Archive

Cathy’s Wager

I know you guys might be getting kind of exhausted from all the oversharing that’s been happening on mathbabe this week. I am too. But let me finish the phase with one piece of advice which I hope you find helpful.

I call it “Cathy’s Wager” (h/t Chris Wiggins) in reference to a much more famous and better idea called Pascal’s Wager. That, you may remember, is the argument that you might as well be a good person because there’s either a god, who cares, or there isn’t, in which case you haven’t lost all that much.

So here’s my version, and it refers to how other people treat you and how you react. I’ll assume most people treat you nicely most of the time, and then sometimes someone doesn’t treat you nicely. How do you react?

My theory is that you always assume it’s something they’re going through, and you try to never take it personally. Here are some examples.

- You’re friends with someone and all of a sudden they stop writing back to your emails. Assume they’re going through something, maybe a depression, maybe a break-up, maybe they just fell in love or moved jobs. It’s not about you and you shouldn’t take it personally. Consider writing to them and saying you’re there for them if they need a friend, or just do nothing and let them take their time, depending on how close a friend they are and how likely each of those scenarios is. Err on the side of compassion, not blame.

- You’re trying to set up a meeting with someone professionally and they never get back to you, or even worse, they don’t show up for the planned meeting and never explain why. First, always assume this has nothing to do with you. Maybe the got into a fight with their significant other, maybe they just got fired. You have no idea. But in order to avoid this from happening, do remember to confirm business meetings the day of, if it’s in the afternoon, or the afternoon before, if it’s in the morning, especially if the meeting was made more than a week in advance.

- You have what you think is an interesting if provocative conversation with someone and they never talk to you again, and you hear 2nd or 3rd hand (or both) that they hate your guts. Again, it’s not about you. There was some trigger in that conversation, and yes if you want to be sensitive you could try to go back over the conversation in your head and figure out what the heck happened. Do it once, but if you are convinced you meant no offense, then assume that person is going through something. They might even get over it and want to make up someday. Who knows, maybe part of what they like in life is getting offended and complaining. For example, maybe they take this article to heart entitled “The 14 Habits of Highly Miserable People.”

- Someone gets into your face and tells you you’re an awful person and are being mean to them for whatever reason. Not about you.

As I’m sure you can see, the assumption that “it’s not about me” is super useful and time-saving. I use it a lot, which means I don’t spend a lot of time second guessing myself or trying to change things that I can’t change about other people’s feelings. It’s kind of a selfish version of the Serenity Prayer, if you will, without all the religious stuff.

And this is not to say I don’t spend time trying to mend differences and reach out to my friends! I totally do! I just don’t feel personally affected if it doesn’t work. And I think that actually helps me do it more often in the end.

One caveat: the above examples work pretty well unless you are actually an awful person. I’m assuming you’re not. If you are actually a bad person, please don’t rely on Cathy’s Wager, thanks. Of course that begs the question of whether anyone actually thinks they’re awful, and if you go there, consider the idea that awful people are already using Cathy’s Wager, so you may as well too.

I’m already fat so I may as well be smart

I seem to be in a mood this week for provocative posts about body image and appearance (maybe this is what happens when I skip an Aunt Pythia column). Apologies to people who came for math talk.

I just wanted to mention something positive about the experience of being fat all my life, but especially as a school kid. Because just to be clear, this isn’t a phase. I’ve been pudgy since I was 2 weeks old. And overall it kind of works for me, and I’ll say why.

Namely, being a fat school kid meant that I was so uncool, so outside of normal social activity with boys and the like, that I was freed up to be as smart and as nerdy as I wanted, with very little stress about how that would “look”. You’re already fat, so why not be smart too? You’re not doing anything else, nobody’s paying attention to you, and there’s nothing to gossip about, so might as well join the math team.

It’s really a testament to both the pressure to be thin and the pressure to conform intellectually, i.e. not be a nerd, when you’re a young girl: they are both intense and super unpleasant. The happy truth is, one can be cover for the other. More than that, really: being fat (or “overweight” for people who are squeamish about the word “fat”) has opened up many doors that I honestly think would have, or at least could have, remained shut had I been more socially acceptable.

Going back to dress code at work for a moment: while people claim that corporate dress codes are meant to keep our minds off of sex, that is clearly a huge lie when it comes to many categories of women’s work clothes. Who are we kidding? The mere fact that many women wear high heels to work kind of says it all. And that’s fine, but let’s freaking acknowledge it.

On the other hand, it’s pretty hard to look sexy in a plus-sized suit (although not impossible), and the idea of high heels at work is just nuts. This ends up being a weirdly good thing for me, though: people take me more seriously because I have taken myself out of the sex game altogether – or at least the traditional sex game.

By the way, I’m not saying all fat women have the same perspective on it. I’m lucky enough to have figured out pretty early on how to separate other people’s projected feelings about my body from my own feelings. I am an observer of fat hatred, in other words. That doesn’t make me entirely insulated but it does give me one critical advantage: I have a lot of time on my hands to do stuff that I might otherwise spend fretting about my body.

It also might help partly explain why some girls get on the math team and others don’t. Being fat is something you don’t have control over (the continuing and damaging myth that each person does have control over it notwithstanding) but joining the math team is something you do have control over. And if you aren’t already excluded for some other reason (being fat is one but by no means the only way this could happen of course), you might not want to start that whole thing intentionally. Just a theory.

One reason corporate culture sucks for women

Am I the only person offended by the recent wave of articles wherein “senior women” at corporate offices are going around telling “younger women” about the appropriate dress code?

For example, here’s the beginning of a WSJ piece on just that subject:

Clothes may make the man. Can they undo the woman?

When female employees at Frontier Communications Corp. show up at its headquarters in very short skirts, sweatpants or sneakers, Chief Executive Maggie Wilderotter sometimes pulls them aside for a quick, private chat on dressing for success.

“I want women to be paid attention to for what they say–and not how they look,” explains Ms. Wilderotter.

Later in the article the explain why this is ok:

Women face more pitfalls because they have more clothing choices than men. And because male bosses fear being accused of sexual harassment, it usually falls to female supervisors to confront an associate about her attire.

This is one reason I hate corporate jobs. And yes, it’s because I come from academia and because I’m essentially a hippie, but seriously, why do we need so much policing? Why can’t people just leave each other alone to express themselves? It’s also a double standard:

Rosalind Hudnell, human resources vice president of Intel Corp., occasionally intervenes when she sees young female staffers clad unprofessionally, even though Intel staffers often wear shorts and jeans.

It’s just another in a long list of things you are scrutinized on if you’re a woman. In addition to whether you are a good mother, a feminine-enough-without-being-too-feminine employee, and, as a tertiary issue, if that, whether you actually do your job well. Fuck this.

Question for you readers: what does it really mean that these “senior women” are taking it upon themselves to scrutinize and criticize young women? Am I wrong, is it actually generous? Or is it some kind of hazing thing? Or is it a media invention that doesn’t actually happen?

Debunking Economic Myths #OWS

Yesterday in Alt Banking we were honored to have Suresh Naidu visit us to talk about and debunk economic myths.

The first myth, and the one we spent the most time on, is the idea that people “deserve” the money they earn because it is an accurate measure of their “added value” to society.

There are two parts of this, or actually at least two parts.

First, there’s the idea that you can even dissect the meaning of one person’s value. And if you can, it’s likely a question of a marginal value: what does our society look like without Steve Jobs, and then with him, and what’s the difference between the two worlds? As soon as you say it, you realize that such a thought experiment is complicated, considering the extent to which Steve Jobs’ journey intersected with other people’s like Steve Wozniak and a huge crowd of Chinese workers.

If you think about it some more, you might conclude that the marginal value of a single person is impossible to actually measure, at least with any precision, and not just because of the counterfactual problem, i.e. the problem that we only have one universe and can’t run two parallel universes at the same time. It’s really because any one person succeeds or fails, or more generally contributes, within a context of an entire culture. Even Mozart wrote his symphonies within a cultural context. In another context he would have been a kid who hums to himself a lot.

Second, there’s the assumption that people who earn a lot of money are actually adding value at all. This isn’t clear, and you don’t need to refer to formally criminal acts to make that case (although of course there are plenty of rich people who have committed criminal acts).

In many examples of super rich people, they got that way through not paying for negative externalities like polluting the environment, or because they had control of the legal mechanisms to reap profits off of other peoples’ work. Not technically illegal, then, but also not exactly a fair measure of their added value.

Or, of course, if they worked in finance, they might have made money by keeping stuff incredibly complicated and opaque while providing liquidity to the credit markets. It’s not clear that such work has added any value to society, or if it has, whether it’s balanced the good with the bad.

Some observations about this myth that were brought up include:

- There’s a deep belief in “the markets” at work here which is rather cyclical. The market values you more than other people which is why you’re paid so well for whatever it is you do. Other people who have less to offer the market are get paid less. Anyone who doesn’t have a job doesn’t deserve a job since the market isn’t offering them a job, which must mean they are adding no value.

- There are exceptions where people add obvious value – caretakers of our children for example – but aren’t paid well. This is because of a different mechanism called supply and demand. For whatever reason supply and demand isn’t at work at high ends of the market.

- Or maybe it is and there’s really only one possible person who could do what Steve Jobs did. Personally I don’t buy it. And I chose Steve Jobs because so many people love that guy, but really he’s one of the best examples of someone who might have had a unique talent. Most rich people are generically good at their job and not all that unique.

- It’s mostly the people that benefit from the market system that believe in it. That kind of reminds me of the marshmallow study, or rather one of the many re-interpretations of the marshmallow study. See the latest one here.

- It’s patently difficult to believe in the market system if you consider a lack of equality of opportunity in this country due to extreme differences in school systems and the like. I’m about to start reading this book which explains this issue in depth.

- For other evidence, look at Pimco’s Bill Gross’s recent confessions about being born at the right time with easy access to credit.

- The unequal access of opportunities in this country is becoming increasingly entrenched, and as it does so the myth of the market giving us what we deserve is becoming increasingly difficult to swallow.

Crisis Text Line: Using Data to Help Teens in Crisis

This morning I’m helping out at a datadive event set up by DataKind (apologies to Aunt Pythia lovers).

The idea is that we’re analyzing metadata around a texting hotline for teens in crisis. We’re trying to see if we can use the information we have on these texts (timestamps, character length, topic – which is most often suicide – and outcome reported by both the texter and the counselor) to help the counselors improve their responses.

For example, right now counselors can be in up to 5 conversations at a time – is that too many? Can we figure that out from the data? Is there too much waiting between texts? Other questions are listed here.

Our “hackpad” is located here, and will hopefully be updated like a wiki with results and visuals from the exploration of our group. It looks like we have a pretty amazing group of nerds over here looking into this (mostly python users!), and I’m hopeful that we will be helping the good people at Crisis Text Line.

On being a mom and a mathematician: interview by Lillian Pierce

This is a guest post by Lillian Pierce, who is currently a faculty member of the Hausdorff Center for Mathematics in Bonn, and will next year join the faculty at Duke University.

I’m a mathematician. I also happen to be a mother. I turned in my Ph.D. thesis one week before the due date of my first child, and defended it five weeks after she was born. Two and a half years into my postdoc years, I had my second child.

Now after a few years of practice, I can pretty much handle daily life as a young academic and a parent, at least most of the time, but it still seems like a startlingly strenuous existence compared to what I remember of life as just a young academic, not a parent.

Last year I was asked by the Association for Women in Mathematics to write a piece for the AWM Newsletter about my impressions of being a young mother and getting a mathematical career off the ground at the same time. I suggested that instead I interview a lot of other mathematical mothers, because it’s risky to present just one view as “the way” to tackle mathematics and motherhood.

Besides, what I really wanted to know was: how is everyone else doing this? I wanted to pick up some pointers.

I met Mathbabe about ten years ago when I was a visiting prospective graduate student and she was a postdoc. She made a deep impression on me at the time, and I am very happy that I now have the chance to interview her for the series Mathematics+Motherhood, and to now share with you our conversation.

LP: Tell me about your current work.

CO: I am a data scientist working at a small start-up. We’re trying to combine consulting engagements with a new vision for data science training and education and possibly some companies to spin off. In the meantime, we’re trying not to be creepy.

LP: That sounds like a good goal. And tell me a bit about your family.

CO: I have three kids. I got pregnant with my first son, who’s 13 now, soon after my PhD. Then I had a second child 2 years later, also while I was a postdoc. I also have a 4 year old, whom I had when I was working in finance.

LP: Did you have any notions or worries in advance about how the growth of your family would intersect with the growth of your career?

CO: I absolutely did worry about it, and I was right to worry about it, but I did not hesitate about whether to have children because it was just not a question to me about how I wanted my life to proceed. And I did not want to wait until I was tenured because I didn’t want to risk being infertile, which is a real risk. So for me it was not an option not to do it as a woman, forget as a mathematician.

LP: What was it like as a postdoc with two very young children?

CO: On the one hand I was hopeful about it, and on the other hand I was incredibly disappointed about it. The hopeful part was that the chair of my department was incredibly open to negotiating a maternity leave for postdocs, and it really was the best maternity policy that I knew about: a semester off of teaching for each baby and in total an extra year of the postdoc, since I had 2 babies. So I ended up with four years of postdoc, which was really quite generous on the one hand, but on the other hand it really didn’t matter at all. Not “not at all”—it mattered somewhat but it simply wasn’t enough to feel like I was actually competing with my contemporaries who didn’t have children. That’s on the one hand completely obvious and natural and it makes sense, because when you have small children you need to pay attention to them because they need you—and at the same time it was incredibly frustrating.

LP: It’s interesting because it’s not that you were saying “I won’t be able to compete with my contemporaries over the course of my life,” but more “I can’t compete right now.”

CO: Exactly, “I can’t compete right now” with postdocs without children. I realize—and this is not a new idea—that mathematics as a culture frontloads entirely into those 3 or 4 years after you get your PhD. Ultimately it’s not my fault, it’s not women’s fault, it’s the fault of the academic system.

LP: What metrics could departments use to be thinking more about future potential?

CO: I actually think it’s hard. It’s not just for women that it should change. It’s for the actual culture of mathematics. Essentially, the system is too rigid. And it’s not only women who get lost. The same thing that winnows the pool down right after getting a PhD—it’s a whittling process, to get rid of people, get rid of people, get rid of people until you only have the elite left—that process is incredibly punishing to women, but it’s also incredibly punishing to everybody. And moreover because of the way you get tenure and then stay in your field for the rest of your life, my feeling is that mathematics actually suffers. The reason I say this is because I work in industry now, which is a very different system, and people can reinvent themselves in a way that simply does not happen in mathematics.

LP: Do you think industry, in terms of the young career phase, gets it closer to “right” than academia currently does?

CO: Much closer to right. It’s a brutal place, don’t get me wrong, it’s brutal. I’m not saying it’s a perfect system by any stretch of the imagination. But the truth is in industry you can have a 3 year stint somewhere that is a mistake. Forget having kids, you can have a 3 year stint that was just a mistake for you. You can say “I had a bad boss and I left that place and I got a new job” and people will say “Ok.” They don’t care. One thing that I like about it is the ability to reinvent yourself. And I don’t think you see that in math. In math, your progress is charted by your publication record at a granular level. And if you’re up for tenure and there’s a 3 year gap where you didn’t publish, even if in the other years you published a lot, you still have to explain that gap. It’s like a moral responsibility to keep publishing all the time.

LP: How are you measured in industry?

CO: In industry it’s the question “what have you done for me,” and “what have you done for me lately.” It’s a shorter-term question, and there are good elements to that. One of the good elements is that as a woman you can have a baby or a couple babies and then you can pick up the slack, work your ass off, and you can be more productive after something happens. If someone gets sick, people lower their expectations for that person for some amount of time until they recover, and then expectations are higher. Mathematics by contrast has frontloaded all of the stress, especially for the elite institutions, into the 3 or 4 years to get the tenure track offer and then the next 6 years to get tenure. And then all the stress is gone. I understand why people with tenure like that. But ultimately I don’t think mathematics gets done better because of it. And certainly when the question arises “why don’t women stay in math,” I can answer that very easily: because it’s not a very good place for women, at least if they want kids.

LP: You mention on your blog that your mother is an unapologetic nerd and computer scientist; the conclusion you drew from that was that it was natural for you not to doubt that your contributions to nerd-dom and science and knowledge would be welcomed. How do you think this experience of having a mother like that inoculated you?

CO: One of the great gifts that my mother gave me as a Mother Nerd was the gift of privacy—in the sense that I did not scrutinize myself. First of all she was role-modeling something for me, so if I had any expectations it would be to be like my mom. But second of all she wasn’t asking me to think about that. I think that was one of the rarest things I had, the most unusual aspect of my upbringing as a girl. Very few of the girls that I know are not scrutinized. My mother was too busy to pay attention to my music or my art or my math. And I was left alone to decide what I wanted to do—it wasn’t about what I was good at or what other people thought of my progress. It was all about answering the question, what did I want to do. Privacy for me is having elbow space to self-define.

LP: Do you think it’s harder for parents to give that space to girls than to boys?

CO: Yes I do, I absolutely do. It’s harder and for some reason it’s not even thought about. My mother also gave me the gift of not feeling at all guilty about putting me into daycare. And that’s one of my strongest lessons, is that I don’t feel at all guilty about sending my kids to daycare. In fact I recently had the daycare providers for my 4-year-old all over for dinner, and I was telling them in all honesty that sometimes I wish I could be there too, that I could just stay there all day, because it’s just a wonderful place to be. I’m jealous of my kids. And that’s the best of all worlds. Instead of saying “oh my kid is in daycare all day, I feel bad about that,” it’s “my kid gets to go to daycare.”

LP: Where did this ability not to scrutinize come from? Where did your mother get this?

CO: I don’t know. My mother has never given me advice, she just doesn’t give advice. And when I ask her to, she says “you know more about your life than I do.”

LP: How do you deal with scrutiny now?

CO: It’s transformed as I’ve gotten older. I’ve gotten a thicker skin, partly from working in finance. I’ve gotten to the point now where I can appreciate good feedback and ignore negative feedback. And that’s a really nice place to be. But it started out, I believe, because I was raised in an environment where I wasn’t scrutinized. And I had that space to self-define.

LP: The idea of pushing back against scrutiny to clear space for self-definition is inspiring for adults as well.

CO: Women in math, especially with kids, give yourself a break. You’re under an immense amount of pressure, of scrutiny. You should think of it as being on the front lines, you’re a warrior! And if you’re exhausted, there’s a reason for it. Please go read Radhika Nagpal’s Scientific American blog post (“The Awesomest 7-Year Postdoc Ever”) for tips on how to deal with the pressure. She’s awesome. And the last thing I want to say is that I never stopped loving math. Cardinal Rule Number 1: Before all else, don’t become bitter. Cardinal Rule Number 2: Remember that math is beautiful.

#AskJPM and public shaming #OWS

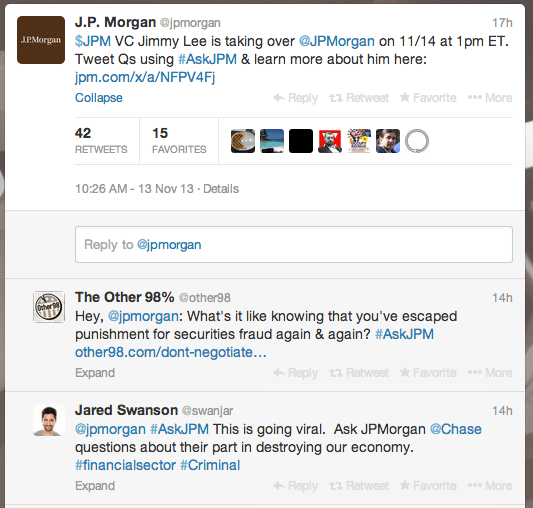

I don’t usually shill for companies but this morning I’m completely into how much of a circus my Twitter feed became yesterday when JP Morgan Chase’s PR team decided to open up to the public for questions. You can see from the immediate replies how this was going to go:

The questions asked which were tagged with #AskJPM are stunning and constitute a well-deserved public shaming of JP Morgan.

My friend and co-occupier Alexis Goldstein was absolutely killing it on Twitter, as usual. Here’s just a snippet from her feed:

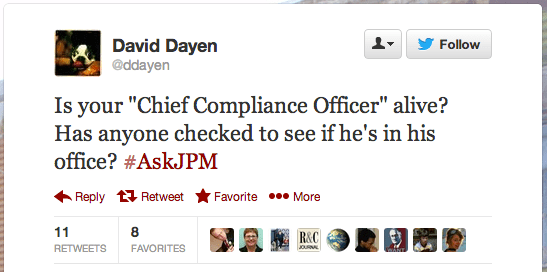

See also Dave Dayen’s choice question:

Needless to say the Q&A was canceled, but not until the #AskJPM hashtag went viral in an amazing way. See more examples here and here.

Update: Watch #AskJPM tweets read by Stacy Keach live on CNBC!!

You are not a loan: Rolling Jubilee eradicates $15,000,000 worth of debt #OWS

This is super cool. Occupy Wall Street’s Strike Debt group has bought up almost $15 million dollars worth of mostly medical debt which was owned by 2,700 people across 45 states and Puerto Rico. They used donations they’ve been collecting over the last year. There’s more information about this action in this Guardian piece.

Here’s what I like about this. By freeing people of medical debt in particular, which is the biggest cause of bankruptcy filings, it emphasizes the lie of the “moral sin” often associated with crushing debt.

In other words, instead of imagining poor and debt-ridden people as lazy and glibly unable to keep their promises, the Rolling Jubilee action bestows a much-needed act of compassion for some of the millions of the unlucky people in this country caught in a dysfunctional health and credit system.

And while it’s true that it is making a small dent in the debt problem, in dollars and cents terms, I think the Strike Debt’s debt action, and its Debt Resistors’ Operation Manual, has made huge strides in how people think about debt in this country, which is tremendously important.

There is no “market solution” for ethics

We saw what happened in finance with self-regulation and ethics. Let’s prepare for the exact same thing in big data.

Finance

Remember back in the 1970’s through the 1990’s, the powers that were decided that we didn’t need to regulate banks because “they” wouldn’t put “their” best interests at risk? And then came the financial crisis, and most recently came Alan Greenspan’s recent admission that he’d got it kinda wrong but not really.

Let’s look at what the “self-regulated market” in derivatives has bestowed upon us. We’ve got a bunch of captured regulators and a huge group of bankers who insist on keeping derivatives opaque so that they can charge clients bigger fees, not to mention that they insist on not having fiduciary duties to their clients, and oh yes, they’d like to continue to bet depositors’ money on those derivatives. They wrote the regulation themselves for that one. And this is after they blew up the world and got saved by the taxpayers.

Given that the banks write the regulations, it’s arguably still kind of a self-regulated market in finance. So we can see how ethics has been and is faring in such a culture.

The answer is, not well. Just in case the last 5 years of news articles wasn’t enough to persuade you of this fact, here’s what NY Fed Chief Dudley had to say recently about big banks and the culture of ethics, from this Huffington Post article:

“Collectively, these enhancements to our current regime may not solve another important problem evident within some large financial institutions — the apparent lack of respect for law, regulation and the public trust,” he said.

“There is evidence of deep-seated cultural and ethical failures at many large financial institutions,” he continued. “Whether this is due to size and complexity, bad incentives, or some other issues is difficult to judge, but it is another critical problem that needs to be addressed.”

Given that my beat is now more focused on the big data community and less on finance, mostly since I haven’t worked in finance for almost 2 years, this kind of stuff always makes me wonder how ethics is faring in the big data world, which is, again, largely self-regulated.

Big data

According to this ComputerWorld article, things are pretty good. I mean, there are the occasional snafus – unappreciated sensors or unreasonable zip code gathering examples – but the general idea is that, as long as you have a transparent data privacy policy, you’ll be just fine.

Examples of how awesome “transparency” is in these cases vary from letting people know what cookies are being used (BlueKai), to promising not to share certain information between vendors (Retention Science), to allowing customers a limited view into their profiling by Acxiom, the biggest consumer information warehouse. Here’s what I assume a typical reaction might be to this last one.

Wow! I know a few things Acxiom knows about me, but probably not all! How helpful. I really trust those guys now.

Not a solution

What’s great about letting customers know exactly what you’re doing with their data is that you can then turn around and complain that customers don’t understand or care about privacy policies. In any case, it’s on them to evaluate and argue their specific complaints. Which of course they don’t do, because they can’t possibly do all that work and have a life, and if they really care they just boycott the product altogether. The result in any case is a meaningless, one-sided conversation where the tech company only hears good news.

Oh, and you can also declare that customers are just really confused and don’t even know what they want:

In a recent Infosys global survey, 39% of the respondents said that they consider data mining invasive. And 72% said they don’t feel that the online promotions or emails they receive speak to their personal interests and needs.

Conclusion: people must want us to collect even more of their information so they can get really really awesome ads.

Finally, if you make the point that people shouldn’t be expected to be data mining and privacy experts to use the web, the issue of a “market solution for ethics” is raised.

“The market will provide a mechanism quicker than legislation will,” he says. “There is going to be more and more control of your data, and more clarity on what you’re getting in return. Companies that insist on not being transparent are going to look outdated.”

Back to ethics

What we’ve got here is a repeat problem. The goal of tech companies is to make money off of consumers, just as the goal of banks is to make money off of investors (and taxpayers as a last resort).

Given how much these incentives clash, the experts on the inside have figured out a way of continuing to do their thing, make money, and at the same time, keeping a facade of the consumer’s trust. It’s really well set up for that since there are so many technical terms and fancy math models. Perfect for obfuscation.

If tech companies really did care about the consumer, they’d help set up reasonable guidelines and rules on these issues, which could easily be turned into law. Instead they send lobbyists to water down any and all regulation. They’ve even recently created a new superPAC for big data (h/t Matt Stoller).

And although it’s true that policy makers are totally ignorant of the actual issues here, that might be because of the way big data professionals talk down to them and keep them ignorant. It’s obvious that tech companies are desperate for policy makers to stay out of any actual informed conversation about these issues, never mind the public.

Conclusion

There never has been, nor there ever will be, a market solution for ethics so long as the basic incentives between the public and an industry are so misaligned. The public needs to be represented somehow, and without rules and regulations, and without leverage of any kind, that will not happen.

How do I know if I’m good enough to go into math?

Hi Cathy,

I met you this past summer, you may not remember me. I have a question.

I know a lot of people who know much more math than I do and who figure out solutions to problems more quickly than me. Whenever I come up with a solution to a problem that I’m really proud of and that I worked really hard on, they talk about how they’ve seen that problem before and all the stuff they know about it. How do I know if I’m good enough to go into math?

Thanks,

High School Kid

Dear High School Kid,

Great question, and I’m glad I can answer it, because I had almost the same experience when I was in high school and I didn’t have anyone to ask. And if you don’t mind, I’m going to answer it to anyone who reads my blog, just in case there are other young people wondering this, and especially girls, but of course not only girls.

Here’s the thing. There’s always someone faster than you. And it feels bad, especially when you feel slow, and especially when that person cares about being fast, because all of a sudden, in your confusion about all sort of things, speed seems important. But it’s not a race. Mathematics is patient and doesn’t mind. Think of it, your slowness, or lack of quickness, as a style thing but not as a shortcoming.

Why style? Over the years I’ve found that slow mathematicians have a different thing to offer than fast mathematicians, although there are exceptions (Bjorn Poonen comes to mind, who is fast but thinks things through like a slow mathematician. Love that guy). I totally didn’t define this but I think it’s true, and other mathematicians, weigh in please.

One thing that’s incredibly annoying about this concept of “fastness” when it comes to solving math problems is that, as a high school kid, you’re surrounded by math competitions, which all kind of suck. They make it seem like, to be “good” at math, you have to be fast. That’s really just not true once you grow up and start doing grownup math.

In reality, mostly of being good at math is really about how much you want to spend your time doing math. And I guess it’s true that if you’re slower you have to want to spend more time doing math, but if you love doing math then that’s totally fine. Plus, thinking about things overnight always helps me. So sleeping about math counts as time spent doing math.

[As an aside, I have figured things out so often in my sleep that it’s become my preferred way of working on problems. I often wonder if there’s a “math part” of my brain which I don’t have normal access to but which furiously works on questions during the night. That is, if I’ve spent the requisite time during the day trying to figure it out. In any case, when it works, I wake up the next morning just simply knowing the proof and it actually seems obvious. It’s just like magic.]

So here’s my advice to you, high school kid. Ignore your surroundings, ignore the math competitions, and especially ignore the annoying kids who care about doing fast math. They will slowly recede as you go to college and as high school algebra gives way to college algebra and then Galois Theory. As the math gets awesomer, the speed gets slower.

And in terms of your identity, let yourself fancy yourself a mathematician, or an astronaut, or an engineer, or whatever, because you don’t have to know exactly what it’ll be yet. But promise me you’ll take some math major courses, some real ones like Galois Theory (take Galois Theory!) and for goodness sakes don’t close off any options because of some false definition of “good at math” or because some dude (or possibly dudette) needs to care about knowing everything quickly. Believe me, as you know more you will realize more and more how little you know.

One last thing. Math is not a competitive sport. It’s one of the only existing truly crowd-sourced projects of society, and that makes it highly collaborative and community-oriented, even if the awards and prizes and media narratives about “precocious geniuses” would have you believing the opposite. And once again, it’s been around a long time and is patient to be added to by you when you have the love and time and will to do so.

Love,

Cathy

Aunt Pythia’s advice

Aunt Pythia is well-slept and excited to be here to answer your wonderful and thoughtful ethical conundrums. Please do comment on my answers, if you disagree but especially if you agree wholeheartedly and want me to keep up the good work. Love that kind of encouraging comment.

And please, don’t forget to ask me a question at the bottom of the page!

By the way, if you don’t know what the hell I’m talking about, go here for past advice columns and here for an explanation of the name Pythia.

——

Dear Aunt Pythia,

What is your text editor of choice? The most popular ones, the ones in which I know die-hard fans, are for Emacs, Vi/Vim, and Sublime. I am personally an Emacs user, but I haven’t given any other editors a chance, to be honest. Which do you prefer to use, and why?

Text Editor

Dear TE,

I use emacs mostly, and xemacs when it’s available. It’s easy, it “knows” about python and other languages, and the drop-down menu is easier than remembering keystroke commands. I’ve been known to use an IDE or two depending on codebase context. For me it’s all about ease of use and, since I’ve never been a professional engineer and so I’ve never spent a large majority of my time with source code, vim doesn’t attract me, even though everything is keystroke and you never need to use your mouse.

As an aside, I’d like to argue this point, because it’s often shrouded in weird macho crap: why not use your mouse? Does it really waste that much time? I honestly have never been prevented from coding efficiently because my arm is too tired from moving from the keyboard to the mouse and back. Is the goal really to be able to stay in the exact same position for as long as possible? I’m the kind of person that is too fidgety for such ideas. I take the “stand up and walk around every 20 minutes” rule seriously, at least before 4pm, when I become a zombie.

Good luck, young padawan!

Aunt Pythia

——

Dear Aunt Pythia,

What are your thoughts on the famous (infamous?) two-daughter problem? I have three PhDs who give different answers all of which appear to be statistically correct. Modinow says the answer is 1/2. The chair of the stats department at local university says the answer is 3/7, and a chap at Fl Coastal College has yet a 3rd answer which I have lost.

How can this be?

Tombs

Dear Tombs,

OK I’m pretty sure there’s only one answer to this if it’s stated precisely. So let’s try to do that. Here’s the question:

Suppose I have two children. One of them is a girl who was born on a Friday. What are the chances of both children being girls?

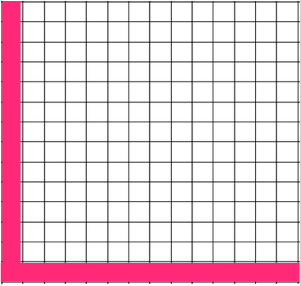

Now I’m a big fan of making things incredibly easy and visual. So what I’m going to do here is identify the fact that, as far as children go, there are two attributes of interest in this question, namely gender and day of birth. I will assume that all options are equally likely and that they are independent from each other as well as between kids, and in my first iteration I’ll draw up a list of equally likely bins for a given child, namely of either gender and of any day born. That’s 14 equally likely bins for a given single child, and that means they happen with probability 1/14.

Now, for the second iteration, let’s talk about having two kids. You have a 2-dimensional array of bins, which you arrange to be 14-by-14, and you assume that any of those 14*14 = 196 bins is a priori equally likely.

Label the bins with ordered pairs (gender, day). The x-axis is first kid, y-axis is 2nd kid. Each bin equally likely.

If you label the first bin as “(Female, Friday)” and the second bin as “(Female, Saturday)” and so on, you realize that the condition that “one of the two kids is a girl who was born on Friday” means that we already know we are working in the context where we are either in the left-most column or the bottom row. Here’s my awesome rendition of this area:

Specifically, the left bottom corner is the case where there are two girls, both born on Friday. The one to the right and above that corner refers to the case where there are two girls, one born on Friday and one born on Saturday. The stuff on the right and in the upper part of the column refers to the case where there’s a Friday girl and a boy.

Altogether we have 13 pink bins with two girls and 14 pink bins of a boy and a girl. So the overall chances of two girls, given one Friday girl, is 13/27.

I hope that’s convincing!

Aunt Pythia

——

Dear Auntie P,

What do you think about topological data analysis (some info here). Should we trust people who can’t tell the difference between their rear end and a coffee cup because the two are topologically equivalent?

Topological Fear

Dear TF,

Geez I don’t know about you but my rear end is not topologically equivalent to my coffee cups. You either need to go to a doctor or buy some coffee cups that don’t leak.

So, I don’t know very much about this stuff, but I do think it’s potentially interesting, and it’s maybe close to an idea I’ve had for a while now but for which I haven’t found a practical use. Yet.

The idea I have had, if it’s close to this idea, and I think from short conversations with people that it is, is that if you draw a bunch of scatter plots of, say, two attributes x1 and x2 and an outcome y (so you need numerical data for this), then you’ll notice in the resulting 3-dimensional blob of points some interesting topological properties. Namely, there seem to be pretty well-defined boundaries, and those boundaries might have certain kinds of curves, and there may possibly even be well-defined holes in the blob, at least if you “fatten up” the points (sufficiently but not more than necessary) and then take the union of all of the resulting spheres to be some kind of 3-d manifold. You can then play with the relationship between, say, the radius of these fattened points and the topological properties of the resulting blob.

Anyhoo, the idea could be that, if you see x1 and x2 then you can exclude a y that lives in a hole, or rather where point (x1, x2, y) would live in a hole. This is more than most kinds of modern models can do for you, but even so I’ve never seen this actually come in handy.

I hope that helps, and please do see a doctor!

Auntie P

——

Dear Aunt Pythia,

This is a reaction to a previous post (maybe Oct 12?) where you said the following:

My kids, to be clear, hate team sports and suck at them, like good nerds.

Now, as a nerd whose parents never let play team sports growing up and now plays one in college (a “nerd” sport, but still…), I have a question for you: Why do “good nerds” have to hate sports and/or suck at them? What classifies a “good nerd”? Does this generalize to other things that nerds are stereotypically bad at, like sex lives? Is there another category that should be created for nerdy type people that are also jocky-er, like a nerock or a jord?

With Love,

A “Bad Nerd”

Dear Bad Nerd,

Great question, and you’re not the only nerd that called me out on my outrageous discrimination. I wasn’t being fair to my nerock and jord friends, and that ‘aint cool. Although, statistically I believe I still have a point, there’s no reason to limit people in arbitrary ways like that, and it’s fundamentally un-nerdy of me to do so.

For all you nerocks and jords out there: you go, girls! and boys!

But just for the record, nerds are categorically excellent at sex. We all know that. Say yes.

Love,

Aunt Pythia

——

Please submit your well-specified, fun-loving, cleverly-abbreviated question to Aunt Pythia!

Alan Greenspan still doesn’t get it. #OWS

Yesterday I read Alan Greenspan’s recent article in Foreign Affairs magazine (hat tip Rhoda Schermer). It is entitled “Never Saw It Coming: Why the Financial Crisis Took Economists By Surprise,” and for those of you who want to save some time, it basically goes like this:

I’ll admit it, the macroeconomic models that we used before the crisis failed, because we assumed people financial firms behaved rationally. But now there are new models that assume predictable irrational behavior, and once we add those bells and whistles onto our existing models, we’ll be all good. Y’all can start trusting economists again.

Here’s the thing that drives me nuts about Greenspan. He is still talking about financial firms as if they are single people. He just didn’t really read Adam Smith’s Wealth of Nations, or at least didn’t understand it, because if he had, he’d have seen that Adam Smith argued against large firms in which the agendas of the individuals ran counter to the agenda of the company they worked for.

If you think about individuals inside the banks, in other words, then their individual incentives explain their behavior pretty damn well. But Greenspan ignores that and still insists on looking at the bank as a whole. Here’s a quote from the piece:

Financial firms accepted the risk that they would be unable to anticipate the onset of a crisis in time to retrench. However, they thought the risk was limited, believing that even if a crisis developed, the seemingly insatiable demand for exotic financial products would dissipate only slowly, allowing them to sell almost all their portfolios without loss. They were mistaken.

Let’s be clear. Financial firms were not “mistaken”, because legal contracts can’t think. As for the individuals working inside those firms, there was no such assumption about a slow exhale. Everyone was furiously getting their bonuses pumped up while the getting was good. People on the inside knew the market for exotic financial products would blow at some point, and that their personal risks were limited, so why not make systemic risk worse until then.

As a mathematical modeler myself, it bugs me to try to put a mathematical band-aid on an inherently failed model. We should instead build a totally new model, or even better remove the individual perverted incentives of the market using new rules (I’m using the word “rules” instead of “regulations” because people don’t hate rules as much as they hate regulations).

Wouldn’t it be nice if the agendas of the individuals inside a financial firm were more closely aligned with the financial firm? And if it was over a long period of time instead of just until the bonus day? Not impossible.

And, since I’m an occupier, I get to ask even more. Namely, wouldn’t it be even nicer if that agenda was also shared by the general public? Doable!

Mr. Greenspan, there are ways to address the mistake you economists made and continue to make, but they don’t involve fancier math models from behavioral economics. They involve really simple rule changes and, generally speaking, making finance much more boring and much less profitable.

Math pick-up lines

Wei Ho informed me of the existence of this tumblr page, which I am thinking it might help out a lot of nerds. An example:

How do you know when you’ve solved your data problem?

I’ve been really impressed by how consistently people have gone to read my post “K-Nearest Neighbors: dangerously simple,” which I back in April. Here’s a timeline of hits on that post:

I think the interest in this post is that people like having myths debunked, and are particularly interested in hearing how even the simple things that they thought they understand are possibly wrong, or at least more complicated than they’d been assuming. Either that or it’s just got a real catchy name.

Anyway, since I’m still getting hits on that post, I’m also still getting comments, and just this morning I came across a new comment by someone who calls herself “travelingactuary”. Here it is:

My understanding is that CEOs hate technical details, but do like results. So, they wouldn’t care if you used K-Nearest Neighbors, neural nets, or one that you invented yourself, so long as it actually solved a business problem for them. I guess the problem everyone faces is, if the business problem remains, is it because the analysis was lacking or some other reason? If the business is ‘solved’ is it actually solved or did someone just get lucky? That being so, if the business actually needs the classifier to classify correctly, you better hire someone who knows what they’re doing, rather than hoping the software will do it for you.

Presumably you want to sell something to Monica, and the next n Monicas who show up. If your model finds a whole lot of big spenders who then don’t, your technophobe CEO is still liable to think there’s something wrong.

I think this comment brings up the right question, namely knowing when you’ve solved your data problem, with K-Nearest Neighbors or whichever algorithms you’ve chosen to use. Unfortunately, it’s not that easy.

Here’s the thing, it’s almost never possible to tell if a data problem is truly solved. I mean, it might be a business problem where you go from losing money to making money, and in that sense you could say it’s been “solved.” But in terms of modeling, it’s very rarely a binary thing.

Why do I say that? Because, at least in my experience, it’s rare that you could possibly hope for high accuracy when you model stuff, even if it’s a classification problem. Most of the time you’re trying to achieve something better than random, some kind of edge. Often an edge is enough, but it’s nearly impossible to know if you’ve gotten the biggest edge possible.

For example, say you’re binning people you who come to your site in three equally sized groups, as “high spenders,” “medium spenders,” and “low spenders.” So if the model were random, you’d expect a third to be put into each group, and that someone who ends up as a big spender is equally likely to be in any of the three bins.

Next, say you make a model that’s better than random. How would you know that? You can measure that, for example, by comparing it to the random model, or in other words by seeing how much better you do than random. So if someone who ends up being a big spender is three times more likely to have been labeled a big spender than a low spender and twice as likely than a medium spender, you know your model is “working.”

You’d use those numbers, 3x and 2x, as a way of measuring the edge your model is giving you. You might care about other related numbers more, like whether pegged low spenders are actually low spenders. It’s up to you to decide what it means that the model is working. But even when you’ve done that carefully, and set up a daily updated monitor, the model itself still might not be optimal, and you might still be losing money.

In other words, you can be a bad modeler or a good modeler, and either way when you try to solve a specific problem you won’t really know if you did the best possible job you could have, or someone else could have with their different tools and talents.

Even so, there are standards that good modelers should follow. First and most importantly, you should always set up a model monitor to keep track of the quality of the model and see how it fares over time. Because why? Because second, you should always assume that, over time, your model will degrade, even if you are updating it regularly or even automatically. It’s of course good to know how crappy things are getting so you don’t have a false sense of accomplishment.

Keep in mind that just because it’s getting worse doesn’t mean you can easily start over again and do better. But a least you can try, and you will know when it’s worth a try. So, that’s one thing that’s good about admitting your inability to finish anything.

On to the political aspect of this issue. If you work for a CEO who absolutely hates ambiguity – and CEO’s are trained to hate ambiguity, as well as trained to never hesitate – and if that CEO wants more than anything to think their data problem has been “solved,” then you might be tempted to argue that you’ve done a phenomenal job just to make her happy. But if you’re honest, you won’t say that, because it ‘aint true.

Ironically and for these reasons, some of the most honest data people end up looking like crappy scientists because they never claim to be finished doing their job.

Yves Smith and Dean Baker discuss the Trans Pacific Partnership #OWS

Last night I watched this interview by Yves Smith and Dean Baker on billmoyers.com. I recommend it for everyone interested in learning about the secret “free trade” agreement currently under negotiation between the U.S. and a bunch of other countries which touch the Pacific Ocean.

The interview will explain why “free trade” is in quotes, because it’s really more about protecting corporate interests and extending patents than about reducing obstacles to trade:

As a member of Alt Banking, I’m particularly outraged by the financial regulation part of the treaty, which sound like a race to the bottom in terms of common laws between the countries. But probably the worst part of the treaty is related to pharmaceutical protectionism.

Near the end of the interview there’s an appeal, involving a monetary award, for people on the inside to come out and show the world exactly what the contents of the treaty contain. The award is sponsored by WikiLeaks and is crowdsourced: it currently stands at $61,252. So you can add to it if you want to sweeten the pot.

How do we fix LIBOR?

It’s kind of hard to believe, but it’s true: many of the problems that led up to the financial crisis are still with us and simply haven’t been addressed.

For example:

- There are too few banks, and they are too interconnected. This is still a huge problem, and it’s called “Too Big To Fail.”

- In fact they’re so big they can engage in criminal activity and not fear prosecution. Still true, and it’s got a name too, “Too Big To Jail.”

- Also, the credit rating agencies, who get paid by debt issuers for AAA ratings on crappy debt? They’re still alive, there are still only three of them, and they still rate debt.

- Also, remember the LIBOR rate manipulations? Still being run by asking individual traders what they’ve been paying recently, and the answers are still being taken on faith. Oh, and they’ve been asked “not be located in close proximity to traders who primarily deal in derivative products” based on Libor. That’ll work, because nobody know how to text!

I’d like to perform a thought experiment for this last one, because it seems like a solvable problem, although I will confess up front that I don’t have a solution off the top of my head. That’s where you readers come in.

Just a little background. LIBOR is (supposedly) the very short-term interest rate that banks pay each other for loans. A huge pile – hundreds of trillions of dollars worth – of derivatives in the form of futures, swaps, and loans are tied to the LIBOR, and most of them seems to reference the three-month rate. Here’s a NY Times graphic explaining how it works and explaining how the fraud played out at Barclay’s.

So what are the attributes of the benchmark that make LIBOR so important and so widely used? And how would we start using something else instead?

Let’s answer that second question first. If we could find another 3-month benchmark rate with good properties, we could start writing contracts based on the new rate from now on, while continuing to compute LIBOR until the existing contracts have played out and LIBOR would be grandfathered out of the market.

Now on to the first question, a list critical attributes of this rate.

- It’s supposed to reflect very short-term kinds of risk, which means you don’t want to base it on, say, long term treasuries.

- It should be public data, so we don’t have manipulation behind the scenes

- But it shouldn’t be based on a market that is so small that it is worth losing money on that small market to manipulate the new LIBOR rates. Remember, the derivatives market that uses that rate is enormous, so if we base the rate on a smallish if transparent market, that would just invite market manipulation for that small market.

- The point of LIBOR-based derivatives is that it’s a floating rate, which means that as credit gets tighter or looser so does the rate references in a given derivative. But of course LIBOR is a very bank-specific kind of credit. So it’s not just “as credit gets tighter or looser” but rather “as interbank credit gets tighter or looser” (and here I’m ignoring the manipulation, since when bank credit actually got tighter, it wasn’t actually reflected in LIBOR rates).

- So I guess my question is, do we actually want bank-specific credit rates? Isn’t it good enough to have a market-wide concept of credit tightness? For most people who own one side of those LIBOR-based derivatives, I’m sure their own access to credit matters more to them than some London bank’s access, although I’m also sure there’s a relationship between the two.

I’m asking you readers to put up suggestions or explain how we can do without LIBOR altogether.

Aunt Pythia’s advice

Aunt Pythia lovers! Please rest assured that Aunt Pythia took a much-needed one week rest but is now back and is bigger and better than before!

What?! YES!!!

And please, don’t forget to ask me a question at the bottom of the page!

By the way, if you don’t know what the hell I’m talking about, go here for past advice columns and here for an explanation of the name Pythia.

——

Dear Aunt Pythia,

I have been dating a guy for 6 months, and realized that I have been suffering due to his “too direct” way of communicating, a.k.a. criticizing me too much.

Everything is bad, he said my skin will look better if I exfoliate more, he said the shoes I wear looked too cheap on me, or that I should use different deodorant because the one I am using right now is “failing”, and the worse, he said I have bad breath.

I understand that I should not take criticism too personal, and it reminds me that I have many things to improve, but he made me feel horrible and I’m losing confidence.

I really want to break up with him because I don’t think he loves me, but he keeps on saying that he does, and despite all those critics, he stays in this relationship with me. What should I do?

I Am Sad

Dear Sad,

A few things.

First, what you’ve described is a classic case of someone (namely, a jerk) projecting their insecurities onto someone else (namely, you). He does it through accusations, and as a good friend explained to me, people accuse you of the thing they are guilty of. So next time he accuses you of having bad breath, realize it is he who is sensitive to his breath. So your first task is to flip those statements around every time they come out of his mouth.

Next, I know it’s easier said than done, but I want you to work on flipping more than just his words. I want you to start realizing that when you say “he stays in this relationship with me” it means that it’s up to him, whereas it’s really just as much up to you. In other words, you’ve given him all the power to decide whether this relationship is going to continue. You didn’t even tell me if you love him, only that he loves you (or at least claims to), which is another indication that you feel powerless and your emotions are irrelevant. So they second task I’d like you to try is to flip that mindset around and realize that, given how insecure and mean he is, he’s lucky you haven’t broken up with him. You have the power to end this, even if you haven’t exerted it yet.

Finally, I want you to address this stuff with him (if you do indeed love him – otherwise skip to last four words of this paragraph). Once you’ve learned to recognize his projections for insecure and mean barbs, and once you realize the power you have in that relationship, I’d like you to tell him that you have standards for a high quality of life, and this treatment is not meeting those standards, so he needs to stop. And if he can’t, then break up with him.

Good luck!

Aunt Pythia

——

Aunt Pythia,

If I drink quickly enough and pee slowly enough simultaneously, do you think I could pee forever?

Aspiring Guinness

Dear AG,

Dunno but please do document your efforts.

AP

——

Dear Aunt Pythia,

How do you find the time to work as a data scientist, be a mom, write daily blog posts, organize Occupy/hacker events and still maintain a sense of humor? I’ve got one job, one hobby, no kids and can do little more than collapse on my day off. I don’t even have a TV.

What’s your secret? Are you one of those amazing people who only needs four hours of sleep per night?

More energy hopeful

Dear More,

I’ve been asked this question before and, although I will tell you my “secrets”, I’m guessing you are underplaying all the stuff you actually do. To convince yourself of that, think about how your best friend would describe you, not how you did above. Just sayin’. OK here goes.

First of all, I’m a huge sleep hog. I think that’s one of my secrets, which is that I don’t deny myself sleep. I often fall asleep before my kids, who are themselves sleep hogs and go to bed at 9:30 [Update: after reading this my oldest son insists that he is not a sleep hog and that the 9:30 bedtime is mandated by the dictator who is his mother]. I also take naps whenever I can. Love naps.

I generally think people shortchange their own sleep thinking it will make them more efficient, when in fact it does the opposite. A great night’s sleep sees me jumping out of bed at 6am to blog some point that got me all in a huff the day before. I can’t wait! I’m excited to do it!

The second thing I want to mention is that I’m a scrupulous planner, and I have enormously high (extremely personal) standards for my activities. I say “no” almost all the time to almost everything, so I can spend more time doing stuff I love like watching Star Trek: Deep Space 9 with my kids and taking naps. That means I’m a persona non grata when it comes to, say, the PTA, where my policy is that if my husband won’t do it, neither will I (and he basically won’t do anything).

Third, what with all the reinventing I’ve done over the years, I don’t hover needlessly over my own decisions. I write a blog post, then publish it. I give myself 1.5 times as long to prepare a talk as the talk will last, a trick I learned from my teaching experience. If things suck, I take it in stride, make a mental note to myself, and move on. In other words, I’m ruthlessly efficient and my skin is thick. It means I’m not a stickler for details but I get through more stuff than otherwise.

Finally, I really like and trust the people I meet and work with. It sometimes burns me but then again almost always works out, and I’d recommend it overall, especially if paired with a natural or learned resilience to disappointments, which gets easier when you have a fantastic support system. That means I’m always psyched to work on the next project with other people and that energy feeds me and gets me going.

I hope that helps!

Aunt Pythia

——

Dearest Aunt Pythia,

I’m a young math professor, and, as you know is typical, this career entails for me a certain level of travel to conferences. Lately, I’ve realized that the colleagues that I meet regularly at conferences are a sad bunch of life cripples. Totally lacking in beneficial social graces and unable to hold even just a slightly decent conversation of non-trivial length (especially one not involving mathematics), I feel continually shocked when around them, particularly by the unsubtle, autistic fashion in which they interrogate me about my personal life, professional activities, collaborations, etc.

Could you suggest any techniques for coping with interactions with them? How can I survive, or even have a little fun in this bad party I’m stuck in? Also, does Aunt Pythia have any ideas for minimizing the anxiety that I’m struck with prior to attending a conference?

Keep up the frank work,

Pitiable In The Suburbs

Dear Pitiable,

I’m afraid I’m going to have to use my previous advice against you. You are accusing these guys of all sorts of things that you yourself are guilty of. In particular, you don’t sound like someone overbrimming with social graces when you call people “cripples”.

And when I pair your nasty and dismissive tone with the acknowledged anxiety you experience before going to a conference, I am forced to conclude that you are projecting anxiety and insecurity onto these nerds.

Look, I’ve been to a LOT of conferences, and I agree that there are lots of awkward moments. And yes, there are lots of people that are on the autism spectrum in mathematics. But those people are still really wonderful in general and I have always found a way to enjoy myself with great company. In fact I cannot remember a conference I went to that I didn’t end up enjoying once I sought out the people with whom I click. Even at Oberwolfach, the most macho of all places, I managed to find some bridge partners and beer.

My advice to you: spend a lot of time willfully separating your anxiety from other people’s flaws, and set yourself the task to find something beautiful, or at least amusing, in every person you meet at your next conference. And take it from me, there are assholes in math, but they are typically pretty minor league compared to, say, the finance assholes or the Silicon Valley assholes.

Good luck!

Aunt Pythia

——

Please submit your well-specified, fun-loving, cleverly-abbreviated question to Aunt Pythia!

The private-data-for-services trade fallacy

I had a great time at Harvard Wednesday giving my talk (prezi here) about modeling challenges. The audience was fantastic and truly interdisciplinary, and they pushed back and challenged me in a great way. I’m glad I went and I’m glad Tess Wise invited me.

One issue that came up is something I want to talk about today, because I hear it all the time and it’s really starting to bug me.

Namely, the fallacy that people, especially young people, are “happy to give away their private data in order to get the services they love on the internet”. The actual quote came from the IBM guy on the congressional subcommittee panel on big data, which I blogged about here (point #7), but I’ve started to hear that reasoning more and more often from people who insist on side-stepping the issue of data privacy regulation.

Here’s the thing. It’s not that people don’t click “yes” on those privacy forms. They do click yes, and I acknowledge that. The real problem is that people generally have no clue what it is they’re trading.

In other words, this idea of a omniscient market participant with perfect information making a well-informed trade, which we’ve already seen is not the case in the actual market, is doubly or triply not the case when you think about young people giving away private data for the sake of a phone app.

Just to be clear about what these market participants don’t know, I’ll make a short list:

- They probably don’t know that their data is aggregated, bought, and sold by Acxiom, which they’ve probably never heard of.

- They probably don’t know that Facebook and other social media companies sell stuff about them even if their friends don’t see it and even though it’s often “de-identified”. Think about this next time you sign up for a service like “Bang With Friends,” which works through Facebook.

- They probably don’t know how good algorithms are getting at identifying de-identified information.

- They probably don’t know how this kind of information is used by companies to profile users who ask for credit or try to get a job.

Conclusion: people are ignorant of what they’re giving away to play Candy Crush Saga[1]. And whatever it is they’re giving away, it’s something way far in the future that they’re not worried about right now. In any case it’s not a fair trade by any means, and we should stop referring to it as such.

What is it instead? I’d say it’s a trick. A trick which plays on our own impulses and short-sightedness and possibly even a kind of addiction to shiny toys in the form of candy. If you give me your future, I’ll give you a shiny toy to play with right now. People who click “yes” are not signaling that they’ve thought deeply about the consequences of giving their data away, and they are certainly not making the definitive political statement that we don’t need privacy regulation.

1. I actually don’t know the data privacy rules for Candy Crush and can’t seem to find them, for example here. Please tell me if you know what they are.

Harvard Applied Statistics workshop today

I’m on an Amtrak train to Boston today to give a talk in the Applied Statistics workshop at Harvard, which is run out of the Harvard Institute for Quantiative Social Science. I was kindly invited by Tess Wise, a Ph.D. student in the Department of Government at Harvard who is organizing this workshop.

My title is “Data Skepticism in Industry” but as I wrote the talk (link to my prezi here) it transformed a bit and now it’s more about the problems not only for data professionals inside industry but for the public as well. So I talk about creepy models and how there are multiple longterm feedback loops having a degrading effect on culture and democracy in the name of short-term profits.

Since we’re on the subject of creepy, my train reading this morning is this book entitled “Murdoch’s Politics,” which talks about how Rupert Murdoch lives by design in the center of all things creepy.