The sin of debt

It’s fascinated me for a while how people use language to indicated the relationship between money and morality. David Graeber’s book about debt took this issue on directly, but even before reading it I had noticed the disconnect between individual debt and corporate debt.

It was clear from my experience in finance that debt is something that, at the corporate level, is considered important – you are foolish not to be in debt, because it means you’re not taking advantage of the growth opportunities that the business climate affords you. In fact you should maximize your debt within “reasonable” estimates of its risk. Notable this is called leveraging your equity, a term which if anything sounds like a power move.

That just describes the taking on of debt, which for an individual is something they are likely not going to describe with such bravado, since they’d be forced to use measly terms such as “I got a loan”. What about when you’re in trouble with too much debt?

My favorite term is debt restructuring, used exclusively at the corporate (or governmental) level. It makes defaulting on ones debt a business decision by a struggling airline or what have you, and the underlying tone is sympathy, because don’t we want our airlines (or other american companies) to succeed?

When you compare this language and its implied morality (neutral) to the moralistic preaching of late-night talk radio, it’s quite stark. It’s made clear on such shows that debt is a sin, that the reason the show is a success is that it’s entertainment to hear how messed up the callers’ finances are, and to hear the radio host drill into their most private details in the name of ferreting out that sin.

The Suzy Ormon show is another example of this, and this blog entry is a great description of the emotional and spiritual repentance required in our culture when one is in debt, bizarrely combined with her urging you to go out and consume some more.

For the individual there is no debt restructuring available – at best you can get your debt consolidated, but the people who do that are themselves considered icky. There’s no clean way to deal with out-of-control debt as an individual.

Until now! I found an interesting article the other day which somehow excludes certain people from the moral failing of being in debt – namely, if they have the help of another powerful buzzword – a moral reclamation if you will – namely, “entrepreneur.” Because we all want our entrepreneurs to succeed!

The fact that the program doesn’t apply to most of a typical person’s student debt load is only partly relevant – for me, the fascinating part is the way that, when you stick in the word “entrepreneur,” you suddenly have the vision of someone who shouldn’t be saddled with debt, who is immediately forgiven for their sins. It brings up the question, can we perform this moral cleansing for other groups of people who are currently in debt?

What if we coopted the language of the corporations for the individual? I’d love to hear people talking about large-scale restructuring of their debt. Just the phrase makes me realize its possibilities. One of the main tools of leverage for such talks is the amount of money on the table. If sufficiently many people got together to formally restructure their credit card debts, what would the banks do? What could they do except negotiate?

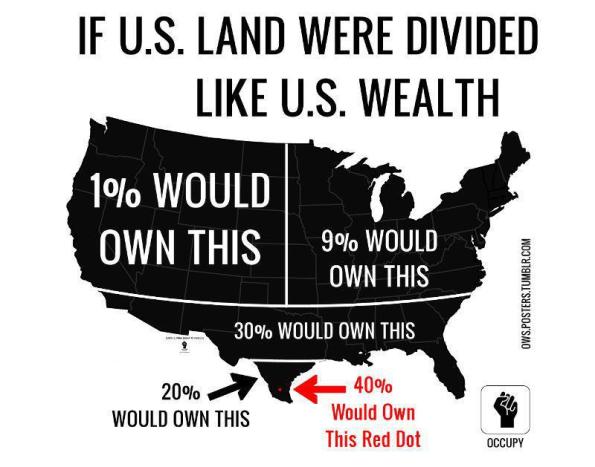

Here’s a graphic I like just in case you haven’t seen it yet:

“For the individual there is no debt restructuring available – at best you can get your debt consolidated”–um, true for student debt (which by statute is not dischargeable in bankruptcy), but not true for other types of debt–they very much can be restructured in individual bankruptcy, and quite often are. The other exception is the lack of mortgage cram-downs in bankruptcy which is important, although mortgages are a particular kind of debt as the lender is lending against you and you are posting your house as collateral (and many states do not allow your primary home to be taken from you in bankruptcy under the ‘homesteader exception’, although this depends on the state and the size of your home).

Just for terminology, “restructuring” is the term for particular form of bankruptcy. A “restructuring bankruptcy” (say, an airline bankruptcy) means the business continues to operate as a going concern (because that ongoing business has value), but the business cannot pay all of its debts without defaulting, and so the court restructures the debt to keep the actual business (and its employees!) alive.

In contrast, a “liquidating bankruptcy” (Borders, MF Global for recent examples) means the business simply isn’t viable any more. The assets are sold and whatever is left is distributed to those who have loaned the business money (and the lenders usually take a pretty big loss in the process).

FoW

LikeLike

FogOfWar,

Fair enough. I meant there is no “restructuring” available, only “bankruptcy”, which is a different term with a different connotation. But yes there is bankruptcy available outside of student debt. Thank you for the clarification.

Cathy

LikeLike

Words are important. When the press announces that Delta is “going through a restructuring”, what they mean is that Delta is going through bankruptcy in a pretty close parallel to the bankruptcy proceedings available to you & I. There shouldn’t be a double standard between the two: acceptable or corporations but moral onus for individuals.

FoW

LikeLike

Cathy,

I just discovered your blog via a link from Peter Woit’s Not Even Wrong. What a great blog. I love this post.

Thanks a lot – now I’ll spend less time on my research!

Jay

LikeLike

You’re welcome, I think.

Cathy

LikeLike

I’m not going to touch the issue of morality with a ten-foot pole, but in terms of wisdom, borrowing to finance an investment (e.g., a house, a car, an education) may or may not be wise, but borrowing to finance consumption (i.e., luxury goods) almost never is.

LikeLike

Hello,

I really enjoyed this post. For all the million pieces i have read on the economic aspects, exploring the discourse of ‘good’ vs. ‘bad’ debt usage is novel. I never thought I’d read a post-modern article on economics that I didn’t hate!

With that said, I do wonder if there is a good reason for the difference. To encourage growth we allow LLC designations so the entre can take a chance without risking his home. For him, failure came at an attempt to create wealth. Whereas for other individuals who use debt poorly, failure comes from ‘immoral’ over consumption followed by bankruptcy that is covered by the ‘rest of us.’

This comes down to the same issue Foucault could never get past (at least to the skeptics, I don’t think he ever tried to make this argument). How can you prove that language shapes thought, when it might simply be that thought shapes language. I view a widespread misunderstanding of economics and the difference between corporate/government/individual debt usage as the prime contributor. Of course, like most post-modern arguments on discourse, you might be correct. But from the positivist (economic) burdens of proof they would ignore you, so we often don’t have enough research from proper economic intellectuals like yourself on these topics. Instead them coming from silly sociology writers.

LikeLike