Archive

Why not bored and brilliant kids?

If you’re like me you’ve been listening on public radio for the last couple of weeks to a “New Tech City” challenge called Bored and Brilliant, focused on getting people to stop checking their phones for email, twitter, and games. The idea is that “your most creative moments happen when you’re bored,” so try to let yourself be bored. The challenge ended yesterday.

I liked the challenge, since I’ve been on record that I’d like to be bored for the last couple of decades (very unsuccessfully!). It’s a constant goal of mine, and I thought it was obvious that boredom creates moments of creativity.

That’s not to say I don’t get addicted to games on my phone – curse you Candy Crush! – but I do delete them with regularity. And I always cherish the couple of days when I’ve lost my phone but before I get my new one. Sweet freedom!

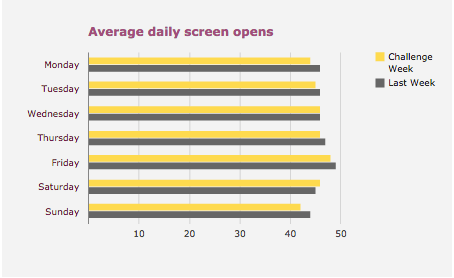

Anyhoo, two points. First, the challenge didn’t have an enormous effect on actual phone usage for the people who signed up for it (other data is here and looks similar):

That doesn’t surprise me, but even changing people’s mind about whether it’s good to be bored is a worthy secondary goal.

Which brings me to my second point, namely, why don’t we let our kids get bored if we think it’s so great? I mean, I deliberately keep my kids virtually unscheduled outside of their school and homework. To be fair I mean the older kids, who are 12 and 14. The 6-year-old still goes to after school most days, although he comes home with his 12-year-old brother on Thursdays to do absolutely nothing. But that doesn’t seem to be the general practice of most other parents nowadays, including, I’d bet, quite a few of the participants in the “Bored and Brilliant” project. What gives?

After all, kids aren’t addicted to phones (yet), and they don’t have as many family responsibilities, and they do have plenty of reasons and avenues to be incredibly creative. My best moments of childhood – playing music, forming lifelong friendships, reading Dostoyevsky, and yes, experimenting with things – only happened because I was utterly without other grown-up plans.

Where does all that settlement money go?

In the Alternative Banking meeting yesterday we kicked things off with a great visit from Katya Cohen, author of a new book called The American Spellbound, where she describes the fictional account of a women working in a large bank and learning to fit in with the mindset of greed combined with a superhero complex. Good stuff, and it explains at least a little bit to me about what the heck was going on in the one outrageous Robin Hood Foundation awards night dinner I went to at Cipriani way back when.

After that we talked for a bit about the recent S&P settlement with the Justice Department, which was one of those nobody-goes-to-jail deals that cost $1.5 billion.

Now, that’s a lot of money to you and me, but it’s not that much to huge financial institutions; in the case of S&P it’s about two years of profit, depending of course on which two years you’re talking about:

That’s not what we focused on yesterday, though, because it’s really old news. All these massive settlements are relatively manageable for the financial companies that end up paying them. In fact that is implicitly part of the deal, and it’s part of why the system is so contemptible. In the end, the settlements don’t substantially threaten business as usual. Instead, as Gerald mentioned, you should take the word literally: the settlements do nothing but “settle” things back to the way they were.

That brings us to the question we focused on yesterday: where does all this money go? It’s big money after all, and if it goes into state coffers, to be used as Cuomo or whomever sees fit, then the concern is that, as corrupt as this system is, there will be powerful forces at work to keep it just like this. If a given state (New York State, I’m looking at you) gets addicted to this cash flow, there will be no reason to change tactics and, instead of massive fines, simply jail wrong doers and break up or dissolve corrupt institutions.

In fact, if you think about it, there will even be reasons for places like New York State to allow wrongdoing in order to cash in for the settlement a few years later. The more you think about it, the more this “big fines but no jail time” settlement practice we now have in place seems like a way to legalize and tax crime.

Anyhoo, we might be getting ahead of ourselves (although, equally, we might be late to this game) and so we’d like to follow the money. Where does the settlement money go? Do the funds earmarked for “victims” actually go to victims? Is this information available beyond vague statements like “S&P parent McGraw Hill Financial Inc, said it will pay $687.5 million to the U.S. Department of Justice, and $687.5 million to 19 states and the District of Columbia, which had filed similar lawsuits over the ratings“? Can we build an infographic to see who might be compromised in terms of demanding and enacting a more functional white-collar crime system?

Aunt Pythia’s advice

Holy shit, guys, it’s already fucking February, and Aunt Pythia isn’t ready for Spring at all. Spring is when things get frighteningly beautiful and distracting and the cycle of nature breaks our hearts and blah blah blah and a certain something is due, and Aunt Pythia would rather it stay mid-January for a while yet, do you dig?

Speaking of being distracted (or not!), someone sent me this link (hat tip name withheld for privacy protection) that’s supposed to be “porn for women”:

The book’s description:

Prepare to enter a fantasy world. A world where clothes get folded just so, delicious dinners await, and flatulence is just not that funny. Give the fairer sex what they really want beautiful PG photos of hunky men cooking, listening, asking for directions, accompanied by steamy captions: “I love a clean house!” or “As long as I have two legs to walk on, you’ll never take out the trash.” Now this is porn that will leave women begging for more!

Talk about perverted! You’d have to be a real fetish freak to be turned on by stuff like that. Personally, and Aunt Pythia doesn’t know about you, but Aunt Pythia prefers the kind of book that involves penises and vaginas.

And, good news on that front: when scouring the web with the phrase “porn for women,” it turned up this book list entitled 10 Sexy Books That’ll Make You Forget ’50 Shades Of Grey’ (Warning: Don’t read bad erotica. It’s bad for your vagina.).

Let’s start there, shall we? And if we ever find ourselves really falling off the deep end we can try out the above smut with vacuum cleaners, but Aunt Pythia highly doubts it will ever come to that. Plus, let’s face it, flatulence is always funny.

Which reminds me, I’m supposed to be farting out some advice to you wonderful and patient people. Let’s start this immediately, with the understand that, at the end of the column, you might just be willing to:

ask Aunt Pythia a question at the bottom of the page!

By the way, if you don’t know what the hell Aunt Pythia is talking about, go here for past advice columns and here for an explanation of the name Pythia.

——

Dear Aunt Pythia,

I’m a guy and a grad student and I was talking to a fellow grad student, Z, about gender issues in academia. Specifically, I was arguing that gender plays a role in fellowship/scholarship selection and college admissions, and she claimed that no, an applicant’s sex does not have any detectable influence on such decisions. We started talking about affirmative action and before we had time to even discuss the implications of affirmative action, she had to go to class and I thought that was the end of it.

A week or two later, one of my friends, Y, lets me know that Z had told her and several people that I had made some sexist comments. I was shocked and decided to confront her about it the next day. I said, “I heard from a friend that you’ve been telling people I made sexist comments.” When I asked her whether she had told anyone I made sexist comments she said no. I then asked her what she thought about our talk about gender issues several weeks ago, and she said essentially that some people think gender plays a larger role in fellowship selection than it really does. I told her that I agreed with her, some people exaggerate who big a role it plays and that people who obtained these fellowships obviously deserved them, but that gender does play a minor role. I asked her a few more times whether she had said anything to anyone even as an offhand remark (and in the least aggressive way as I could), to which she replied no each time.

I have little doubt that she did tell people about our talk and report to them without context what I had said, but I don’t understand why she wouldn’t just admit it and talk more about it. Of course any statements, even factual ones, in support of the thesis: being female sometimes helps in getting scholarships and in college admissions, is terribly easy to twist into a sexist remark, and I think that’s probably what happened in this case. I don’t think intrinsically this is a sexist stance—it is a statement about the nature of the system, not one about the abilities of women. Am I crazy?

This whole experience has been extremely frustrating for me. Discussion about sensitive issues shouldn’t result in someone being labeled a sexist. How can we understand it if we can’t even talk without people getting defensive? Now I don’t know whether other people in the department who have heard the gossip and don’t know me think I’m a sexist. What should I do?

Gossiped About And Hurt Humongously

Dear GAAHH,

Life lesson learned! Or, otherwise put, you play with fire you gonna get burned.

Here’s the mistake you made. You talked to a person you didn’t really know, when you didn’t have enough time to have a proper conversation, about how “people like them” have it less tough than “people like you.” And even though it is not what you meant to say, that’s how it came across, and you’re going to have to live with that. Have you tried to imagine how that came across to her? Not great.

Also, it sounds like you decided to spend your time trying to prevent people from thinking you’re an asshole, but that will only make matters worse, because you haven’t acknowledged any mistake, real or perceived.

In other words, if you want to make things right with the woman you originally talked to, here’s what you don’t do: accuse her of telling lies about you, since that would make her defensive, and moreover, she wasn’t telling lies. She was telling people how she felt after your conversation. In her shoes I probably would have done the same thing, in fact, and if you came up to me afterwards and said, “hey, did you tell people I’m sexist?” I would deny it too, since after all it’s not my problem, it’s yours.

Here’s what you could do that may or may not work, depending on how deep the hole is that you dug already: write a letter to her showing you know how much sexism is in the field of mathematics, with reference to various double blind experiments that show how people assume women don’t understand stuff, how they write weaker letters of recommendation, and so on, and conclude with an acknowledgement that the system has to make up for that in order to be fair. And that, moreover, the result of that system is still probably not sufficient, given how few women there are, but that in any case the women that are in the grad program, on average, are clearly just as strong, and quite possibly stronger, than the men. Finish the letter by apologizing if it came out wrong the first time but now you’ve learned you lesson.

Good luck!

Aunt Pythia

p.s. I’d be happy to publish your apology letter once it’s complete. That way other confused men (and women!) can use it too.

p.p.s. I notice you signed off “gossiped about and hurt humongously.” Hopefully you can understand that you were likely gossiped about because you hurt someone else humongously, and that this is just as much about them than about you. Which is not to say you haven’t been hurt, but if we spend all our time licking our own wounds rather than understanding what went wrong, then no progress will be made. I do actually think this turn out well, but it will require you to think about what you did, and to make amends for that first, before trying to address yourself.

——

Dear Aunt Pythia,

I take my six-year old daughter to school on subway every day. Recently, ads appeared on our line, which sometimes happen to be right in front of us, for the Museum of Sex, or “MoSex” (incidentally, located around the corner from MoMath). They include the quote “Like a Willy Wonka sex dream!”

My daughter hasn’t asked anything yet, and probably hasn’t paid any attention. I still think it’s inappropriate. Sex may be great fun and entertainment to some, but shouldn’t be advertised as such to children. Am I a prude?

Anyway, I was bothered enough to write a complaint on the MTA website. I got a response:

“As you may know, the MTA’s Board had enacted an advertising guideline that prohibited ads that are demeaning to people on account of their race, sex, religion or national origin, but that guideline was recently struck down by a federal court as inconsistent with the First Amendment. As a result, the MTA is prohibited from applying that standard to restrict ads and must post the ad in question. As we have sought to make clear by requiring prominent disclaimers, the MTA does not endorse or support this or any other paid advertisement that appears in the MTA system. The MTA displays advertisements in the system to generate much-needed revenue to support the MTA’s vital transportation function.”

The response makes me angrier.

Is there anything else I can do? Or should do? Or should I relax and be grateful there is no outright pornography in the subway? Or should I be sad about it? It could also generate much-needed revenue…

Not a fan of MoSex

Dear Not a fan,

It’s New York. And your kid hasn’t actually complained. Personally I find the constant barrage of sexualized advertisements with perfect plastic people more demeaning than straight up sex museum advertising, but I don’t know who to complain to about that.

Luckily, you do have lots of power in this situation, since it’s your kid. Namely, you can talk to her about how ads manipulate people and make her aware of stuff before they reach puberty but after she start actually reading the ads.

Those are some of the best parent-to-kid conversations I’ve ever had, and they basically sparked an ongoing game, whereby my two teenagers compete to explain what the “underlying message” of any advertisement or TV show is (but my 6-year-old doesn’t understand what we’re talking about and that’s fine). It’s fun! It’s life!

Good luck,

Aunt Pythia

——

Dear Aunt Pythia,

I am a man, not exactly young (I have grand-daughters in high school and college now, and I retired one year ago). My quandary is the following: I have been diagnosed with prostatic cancer and the prognosis if I don’t have surgery is bleak: between one and two years. But the prognosis if I have surgery is bleak as well: even if the hospital I go to has very good reputation, the risk of relapse combined to the pain of post-op, the damage to urinary and most importantly for me to sexual function would probably make me miserable for say five or ten years I would possibly gain with this procedure. I feel very much like choosing to spend the next two years having all the great sex we want with my lovely wife, put my scientific papers in order and damn the cancer anyway.

What is your opinion?

Shadow Or/And Prey

Dear SOAP,

It’s your life! And if you have the option to have more sex with your hot wife, I say go for it. People overemphasize length of life over quality of life.

Aunt P

——

Hi Aunt Pythia,

I have a higher libido then my boyfriend, who I love very much. How can I satisfy both our needs? I find it would be awkward to “help” myself if he is there, we live together. I think I would be up for doing it everyday, for about 2/3 of the month, he, far less so… On a related note, is there good erotica you would recommend?

On a completely unrelated note, what was your advisor student relationship dynamic like back in your math phd years? I have had both a young advisor and a relatively old one (current) and find that the two operate very differently. With the younger one, we talked a lot, whereas with my current one, I am left with a question and it’s harder to talk to him about intuitions for the problem…etc. We also meet weekly, but I feel like it is harder to speak about a problem with him. How can I improve this to a working relationship that is more similar to the one I had before (in case you are wondering why the previous one is over, it was for an undergraduate research project).

Love,

NYMPHO

Dear NYMPHO,

Masturbate! Masturbate until you’re raw, if that works! If your fingers get tired, consider getting an electric vibrator, they are easily available.

And if you find masturbating awkward, keep in mind that the alternatives are often way more so. And hopefully the above-mentioned erotica will help. Please send me reviews of each and every book on that motherfucking list.

As for the advisee situation, experiment on more structure in your meetings with him, until you find a format that leads to better and more fluent conversations. For example, tell him to come each week prepared with three specific questions. And think about it from his perspective, he’s so lost he probably doesn’t even know how to describe how lost he is, and giving him a task to complete, even if it’s just “write a list of three questions for me,” might help him a lot.

UPDATE: some eagle-eyed readers noticed I likely misinterpreted your question. I thought you were the advisor, not the student. Now that I’ve been set straight, though, I wouldn’t change my advise too much. Set yourself the goal of asking three specific questions, and see how that goes. Tell your advisor you’d like to improve the fluency of your conversations and you’re trying different things towards that end. Tell your advisor it’s important to you to have an easy conversational relationship with them.

Good luck!

Aunt Pythia

——

Well, you’ve wasted yet another Saturday morning with Aunt Pythia! I hope you’re satisfied! If you could, please ask me a question. And don’t forget to make an amazing sign-off, they make me very very happy.

Click here for a form or just do it now:

I Love you Mathbabe, but 529 Plans are Awesome.

This is a guest post by FogOfWar, who disagrees with me about 529 plans and my plan to make paying for college harder.

I’m catching up on the 529 kerfuffle. First observation: this made a massively outsized splash in public perception compared to what one would expect from a technical tax provision, which (more on this later) has a budgetary impact within a 5% confidence interval of $0.

Second observation: my good friend Cathy, who has kids mind you, is arguing against the 529 plan. Huh? When did we enter the Twilight Zone? Beating up on 529 plans is like stealing oatmeal from orphans—they’re too small to defend themselves, you don’t really get much if you win and everyone loves the soot- smudged little munchkins.

So here is what may be patient zero: this GAO Report released in 2012. The headlines read right into the talking points people are quoting. If you’re going to read it, try an interesting thought experiment: mentally substitute “401(k)” for “529” and “saving for retirement” for “saving for college” everywhere you see it. That’s not a completely fair analogy, but neither is it completely unfair…

Also, right at the beginning of the report, there’s an interesting omission. It’s in the “who did we talk with to figure out what was going on here?” section. Not that the report did a bad job, but why didn’t they talk to the AICPA (the national organization of CPAs)? These are the people who are most commonly on the ground talking to clients (rich and poor alike) about whether a 529 plan makes sense for them. I think you’d get a slightly different focus in the report with this on the ground perspective.

529 Plans Work Really Well for Everyone but the Very Rich and the Actually Poor

You can define ‘rich and poor’ in a hundred different ways, so let’s pick 4 examples in a semi-arbitrary manner. All couples are two parents and 1 kid who is 3, and all live in NYC. Couple 1 (“poor”) earned $20,000 last year; Couple 2 (“middle class”) earned $75,000 last year; Couple 3 (“mass affluent”, or “the bottom 1% of the top 1%”) earned $250,000 last year and Couple 4 (“rich”) earned $3-5m last year. Each couple has $100.00 of extra funds and is deciding what to do with it.

Important note: that’s not “$100x” as code for $100,000.00, that’s really $100.00.

Everything we’re talking about here is downwardly scalable and transaction costs are minimal (the cost of a stamp or time to set up direct deposit/withdrawal). All the couples have student loans, which are charging them 5%. Assume a stable long term low-risk portfolio also returns 5% (this is a side debate, but for those wanting to make it higher, I’d say you should consider your returns on a risk-adjusted basis).

Each couple has 3 rough choices, A: contribute the $100.00 to a 529 for kids, B: invest the $100.00 outside the 529 plan for kids, C: pay down $100.00 of student loans.

Poor Couple: Well, these guys get no state tax advantage from making the initial 529 contribution, and given their tax rate, the compounding on the 529 earnings has a negligible tax impact. Plus they’re giving up liquidity, which has more value in their hands than it does in the higher income cohort. Not only that, but I believe (chime in if you know this for sure) that moving the $100.00 from parent’s account to 529 account moves the asset from “parent asset” to “child’s asset” on many (but not all) needs-based financial aid forms. In short, the 529 plan is a terrible idea for this couple.

The real question is whether they should pay down the student loans or invest the $100.00 outside. That question is more subtle, but the availability of the student-loan interest deduction (lower after-tax return on debt paydown) and liquidity considerations makes $100.00 outside investment the likely best option.

Basically the tax code (this portion) combined with student aid gives no incentive for this couple to save and maybe a disincentive (or maybe an incentive to buy physical silver and not declare it on fin aid forms).

Middle Class Couple: At $75,000 the couple is still getting the tax shield for their student loans. So, at a combined Federal/State rate approaching 25% (NYC is a very high-tax place to live), their ROI (Return On Investment) from paying down student loan debt will be only 3.75%, compounding. So cash in pocket of $3.75 in year 1, $3.89 in year 2, etc. Their return on outside investment is sorta the same, with a big caveat. It’s all in the taxes. If middle class couple is invested in mutual funds or bonds, then yes, it’s $3.75 in year 1, $3.89 in year 2, etc. If Middle Class Couple is tax smart, they’ll invest only in low-dividend/high-growth stocks that will compound over the next 15 years before being cashed out to pay for kid’s college. In this case, the taxes are much, much lower—not zero, but much closer.

Doing some quick math: if the $5 in appreciation is going to be taxed at 20% capital gains 15 years from today, that makes the current tax cost = ($5.00*20%)/(1+0.05)^15 or $0.48. So year 1 the stock investment gains $4.52 compared to $3.75 from paying down student loans.

That’s not the full analysis, however, as (i) that difference compounds over the next 15 years, and (ii) the compounding is on $5.00, not $3.75, so it’s even more powerful. Run a quick spreadsheet and the student loan deduction compounds to $173.70 over 15 years and the stock investment runs to $186.31 after cash-out capial gains. Note that I’m assuming that student debt “savings” are reinvested in additional paydowns of student debt (somewhat for simplicity).

There’s a more subtle point as well: income is dynamic, not static, and thus tax brackets and availability of tax benefits is not locked in. If their income increases over time (as is very likely to happen statistically), they may knock themselves out of the deductibility of the student loan interest, which would cut back to paying down debt. OTOH, liquidity concerns (which are hard to reduce to a single dollar value but are extremely important) push towards the stock investment. Complicated analysis and everything above should be the starting point not the ending point if you’re looking at this choice in real life.

Now let’s add 529 Plans to the mix. Because the couple is NYC resident, they get an immediate tax advantage of $10 cash-in pocket state tax advantage (this assumes no itemizing, which is just over the cusp of reasonable given the numbers). The compounding is 100% tax free, either now or on distribution, so right away the earnings are $5.00 in year 1, compared to $4.52 and $3.75 for the other two options.

But that’s not all: the $10 in pocket is also invested—let’s assume in 5% stock investments, as above, so there’s an additional $0.45 return on that, making the 529 earnings in year one a Patriots four-time superbowl championship winner at $5.45. Not only that, but the benefit compounds over time, so the 15-year return is $226.52, all in. 30% higher than paying off student debt on an after-tax basis.

Liquidity is still a concern, although 529 plans have more liquidity than paying off student debt (b/c of ‘wrong way risk’ but that’s another discussion)—you can at least get at the money, but you have to pay a 10% penalty. Also, all of these numbers get much more dramatic if you assume investment in the stock market at a 10% rate of return over time, rather than the more conservative 5% rate of return I’ve worked with. Also, if you factor in dynamic tax rates the 529 becomes even more attractive, as the tax cut from investment income gets higher in the out years.

Takeaway? The 529 plan is an extremely powerful tool for the true working class.

Second Takeaway: running some quick numbers, about 46% of the benefit over the ‘buy and hold stocks’ strategy here is from the state tax advantage and 70% is from the federal compounding and exemption on distribution of profits. If this couple has the misfortune to move to a state that doesn’t seem to care about the middle class saving for college, like, let’s say…Massachusetts or California (neither of which give a state tax advantage for 529 contributions), the 15 year return drops down from $226.52 to $207.89. Still not bad, but the state incentives are a huge part of the practical analysis. Note also, that anyone living in a state without an income tax (Texas, Florida) gets no state income tax advantage because there ain’t any state income tax to take the deduction against!

Mass Affluent Couple: Whew, that was a lot of ink on the middle class couple, and if you’re in the Mass Affluent income cohort and reading this for practical advice, go back and read the numerical analysis of the middle class closely, because with a few modifications it’s going to apply to you as well.

Before that, though, let me say that there’s been a lot of progressive spite (not sure what adjective to use here) thrown at this couple. Cries of “they really don’t need any help—we should take this away” are there either explicitly or just below the surface. Some of my best friends are mass affluent couples in NYC, and I will tell you that the cost of college is something that gives them grey hairs. It’s enough money to be able to pay for college, yes, but not as easily as it might look from the outside.

Plus, and maybe most importantly, earnings now are not a guarantee of earnings for the next 15 years. You’re free to say “cry me a river”, but these are people, and all they want is the best for their children and to villainise them for such doesn’t sit well with me. Also, as we said before, the state tax benefit is close to ½ of the total 529 benefit, and that benefit is capped out in NY at $5,000 per parent per year, so this isn’t reducing anyone’s state tax bill to $0.

OK, here are the numbers: paying off student debt is actually more attractive for this couple because they earn too much money to get the income tax deduction, which, by the way, now stands at 43% combined state & federal (I’m assuming, not unreasonably, that this couple are AMT taxpayers). So $100.00 paying down student debt compounds at the full $5.00 ending up at a full $207.89 at the end of year 15. Not too bad, and liquidity is sacrificed, which is still important, but probably less important for this couple than the others.

Investing on the side, even if done in a tax efficient manner yields only $186.31 after 15 years (I upped the capital gains rate to 25% to reflect higher taxes—this gets a little more messy in real life but it’s a decent approximation). Hmmm…

Takeaway: Mass Affluent couple is better off paying away their student debts than investing in the stock market, given our mathematical assumptions (and, critically, on a risk-adjusted basis).

What about 529 plans? Well, the 529 plan still yields $226.52. Definitely better than paying off student debt (and that investment opportunity doesn’t even exist after all debt is paid off).

Interestingly 100% of the benefit in that comparison is now state level. Let me say that again: for well off taxpayers who still have student loans, the federal tax advantage is in some ways $0 and the advantage is all at the state level.

Interesting observation, given that many of the cries were for Obama to remove this great federal incentive in 529 plans (neither Obama nor the US Congress has any input on what states decide to do with 529 tax treatment).

Takeaway: The well-off/upper middle class/mass affluent/merely wealthy/whatever you want to label them get some advantage from 529 plans, but mostly from the state level & that really has nothing to do with Obama one way or another.

The Rich Couple: Nothing we’ve talked about matters at all. For reasons I won’t get into, anyone earning this level of income who is contributing to 529 plans should chew out their tax planner and/or financial advisor. There are a few situations where they make sense, but usually 529s are an unbelievably sub-optimal use of your annual gift tax exclusion.

Takeaway: 529 plans aren’t relevant to the rich at all. They’re glad you’re spending your time thinking about 529 taxation rather than something that matters, like carried interest or the step up in basis at death…

OK, that’s great, but what about Cathy’s point?

Oh, right. Well, yes—when you subsidize an asset the price generally increases to at least some degree (there’s all sorts of complicated analysis on relative elasticity here), and in theory that impact of the 529 is hosing the poor at the expense of the middle class and upper middle class (and the rich, sortof/maybe). Still, I feel like there are a lot of much bigger moving pieces in the overall calculus of costs of college that 529 plan tax advantages aren’t really the primary driver moving the needle.

So, for example, the total budgetary impact from 529 plans & prepaid plans is scored at around $1bn/year (page 39 here). If you’ve never worked with OMB numbers that sounds like a lot, but there’s a special phrase for a number like $1bn/year in the beltway: it’s called “a rounding error”. This is less than peanuts in the overall scope of the budget.

Which leads me full circle to an interesting question: what’s really going on here? I mean, the Obama administration is, depending upon the color of your pin, either Reed Richards or Lex Luthor—you may hear that he’s evil or a Marxist, but not usually that he’s a moron. Yet, this was an unbelievably dumb thing to propose, and honestly, it was entirely predictable that it would be not only a hideous failure, but a very public hideous failure. Again, any on-the-ground CPA could have told anyone in the administration willing to listen that these plans are one of the only reeds the government gives to parents grasping at straws to find the money to cover college and pulling it away would be…well, like stealing porridge from an orphan.

Unless there really is a brilliant “I’m thinking 3 moves ahead of you” long-game/long-con (again, depending on the color of your pin) strategy. If so, could it be this:

The left wants to win the next election. Statisticians working hard have studied the impact of the Tea Party on electoral results for the right and have determined that the optimal game-theory path is to alienate and marginalize the Elizabeth Warren/Bernie Sanders progressive wing. To do so, Obama created a straw man (the proposal to cut back 529 Plans) that pretty much most of America would hate but die-hard progressives would love. This lays the foundation for important discussions of party planks between centrists and progressives, for the centrists to say “look at what your wingnut policies cost us on that 529 debacle”, thus isolating progressives from the central discussion in formulating policy and, you know, trying to make radical change or something crazy like that…

Paranoid? Or not paranoid enough….

FoW

Cathy’s short response: nobody except the affluent middle class (and the rich) has $100 extra to begin with.

S&P and the Puffery Defense

Yesterday the ratings agency S&P settled a lawsuit with the Department of Justice for awarding ridiculously high ratings for mortgage-backed securities way back when. For their massive contribution to the world-wide financial crisis, they got fined $1.5 billion, nobody went to jail, and they didn’t even have to admit what they’d done is wrong.

But here’s something they did admit: their use of the word “objective” when describing their models was mere “marketing puffery,” not to be taken seriously. This is called the “puffery defense” by Bloomberg.

To be fair, this wasn’t just about the usage of the word objective. From Bloomberg’s piece:

S&P said in its request to dismiss the case that the government can’t base its fraud claims on S&P’s assertions that its ratings were independent, objective and free of conflicts of interest because U.S. courts have found that such vague and generalized statements are the kind of “puffery” that a reasonable investor wouldn’t rely on.

Now, as some of you know, I’m writing a book about destructive mathematical models. And pretty much all of the models make claims of being objective. It’s part of the marketing for those models, a requirement to lure people into using complex, mathematical black boxes instead of their own brains, and crucially, in place of their own sense of fairness and accountability.

Example: Value-added models for teachers are showered with claims of objectivity (see page 4 of this marketing brochure for example), even though those claims are questionable at best.

So, it makes me wonder, is the Puffery Defense going to be widespread? Is it a technical and legalistic approach? Are we going to have a redefinition of that word so that companies are officially allowed to claim objectivity while actually meaning nothing like objectivity?

Let’s make paying for college harder

I was disappointed with Obama’s retraction of the tax benefit for college savings, referred to as the “529 plan.”

And, although some would claim that the 529 tax shelter was used by more than rich or very well-off people, it’s still a very lopsided regressive tax, because the majority of Americans can barely scrape by on their income, never mind saving for their kids’ college funds. But that’s not exactly the point I’m trying to make, although it’s a very important point.

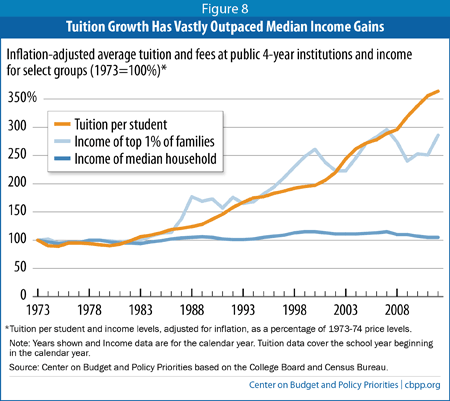

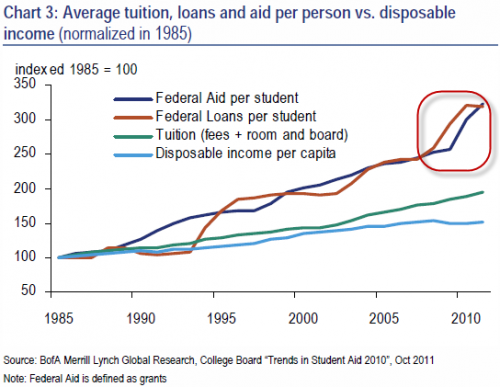

The larger point is this: whenever we make college more affordable by helping people pay for college, it just makes college more expensive. Tuition rises to meet our new-found ability to pay. And although I can’t prove causality for every tuition hike, the data kind of speaks for itself:

versus here’s the federal aid growth:

The result of our federal loan programs, which were started with good intentions, is that whereas before college was out of reach for lots of people, now it’s still out of reach, they go anyway, and then emerge loaded with debt. It’s not actually a huge improvement for the vast majority of the middle class, but it’s become a requirement to get a reasonable job so people are forced to go through it, kind of like a hazing ritual.

There’s another related reason why college tuition goes up, namely because we have stopped funding state schools, so their tuition is higher, and the other colleges also rise to meet them. But part of the reasoning behind that is because we have all these federal loans available, so why would we need to fund the state schools.

We need to put into place ways for tuition to go down. First, we make paying for college harder, and that includes for upper middle class folks. The reasoning is this: if you’re the only person having trouble paying for something, that’s bad. But if everyone has trouble paying for something, the price goes down.

Second, we make state schools much cheaper, or even free, by funding them.

Slate Money Talks Sports

Lots of traveling in the last couple of days, and not enough sleep, has prevented me from posting as often as I’d like. Aunt Pythia sends her regrets.

But if you’re interested, please take a few minutes to listen to this week’s Slate Money podcast, which I particularly enjoyed being part of, and meeting this week’s esteemed guest Mina Kimes of ESPN the Magazine. We talked about money issues around sports, namely whether college athletes should be paid, the economics of stadiums in cities, and the NFL Commissioner Roger Goodell.

If you’re interested, go here or look up “Slate Money podcast” on iTunes.

When Errorbars Hit Mainstream News

It’s interesting to me how science has come into conflict with the news in the past week. First we had the deflategate, where footballs mysteriously deflated during a playoff game, and then we had an over hyped blizzard.

The NFL recently hired physicists at Columbia to help make the case for science with the football fiasco, but I think that’s unnecessary: a few good experiments with temperature and friction and lots of measurements by lots of different pressure gauges will empirically demonstrate how much of a range we might expect from such things. In other words, understanding errorbars.

As for the blizzard, this article nicely articulates the science of weather forecasting and what went wrong. But what is interesting is that, in general, models have gotten much better, and in particular are good at predicting how powerful a storm is going to get. In this case the model got that right, but then the error came in figuring out exactly where the storm would travel and when.

Again, it’s a case of errorbars, and the public seems not to understand it. Or maybe they just don’t want to.

In fact, I heard quite a few people call in to ESPN radio over the past week trying to explain to the sports radio hosts what might be going on scientifically, only to be hung up on. The truth is, it’s not as interesting a story to think about it just happening outside our control. It messes with our sense of omnipotence and control.

This is bad news for society, as more and more things become “datafied” and as we assume that will translate into perfect information.

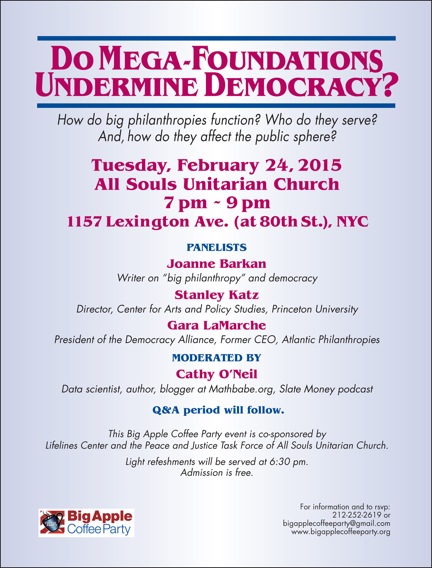

Dartmouth Math Colloquium & All Souls Panel on Mega-Foundations

This Thursday I’m heading up to the Dartmouth Math department to give a colloquium on the subject of data science. They made the following poster for my talk:

Also, next month I’m excited to be the moderator of a panel at the All Souls Unitarian Church on the east side of Manhattan, with some amazing panelists. There’s also a poster for that event:

I hope I see you there!

Grexit

The exciting news today (besides tonight’s blizzard!) is the Greek elections. Yesterday an anti-austeristy party called Syriza won the plurality of the votes, and is on the very verge of winning a majority as well.

This is huge because the leader of the party, Alexis Tsipras, has basically promised the Greek people that, if elected, he would refuse to pay off any more of Greece’s debt.

How did this happen? Well, From the perspective of the Greek people, the negotiations around their economic problems have been taken on by their last two governments since 2008 with a bunch of European technocrats behind closed doors and in an intensely undemocratic process. Well, this is when democracy fought back.

Possible ramifications: If Greece indeed defaults, and it might leave or get booted out of the Eurozone (this is called “Grexit”), which may or may not be a good thing for Greece long term, but in any case is very interesting. Short term, the black market in Greece is said to be highly developed, so the average person isn’t entirely dependent on functioning banks anyway.

Also, I’m sure Greece has been looking at Argentina recently to see how their (accidental) default has been going, namely not as bad as everyone predicted. The world will be watching Greece to see what happens and to see how smaller countries can and will deal with stifling debt in the future.

Aunt Pythia’s advice

Time passes quickly, my friends. It seems like only yesterday that Aunt Pythia was answering really long questions, and today her questions seem to be extra short. Last week it was cold outside – freezing! – but this week it is warm and snowy (but not for long!). Last week she was knitting a cowl, this week a colorful scarf. Crazy changes, in other words.

Indeed the only thing that hasn’t changed is an absolute willingness, on the part of Aunt Pythia, to offer up irrelevant and terrible advice to you earnest people. Many apologies, you definitely deserve better, but this is just something Aunt Pythia was born with, there’s nothing for it.

My suggestion for you is to just turn away and stop reading. I mean, how many obscene images must one be subjected to??

This is a liqueur filled sperm-shaped bottle. I know it really exists because I bought one at a liquor store in San Antonio a couple of weeks ago, no shit. No, I haven’t opened it yet.

Wait, you’re still here? Really? Well, in that case, come on in, enjoy the warmth, get under a hand-knitted blanket, and don’t forget to:

ask Aunt Pythia a question at the bottom of the page!

By the way, if you don’t know what the hell Aunt Pythia is talking about, go here for past advice columns and here for an explanation of the name Pythia.

——

Dear AP,

is it worth saving, or should we just burn it all down and start again?

Sick of Bull Systems

Dear Sick,

I’m going to assume you’re talking about the financial system. I’m tempted to say “burn it” but there would actually be severe short-term problems caused by there being no financial system. Moreover, it isn’t clear that a new one would be built better than the existing one. I know that sounds disappointingly unrevolutionary, but there it is.

If you are feeling desperate, may I suggest ignoring it and starting a new one. If I had time I would be more active in the public bank movement in this country, which seems like a better alternative to ours and can exist in parallel.

Aunt Pythia

——

Dear Aunt Pythia,

Have you seen the Celtic Oracle designs? I made a deck but would like additional divination material.

Oracular Designs

Dear Oracular,

Nice! And flattering to oracles such as myself! Can I make a wee request? More naked people, especially men? Thanks.

Aunt Pythia

——

Dear Aunt Pythia,

I would like to start watching Dr. Who but I’m intimidated by 50+ years of shows. How do you get started?

Dr. Who Ignoramus

Dear DWI,

Common problem, I sympathize. The truth is, it doesn’t matter much. Let me give you a cheat sheet which should be more than adequate:

- Dr. Who is always a man who talks fast and is incredible smug, although usually in a lovable way.

- He sometimes has a dog named K-9 with him. If he does, you’re watching an earlier show.

- He almost always has a “companion” with him, who is almost always female, mostly young, and sometimes a love interest, although not in earlier shows.

- Sometimes his companion has other companions, who are often there as comedic relief.

That’s about it! Oh, and they travel through time solving problems on earth and on alien planets. So there, now you have no excuse not to watch.

Aunt Pythia

——

Hello Aunt Pythia,

Not a question, but a thank you for your answer to my previous question. It was helpful, and you are right! College towns are still towns, and as such the occupants must take the usual precautions when going out. I knew this, from personal experience walking home many a late night during grad school. But somehow the father in me did not want to admit it.

After I first wrote, a talk with my daughter segued into a talk about college, academics, academic pressure, and campus safety, and I was once again surprised by how grown up my daughter is. She and her friends are well aware of the risks, and do watch out for each other. And now that she has been accepted at Cornell (we found out last night), we’ll no doubt have these talks again, at which time I will mention Aunt Pythia’s advice.

Thank you once again,

Worried In Academia

Dear Worried,

Wow, wonderful! I almost never know if my advice actually helps, so this is amazing feedback, thank you for giving it to me!

Aunt Pythia

——

Dear Aunt Pythia,

I’m in my first year in a Phd program in math. I’ve always been academically successful, especially in math, and this semester is no exception. Although I know it will be difficult and take a lot of hard work, I’m moderately confident that I have the ability to get through my qualifying exams. After all, my aptitude for high stakes testing is what’s gotten me this far.

It’s what comes next that concerns me. Specifically, I’m not at all confident that I have what it takes to actually do research in math. I generally have a good memory (especially in the short term); I’m good at reproducing proofs I’ve seen before and at applying techniques in ways I’m familiar with, but I worry that I’m not an especially creative thinker and also that I coast by via collaborating with others. (I realize that the second concern can be irrational, at least from a coursework perspective, since I do comparably well on exams as on homework, but it’s still in the back of my head.)

(It’s probably also be pertinent to mention that I’m male, and haven’t ever felt invalidated either institutionally or on an individual level with respect to my ability–these concerns are entirely my own.)

I’ve had only two research experiences up until this point. The first I don’t put much weight on, since it was in another field that I quickly realized I was not that interested in (which contributed to my decision a few years ago to focus more on math). The second was a project I worked on with a faculty advisor throughout my last year and a half of undergrad. It was in an area that I was interested in and my advisor was great. However, I often would become consumed with anxiety and overwhelmed to the point that I was unable to get anything done.

Part of it was adjusting to working independently and in an unstructured environment, but even when I was given a list of moderately specific things to do it didn’t necessarily help. Despite having plenty of time available to devote to the project, I would put off working persistently, often getting to the point where I would stay up later and later the hour before my next meeting, becoming more and more panicked but for some reason still incapable of working. By the time I’d snap out of it, it would be so late that I would be too exhausted to really do my best work, and it definitely showed. It was stressful for me, frustrating for my advisor, and (clearly) not really productive mathematically. And yet I couldn’t bring myself to change, week after week!

I felt especially bad for being a disappointment for someone who has done a lot for me and who inspired me to seriously pursue math in the first place. Especially, since to anyone not in my head this all came across as purely poor work habits/laziness–my advisor told me shortly before graduation that I have everything it takes to succeed in grad school, as long as I work hard enough, which was simultaneously affirming and distressing. Part of me also thinks that this was all just garden variety laziness and that if I just had worked harder and focused better it wouldn’t have been an issue.

So I guess my question is, where do I go from here? What can I do to keep this from happening in the future? Do I really have a problem, or is it just a combination of laziness and lack of self-confidence?

Apprehensively,

Uneasy New Scholar, Upbraiding or Reassurance Essential

Dear UNSURE,

First off, amazing sign off. Much appreciated.

Next, thank you so much for asking this question. And, given that you are a highly successful and encouraged male, the issue is nicely isolated: how does doing well on highly structured undergrad work and standardized tests relate to being a good researcher?

The answer is unclear, actually, in general. I mean, I don’t want to panic you, because I actually think math research is a skill you can pick up if you are smart and work hard, but on the other hand, it might not be that easy, especially for you.

Let me put it this way. Theoretically, we want to attract to math research a bunch of people who:

- love math,

- work hard and don’t mind being wrong and can live with not knowing whether they are, and

- are “good at math”, where I’m going to ignore what exactly that means, partly because I don’t want to get drawn into the genius myth discussion and partly because I actually think the first two qualifications are dominant.

But here’s the thing. Instead, we attract to math research, via our post-college applications selection method, people who:

- may love math but may just have been told they’re “good at math” and may not know the difference,

- know how to master a well-defined skill where they get continuous feedback from tests and other people that they are making progress, and

- are probably plenty “good at math.”

So you see, there is likely a mismatch between the first two points.

I’m going to hope, for your sake, that you love math. Because you’ll need it, believe me.

Assuming you do, then you’ll need to spend time on #2, which means you (ironically) need to stop caring about outside measures of progress so you can lose yourself in your work and make progress. Get it? It’s confusing when you first encounter it, and unintuitive, and it might be extra hard for someone who is addicted to external evaluations and encouragement, which honestly it sounds like you are to some extent. Just as an example, you don’t owe your advisor anything except your gratitude. You are doing math for yourself from here on in.

The good news is, it often sucks at first, so don’t think you’ve already failed. You just need to develop new skills. It’s kind of like a muscle you didn’t know you had that you need to make super strong.

I suggest trying it out in short bursts. Find yourself a few hours of time, where you are not urgently needed by some classwork or something, and lose yourself in thought around some mathematical object, with no specific need of a milestone. Play with the math, see what you find, and don’t feel like you’ve wasted your time at the end, even if you feel like you have. It was your time to waste, after all.

Anyhoo, that’s the muscle you will need to develop. Once you get good at it, you can lose yourself for days or weeks at a time and then every now and then stumble on actual progress. You can do it! Start small!

At least that’s how it has always worked for me. Other mathematicians, feel free to chime in if you disagree.

Good luck!

Aunt Pythia

——

Well, you’ve wasted yet another Saturday morning with Aunt Pythia! I hope you’re satisfied! If you could, please ask me a question. And don’t forget to make an amazing sign-off, they make me very very happy.

Click here for a form or just do it now:

Intentional discrimination versus disparate impact

I’m paying lots of attention to the Supreme Court’s coming decision on The Fair Housing Act. A New York Times editorial of this morning does a good job explaining the issues, including the concern that Chief Justice Roberts seems to think we’ve moved past racial discrimination in this country.

The burning question is whether housing developments and the like are responsible only for intentionally discriminating against individuals, or whether they are responsible in a more general, statistical sense, of having disparate impact on groups of people. The New York Times, like me, hopes for a broader reading, consistent with the 11 courts of appeals decisions over the last 40 years. From the Times:

The ability to show discriminatory effect has only become more important as intentional discrimination has become harder to prove. To take one prominent example, the Justice Department relied on it to negotiate the largest-ever fair-lending settlement — $335 million — with Bank of America in 2011. The bank’s mortgage unit, Countrywide Financial, had charged higher average fees and interest rates to black and Latino borrowers than to whites with the same credit risk, a practice that former assistant attorney general Thomas Perez called “discrimination with a smile.”

This case is focused on housing, but of course it could generalize to all sorts of other systems, including job applications and credit applications among others.

If we stick to the “intentional discrimination” only, we are opening up a door to (even more) widespread use of algorithmic decision-making that produces unfair and discriminatory results. And as it turns out, it’s easy to produce a model that effectively discriminates.

And if you are not in charge of your own system, then who is?

Two articles on feminism

I’m neck deep in writing nowadays, but I wanted to share two extremely interesting and provocative pieces around women which come at feminism with from very different angles.

First, this essay, entitled If we liberate men’s sexuality, the war against women can end (hat tip Susan Webber), was written by a professional dominatrix, which is always an eye-opening perspective. She suggests that if we promote a new kind of feminism which she calls intersectional feminism, rather than depending on the old-school moralistic feminism, then we have a better chance to reach men, especially the men who might otherwise join the extremist misogynistic “men’s right’s” movement or become part of the vile pickup artist movement.

I think she has a bunch of interesting points. It is clearly true that men are boxed in in terms of their sexuality just as women are, and for men that don’t fit the standard mold it amounts to a kind of torture; the answer then is to promote a kind of sexual license for all people, not just women. Also, I think she’s absolutely correct to focus on sexual frustration as a major cause of all sorts of bad things. It’s not just about competing for jobs with women, it’s also about not getting laid.

Second, this Science Friday piece (hat tip Thessy) on the perceived requirement of innate genius as an obstacle for women in various fields. I wrote about this issue recently.

In particular a caller named Emily tells the guests how she was a straight A student at NYU, who graduated summa cum laude, and was passionate about philosophy, but was told by her advisor that she “just didn’t have what it takes” to go on to graduate school.

I cannot tell you how many people I know who have gone through something similar. And, I might add, such stories, which are generally completely unreported, flies in the face of ridiculous claims such as those made in this recent New York Times opinion piece that sexist mistreatment in science is minor and anecdotal.

Last thing: it’s cool and interesting how many conversations are being conducted around these important issues. I see it as progress just to be able to assume that other people I run into are sufficiently aware of the issues to talk about them, including my teenage sons.

Peter Woit: The NSA, NIST and the AMS

This was crossposted from Not Even Wrong and written by Peter Woit.

Last summer I wrote here about an article in the AMS Notices which appeared to make misleading claims about the NSA’s involvement in putting a backdoor in an NIST cryptography standard known as DUAL_EC_DRBG. The article by Richard George, a mathematician who worked at the NSA, addressed the issue of the NSA doing this kind of thing by discussing an example of past history when they were accused of doing this, but were really actually strengthening the standard. He then went on to claim that:

I have never heard of any proven weakness in a cryptographic algorithm that’s linked to NSA; just innuendo.

This appears to be a denial of an NSA backdoor in the standard, while not saying so explicitly. If there is a backdoor, as most experts believe and the Snowden documents indicate, this was a fairly outrageous use of the AMS to mislead the math community and the public. At the time I argued with some at the AMS that they should insist that George address explicitly the question of the existence of the backdoor, but didn’t get anywhere with that. One of their arguments was that George was speaking for himself, not the NSA.

The question of fact here is a very simple and straightforward mathematical one: how was the choice used in the standard of points P and Q on an elliptic curve made? There is a known way to do this that provides a backdoor. Did the NSA use this method, or some other one for which no backdoor is known? The NSA refused to cooperate with the NIST investigation into this question. The only record of what happened when the NIST asked about how P and Q were chosen early on in the development of the standard is this, which indicates that people were told by the NSA that they were not allowed to publicly discuss the question.

Remarkably, the latest AMS Notices has a new article with an extensive discussion of the DUAL_EC_DRBG issue, written by mathematician Michael Wertheimer, the NSA Director of Research. At first glance, Wertheimer appears to claim that the NSA was unaware of the possibility of a backdoor:

With hindsight, NSA should have ceased supporting the dual EC_DRBG algorithm immediately after security researchers discovered the potential for a trapdoor. In truth, I can think of no better way to describe our failure to drop support for the Dual_EC_DRBG algorithm as anything other than regrettable.

On close reading though, one realizes that Wertheimer does not address at all the basic question: how were P and Q chosen? His language does not contain any actual denial that P and Q have a backdoor.

For a careful examination of the Wertheimer piece by an expert, see this from Matthew Green. Green concludes that

… it troubles me to see such confusing statements in a publication of the AMS. As a record of history, Dr. Wertheimer’s letter leaves much to be desired, and could easily lead people to the wrong understanding.

In a recent podcast on the subject Green states

I think it’s still going on… I think that the NSA has really adopted a policy of tampering with cryptographic products and they’re not going to give that up. I don’t think that this is a time that they want to go out admitting what they did in this particular case as a result of that.

Given that this is now the only official NSA statement about the DUAL_EC_DRBG issue, the Notices article has drawn a lot of attention, see for instance here. The Register summarizes the story with the headline NSA: So sorry we backed that borked crypto even after you spotted the backdoor.

The publication of the George and Wertheimer pieces by the AMS has created a situation where there are just two possibilities:

- Despite what experts believe and Snowden documents indicate, the NSA chose P and Q by a method that did not introduce a backdoor. For some reason though they are unwilling to state publicly that this is the case.

- P and Q were chosen with a backdoor, and the AMS has been now repeatedly been used to try and mislead the mathematics community about this issue.

I’ve contacted someone at the AMS to try and find out whether the question of a backdoor in P and Q was addressed in the refereeing process of the article, but been told that they won’t discuss this. I think this is an issue that now needs to be addressed by the AMS leadership, specifically by demanding assurances from Wertheimer that the NSA did not choose a backdoored P and Q. If this is the case I can see no reason why such assurances cannot be provided. If the NSA and Wertheimer won’t provide this, I think the AMS needs to immediately cut off its cooperative programs with the agency. There may be different opinions about the advisability of such programs, but I don’t think there can be any argument about the significance of the AMS being used by the NSA to mislead the mathematics community.

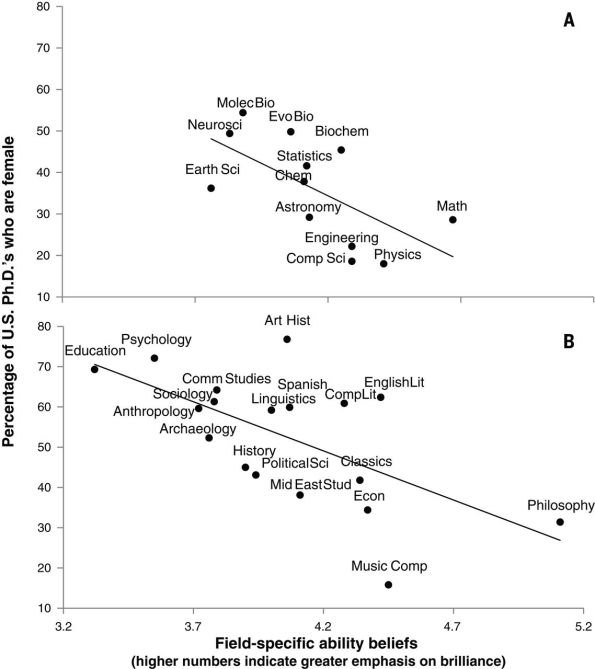

Representation of women and the genius myth

In a recent issue of Science, there was an article entitled Belief that some fields require ‘brilliance’ may keep women out (hat tip Gary Cornell) that absolutely resonates with my experiences, both as a mathematician and as a teacher.

Namely, it talks about the extent to which women are discouraged to go into a field because that field is somehow reserved for “geniuses,” and women are rarely if ever bestowed with that label. Mathematics is definitely one of those fields; if you are exceptionally successful in mathematics, people call you a genius, and it’s pretty hard to be successful if people don’t think you’re a genius.

But other STEM fields have less of a reputation for geniuses, and they have correspondingly more women. Biology, for example. Moreover, there are some fields outside of STEM that have way fewer women, which seems unexplained unless you have the “genius” theory. Philosophy is the obvious example here, a very macho field.

In the Science article, they were reporting on a study done by Sarah-Jane Leslie, Andrei Cimpian, Meredith Meyer, and Edward Freeland, in which they surveyed researchers from all sorts of fields in all sorts of research universities and asked them to rate, on a scale of 1-7, statements about their own discipline along the lines of, “Being a top scholar of [discipline] requires a special aptitude that just can’t be taught”. Here’s the critical graph:

STEM subjects above, non-STEM below. The negative correlation is the key to this study. I am particularly struck by the difference between statistics and math.

It’s just one study, and the response rate was small, so the word is not final. Even so, I think this proves that we should look into this more, gather more evidence, and see where it leads.

Personally, I have already spent quite a bit of time trying to deal with this very problem in mathematics. For example, I’ve explained before how I deliberately teach kids an introduction to proof that emphasizes practice over the silly and distracting concept of having an innate gift. It works, and it’s more fun too, for both men and women.

If I were designing a curriculum for STEM subjects I would rely heavily on this idea to inform my approaches to all sorts of things, partly because I think it’s true, but partly because the other things we think might matter are harder to change.

If you think about it, it’s actually a pretty reasonable roadmap for how to attract a more diverse group of people to mathematics or other subjects. You just need to create an environment of learning that emphasizes practice over genius. Actively dispel the genius myth. Achieving that cultural shift gets harder the higher up the research ladder you go, though, partly because it’s hard for older people to give up the “genius” label they worked so hard for. But it’s worth a try.

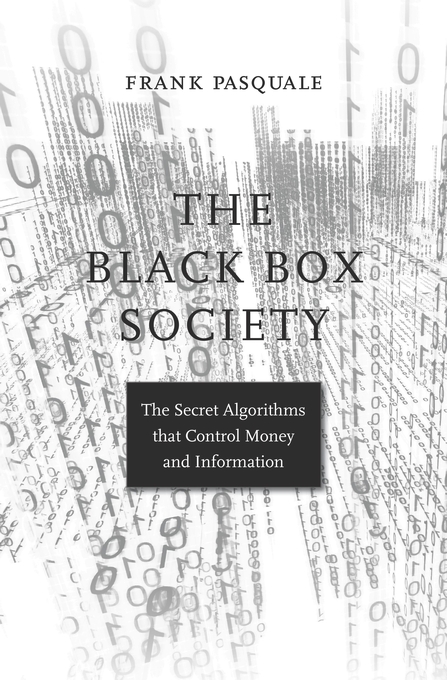

The Black Box Society by Frank Pasquale

There’s a new book out, called The Black Box Society and written by Frank Pasquale, a lawyer focused on technology and a friend of mine. It’s published by Harvard University Press and it looks like this:

To be honest, when I first received it I was a bit worried that it would make my book, which I am utterly engaged in writing, entirely moot. After all, Frank and I had discussed his book and I’d seen earlier versions. I knew it contained information about racist secret algorithms in finance and tech, and there were also other issues in common with our two books.

Now that I’ve had a chance to read it, though, I’m not as worried. First of all, Frank’s book is aimed at a different audience, which is to say a somewhat more academic and technical audience. In particular his policy recommendations near the end of the book seem to be written for lawyers who know the current laws and need arguments to improve them.

Also, his focus is on secrecy itself as a means of power, whereas I focus on models as the object of interest.

I like a lot of what Frank says, and I think his metaphors work really well. For example, he talks about the early promise of the internet to expose information of all sorts, on powerful corporations as well as individuals. Then he talks about how reality has been a disappointment, and we’ve ended up with an internet that acts as a “one way mirror,” whereby powerful corporations can see into individual’s lives but those individuals can’t look back.

He also makes the important point that, when it comes to the NSA and other government agencies snooping around, while they might be legally prevented from gathering certain kinds of data about people, nothing prevents them from buying information and profiles from data warehouses like Acxiom, which can do the kind of collecting that they can’t. In other words, the data warehousing industry acts as a giant loophole in the set of rules protecting our civil liberties.

For another really interesting review of Frank’s book, written by a software engineer, take a look at David Auerbach’s Slate review (hat tip Jordan Ellenberg). In particular he has interesting things to say about the extent to which algorithms are intentionally evil (they’re probably not) and the extent to which engineers can fix problems (they probably can).

In any case, I recommend The Black Box Society, it’s a fascinating and important book.

Link to my JMM prezi talk

I seem to have caught a break at the San Antonio airport, with free wifi. So I will take this opportunity to offer a link to my prezi talk.

See the prezi here: http://prezi.com/makkue0d84nc/?utm_campaign=share&utm_medium=copy&rc=ex0share

One embarrassing omission from my talk is the existence of many public facing math podcasts. Embarrassing not because I knew about them – I didn’t – but because I should have, since after all I participate in a weekly podcast myself, so of course I know it’s a new and exciting medium. Luckily, the audience member who pointed out my mistake has agreed to write a guest post surveying the math podcast landscape, so stay tuned for that.

Palantir’s leaked documents and the concept of uncertainty

Did you hear about TechCrunch’s leaked documents detailing the client list of Palantir, the super secretive data mining contractor (hat tip Chris Wiggins)? Palantir, founded by uberlibertarian Peter Thiel, had clients as of 2013 including the LAPD, the CIA, DHS, NSA, the FBI, and CDC. Besides data mining for government agencies, they also work in the finance sector and the legal sector.

Here’s the scariest thing about the TechCrunch article:

Samuel Reading, a former Marine who works in Afghanistan for NEK Advanced Securities Group, a U.S. military contractor, was quoted in the document as saying It’s the combination of every analytical tool you could ever dream of. You will know every single bad guy in your area.”

That quote, if true, belies a lack of understanding of what data mining can actually do in terms of accuracy. No data mining tool can be both comprehensive and accurate – find all the bad guys with no accidental good guys getting caught in the net. It’s just not possible, unless you have DNA samples with markers for “bad guyness,” and even then DNA tests sometimes get mixed up.

It behooves an expensive and fancy consulting company to act like their tools are prophetic, however, even if that means false positives or false negatives happen all the time, which of course they do, with any algorithm.

It’s bad enough when stupid start-up companies claim big data solves everything, when what they’re doing is trying to solve a problem nobody cares about. It’s another thing altogether when it’s our military and military contractors and police and secret services, and when we don’t have any view into what it actually does. Scary stuff.

Citation as received wisdom

So I’m here at JMM, hanging out with my buddy Aaron Abrams and finagling free wifi at the Hyatt (pro tip from Jonathan Bloom: sign up to be on their gold membership plan, which is free, and as a member you get free wifi).

Aaron and I started talking about the case of MIT professor Walter Lewin, and whether his OpenCourseWorks physics lectures should or should not have been removed after he was discovered to have been a sexual harasser.

UPDATE: Here’s an article giving some idea of what Lewin did, which was basically to harass women who were taking his online class.

I’ve already asserted that it makes sense to me that they are removed, but I wasn’t happy with my explanation. I think I’ve understood it better now, and I wanted to throw it out there.

To explain it, let’s move to a more cut and dry example, or at least an older one, namely Harvard mathematician George Birkhoff. That guy was a hugely famous and powerful mathematician in his day, which was in the 1930’s. He was also a huge anti-semite, and prevented Harvard from hiring jewish mathematicians fleeing the Nazis.

When it comes to doing math, I might write a paper that uses a result he proved. Will I cite him? Personally, I would feel weird about it. Citing someone, speaking their name, is not just a mathematical shortcut, a way of avoiding proving everything from basic principles, although it is that, of course. If you have no prior knowledge about someone, you might not see that, but I’ve set it up explicitly so you see more than that.

Here’s what I see. By citing him, I am doing more than giving him credit for proving something, I’m including him in the community of mathematics, which is actually an honor. And honestly I’d rather not honor the wisdom of someone I detest.

Update: to be clear I would cite him if I needed to. I just would actively feel weird about it. I might even add a note.

Going back to Walter Lewin. Supposedly he can explain certain kinds of physics really really well. People say this, and I believe them. But of course the physics is already known, he’s not inventing something, and other people can also explain it, just not quite as well, at least right now.

Why would a given person choose to watch Lewin’s lectures instead of someone else’s lectures on the same material? Well, what is the delta between those two experiences? On the one hand, it’s a better explanation, which adds, but on the other hand, it’s the knowledge that we are honoring a man with no integrity, which subtracts. If written citation is received wisdom, then actually sitting and listening to a person is even more intimate.

For me, personally, these two opposite considerations don’t add up to a net positive. I’d rather watch someone else explain the physics.

As for MIT’s OpenCourseWorks (OCW) platform, they also had a “delta” computation to make, and they had to take into account the community they are trying to build through OCW. They want women in particular to feel welcomed to that community, and they decided that the videos’ presence made that more difficult (and it’s already difficult enough in physics). I think they made the right call.

Guest post by Tom Adams: Obama homeownership push or mortgage market share battle?

This is a guest post by Tom Adams, who spent over 20 years in the securitization business and now works as an attorney and consultant and expert witness on MBS, CDO and securitization related issues.

Good news for would-be home buyers – the Obama Administration heard your concerns and has a new tool to help make homes more affordable!

Are they going to increase wages? Or reduce the price of homes? No, they’re going to attack mortgage rates for Federal Housing Administration (FHA) borrowers. Of course, mortgage rates are already at close to all time lows, having declined significantly over the past year to about 3.7% on conventional 30 year fixed rate loans. The Administration’s main tool for doing this is to cut the insurance fee charged by the Federal Housing Authority on new mortgages by 0.50%, from 1.35% to 0.85% (on top of the interest rate charged to borrowers).

This fee is paid by borrowers into a fund that the FHA uses to protect itself against losses in case borrowers that it has insured later default. In theory, this move was somewhat controversial because the FHA’s fund had incurred higher than expected losses during the crisis and the FHA had to ask Congress for money to shore up the fund not that long ago. Around the same time, the FHA raised this insurance premium to additionally replenish the fund.

If it’s already really cheap to borrow money, is another 0.5% reduction going to make that big a difference? Probably not, because historically low interest rates haven’t been the obstacle to buying a house. I expect the number of net, new home buyers produced as a result of this change will be considerably lower than the Administration is projection (“millions of homeowners,” according to Obama’s statement today).

Rather, would-be homeowners don’t have the income to support buying the houses listed for sale in their markets – which is another way of saying that, for average Americans homes are too expensive for them to afford (or wages are too uncertain for them to want to buy).

Also note that the new lower fee is primarily aimed at new home purchasers. In order for existing FHA borrowers to get the new lower premium they would have to refinance into a new loan, which means they’d have to incur new closing costs. The new closing costs would probably eat up most of the savings for a year or more. Presumably, this would discourage many existing borrowers from refinancing for the lower premium, which helps the FHA by allowing it to retain the old, higher premium on the borrowers who don’t refinance.

This highlights one of those fundamental conundrums in the housing market. Existing homeowners and home sellers want home prices to go up. Representatives of this group are great at lobbying and have convinced many people (including, by all appearances, this Administration) that rising home prices are a good thing for America. On the other hand, potential home buyers would rather not have home prices going up – because that makes buying much harder. For whatever reason, this group has about zero lobbying juice.

Making credit cheaper is a small tool the Administration has via this reduced premium, so they used it, I guess. But it’s an action that has consequences, including potentially running the risk of not having enough in the fund down the road if losses increase (not a risk I’m especially worried about – the Urban Institute did a fine analysis of why the lower fee is probably sufficient – but it’s a reasonable concern). In addition, it is somewhat disheartening that the Administration still seems to believe that the solution to consumer issues is to have the consumers take on more debt.

The most significant impact of this change is that it will make FHA loans more competitive with Fannie Mae and Freddie Mac loans. You may recall that Mel Watt, the man in charge of the Federal Housing Finance Agency (FHFA), which manages Fannie and Freddie, made a big announcement recently that the GSE’s would offer 97% loan-to-value (LTV) ratio loans to qualified borrowers. Previously, that type of LTV had been mostly the territory of the FHA.

So, effectively, this is just a form of catch-up for the FHA. The various government housing agencies are competing for market share among the same limited universe of qualifying borrowers by trying to get them to take on bigger mortgages than they would qualify for previously. For the average would-be buyer of the average house, the new, lower FHA fee would be worth about $900 a year, equivalent to about a $75 reduction in monthly payment.

It’s hard to believe that anyone in the Administration believes that this will do much for making homes more affordable for Americans. Perhaps it is a measure, however, of how seriously the Administration is taking the issue of housing affordability. There are big issues in housing and the economy that need to be taken seriously – like resolution of Fannie and Freddie, home prices that still remain beyond the reach of many Americans, stagnant wages, on-going foreclosure and mortgage servicing problems – but the Administration seems content to tinker around the edges and try to sell it as important reform.