The sin of debt (part 2)

I wrote a post about a month ago about the sin of debt and how, for normal people, debt carries a moral weight that isn’t present for corporations (even though corporations are people). Since then I’ve noticed some egregious examples of this phenomenon which I want to share with you.

Warning: this post contains really sickening stuff. I usually try to think of how to solve problems (I really do!) but today I’m just in awe of the problems themselves. Maybe I’ll eventually come up with a “part 3” for this post and have some good, proactive ideas (please help!).

First, there’s this article from the Wall Street Journal which discusses the fact that people are being arrested and put in jail for their credit card, auto loan, and other debt:

More than one-third of U.S. states allow borrowers who can’t or won’t pay to be jailed. Nationwide statistics aren’t known because many courts don’t keep track of warrants by alleged offense, but a tally by The Wall Street Journal earlier this year of court filings in nine counties across the U.S. showed that judges signed off on more than 5,000 such warrants since the start of 2010.

…

Some judges have criticized the use of such warrants, comparing them to a modern-day version of debtors’ prison. Ms. Madigan said she has grown increasingly concerned that borrowers sometimes are being thrown into jail without even knowing they were sued, a problem she blames on sloppy, incomplete or false paperwork submitted to courts.

Outrageous. To contrast that, let’s take a peek at the tone of a Reuters article on AMR bankruptcy filing; AMR is the parent company of American Airlines. From the article:

American plans to operate normally while in bankruptcy, but the Chapter 11 filing could punch a hole in the pensions of roughly 130,000 workers and retirees.

AMR pension plans are $10 billion short of what the carrier owes, and any default could be the largest in U.S. history, government pension insurers estimated.

Ray Neidl, aerospace analyst at Maxim Group, said a lack of progress in contract talks with pilots tipped the carrier into Chapter 11, though it has enough cash to operate. The carrier’s passenger planes average 3,000 daily U.S. departures.

“They were proactive,” Neidl said. “They should have adequate cash reserves to get through this.”

So from where I stand, it looks like this company is being applauded for its bankruptcy filing because it’s such a great opportunity to get rid of pesky pensions from its 130,000 workers and retirees. Note there’s nothing about AMR or American Airlines executives being arrested and brought to jail here.

Finally, there’s the “debt as sin” theme amplified by mourning. This Wall Street Journal article describes the practice that debt collection agencies use to harass the living relatives of people who have passed away in debt. From the article:

Debt collectors often tell surviving family members that they aren’t personally responsible for paying the debts of the deceased. But those words barely register with grieving relatives, according to interviews with a dozen lawyers who represent about 60 families pursued for money owed by dead relatives.

“Each call brought up fresh memories of my husband’s death,” Patricia Smith, 56, says about the calls she started getting last year about $1,787.04 in credit-card debt owed by her late husband, Arthur.

The debt-collection calls and letters kept coming and wore her down, says Mrs. Smith, who lives in Jackson, Miss. She agreed to scrounge together $50 a month “just to make the calls stop.”

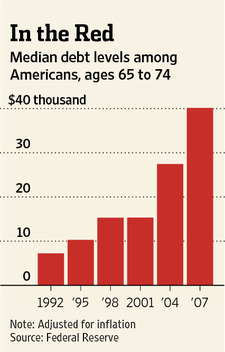

The Wall Street Journal provides a graphic to explain why this is a growing field for debt collectors:

You might ask what the relevant regulator, the Federal Trade Commission (FTC), is doing about this practice. From the article:

Still, the agency determined the previous guidelines were ineffective and “too constricting,” Mr. Dolan says. So, in July, the agency issued a policy statement. Before the new guidelines, collectors were supposed to discuss a dead person’s debt only with the person’s spouse or someone chosen by the dead person’s estate. But Mr. Dolan said few debtors are formally designating someone to handle their affairs after death, leaving debt-collection firms unable to determine whom to contact for payment of any outstanding bills.

The FTC sought to improve the process and now allows debt-collection firms to contact anyone believed to be handling the estate, including parents, friends and neighbors. Agency officials wanted to resolve a “tension that was emerging” between state and U.S. laws on how collectors can go after money, Mr. Dolan adds. “While people might think it is horrible for collectors to speak with surviving spouses, we have no power to change that.”

FTC officials rejected requests by lawyers representing family members for an outright ban on calling surviving family members. The agency also declined to impose a cooling-off period during which relatives couldn’t be contacted by debt collectors.

Thanks, FTC! Thanks for representing the little guy, with the dead wife.

Great post!

I grew up in a poor country where there is no bankruptcy law for normal people. So, you go to jail and the lender (bank or microfinance institution) has the right to seize all your properties if you can’t pay back the loan.

Here, people always blame the banks for predatory lending practice but I think the consumers are to blame, too. Nobody points a gun at your head that you have to sign up for those offers you get through the mail. I notice that many people taking advantages of the system by going into debt, using their credit cards without paying them in full for unnecessary spending (buying stuff, traveling abroad, cruise,…).

I steal a comment I read on NYT: “If corporations are people, then they should go to jail, too.”

Unfortunately, that hasn’t happened yet. I think that’s the first reason why the OWS movement started.

LikeLike

I read all three of those articles–great job tying the thread together!

FoW

LikeLike