the time of his next column in Bloomberg, protests had broken out at Princeton.

Ultimately ineffectual, but still better than…

Lewis was right in the end, but more than anyone sympathetic to the movement might like. OccupyPrinceton now consists of only two bloggers, one of which has graduated and deleted all his work from an already quiet site and another who is a senior this year. OccupyHarvard contains a single poorly written essay on the front page. Although OccupyNewHaven outlasted the original Occupation, Occupy Yale no longer exists. Occupy Dartmouth hasn’t been active for over a year, although it has a rather pathetic Twitter feed here. Occupy Cornell, Brown, Caltech, MIT and Columbia don’t exist, but some have active facebook pages. Occupy Michigan State, Rutgers and NYU appear to have had active branches as recently as eight months ago, but have gone silent since. Functionally, Occupy Berkeley and its equivalents at UCBerkeley predate the Occupy movement and continue but Occupy Stanford hasn’t been active for over a year. Anecdotally, I recall my friends expressing some skepticism that any cells of the Occupy movement still existed.

As for Lewis’ other points, I’m extremely skeptical about “examined lives” being undermined by Wall Street. As someone who started in math and slowly worked his way into finance, I can safely say that I’ve been excited by many of the computing, economic, and theoretical problems quants face in their day-to-day work and I’m typical. I, and everyone who has lived long-enough, knows a handful of geniuses who have thought long and hard about the kinds of lives they want to lead and realized that A. there is no point to life unless you make one and B. making money is as good a point as any. I know one individual, after working as a professional chemist prior to college,who decided to in his words, “fuck it and be an iBanker.” He’s an associate at DB. At elite schools, my friend’s decision is the rule rather than the exception, roughly half of Harvard will take jobs in finance and consulting (for finance) this year. Another friend, an exception, quit a promising career in operations research to travel the world as a pick-up artist. Could one really say that either the operations researcher or the chemist failed to examine their lives or that with further examinations they would have come up with something more “meaningful”?

One of the social hacks to give lie to Lewis-style idealism-emerging-from-an attempt-to-examine-ones-life is to ask freshpeople at Ivy League schools what they’d like to do when they graduate and observe their choices four years later. The optimal solution for a sociopath just admitted to a top school might be to claim they’d like to do something in the peace corp, science or volunteering for the social status. Then go on to work in academia, finance, law or tech or marriage and household formation with someone who works in the former. This path is functionally similar to what many “average” elite college students will do, sociopathic or not. Lewis appears to be sincere in his misunderstanding of human(s) nature(s). In another book he reveals that he was surprised at the reaction to Liar’s Poker – most students who had read the book “treated it as a how-to manual” and cynically asked him for tips on how to land analyst jobs in the bulge bracket. It’s true that there might be some things money can’t buy, but an immensely pleasurable, meaningful life do not seem to be one of them. Today for the vast majority of humans in the Western world, expectations of sufficient levels of cold hard cash are necessary conditions for happiness.

In short and contra Lewis, little has changed. As of this moment, Occupy has proven so harmless to existing institutions that during her opening address Princeton University’s president Shirley Tilghman called on the freshmen in the class of 2016 to “Occupy” Princeton. No freshpeople have taken up her injunction. (Most?) parts of Occupy’s failure to make a lasting impact on college campuses appear to be structural; Occupy might not have succeeded even with better strategy. As the Ivy League became more and more meritocratic and better at discovering talent, many of the brilliant minds that would have fallen into the 99% and become its most effective advocates have been extracted and reached their so-called career potential, typically defined by income or status level. More meritocratic systems undermine instability by making the most talented individuals part of the class-to-be-overthrown, rather than the over throwers of that system. In an even somewhat meritocratic system, minor injustices can be tolerated: Asians and poor rural whites are classes where there is obvious evidence of discrimination relative to “merit and the decision to apply” in elite gatekeeper college admissions (and thus, life outcomes generally) and neither group expresses revolutionary sentiment on a system-threatening scale, even as the latter group’s life expectancy has begun to decline from its already low levels. In the contemporary United States it appears that even as people’s expectations of material security evaporate, the mere possibility of wealth bolsters and helps to secure inequities in existing institutions.

Lewis continues:

Hence our committee’s conclusion: we must be able to quit American society altogether, and they must know it.The modern Greeks offer the example in the world today that is, the committee has determined, best in class. Ordinary Greeks seldom harass their rich, for the simple reason that they have no idea where to find them. To a member of the Greek Lower 99 a Greek Upper One is as good as invisible.

He pays no taxes, lives no place and bears no relationship to his fellow citizens. As the public expects nothing of him, he always meets, and sometimes even exceeds, their expectations. As a result, the chief concern of the ordinary Greek about the rich Greek is that he will cease to pay the occasional visit.

Michael Lewis is a wise man.

I can recall a conversation with one of my Professors; an expert on Democratic Kampuchea (American: Khmer Rouge), she explained that for a long time the identity of the oligarchy ruling the country was kept secret from its citizens. She identified this obvious subversion of republican principles (how can you have control over your future when you don’t even know who runs your region?) as a weakness of the regime. Au contraire, I suggested, once you realize your masters are not gods, but merely humans with human characteristics, that they: eat, sleep, think, dream, have sex, recreate, poop and die – all their mystique, their claims to superior knowledge divine or earthly are instantly undermined. De facto segregation has made upper classes in the nation more secure by allowing them to hide their day-to-day opulence from people who have lost their homes, job and medical care because of that opulence. Neuroscience will eventually reveal that being mysterious makes you appear more sexy, socially dominant, and powerful, thus making your claims to power and dominance more secure (Kautsky et. al. 2018).*

If the majority of Americans manage to recognize that our two tiered legal system has created a class whose actual claim to the US immense wealth stems from, for the most part, a toxic combination of Congressional pork, regulatory and enforcement agency capture and inheritance rather than merit, there will be hell to pay. Meanwhile, resentment continues to grow. Even on the extreme right one can now regularly read things like:

Now, I think I’d be downright happy to vote for the first politician to run on a policy of sending killer drones after every single banker who has received a post-2007 bonus from a bank that received bailout money. And I’m a freaking libertarian; imagine how those who support bombing Iraqi children because they hate us for our freedoms are going to react once they finally begin to grasp how badly they’ve been screwed over by the bankers. The irony is that a banker-assassination policy would be entirely constitutional according to the current administration; it is very easy to prove that the bankers are much more serious enemies of the state than al Qaeda. They’ve certainly done considerably more damage.

Wise financiers know when it’s time to cash in their chips and disappear. Rarely, they can even pull it off with class.

The rest of part I reviewed tomorrow. Hang in there people.

Addendum 1: If your comment amounts to something like “the Nobel Prize in Economics is actually called the The Sveriges Riksbank Prize in Economic Sciences in Memory of Alfred Nobel” and thus “not a real Nobel Prize” you are correct, yet I will still delete your comment and ban your IP.

*Addendum 2: More on this will come when we talk about the Saez-Delong discussion in part III.

Guest Post SuperReview Part I of VI: The Occupy Handbook

Whassup.

It has become a truism that as the amount of news and information generated per moment continues to grow, so too does the value of aggregation, curation and editing. A point less commonly made is that these aggregators are often limited by time in the sense, whatever the topic, the value of news for the median reader decays extremely rapidly. Some extremists even claim that it’s useless to read the newspaper, so rapidly do things change. The forty eight hours news cycle, in addition to destroying context, has made it impossible for both reporters and viewers to learn from history. See “Is News Memoryless?” (Kautsky et. al. 2014).

A more promising approach to news aggregation (for those who read the news with purpose) is to organize pieces by subject and publish those articles in a book. Paul Krugman did this for himself in The Great Unraveling, bundling selected columns from 1999 to 2003 into a single book, with chapters organized by subject and proceeding chronologically. While the rise and rise of Krumgan’s real-time blogging virtually guarantees he’ll never make such an effort again, a more recent try came from uber-journalist Michael Lewis in Panic!: The Story of Modern Financial Insanity. Financial journalists’ myopic perspective at any given point in time make financial column compilations of years past particularly fun(ny) to read.

Nothing is staler than yesterday’s Wall Street journal (financial news spoils quickly) and reading WSJ or Barron’s pieces from 10 to 20 years ago is just painful.

The title PANIC: The story of modern financial insanity led me to believe the book was about the current crises. The book does say, in very, very fine print “Edited by” Michael Lewis.

-Fritz Krieger, Amazon Reviewer and chief scientist at ISIS

Unfortunately, some philistines became angry in 2008 when they insta-purchased a book called Panic! by Michael Lewis and to their horror, discovered that it contained information about prior financial crises, the nerve of the author to bring us historical perspective, even worse…some of that perspective relating to nations other than the ole’ US of A.

As the more alert readers have noted, almost nothing in the book concerns the 2008 Credit Meltdown, but instead this is merely a collection of news clippings and old magazine articles about past financial crises. You might as well visit a chiropodist’s office and offer them a couple of bucks for their old magazines.

Granted, the articles are by some of today’s finest and most celebrated journalists (although some of the news clippings are unsigned), but do you really want to read more about the 1987 crash or the 1997 collapse of the Thai Baht?

Perhaps you do, but whoever threw this book together wasn’t very particular about the articles chosen. Page 193 reprints an article from “Barron’s” of March, 2000 in which Jack Willoughby presents a long list of Internet companies that he considered likely to run out of cash by 2001. “Some can raise more funds through stock and bond offerings,” he warns. “Others will be forced to go out of business. It’s Darwinian capitalism at work.” True, many of the companies he listed did go belly-up, but on his list of the doomed are

[..]Amazon.com– Someone named Keith Otis Edwards

Perhaps because I was abroad for both the initial disaster and the entire Occupation of Zucotti Park, both events have held my attention. So it is with a mixture of hope and apprehension that I picked up Princeton alum Janet Byrne’s The Occupy Handbook from the public library. The Occupy Handbook is a collection of essays written from 2010 to 2011 by an assortment of first and second-rate authors that attempt to: show what Wall Street does and what it did that led to the most recent crash, explain why our policy apparatus was paralyzed in response to the crash, describe how OWS arose and how it compared with concurrent international movements and prior social movements in the US, and perhaps most importantly, provide policy solutions for the 99% in finance and economics. Janet Byrne begins with a heartfelt introduction:

One fall morning I stood outside the Princeton Club, on West 43rd Street in Manhattan. Occupy Wall Street, which I had visited several times as a sympathetic outsider, has passed its one month anniversary, and I thought the movement might be usefully analyzed by economists and financial writers whose pieces I would commission and assemble into a book that was analytical and- this was what really interested me – prescriptive. I’d been invited to breakfast to talk about the idea with a Princeton Club member and had arrived early out of nervousness.

It seemed a strange place to be discussing the book. I tried the idea out on a young bellhop…

And so it continues. The book is divided into three parts. Part I, broadly speaking, tries to give some economic background on the crash and the ensuing political instability that the crash engendered, up to the first occupation of Zuccotti Park. Part II, broadly speaking, describes the events in Zuccotti Park and around the world as they were in those critical months of fall 2011. Part III, broadly speaking, prescribes solutions to current depression. I say broadly speaking because, as you will see, several essays appear to be in the wrong part and in the worst cases, in the wrong book.

Modeling fraud in the financial system

Today we have a guest post by Dan Tedder. Actually it’s a letter he sent me after listening to my EconTalk podcast with Russ Roberts which he kindly agreed to let me post. Dan’s bio is below the letter.

I think this letter is profound (although I don’t completely agree about the Markov stuff), because it points out something that I see as a commonly held blindspot by people who think about regulation and modeling. Namely, that any systemic risk model of the financial system that doesn’t take account of lying isn’t worth the memory it takes up on a computer.

That brings us to the following question: can we incorporate lies into models? Can we anticipate and model fraud itself, in addition to the underlying system? Or do we give up on models and rely on skeptical people to ferret out lies? Or possibly some hybrid?

——

Hi Cathy,

I really liked your interview, and I think you are right on in pointing to a lack of ethics. I would say further that what we need is rigorous honesty in all aspects of the financial system. I agree with your objections to conflicts of interest. Allowing such conflicts to exist demonstrates a lack of rigorous honesty on the part of the participants. In my opinion a lot of bankers and folks on Wall Street should be headed to jail. The inability of the SEC to file charges and prosecute them further demonstrates the lack of honesty and character in the financial system and the government. So why am I telling you things you already know?

My father was a successful businessman. Years ago I was invited to invest in an ice cream franchise by another faculty member. I spent several days developing models using Excel. Finally, I decided to talk to my father. I called him and he immediately asked me to tell him about the present owners and their accounting. I told him the husband was in jail and accounting was five years behind. Further, his wife was probably taking money out of the till.

He stopped me right there, and pointed out that I needed to look no further. The present owners were not honest and therefore the opportunity was too risky. No telling what liabilities they had incurred and passed on to the franchise. I felt like an idiot. My modeling was a total waste of time because it assumed the present owners were honest. In fact, they were dishonest and no defensible model could be constructed based upon their accounting or lack thereof.

I think the complexity of our present financial problems will largely disappear if we try to focus more on the obvious. First, it is obvious that bankers, accountants, modelers, and other participants must be rigorously honest. Second, George Box, a statistician at the University of Wisconsin, studied the stock market and found through time series analysis that stock market prices are Markov processes. So in modeling stock prices we need only worry about today and tomorrow. The best indicator of tomorrow’s price is today’s price. The best indicator of what will happen tomorrow is where we are today, and probably our models of the larger process should also be Markovian. Third, apply the KISS method, “Keep it simple, stupid.” Instead of worrying about the mathematical model, worry about the honesty of the participants. The financial system cannot tolerate dishonesty. Making sure the bankers are honest will go a long way toward balancing the books.

Regards, Dan

——

Daniel William Tedder is Associate Professor Emeritus, School of Chemical and Biomolecular Engineering, and Adjunct Professor, School of Mechanical Engineering, both at the Georgia Institute of Technology. He attended Kenyon College and received a Bachelor’s in Chemical Engineering at the Georgia Institute of Technology. He obtained MS and PhD degrees in Chemical Engineering at the University of Wisconsin, Madison. He was a staff engineer in the Chemical Technology Division of the Oak Ridge National Laboratory before joining the faculty at Georgia Tech. He served as an independent technical reviewer at the Nuclear Regulatory Commission after retiring from Georgia Tech. He has numerous publications, has edited 11 books, and has authored one book, Preliminary Chemical Process Design and Economics, which is available from Amazon. He is an expert in chemical separations and in actinide partitioning, an advanced method for radioactive waste management.

Sentiment should not be the new horizon in journalism

This is a guest post by Anchard Scott, and is cross-posted at aluation.

Nate Silver’s high-profile success in predicting the 2012 election has triggered a wave of articles on the victory of data analysts over pundits. Cathy has already taken on the troubling aspects of Silver’s celebrity, so I’d like to focus instead on the larger movement toward big data as a replacement for traditional punditry. It’s an intriguing idea, especially given the sad state of political punditry. But rather than making things better, it’s entirely possible that the methods these articles propose could make things even worse.

There’s no question that we need better media, especially when it comes to politics. If we take the media’s role to be making sure that voters are informed, then they’re clearly doing a poor job of it. And one of the biggest problems is that political coverage has largely abandoned any pretense of getting to the truth in favor of “he said/she said” and endless discussion of the horse race, with the pundits being the worst offenders. Instead of “Will this be good for citizens?” we get “Will this be good for the Democrats/Republicans in the next poll?”

This is where the big data proposals enter the picture, and where I think they go wrong. Rather than addressing the accuracy or usefulness of the information being provided to us as voters, or working to shift the dialogue away from projections of how a given policy will play in Iowa, the proposals for big data revolve around replacing pundits’ subjective claims about shifting perceptions with more objective analysis of shifting perceptions.

For example, this piece from the Awl convincingly describes the potential for the rapid analysis of thousands or even millions of articles as a basis for more effective media criticism, and as a replacement for punditry by “anecdata.” A more recent post from the Nieman Journalism Lab at least acknowledges some methodological weaknesses even as it makes a very strong case for large-scale sentiment analysis as a way of “getting beyond pundits claiming to speak for others.” By aggregating and analyzing the flow of opinion across social media, the piece argues, journalism can deliver a more finely tuned representation of public opinion.

It’s true that perceptions in a democracy matter a lot. But it’s also true that getting a more accurate read on perceptions is not going to move us toward more informative coverage, let alone toward better politics. Worse still, these proposals ignore the fact that public perception is heavily affected by media coverage, which implies that pulling public perception more explicitly into the coverage itself will just introduce reflexivity rather than clarification.

In other words, we could end up with a conversation about the conversation about the conversation about politics. Is that really what we need?

As I see it, there are two precedents here, neither of which is encouraging. Financial markets have been treated as a source of perfect information for a very long time. The most famous justification for this was Hayek’s claim that the price system inherent in markets acts as “a system of telecommunications” that condenses the most relevant information from millions of agents into a single indicator. Even if we accept this as being true when Hayek wrote his essay in 1945 (which we shouldn’t), it’s certainly not true now. That’s in part because financial markets have attracted more and more speculators who base their decisions on their expectations of what others will do rather than introducing new information. So rather than informational efficiency, we get informational cascades, herding and periodic crashes.

The other example is consumer markets, which have the most experience with sentiment analysis for obvious reasons. In fact, this analysis is only the latest service offered by an enormous industry of advertising, PR and the like that exists solely to engineer and harness these waves of sentiment and perception. Their success proves that perception doesn’t exist in some objective void, but is closely shaped by the process of thinking about and consuming the very products it’s attached to. Or to be wonky about it, preferences can be more endogenous than exogenous in a consumer society.

Which is ultimately my point. If we want to treat the information provided by the media – the primary source of information for our democracy – as a more and more finely tuned consumer good whose value is determined by how popular it is, then this sort of analysis is emphatically the way to go. But we should not be surprised by the consequences if we do.

Open data and the emergence of data philanthropy

This is a guest post. Crossposted at aluation.

I’m a bit late to this conversation, but I was reminded by Cathy’s post over the weekend on open data – which most certainly is not a panacea – of my own experience a couple of years ago with a group that is trying hard to do the right thing with open data.

The UN funded a new initiative in 2009 called Global Pulse, with a mandate to explore ways of using Big Data for the rapid identification of emerging crises as well as for crafting more effective development policy in general. Their working hypothesis at its most simple is that the digital traces individuals leave in their electronic life – whether through purchases, mobile phone activity, social media or other sources – can reveal emergent patterns that can help target policy responses. The group’s website is worth a visit for anyone interested in non-commercial applications of data science – they are absolutely the good guys here, doing the kind of work that embodies the social welfare promise of Big Data.

With that said, I think some observations about their experience in developing their research projects may shed some light on one of Cathy’s two main points from her post:

- How “open” is open data when there are significant differences in both the ability to access the data, and more important, in the ability to analyze it?

- How can we build in appropriate safeguards rather than just focusing on the benefits and doing general hand-waving about the risks?

I’ll focus on Cathy’s first question here since the second gets into areas beyond my pay grade.

The Global Pulse approach to both sourcing and data analytics has been to rely heavily on partnerships with academia and the private sector. To Cathy’s point above, this is true of both closed data projects (such as those that rely on mobile phone data) as well as open data projects (those that rely on blog posts, news sites and other sources). To take one example, the group partnered with two firms in Cambridge to build a real-time indicator of bread prices in Latin America in order. The data in this case was open, while the web-scraping analytics (generally using grocery-story website prices) were developed and controlled by the vendors. As someone who is very interested in food prices, I found their work fascinating. But I also found it unsettling that the only way to make sense of this open data – to turn it into information, in other words – was through the good will of a private company.

The same pattern of open data and closed analytics characterized another project, which tracked Twitter in Indonesia for signals of social distress around food, fuel prices, health and other issues. The project used publicly available Twitter data, so it was open to that extent, though the sheer volume of data and the analytical challenges of teasing meaningful patterns out of it called for a powerful engine. As we all know, web-based consumer analytics are far ahead of the rest of the world in terms of this kind of work. And that was precisely where Global Pulse rationally turned – to a company that has generally focused on analyzing social media on behalf of advertisers.

Does this make them evil? Of course not – as I said above, Global Pulse are the good guys here. My point is not about the nature of their work but about its fragility.

The group’s Director framed their approach this way in a recent blog post:

We are asking companies to consider a new kind of CSR – call it “data philanthropy.” Join us in our efforts by making anonymized data sets available for analysis, by underwriting technology and research projects, or by funding our ongoing efforts in Pulse Labs. The same technologies, tools and analysis that power companies’ efforts to refine the products they sell, could also help make sure their customers are continuing to improve their social and economic wellbeing. We are asking governments to support our efforts because data analytics can help the United Nations become more agile in understanding the needs of and supporting the most vulnerable populations around the globe, which in terms boosts the global economy, benefiting people everywhere.

What happens when corporate donors are no longer willing to be data philanthropists? And a question for Cathy – how can we ensure that these new Data Science programs like the one at Columbia don’t end up just feeding people into consumer analytics firms, in the same way that math and econ programs ended up feeding people into Wall Street jobs?

I don’t have any answers here, and would be skeptical of anyone who claimed to. But the answers to these questions will likely define a lot of the gap between the promise of open data and whatever it ends up becoming.

Silicon Valley: VC versus startup culture

This is a guest post by David Carlton, who first met Cathy at the Hampshire College Summer Studies in Mathematics when they were high school students. He was trained as a mathematician, but left academia in 2003 and has been working as a programmer and manager in the San Francisco Bay Area since then. This is crossposted from his blog malvasia bianca.

One thing I’ve been wondering recently: to what extent do I like the influence of Silicon Valley venture capital firms on the local startup culture?

There are certain ways in which their influence is good, no question: it’s great that there’s money available for people to try new things, it’s great that it means that there are exciting small companies around, and I’m fairly sure that VCs have valuable specialized knowledge that I don’t have and could benefit from. So that’s all to the good.

However, it is not the case that VCs’ interests and my interests are aligned.

Don’t get me wrong: if I’m working at a VC-funded company, then those VCs and I both want the company to succeed, and that’s great. But beyond that, our interests diverge significantly.

Their goal is to make money in a five-yearish horizon through a portfolio approach, starting from a significant pool of cash. The portfolio is a particularly important factor here: no matter what, most startups are going to fail; so, rather than try to get as many as possible to be a moderate success, it’s a perfectly reasonable thing to do to do what you can to get a few companies in your portfolio to be a major success.

And, while I’d be perfectly happy to be working at a company that’s a major success, it’s much less clear to me that I want to do that at the cost of reducing the chances that the company is a moderate success. Because while the company crashing and burning is potentially a problem at a financial level, it’s also potentially much more of a problem at a personal level.

For example, I believe in the concept of a “sustainable pace”, that on average, for most people, working too hard eventually produces less output. But if the unsustainable pace on average masks nine disasters and one remarkable success, then that may be just fine for a portfolio approach, despite what it does to the people who go through the nine disasters. (This is probably where some of the VC-funded startup youth fetishism comes in, too.)

Time horizons also play into that issue, as well: if you can keep up an unsustainable pace long enough to look good at a payoff threshold, then that could be good enough. (Possibly burning out many people along the way while hiring enough new faces to replace them and keep the company looking healthy from the outside.)

I think I saw a version of this at Playdom: the company spent the year before it got bought going on a hiring spree, buying companies that, even at the time, seemed like they made no sense. (Don’t get me wrong, some of the purchase made a lot of sense, but there were certainly many specific purchases that I raised my eyebrows at.) As far as I can tell, this was a ploy to make Playdom look good to potential purchasers by increasing our headcount, our number of games and players, and our geographic reach; but we shut down a bunch of those games soon after Disney bought us, and I didn’t see anything concrete come out of many of those studios.

The amount of money VCs are investing also plays into this. Even when funding small companies, they don’t want those companies to stay small: they want those companies to grow and grow, to justify larger and larger investments and still larger payouts.

So, if you want to work at a company that is small and focused, VC funded companies probably aren’t the best place to go (though there are exceptions: if your small and focused company is producing something that appeals to tens or hundreds of millions of people, then you can be the next Instagram).

That’s how VCs are looking for aspects of companies that I’m not; but I’m also looking for aspects of companies that VCs don’t have as strong a reason to be attracted to.

I’m always trying to learn something, and typically have specific goals along those lines that I’m looking for at companies; VCs have no reason to care about my personal development.

More broadly, I’ve been participating in industry discussions about how to develop software, and trying to figure out which of those ideas seem to work well for me; I’m sure noises about some of that filters up to the VC level, but I’m also sure that most VCs don’t have any real idea what the word ‘agile’ means. Not that they should; this is a difference, not a judgment.

I also want to work at a company that I feel is doing the right thing: e.g. on a basic level it should treat people of different genders, ethnicities, ages, class backgrounds, sexualities, relationship status, etc. fairly.

Silicon Valley actually strikes me as astonishingly open to different nationalities (most of the founders of most of the companies that I’ve worked at haven’t been American, along with a noticeable fraction of the employees); on many of the other dimensions, though, Silicon Valley isn’t nearly as open.

Here’s a nice takedown of some of the bullshit around the idea of a “meritocracy”, and VC firms themselves apparently don’t do so well themselves in this regard. I hear rumors about VC “pattern matching”; if this means that VCs are happy to insert ignorant sexist assholes into the management ranks of their portfolio companies because those execs fit some sort of pattern that the VCs have seen, that is not good.

What’s scary, too, is how hard it can be to tell this sort of thing in advance: when joining a company, you never know how it is going to change over the next months or years.

For example, when I did my last job search, I talked to a few Facebook game companies; some of them were steeped in testosterone, but one, Casual Collective, seemed like a pleasant enough place. They’d produced one game I respected, they woman I interviewed with seemed sharp, and their name seemed to signal that they weren’t going to go too far down the “core gamer” path.

I didn’t interview further with them because of the technologies they were using and because of their location, but if that job search had gone slightly differently I can easily imagine myself having been interested in them.

A year later, they’d changed their name to Kixeye, turned themselves into a maker of “hardcore” games, and released this recruiting video that positioned them squarely within the brogrammer manchild tradition:

And I saw more news coverage (and for that matter people in person) speaking favorably of that video than not: it’s not just one company, that’s a lamentably strong aspect of the culture around here.

There’s way too much adolescent male status jockeying going on, way too little quiet listening; and I will be perfectly happy never to see another foam bat or nerf gun in my life.

Though Kixeye does seem to be particularly bad: rather than quietly shunning people who don’t fit into that culture, they seem to have had an actively discriminatory culture.

I’d like to think that I would have picked up on that culture if I’d interviewed in person, but I’m not at all confident that that’s the case; and, for that matter, for all I know the culture of the company really may have changed significantly since I interviewed. Which could be fine for somebody on the outside who is trying to get the company to pivot in search of greater profits; not necessarily so great for people in the middle of it.

I dunno; I’ve been in a pretty negative mood recently. Because the truth is, I could find just as many bad things to say about lots of other corporate subcultures around here. I certainly wouldn’t actively want to work in large companies, either, though I’m getting a more nuanced view of their strengths and weaknesses. And I’ve worked with great people at a lot of startups around here: great technically, but also great human beings, people that it’s been an honor to work with. I also certainly have nothing against making money, and I think that it’s great that money is available for people with ideas.

I just wish I had better leads on companies that were concentrating a bit more on their culture and their effects, companies that want to build the right things in the right ways. I’m sure there are a fair number if I knew where to look, I’m just not plugged into networks that enable me to see them.

And, seriously: the sexism in the valley has to stop.

Unequal or Unfair: Which Is Worse?

This is a guest post by Alan Honick, a filmmaker whose past work has focused primarily on the interaction between civilization and natural ecosystems, and its consequences to the sustainability of both. Most recently he’s become convinced that fairness is the key factor that underlies sustainability, and has embarked on a quest to understand how our notions of fairness first evolved, and what’s happening to them today. I posted about his work before here. This is crossposted from Pacific Standard.

Inequality is a hot topic these days. Massive disparities in wealth and income have grown to eye-popping proportions, triggering numerous studies, books, and media commentaries that seek to explain the causes of inequality, why it’s growing, and its consequences for society at large.

Inequality triggers anger and frustration on the part of a shrinking middle class that sees the American Dream slipping from its grasp, and increasingly out of the reach of its children. But is it inequality per se that actually sticks in our craw?

There will always be inequality among humans—due to individual differences in ability, ambition, and more often than most would like to admit, luck. In some ways, we celebrate it. We idolize the big winners in life, such as movie and sports stars, successful entrepreneurs, or political leaders. We do, however (though perhaps with unequal ardor) feel badly for the losers—the indigent and unfortunate who have drawn the short straws in the lottery of life.

Thus, we accept that winning and losing are part of life, and concomitantly, some level of inequality.

Perhaps it’s simply the extremes of inequality that have changed our perspective in recent years, and clearly that’s part of the explanation. But I put forward the proposition that something far more fundamental is at work—a force that emerges from much deeper in our evolutionary past.

Take, for example, the recent NFL referee lockout, where incompetent replacement referees were hired to call the games.There was an unrestrained outpouring of venom from outraged fans as blatantly bad calls resulted in undeserved wins and losses. While sports fans are known for the extremity of their passions, they accept winning and losing; victory and defeat are intrinsic to playing a game.

What sparked the fans’ outrage wasn’t inequality—the win or the loss. Rather, the thing they couldn’t swallow—what stuck in their craw—was unfairness.

I offer this story from the KLAS-TV News website. It’s a Las Vegas station, and appropriately, the story is about how the referee lockout affected gamblers. It addresses the most egregiously bad call of the lockout, in a game between the Seattle Seahawks and the Green Bay Packers. From the story:

In a call so controversial the President of the United States weighed in, Las Vegas sports bettors said they lost out on a last minute touchdown call Monday night…

….Chris Barton, visiting Las Vegas from Rhode Island, said he lost $1,200 on the call against Green Bay. He said as a gambler, he can handle losing, “but not like that.”

“I’ve been gambling for 30 years almost, and that’s the worst defeat ever,” he said.

By the way, Obama’s “weigh-in” was through his Twitter feed, which I reproduce here:

“NFL fans on both sides of the aisle hope the refs’ lockout is settled soon. –bo”

When questioned about the president’s reaction, his press secretary, Jay Carney, said Obama thought “there was a real problem with the call,” and said the president expressed frustration at the situation.

I think this example is particularly instructive, simply because money’s involved, and money—the unequal distribution of it—is where we began.

Fairness matters deeply to us. The human sense of fairness can be traced back to the earliest social-living animals. One of its key underlying components is empathy, which began with early mammals. It evolved through processes such as kin selection and reciprocal altruism, which set us on the path toward the complex societies of today.

Fairness—or lack of it—is central to human relationships at every level, from a marriage between two people to disputes involving war and peace among the nations of the world.

I believe fairness is what we need to focus on, not inequality—though I readily acknowledge that high inequality in wealth and income is corrosive to society. Why that is has been eloquently explained by Kate Pickett and Richard Wilkerson in their book, The Spirit Level. The point I have been trying to make is that inequality is the symptom; unfairness is the underlying disease.

When dealing with physical disease, it’s important to alleviate suffering by treating painful symptoms, and inequality can certainly be painful to those who suffer at the lower end of the wage scale, or with no job at all. But if we hope for a lasting cure, we need to address the unfairness that causes it.

That said, creating a fairer society is a daunting challenge. Inequality is relatively easy to understand—it’s measurable by straightforward statistics. Fairness is a subtler concept. Our notions of fairness arise from a complex interplay between biology and culture, and after 10,000 years of cultural evolution, it’s often difficult to pick them apart.

Yet many researchers are trying. They are looking into the underlying components of the human sense of fairness from a variety of perspectives, including such disciplines as behavioral genetics, neuroscience, evolutionary and developmental psychology, animal behavior, and experimental economics.

In order to better understand fairness, and communicate their findings to a larger audience, I’ve embarked on a multimedia project to work with these researchers. The goal is to synthesize different perspectives on our sense of fairness, to paint a clearer picture of its origins, its evolution, and its manifestations in the social, economic, and political institutions of today.

The first of these multimedia stories appeared here at Pacific Standard. Called The Evolution of Fairness, it is about archaeologist Brian Hayden. It explores his central life work—a dig in a 5000 year old village in British Columbia, where he uncovered evidence of how inequality may have first evolved in human society.

I found another story on a CNN blog about the bad call in the Seahawks/Packers game. In it, Paul Ryan compares the unfair refereeing to President Obama’s poor handling of the economy. He says, “If you can’t get it right, it’s time to get out.” He goes on to say, “Unlike the Seattle Seahawks last night, we want to deserve this victory.”

We now know how that turned out, though we don’t know if Congressman Ryan considers his own defeat a deserved one.

I’ll close with a personal plea to President Obama. I hope—and believe—that as you are starting your second term, you are far more frustrated with the unfairness in our society than you were with the bad call in the Seahawks/Packers game. It’s arguable that some of the rules—such as those governing campaign finance—have themselves become unfair. In any case, if the rules that govern society are enforced by bad referees, fairness doesn’t stand much of a chance, and as we’ve seen, that can make people pretty angry.

Please, for the sake of fairness, hire some good ones.

It’s Pro-American to be Anti-Christmas

This is a guest post by Becky Jaffe.

I know what you’re thinking: Don’t Christmas and America go together like Santa and smoking?

Why, of course they do! Just ask Saint Nickotine, patron saint of profit. This Lucky Strike advertisement is an early introduction to Santa the corporate shill, the seasonal cash cow whose avuncular mug endorses everything from Coca-Cola to Siri to yes, even competing brands of cigarettes like Pall Mall. Sorry Lucky Strike, Santa’s a bit of a sellout.

Nearly a century after these advertisements were published, the secular trinity of Santa, consumerism and America has all but supplanted the holy trinity the holiday was purportedly created to commemorate. I’ll let Santa the Spokesmodel be the cheerful bearer of bad news:

Christmas and consumerism have been boxed up, gift-wrapped and tied with a red-white-and-blue ribbon. In this guest post I’ll unwrap this package and explain why I, for one, am not buying it.

____________________

Yesterday was Thanksgiving, followed inexorably by Black Friday; one day we’re collectively meditating on gratitude, the next we’re jockeying for position in line to buy a wall-mounted 51” plasma HDTV. Some would argue that’s quintessentially American. As social critic and artist Andy Warhol wryly observed, “Shopping is more American than thinking.”

Such a dour view may accurately describe post WW II America, but not the larger trends nor longer traditions of our nation’s history. Although we may have become profligate of late, we were at the outset a frugal people; consumerism and America need not be inextricably linked in our collective imagination if we take a longer view. Long before there was George Bush telling us the road to recovery was to have faith in the American economy, there was Henry David Thoreau, who spoke to a faith in a simpler economy:

The Simple Living experiment he undertook and chronicled in his classic Walden was guided by values shared in common by many of the communities who sought refuge in the American colonies at the outset of our nation: the Mennonites, the Quakers, and the Shakers. These groups comprise not only a great name for a punk band, but also our country’s temperamental and ethical ancestry. The contemporary relationship between consumerism and Christmas is decidedly un-American, according to our nation’s founders. And what could be more American than the Amish? Or the secular version thereof: The Simplicity Collective.

Being anti-Christmas™ is as uniquely American as Thoreau, who summed up his anti-consumer credo succinctly: “Men have become the tools of their tools.” If he were alive today, I have no doubt that curmudgeonly minimalist would be marching with Occupy Wall Street instead of queuing with the tools on Occupy Mall Street.

Being anti-Christmas™ is as American as Mark Twain, who wrote, “The approach of Christmas brings harrassment and dread to many excellent people. They have to buy a cart-load of presents, and they never know what to buy to hit the various tastes; they put in three weeks of hard and anxious work, and when Christmas morning comes they are so dissatisfied with the result, and so disappointed that they want to sit down and cry. Then they give thanks that Christmas comes but once a year.” (From Following the Equator)

Being anti-Christmas™ is as American as “Oklahoma’s favorite son,” Will Rogers, 1920’s social commentator who made the acerbic observation, “Too many people spend money they haven’t earned, to buy things they don’t want, to impress people they don’t like.”

He may have been referring to presents like this, which are just, well, goyish:

Being anti-Christmas is as American as Robert Frost, recipient of four Pulitzer prizes in poetry, who had this to say in a Christmas Circular Letter:

He asked if I would sell my Christmas trees;

My woods—the young fir balsams like a place

Where houses all are churches and have spires.

I hadn’t thought of them as Christmas Trees.

I doubt if I was tempted for a moment

To sell them off their feet to go in cars

And leave the slope behind the house all bare,

Where the sun shines now no warmer than the moon.

I’d hate to have them know it if I was.

Yet more I’d hate to hold my trees except

As others hold theirs or refuse for them,

Beyond the time of profitable growth,

The trial by market everything must come to.

We inherit from these American thinkers a unique intellectual legacy that might make us pause at the commercialism that has come to consume us. To put it in other words:

- John Porcellino’s Thoreau at Walden: $18

- Walt Whitman’s Leaves of Grass: $5.95

- Mary Oliver’s American Primitive: $9.99

- The Life and Letters of John Muir: $12.99

- Transcendentalist Intellectual Legacy: Priceless.

The intellectual and spiritual founders of our country caution us to value our long-term natural resources over short-term consumptive titillation. Unheeding their wisdom, last year on Black Friday American consumers spent $11.4 billion, more than the annual Gross Domestic Product of 73 nations.

And American intellectual legacy aside, isn’t that a good thing? Doesn’t Christmas spending stimulate our stagnant economy and speed our recovery from the recession? If you believe organizations like Made in America, it’s our patriotic duty to spend money over the holidays. The exhortation from their website reads, “If each of us spent just $64 on American made goods during our holiday shopping, the result would be 200,000 new jobs. Now we want to know, are you in?”

That depends once again on whether or not we take the long view. Christmas spending might create a few temporary, low-wage, part-time jobs without benefits of the kind described in Barbara Ehrenreich’s Nickel and Dimed: On (Not) Getting By In America, but it’s not likely to create lasting economic health, especially if we fail to consider the long-term environmental and social costs of our short-term consumer spending sprees. The answer to Made in America’s question depends on the validity of the economic model we use to assess their spurious claim, as Mathbabe has argued time and again in this blog. The logic of infinite growth as an unequivocal net good is the same logic that underlies such flawed economic models as the Gross National Product (GNP) and the Gross Domestic Product (GDP).

These myopic measures fail to take into account the value of the natural resources from which our consumer products are manufactured. In this accounting system, when an old-growth forest is clearcut to make way for a Best Buy parking lot, that’s counted as an unequivocal economic boon since the economic value of the lost trees/habitat is not considered as a debit. Feminist economist and former New Zealand parliamentarian Marilyn Waring explains the idea accessibly in this documentary: Who’s Counting? Marilyn Waring on Sex, Lies, and Global Economics.

If we were to adopt a model that factors in the lost value of nonrenewable natural resources, such as the proposed Green National Product, we might skip the stampede at Walmart and go for a walk in the woods instead to stimulate the economy.

Other critics of these standard models for measuring economic health point out that they overvalue quantity of production and, by failing to take into account such basic measures of economic health as wealth distribution, undervalue quality of life. And the growing gap in income inequality is a trend that we cannot afford to overlook as we consider the best options for economic recovery. According to this New York Times article, “Income inequality has soared to the highest levels since the Great Depression, and the recession has done little to reverse the trend, with the top 1 percent of earners taking 93 percent of the income gains in the first full year of the recovery.”

For the majority of Americans who are still struggling to make ends meet, the Black Friday imperative to BUY! means racking up more credit card debt. (As American poet ee cummings quipped,” “I’m living so far beyond my income that we may almost be said to be living apart.”) The specter of Christmas spending is particularly ominous this season, during a recession, after a national wave of foreclosures has left Americans with insecure housing, exorbitant rents, and our beleaguered Santa with fewer chimneys to squeeze into.

Some proposed alternatives to the GDP and GNP that factor in income distribution are the Human Progress Index, the Genuine Progress Indicator, and yes, even a proposed Gross National Happiness.

A dose of happiness could be just the antidote to the dread many Americans feel at the prospect of another hectic holiday season. As economist Paul Heyne put it, “The gap in our economy is between what we have and what we think we ought to have – and that is a moral problem, not an economic one.”

____________________

Mind you, I’m not anti-Christmas, just anti-Christmas™. I’ve been referring thus far to the secular rites of the latter, but practicing Christians for whom the former is a meaningful spiritual meditation might equally take offense at its runaway commercialization, which the historical Jesus would decidedly not have endorsed.

I hate to pull the Bible card, but, seriously, what part of Ecclesiastes don’t you understand?

Photo by Becky Jaffe. http://www.beckyjaffe.com

Better is an handful with quietness, than both the hands full with travail and vexation of spirit. – Ecclesiastes 4:6

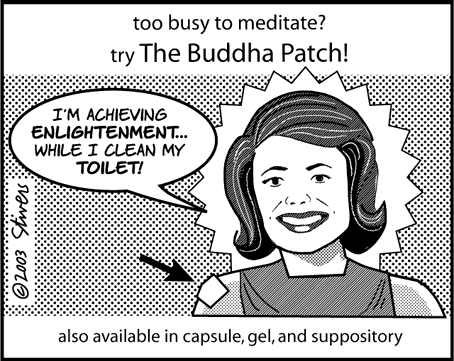

Just imagine if Buddhism were hijacked by greed in the same fashion.

After all,

Right?

Or is it axial tilt?

Whether you’re a practicing Christian, a Born-Again Pagan celebrating the Winter Solstice (“Mithras is the Reason for the Season”), or a fundamentalist atheist (“You know it’s a myth! This season, celebrate reason.”), we all have reason to be concerned about the corporatization of our cultural rituals.

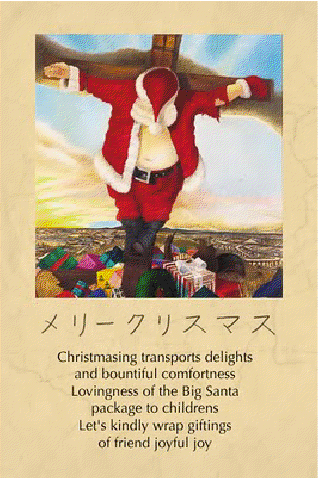

The meaning of Christmas has gotten lost in translation:

So this year, let’s give Santa a much-needed smoke break, pour him a glass of Kwanzaa Juice, and consider these alternatives for a change:

1. Presence, not presents. Skip the spending binge (and maybe even another questionable Christmas tradition, the drinking binge), and give the gift of time to the people you love. I’m talking luxurious swaths of time: unstructured time, unproductive time, time wasted exquisitely together.